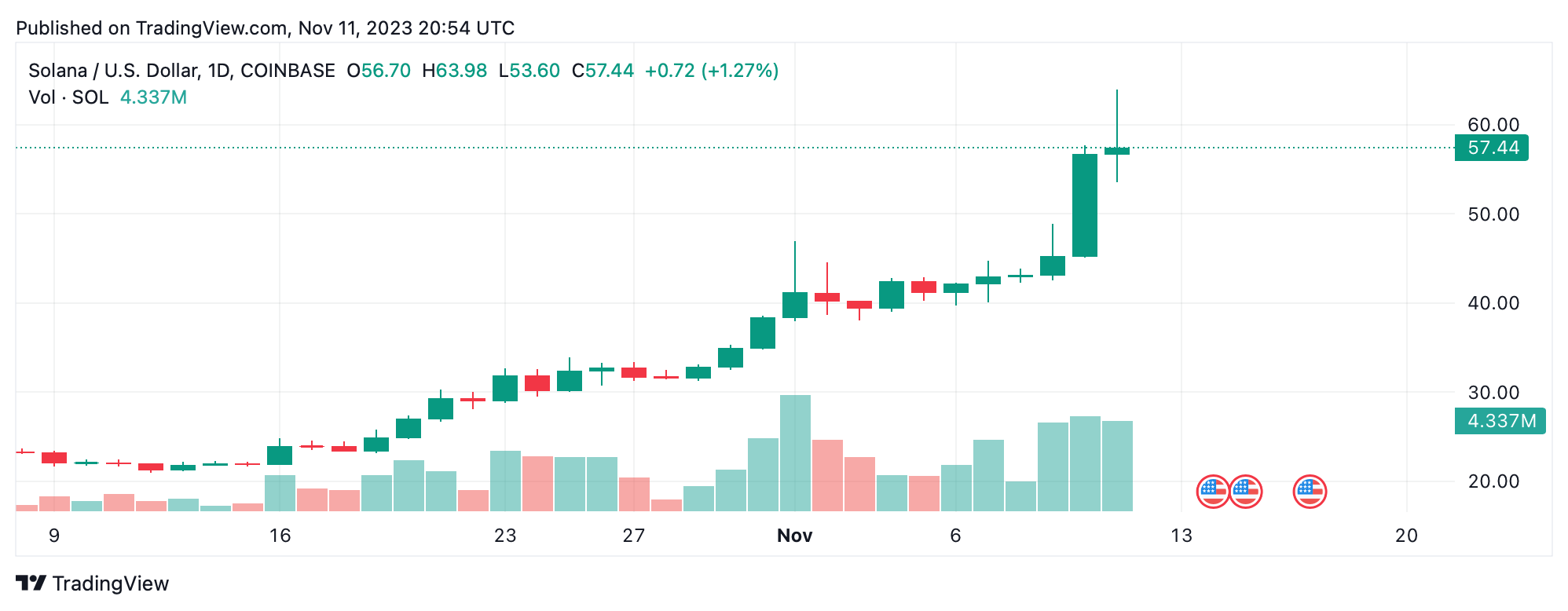

Solana (SOL) has been the talk of the crypto community this weekend, as its value against the U.S. dollar has experienced a remarkable surge. Within the past 24 hours, SOL has gained 11%, and over the course of the week, it has seen an impressive 45.2% increase, propelling it to become the sixth largest asset by market cap.

Solana Takes the Lead in the Crypto Race with a 45% Weekly Rise

Out of the top ten crypto assets based on market value, solana (SOL) has outperformed its competitors this week. Currently, SOL has witnessed a 45.2% growth in the past week and an astonishing 184% surge against the U.S. dollar in the last 30 days. On Saturday, November 11, the trading prices for SOL ranged between $53.59 and $63.44 per coin. With a global trade volume of approximately $4.41 billion in the past day, SOL ranks as the fifth most actively traded cryptocurrency.

