Bitcoin's price fell below $60,000 recently due to tensions between Iran and Israel, raising concerns about potential Western intervention in the Middle East. This situation, a common occurrence in the 21st century, could lead to higher inflation and disrupt global supply chains and commodity markets. Despite critics mocking Bitcoin's rapid selloff in response to the conflict news, Bitcoin remained one of the few assets available for trading over the weekend, drawing attention from equity, commodity, and bond traders trying to gauge the market impact for the upcoming trading week.

On-Chain Spending Behavior and Derivative Markets Analysis

Shifting focus from geopolitical events, this article delves into the latest trends in on-chain spending behavior and Bitcoin derivative markets. The aim is to determine if the recent dip from $73,000 reflects a standard correction in a bull market or signals a cyclical peak.

Revisiting Traditional Bitcoin Cycle Notions

Many traditional views on Bitcoin market cycles have been shattered, with new price highs occurring even before the upcoming halving at block 840,000. This analysis seeks to evaluate the current market status and investor sentiment to anticipate future trends.

Exploring On-Chain Data and Derivatives Market

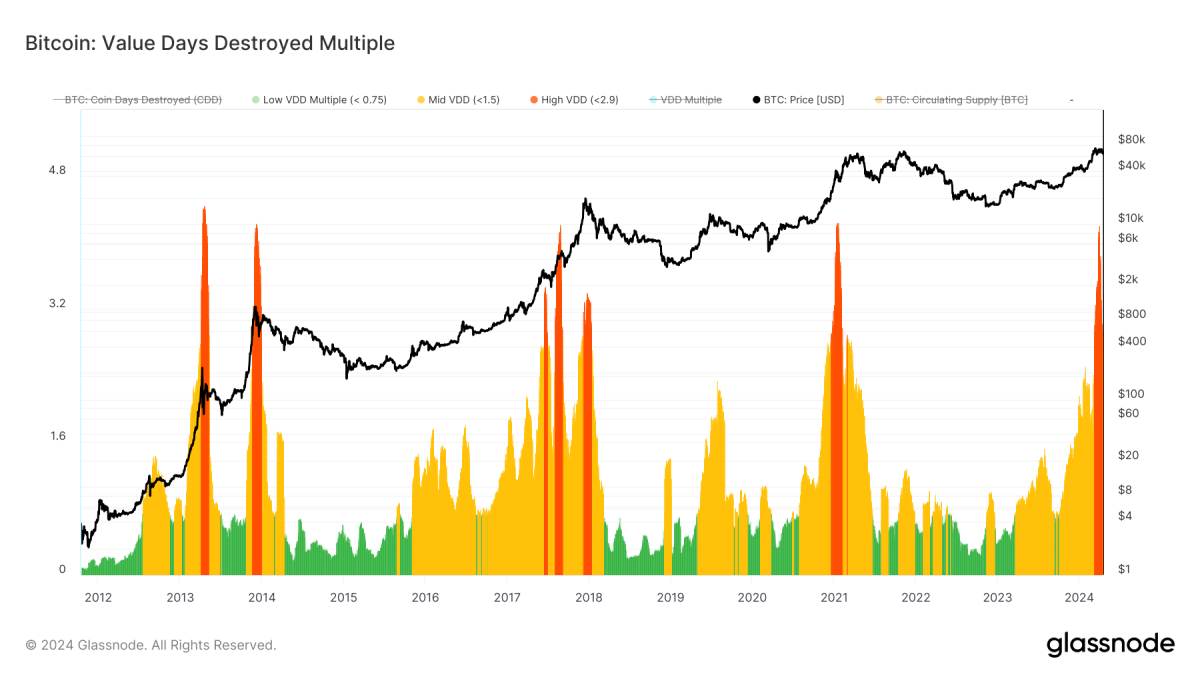

Beginning with the Value Days Destroyed Multiple metric developed by TXMC, the analysis compares short-term spending behavior to annual averages to identify overheated or undervalued market conditions. While a portion of spending involves transfers from Grayscale Bitcoin Trust to new ETF participants, a significant amount of expenditure has contributed to recent price highs.

Examining the interplay between hodlers and new market participants reveals typical behavior in a bull market, where short-term holders revisit their cost basis, often acting as support levels. In the derivatives market, a flush of leverage and speculative activity has been observed, with futures trading at discounts to spot markets, setting the stage for potential price appreciation.

Future Market Outlook and Conclusion

Despite recent pullbacks, the analysis suggests that the bull market remains robust, with opportunities for investors with a long-term perspective. Bitcoin's fundamentals continue to strengthen, and market corrections serve to eliminate excess leverage and speculators during upward market trends.

In conclusion, amid market fluctuations, the key takeaway is to "Buy The Fear Dip," reflecting the resilience of Bitcoin's market trajectory and the potential for long-term growth in the digital asset space.

Frequently Asked Questions

What is the best way to hold physical gold?

Gold is money, not just paper currency or coinage. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Investors today use gold to diversify their portfolios because gold is more resilient to financial turmoil.

Many Americans now invest in precious metals. While owning gold doesn't guarantee you'll make money investing in gold, there are several reasons why it may make sense to consider adding gold to your retirement portfolio.

One reason is that gold has historically performed better than other assets during periods of financial panic. Between August 2011 and early 2013 gold prices soared nearly 100 percent, while the S&P 500 plunged 21 percent. Gold was one of the few assets that performed better than stocks during turbulent market conditions.

