As the launch of Hong Kong’s Bitcoin ETF approaches rapidly, a surprising turn of events has unfolded with applications pouring in from major traditional asset managers in Mainland China.

Unprecedented Interest in Hong Kong’s New ETF

Hong Kong’s forthcoming ETF has been in the works for months, garnering significant attention in the global digital asset arena. Distinguished by its unique in-kind generation model, distinct from the prevalent Bitcoin spot ETF format in the United States, this ETF marks a significant step towards ETF acceptance in East Asia. The already-approved Hong Kong futures ETF has exceeded $100 million in assets under management (AUM) as of February, outperforming spot ETFs in other approved countries. Given the substantial capital investment and strong international financial ties in the region, Hong Kong stands as an ideal testing ground for this innovative market.

Mainland China’s Entry into the Fray

Surprising industry analysts, several prominent Mainland Chinese capital firms expressed interest in launching their own ETFs, with a select few formalizing applications. The landscape shifted dramatically on April 8th when major players like Harvest Fund and Southern Fund, boasting AUMs exceeding $200 billion, submitted applications through their Hong Kong subsidiaries. Reports also surfaced about China Asset Management, with a $270 billion AUM, forming a partnership with existing Bitcoin ETF providers in the city through a subsidiary.

Implications of Mainland China’s Involvement

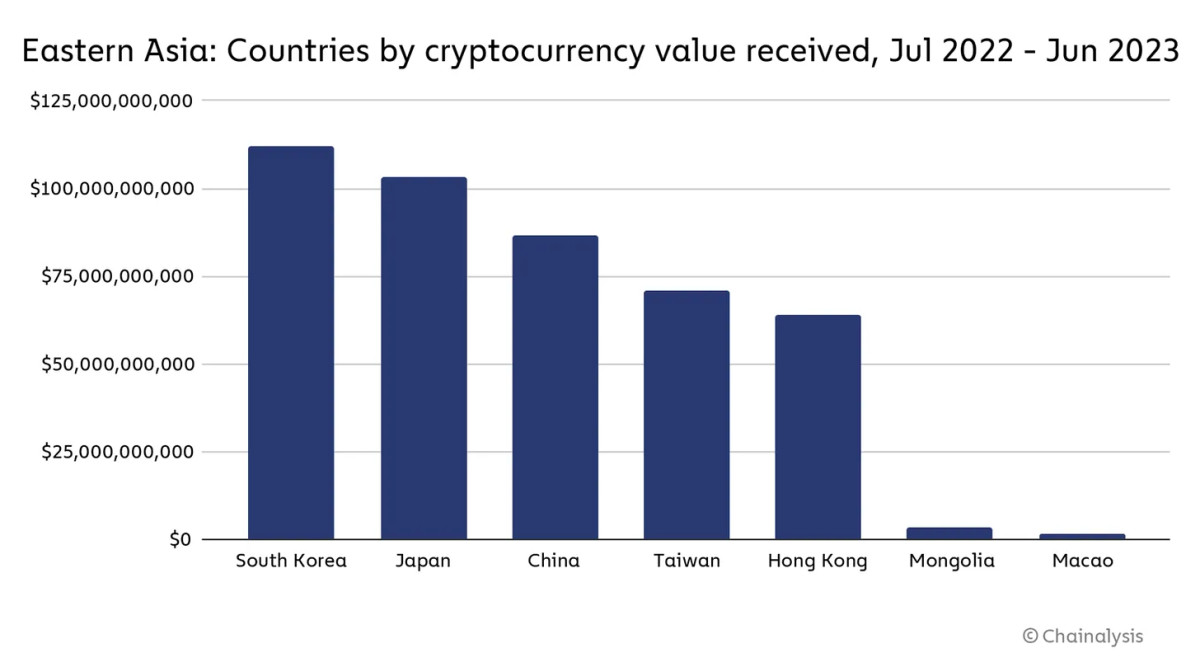

With signs of waning ETF excitement in the US market, the entry of these multibillion-dollar Chinese firms injects fresh vitality into the sector. While top US ETF issuers like BlackRock and Fidelity command trillions in AUM, the emergence of Chinese giants underscores a shifting landscape. The collaboration raises questions about the compatibility of Mainland firms with Hong Kong financial regulations, especially given China’s restrictive stance on Bitcoin. Despite Western media portraying Bitcoin as contraband in China, substantial transaction volumes suggest otherwise.

The Complex Bitcoin Landscape in China

Despite China’s stringent measures against Bitcoin, recent years have witnessed a crackdown, particularly after the 2021 mining ban. While the barriers to entry have increased, loopholes remain open. Legitimate businesses face operational challenges, cautioning Bitcoin users against scams. However, resourceful individuals continue to engage in billions worth of Bitcoin transactions, underscoring the market’s resilience.

Chinese Capital Firms Embrace Bitcoin ETFs

China’s leading asset managers’ foray into the ETF realm signals a significant shift. By engaging with the Bitcoin market through ETFs, these firms navigate a legal pathway to Bitcoin involvement, primarily involving Chinese citizens. The move not only bolsters investor confidence but also fosters regulatory acceptance of Bitcoin in China.

Hong Kong's Crypto Ambitions

On Hong Kong’s end, a commitment to establish a regional crypto hub is evident. Local banks are increasingly receptive to digital assets, aligning with initiatives like HashKey Group’s global expansion. HashKey’s move to launch an exchange in Bermuda reflects ambitious plans to rival US-based crypto giants in trading volume within five years.

Optimism in the Bitcoin Market

Amidst a volatile market, the confidence displayed by firms at the Web3 Festival underscores a collective optimism regarding Bitcoin’s future. Mainland Chinese entities’ growing interest in Bitcoin via Hong Kong signals a potential shift in China’s perspective on the cryptocurrency.