The recent increase in solana's value has resulted in the liquidation of a significant number of short positions that were betting on the decline of this digital currency. Data from Coinglass reveals that solana leads the chart today with short position liquidations amounting to $19.28 million. Simultaneously, conversations about SOL's rise are scattered across various social media networks, including X.

"I missed out on SOL because less than 30 minutes after my prediction of its bottom, it skyrocketed to $12 in a single candle, and now it's at $62," wrote Eric Wall. Meanwhile, others are celebrating their gains from SOL. "Mfers watching me make life-changing gains with solana right now," remarked one individual. Another added:

GM to all the people who understand why SOL is headed higher than it's ever been! Now is the time to embrace the excitement.

Data from Cryptocompare indicates that on Saturday, SOL's primary trading pair is tether (USDT), accounting for 52% of the activity, followed by trades against the U.S. dollar at 17.83%. The Korean won contributes significantly with a 16.27% share of all SOL trades, while BTC claims 5.83% of the market share.

After BTC, SOL's trading volumes are supported by pairs with BUSD, EUR, TRY, USDC, and ETH. Despite solana's impressive performance in the past month with triple-digit growth, its current value is still over 75% lower than its peak of $259 per unit, which was reached two years ago on November 6, 2021.

What are your thoughts on solana's recent growth, both in the past day and over the previous month? Share your insights and perspectives on this topic in the comment section below.

Frequently Asked Questions

Can I buy gold using my self-directed IRA

While you can purchase gold from your self-directed IRA (or any other brokerage firm), you must first open a brokerage account such as TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals may contribute up to $1,000 ($2,000 if married, filing jointly) directly into a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contracts are financial instruments that are based on gold's price. You can speculate on future prices, but not own the metal. Physical bullion, however, is real gold and silver bars that you can hold in your hand.

What are the fees associated with an IRA for gold?

Six dollars per month is the fee for an Individual Retirement Account (IRA). This includes account maintenance and any investment costs.

Diversifying your portfolio may require you to pay additional fees. These fees can vary depending on which type of IRA account you choose. Some companies offer free check accounts, but charge monthly fee for IRA accounts.

Most providers also charge an annual management fee. These fees range from 0% to 1%. The average rate per year is.25%. These rates are usually waived if you use a broker such as TD Ameritrade.

How much should precious metals make up your portfolio?

First, let's define precious metals to answer the question. Precious metals refer to elements with a very high value relative other commodities. They are therefore very attractive for investment and trading. The most traded precious metal is gold.

However, many other types of precious metals exist, including silver and platinum. The price for gold is subject to fluctuations, but stays relatively stable in times of economic turmoil. It also remains relatively unaffected by inflation and deflation.

In general, prices for precious metals tend increase with the overall marketplace. However, they may not always move in synchrony with each other. If the economy is struggling, the gold price tends to rise, while the prices for other precious metals tends to fall. Investors are more likely to expect lower interest rates making bonds less attractive investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors want safe assets such Treasury Bonds and are less inclined to demand precious metals. They are more rare, so they become more expensive and less valuable.

You must therefore diversify your investments in precious metals to reap the maximum profits. Because precious metals prices are subject to fluctuations, it is best to invest across multiple precious metal types, rather than focusing on one.

How much should you have of gold in your portfolio

The amount you make will depend on the amount of capital you have. For a small start, $5k to $10k is a good range. Then as you grow, you could move into an office space and rent out desks, etc. So you don't have all the hassle of paying rent. It's only one monthly payment.

Consider what type of business your company will be running. In my case, I run a website-creation company. Our clients pay us between $1000-2000/month and depending on their order. Consider how much you expect to make from each client, if you decide to do this kinda thing.

If you are doing freelance work, you probably won't have a monthly salary like I do because the project pays freelancers. Therefore, you might only get paid one time every six months.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I suggest starting with $1k-2k gold and building from there.

How does a gold IRA work?

For people who are looking to invest in precious materials, Gold Ira account accounts provide tax-free investments.

You can purchase physical gold bullion coins anytime. You don't have a retirement date to invest in gold.

You can keep gold in an IRA forever. Your gold holdings will not be subject to tax when you are gone.

