The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Introduction

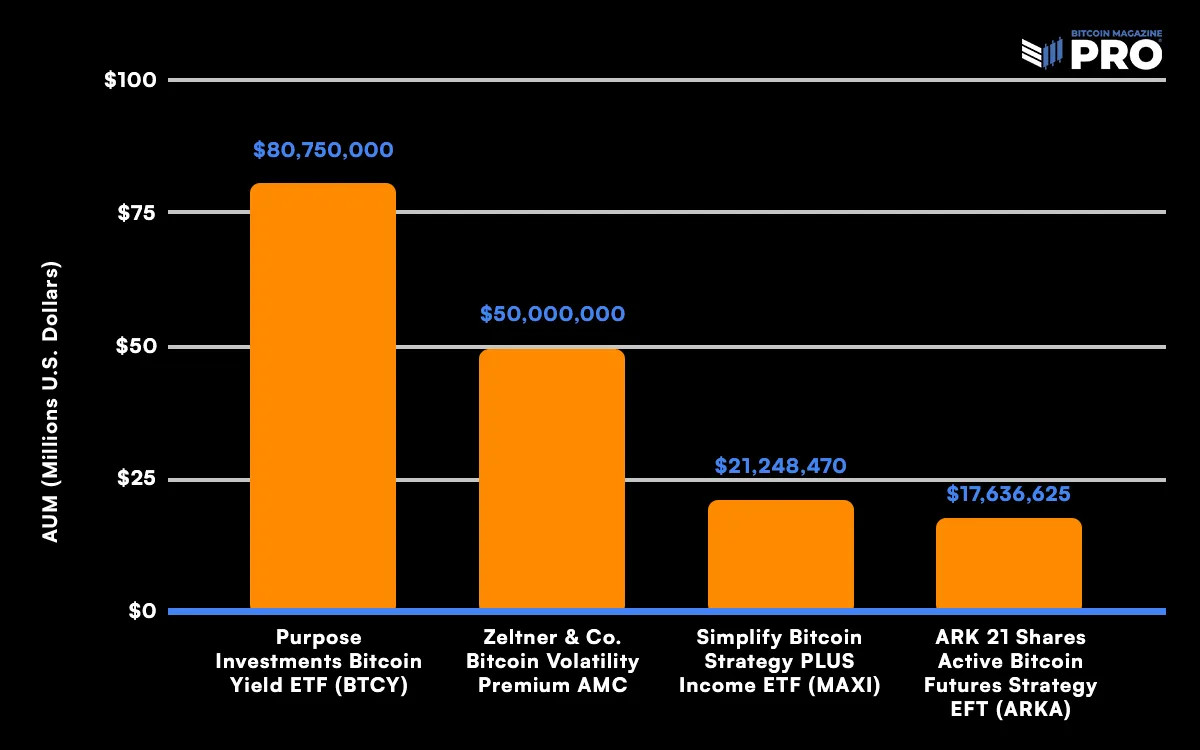

The Bitcoin Volatility Premium AMC, an innovative investment product, has quickly become the largest actively managed bitcoin-only financial product in Europe and the second largest globally. Despite this achievement, to date this bitcoin-only AMC has flown under the radar and has received no media coverage to date until now. What makes this investment product offering particularly interesting is its dramatic rise was due to the seed investment of $50 million to launch from an enigmatic early Bitcoin miner from 2010. The product is designed to curb Bitcoin's volatile pricing, fostering its adoption as a reliable medium of exchange.

What is an AMC?

AMC stands for Actively Managed Certificate. It is a type of structured security that is popular in Europe. Jurisdictions such as Luxembourg and Jersey allow asset managers to create these certificates in order to raise capital from investors. Certificates provide a "wrapper" for an investment strategy, or specific underlying assets. The certificate is sold to investors, and the capital is used to implement the strategy.

Who is the Mysterious Whale?

In response to inquiries about the identity of the Bitcoin Whale behind the new Bitcoin Volatility Premium AMC, Zeltner & Co. confirmed that the seed investor is indeed an early Bitcoin miner who has been involved in Bitcoin since 2010. However, respecting the investor's request to preserve privacy and avoid public scrutiny, Zeltner & Co. declined to reveal any further details about their identity. The motives behind such a significant move by an individual with substantial Bitcoin holdings are particularly intriguing. The creation of this AMC, aimed at stabilizing Bitcoin's price, showcases a strategic approach to managing digital assets. By personally allocating their holdings to develop this investment product, the Bitcoin Whale not only addresses the issue of Bitcoin’s volatility but also enhances its viability as a stable medium of exchange. This AMC stands out as a unique market-making instrument that not only seeks to manage risk but also differentiates itself through its operational approach, targeting a more stable and predictable market for Bitcoin.

Why is this AMC Relevant?