Gold is one of the few assets that has virtually no counterparty risks. You still have your shares even if your stock portfolio falls. You can still own your gold even if the company where you invested fails to pay its debt.

Finally, gold is liquid. This means you can easily sell your gold any time, unlike other investments. You can buy gold in small amounts because it is so liquid. This allows one to take advantage short-term fluctuations within the gold price.

How much gold should you have in your portfolio?

The amount of capital required will affect the amount you make. You can start small by investing $5k-10k. Then as you grow, you could move into an office space and rent out desks, etc. This will allow you to pay rent monthly, and not worry about it all at once. It's only one monthly payment.

Consider what type of business your company will be running. In my case, we charge clients between $1000-2000/month, depending on what they order. This is why you should consider what you expect from each client if you're doing this kind of thing.

As freelance work requires you to be paid freelancers, your monthly salary won't be as high as mine. You might get paid only once every six months.

You need to determine what kind or income you want before you decide how much of it you will need.

I recommend starting with $1k-$2k of gold and growing from there.

How much of your IRA should include precious metals?

The most important thing you should know when investing in precious metals is that they are not just for wealthy people. They don't require you to be wealthy to invest in them. In fact, there are many ways to make money from gold and silver investments without spending much money.

You might also be interested in buying physical coins, such bullion rounds or bars. You could also buy shares in companies that produce precious metals. You may also be interested in an IRA transfer program offered by your retirement provider.

You'll still get the benefit of precious metals no matter which country you live in. These metals are not stocks, but they can still provide long-term growth.

And unlike traditional investments, they tend to increase in value over time. If you decide to make a sale of your investment in the future, you will likely realize more profit than with traditional investments.

What is the tax on gold in an IRA

The fair market value at the time of sale is what determines how much tax you pay on gold sales. If you buy gold, there are no taxes. It is not considered income. If you decide to make a sale of it, you'll be entitled to a taxable loss if the value goes up.

You can use gold as collateral to secure loans. Lenders look for the highest return when you borrow against assets. In the case of gold, this usually means selling it. There's no guarantee that the lender will do this. They might just hold onto it. They might decide that they want to resell it. Either way you will lose potential profit.

You should not lend against your gold if it is intended to be used as collateral. Otherwise, it's better to leave it alone.

Is it a good retirement strategy to buy gold?

Buying gold as an investment may not seem very appealing at first glance, but when you consider how much people spend on average on gold per year worldwide, it becomes worth considering.

Physical bullion bar is the best way to invest in precious metals. There are many ways to invest your gold. The best thing to do is research all options thoroughly and then make an informed decision based on what you want from your investments.

If you don’t have the funds to invest in safe places, such as a safe deposit box or mining equipment companies, buying shares of these companies might be a better investment. If you need cash flow from an investment, purchasing gold stocks is a good choice.

You also can put your money into exchange-traded funds (ETFs), which essentially give you exposure to the price of gold by holding gold-related securities instead of actual gold. These ETFs typically include stocks from gold miners, precious metallics refiners, commodity trading companies, and other commodities.

What is the value of a gold IRA

Many benefits come with a gold IRA. It's an investment vehicle that lets you diversify your portfolio. You have control over how much money goes into each account.

You also have the option to transfer funds from other retirement plans into a IRA. This allows you to easily transition if your retirement is early.

The best part? You don’t need to have any special skills to invest into gold IRAs. These IRAs are available at all banks and brokerage houses. Withdrawals can be made instantly without the need to pay fees or penalties.

There are, however, some drawbacks. Gold is historically volatile. It's important to understand the reasons you're considering investing in gold. Are you looking for safety or growth? Are you trying to find safety or growth? Only after you have this information will you make an informed decision.

If you plan on keeping your gold IRA alive for a while, you may want to consider purchasing more than 1 ounce of pure gold. One ounce won't be enough to meet all your needs. You may need several ounces, depending on what you intend to do with your precious gold.

You don't need to have a lot of gold if you are selling it. You can even manage with one ounce. But, those funds will not allow you to buy anything.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Legal – WSJ

investopedia.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement plans

irs.gov

How To

How to keep physical gold in an IRA

The most obvious way to invest in gold is by buying shares from companies producing gold. This method is not without risks. There's no guarantee these companies will survive. If they survive, there's still the risk of losing money due to fluctuations in the price of gold.

An alternative option would be to buy physical gold itself. This requires you to either open up your account at a bank or an online bullion dealer or simply purchase gold from a reputable seller. This option offers the advantages of being able to purchase gold at low prices and easy access (you don’t need to deal directly with stock exchanges). It's also easy to see how many gold you have. You'll get a receipt showing exactly what you paid, so you'll know if any taxes were missed. You have less risk of theft when investing in stocks.

However, there are some disadvantages too. You won't get the bank's interest rates or investment money. Additionally, you won’t be able diversify your holdings. You will remain with the same items you bought. Finally, tax man may want to ask where you put your gold.

BullionVault.com offers more information on buying gold for an IRA.

—————————————————————————————————————————————————————————————-

By: Dylan LeClair

Title: Analysis of Bitcoin's Recent Price Movement and Market Behavior

Sourced From: bitcoinmagazine.com/markets/dylan-leclair-bitcoin-bull-market-dip-or-cycle-regime-shift

Published Date: Wed, 17 Apr 2024 14:00:00 GMT