Your heirs can inherit your gold and avoid capital gains taxes. You don't need to include your gold in your final estate report, as it isn't part of the estate.

First, an individual retirement account will be set up to allow you to open a golden IRA. After you do this, you will be granted an IRA custodian. This company acts in the role of a middleman between your IRS agent and you.

Your gold IRA custody will take care of the paperwork and send the forms to IRS. This includes filing annual reports.

Once you've set up your gold IRA, it's possible to buy gold bullion. The minimum deposit required to purchase gold bullion coins is $1,000 If you make more, however, you will get a higher interest rate.

You will pay taxes when you withdraw your gold from your IRA. If you're withdrawing the entire balance, you'll owe income taxes plus a 10 percent penalty.

A small percentage may mean that you don't have to pay taxes. There are exceptions. For example, taking out 30% or more of your total IRA assets, you'll owe federal income taxes plus a 20 percent penalty.

You should avoid taking out more than 50% of your total IRA assets yearly. A violation of this rule can lead to severe financial consequences.

What precious metals can you invest in for retirement?

Gold and silver are the best precious metal investments. Both can be easily bought and sold, and have been around since forever. These are great options to diversify your portfolio.

Gold: Gold is one the oldest forms currency known to man. It's stable and safe. It's a great way to protect wealth in times of uncertainty.

Silver: The popularity of silver has always been a concern for investors. It's an ideal choice for those who prefer to avoid volatility. Silver is more volatile than gold. It tends to rise rather than fall.

Platinum: This precious metal is also becoming more popular. It's durable and resists corrosion, just like gold and silver. It is, however, more expensive than its competitors.

Rhodium: Rhodium is used in catalytic converters. It is also used for jewelry making. It's also relatively inexpensive compared to other precious metals.

Palladium – Palladium is an alternative to platinum that's more common but less scarce. It is also cheaper. For these reasons, it's become a favorite among investors looking to add precious metals to their portfolios.

Can the government seize your gold?

Your gold is yours, so the government cannot confiscate it. You worked hard to earn it. It is yours. This rule may not apply to all cases. For example, if you were convicted of a crime involving fraud against the federal government, you can lose your gold. Also, if you owe taxes to the IRS, you can lose your precious metals. You can keep your gold even if your taxes are not paid.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement accounts

finance.yahoo.com

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options? Types, Spreads. Example. And Risk Metrics

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Investing in gold vs. investing in stocks

Investing in gold as an investment vehicle might seem like a very risky proposition these days. This is because many people believe that gold investment is no longer profitable. This belief is based on the fact that gold prices are being driven down by global economic conditions. People believe that investing in gold would result in them losing money. In reality, however, there are still significant benefits that you can get when investing in gold. Below we'll look at some of them.

Gold is the oldest known form of currency. There are records of its use going back thousands of years. People around the world have used it as a store of value. It's still used by countries like South Africa as a method of payment.

When deciding whether to invest in gold, the first thing you need to do is to decide what price per gram you are willing to pay. The first thing you should do when considering buying gold bullion is to decide how much you will spend per gram. You can always ask a local jeweler what the current market rate is if you don't have it.

It is also worth noting that although gold prices have declined recently, the cost of producing gold has increased. Although gold's price has fallen, its production costs have not.

When deciding whether to buy gold, another thing to consider is how much gold you intend on buying. If you plan to buy enough gold to cover your wedding rings then it is probably a good idea to wait before buying any more. This is not a wise decision if you're looking to invest in long-term assets. It is possible to make a profit by selling your gold at higher prices than when you purchased it.

We hope this article has given you an improved understanding of gold investment tools. Before making any investment decisions, we strongly advise that you thoroughly research all options. Only after doing so can you make an informed decision.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Solana's Rally Surges 184% in 30 Days as $19M in SOL Shorts Liquidate in 24 Hours

Sourced From: news.bitcoin.com/solanas-rally-hits-184-gain-in-30-days-as-19m-in-sol-shorts-liquidate-in-24-hours/

Published Date: Sat, 11 Nov 2023 21:30:05 +0000