The impending launch of Hong Kong’s Bitcoin ETF holds immense promise for the global ETF landscape. Should China’s stance towards Bitcoin evolve positively, the ramifications could surpass the ETF launch itself. Observers eagerly await developments in this space, anticipating a transformative impact that could reshape the financial paradigm.

Frequently Asked Questions

Can I buy gold using my self-directed IRA

However, gold can only be purchased with your self-directed IRA. To do so, you must first open a brokerage account at TD Ameritrade. You can also transfer funds from another retirement account if you already have one.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals may contribute up to $1,000 ($2,000 if married, filing jointly) directly into a Roth IRA.

If you do decide that you want to invest, it is a good idea to buy physical bullion and not in futures. Futures contracts are financial instruments that are based on gold's price. They let you speculate on future price without having to own the metal. But physical bullion refers to real gold and silver bars you can carry in your hand.

How much gold do you need in your portfolio?

The amount of money you need to make depends on how much capital you are looking for. If you want to start small, then $5k-$10k would be great. As your business grows, you might consider renting out office space or desks. This way, you don't have to worry about paying rent all at once. It's only one monthly payment.

It is also important to decide what kind of business you want to run. In my case, I run a website-creation company. Our clients pay us between $1000-2000/month and depending on their order. If you are doing this type of thing, it is important to think about how much you can expect from each client.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. You may get paid just once every 6 months.

Before you can determine how much gold you'll need, you must decide what type of income you want.

I suggest starting with $1k-2k gold and building from there.

What is a Precious Metal IRA and How Can You Benefit From It?

An IRA with precious metals allows you to diversify retirement savings into gold and silver, palladium, rhodiums, iridiums, osmium, or other rare metals. These are “precious metals” because they are hard to find, and therefore very valuable. They make excellent investments for your money and help you protect your future from inflation and economic instability.

Precious metals are often referred to as “bullion.” Bullion refers simply to the physical metal.

Bullion can be purchased through many channels including online retailers and large coin dealers as well as some grocery stores.

A precious metal IRA allows you to invest directly in bullion, rather than buying stock shares. This allows you to receive dividends every year.

Precious Metal IRAs don’t require paperwork nor have annual fees. Instead, you only pay a small percentage on your gains. Additionally, you have access to your funds at no cost whenever you need them.

What is the tax on gold in Roth IRAs?

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

The rules that govern these accounts differ from one state to the next. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. In Massachusetts, you can wait until April 1st. And in New York, you have until age 70 1/2 . To avoid penalty fees, it is important to plan and take distributions in time to pay all your retirement savings.

Can I own a gold ETF inside a Roth IRA

You may not have this option with a 401(k), however, you might want to consider other options, like an Individual retirement account (IRA).

An IRA traditional allows both employees and employers to contribute. A Employee Stock Ownership Plan, or ESOP, is another way to invest publicly traded companies.

An ESOP is a tax-saving tool because employees have a share of company stock as well as the profits that the business generates. The money in the ESOP can then be subject to lower tax rates than if the money were in the individual's hands.

Also available is an Individual Retirement Annuity. An IRA allows you to make regular payments throughout your life and earn income in retirement. Contributions made to IRAs are not taxable.

Who has the gold in a IRA gold?

The IRS considers any individual who holds gold “a form of income” that is subject to taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

If you are planning to sell your gold someday, it is necessary that you report its value. This can affect the capital gains taxes that you owe when cashing in on investments.

A financial planner or accountant should be consulted to discuss your options.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement account

irs.gov

bbb.org

cftc.gov

How To

The best place to buy silver or gold online

First, understand the basics of gold. The precious metal gold is similar to platinum. It is rare and used as money due to its durability and resistance against corrosion. It's hard to use, so most people prefer buying jewelry made out of it to actual bars of gold.

There are two types today of gold coins. One is legal tender while the other is bullion. Legal tender coins are designed for circulation in a country. They often have denominations like $1 or $5 or $10.

Bullion coins can only be used as investment currency. They increase in value due to inflation.

They aren't circulated in any currency exchange systems. If a person purchases $100 worth of gold, 100 grams of the gold will be given to him/her. The $100 value is $100. The buyer receives 1 gram of gold for every dollar spent.

The next thing you should know when looking to buy gold is where to do it from. There are a few options if you wish to buy gold directly from a dealer. First, go to your local coin shop. You could also look into eBay or other reputable websites. You may also be interested in buying gold through private sellers online.

Private sellers are individuals who offer gold for sale, either at wholesale prices or retail prices. Private sellers charge a 10% to 15% commission per transaction. Private sellers will typically get you less than a coin shop, eBay or other online retailers. This option is often a great one for investors in gold, as it gives you greater control over the item's value.

An alternative option to buying gold is to buy physical gold. It is easier to store physical gold than paper certificates. But, you still have to take care of it. You need to make sure that your physical gold is safe by storing it in an impenetrable container like a vault or safety depositbox.

If you are looking to purchase gold on your own, you have two options: a bank or an pawnshop. A bank can give you a loan up to the amount you intend to invest in Gold. These are small businesses that let customers borrow money against the items they bring to them. Banks often charge higher interest rates then pawnshops.

Another way to purchase gold is to ask another person to do it. Selling gold is also easy. Contact a company such as GoldMoney.com, and you can set up a simple account and start receiving payments immediately.

—————————————————————————————————————————————————————————————-

By: Landon Manning

Title: Chinese Financial Institutions Embrace Hong Kong’s Revolutionary Bitcoin ETF

Sourced From: bitcoinmagazine.com/markets/chinese-financial-institutions-turn-to-hong-kongs-new-bitcoin-etf-

Published Date: Thu, 11 Apr 2024 14:00:00 GMT