Introduction

During the first week of 2024, the digital currency Solana faced a significant decline, with a loss of more than 6% in value. This downturn has pushed Solana down to the fifth position in the market rankings, as it hovers below the $100 mark on Saturday, January 6, 2024.

A Cooling Off Period for Solana

After experiencing a remarkable surge of over 700% in 2023, Solana (SOL) has entered a period of consolidation. In the past week, SOL saw a slight dip of over 6%, but it still maintains a strong 46% increase against the U.S. dollar compared to the previous month.

Intraday Fluctuations and Market Influence

On January 6, 2024, the intraday value of SOL fluctuated between a high of nearly $100 and a low of $92.23, ultimately trading at $96.75 per unit at 12:51 p.m. Eastern Time. Notably, SOL holds significant influence in the South Korean market, trading at $99 on Upbit and $98.81 on Bithumb, surpassing the global average of $96 per unit as reported by aggregate market sites.

Trading Pairs and Volume

Tether (USDT) is the primary pair for SOL, accounting for over 67% of all Solana trades. The U.S. dollar and the Korean won follow, contributing 14% and 8% of SOL's trade volume, respectively, according to data from cryptocompare.com.

Behind these pairs, BTC and the stablecoin FDUSD represent 3.35% and 2.68% of SOL's trading activity. Currently, Solana ranks fifth in global trade volume, with a total of $2.287 billion traded in the last 24 hours. However, this figure has experienced a decline of over 30% from the previous day.

Market Capitalization and Growth

Solana's market capitalization currently stands at $41.30 billion, accounting for 2.387% of the total $1.73 trillion crypto market value. Despite an impressive 621% rise in the past year, SOL still remains more than 63% below its peak value of $259 per unit on November 6, 2021.

Future Outlook

As Solana navigates the volatile market, its future trajectory remains uncertain. This leaves investors and enthusiasts wondering whether SOL will continue to be a leading performer in 2024.

What are your thoughts on Solana's market performance this week? Feel free to share your opinions and insights in the comments section below.

Frequently Asked Questions

What is a Precious Metal IRA?

A precious metal IRA lets you diversify your retirement savings to include gold, silver, palladium, rhodium, iridium, osmium, osmium, rhodium, iridium and other rare metallics. These are “precious metals” because they are hard to find, and therefore very valuable. These are good investments for your cash and will help you protect yourself from economic instability and inflation.

Bullion is often used for precious metals. Bullion refers to the actual physical metal itself.

Bullion can be bought through many channels, including online retailers, large coins dealers, and some grocery shops.

A precious metal IRA lets you invest in bullion direct, instead of purchasing stock. This ensures that you will receive dividends each and every year.

Unlike regular IRAs, precious metal IRAs don’t require paperwork or annual fees. Instead, you only pay a small percentage on your gains. You can also access your funds whenever it suits you.

How Much of Your IRA Should Be Made Up Of Precious Metals

You should remember that precious metals are not only for the wealthy. You don’t need to be rich to make an investment in precious metals. In fact, there are many ways to make money from gold and silver investments without spending much money.

You might also be interested in buying physical coins, such bullion rounds or bars. Stocks in companies that produce precious materials could be purchased. You may also be interested in an IRA transfer program offered by your retirement provider.

Regardless of your choice, you’ll still benefit from owning precious metals. Even though they aren’t stocks, they still offer the possibility of long-term growth.

And unlike traditional investments, they tend to increase in value over time. So, if you decide to sell your investment down the road, you’ll likely see more profit than you would with traditional investments.

How much are gold IRA fees?

An Individual Retirement Account (IRA) fee is $6 per month. This includes the account maintenance fees and any investment costs associated with your chosen investments.

If you want to diversify, you may be required to pay extra fees. These fees can vary depending on which type of IRA account you choose. Some companies offer free check accounts, but charge monthly fee for IRA accounts.

In addition, most providers charge annual management fees. These fees range between 0% and 1 percent. The average rate is.25% per year. These rates can be waived if the broker is TD Ameritrade.

What is the best precious metal to invest in?

The answer to this question depends on how much risk you are willing to take and what type of return you want. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. If you are looking for quick profits, gold might not be the right investment. If you have time and patience, you should consider investing in silver instead.

Gold is the best investment if you aren’t looking to get rich quick. If you want to invest in long-term, steady returns, silver is a better choice.

How can I withdraw from a Precious metal IRA?

First, you must decide if you wish to withdraw money from your IRA account. Next, ensure you have enough cash on hand to pay any penalties or fees that could be associated with withdrawing funds.

If you are willing to pay a penalty for early withdrawal, you should consider opening a taxable brokerage account instead of an IRA. You will also have to account for taxes due on any amount you withdraw if you choose this option.

Next, you need to determine how much money is going to be taken out from your IRA. The calculation is influenced by several factors such as your age at withdrawal, the length of time you have owned the account and whether or not you plan to continue contributing to retirement plans.

Once you determine the percentage of your total saved money you want to convert into cash, then you need to choose which type IRA you will use. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

Once these calculations have been completed you will need to open an account with a brokerage. Many brokers offer signup bonuses or other promotions to encourage people to open accounts. To avoid unnecessary fees, however, try opening an account using a debit card rather than a credit card.

When it comes time to withdraw your precious metal IRA funds, you will need a safe location where you can keep your coins. Some storage facilities will accept bullion bars, others require you to buy individual coins. You will need to weigh each one before making a decision.

Bullion bars are easier to store than individual coins. But, each coin must be counted separately. However, keeping individual coins in a separate place allows you to easily track their values.

Some people like to keep their coins in vaults. Some people prefer to store their coins safely in a vault. Whichever method you choose, make sure you store your bullion safely so you can enjoy its benefits for years to come.

Is buying gold a good way to save money for retirement?

Although gold investment may not seem appealing at first glance due to the high average global gold consumption, it’s worth considering.

The best form of investing is physical bullion, which is the most widely used. There are other ways to invest gold. It is best to research all options and make informed decisions based on your goals.

If you don’t need a safe place for your wealth, then buying shares of mining companies or companies that extract it might be a better alternative. If you need cash flow to finance your investment, then gold stocks could be a good option.

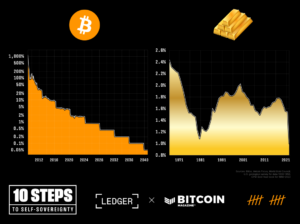

You also can put your money into exchange-traded funds (ETFs), which essentially give you exposure to the price of gold by holding gold-related securities instead of actual gold. These ETFs may include stocks that are owned by gold miners or precious metals refining companies as well as commodity trading firms.

Who is entitled to the gold in a IRA that holds gold?

The IRS considers any individual who holds gold “a form of income” that is subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

Owning gold can also help protect against inflation and price volatility, but it doesn’t make sense to hold gold if you’re not going to use it.

You will need to declare the value of gold if you intend on selling it one day. This could impact how capital gains taxes you owe for cash investments.

It is a good idea to consult an accountant or financial planner to learn more about your options.

Statistics

- If you take distributions before hitting 59.5, you’ll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

finance.yahoo.com

irs.gov

bbb.org

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads and Example. Risk Metrics

How To

A growing trend: Gold IRAs

As investors look for ways to diversify their portfolios and protect themselves against inflation, the gold IRA trend is on the rise.

The gold IRA allows investors to purchase physical gold bars and bullion. It is tax-free and can be used by investors who aren’t concerned about stocks and bond.

Investors can have confidence in their investments and avoid market volatility with a gold IRA. Investors can protect themselves from inflation and other possible problems by using the gold IRA.

Investors also enjoy the benefits of owning physical gold, which includes its unique properties such as durability, portability, and divisibility.

The gold IRA also offers many other benefits, such as the ability to quickly transfer the ownership of the gold to heirs, and the fact the IRS doesn’t consider gold a currency.

All this means that the gold IRA is becoming increasingly popular among investors seeking a haven during financial uncertainty.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Solana’s Market Performance: A Closer Look at the Recent Downturn

Sourced From: news.bitcoin.com/solanas-rocky-start-to-2024-sols-value-dips-over-6-amidst-previous-years-highs/

Published Date: Sat, 06 Jan 2024 18:30:01 +0000