The Bitcoin Volatility Premium AMC has already become the largest actively managed bitcoin-only financial product in Europe and the second largest globally after the Purpose Investments Bitcoin Yield ETF (BTCY), with over $109 million CAD ($80.750 U.S.). There are several large Bitcoin ETFs that actively manage futures positions, such as the ProShares Bitcoin Strategy ETF (BITO), with over $2.82 billion in assets under management; however, these are not actively managed funds in the traditional sense. Instead of trying to outperform or optimize the risk/return of a direct investment in bitcoin, futures ETFs aim to track the price of bitcoin 1:1.

How is its Investment Strategy Unique?

The certificate invests algorithmically in bitcoin and U.S. dollars, aiming to collect a volatility premium while optimizing the risk-return profile directly by investing in bitcoin. The strategy provides liquidity to the BTC/USD spot market with market making on leading exchanges such as Kraken. This leads to small gains, which can accumulate between 2% and 6% per annum, depending on volatility. The volatility premium is generated when the market moves from filling the buy orders generated by the algorithm to filling the sell orders, and vice versa. The algorithm buys low and sells high at each dip or peak, respectively.

Similar to ETFs, as more investors invest in certificates of the Bitcoin Volatility Premium AMC, the certificate must purchase more bitcoin, therefore increasing the demand for bitcoin, which already outpaces the newly created daily supply by several factors. The market making targets an allocation of 70% Bitcoin and 30% U.S. dollars, meaning that the strategy currently owns over 540 Bitcoin.

Market Impact and Future Prospects

The goal of the Bitcoin Volatility Premium AMC is to mitigate the price fluctuations of Bitcoin, making it more stable and functional as a medium of exchange.

Dr. Demelza Hays, a portfolio manager at Zeltner & Co., shared insights with Bitcoin Magazine Pro:

"Bitcoin's potential to become a global medium of exchange and money hinges significantly on achieving stable purchasing power. Currently, the volatility inherent in Bitcoin's price poses a barrier to its widespread adoption for everyday transactions. However, if Bitcoin were to stabilize in value, it could emerge as a viable alternative to traditional fiat currencies, offering benefits such as decentralization, security, and lower transaction costs on Bitcoin scaling solutions such as Liquid, AQUA, and the Lightning Network."

By becoming the largest actively managed bitcoin-only financial product in Europe and a major player globally, the AMC leverages an algorithmic strategy to invest in Bitcoin and U.S. dollars. This strategy aims to profit from market volatility, which in turn influences Bitcoin's demand and price dynamics.

Swiss Family Office Involvement

The strategy is managed by the prestigious family office Zeltner & Co., based in Zurich, Switzerland. Founded by Thomas Zeltner, Zeltner & Co. is continuing the legacy of Thomas’s father, the late former president of UBS' wealth management, Jürg Zeltner. Zeltner & Co., renowned for its discretion and expertise in wealth management, has lent credibility to this venture, solidifying confidence in the strategy's legitimacy and potential for success.

Regulatory and Geographic Advantage

Choosing Zurich, Switzerland for its headquarters, the AMC benefits from the region's favorable regulatory environment and its reputation as a global finance and innovation hub. This strategic location enhances the security and appeal of the Bitcoin Volatility Premium AMC to investors seeking to diversify into digital assets.

Conclusion

The launch of the Bitcoin Volatility Premium AMC comes at a time of heightened interest, with bitcoin recently surpassing all-time highs and capturing the attention of institutional investors and mainstream media alike. As the market continues to mature and attract greater institutional participation, the emergence of innovative investment vehicles such as this certificate highlights the evolving nature of digital asset management.

Frequently Asked Questions

What precious metal should I invest in?

This depends on what risk you are willing take and what kind of return you desire. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. For example, if your goal is to make quick money, gold may not suit you. If you have the patience to wait, then you might consider investing in silver.

If you don’t want to be rich fast, gold might be the right choice. Silver might be a better investment option if steady returns are desired over a long period of time.

How can I withdraw from a Precious metal IRA?

You first need to decide if you want to withdraw money from an IRA account. After that, you need to decide if you want to withdraw funds from an IRA account. Next, make sure you have enough money in order for you pay any fees or penalties.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. This option is also available if you are willing to pay taxes on the amount you withdraw.

Next, you'll need to figure out how much money you will take out of your IRA. This calculation depends on several factors, including the age when you withdraw the money, how long you've owned the account, and whether you intend to continue contributing to your retirement plan.

Once you know what percentage of your total savings you'd like to convert into cash, you'll need to determine which type of IRA you want to use. Traditional IRAs allow for you to withdraw funds without tax when you turn 59 1/2. Roth IRAs, on the other hand, charge income taxes upfront but you can access your earnings later and pay no additional taxes.

Finally, you'll need to open a brokerage account once these calculations are completed. Brokers often offer promotional offers and signup bonuses to encourage people into opening accounts. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When it comes time to withdraw your precious metal IRA funds, you will need a safe location where you can keep your coins. Some storage areas will accept bullion, while others require you to purchase individual coins. Before you choose one, weigh the pros and cons.

Bullion bars are easier to store than individual coins. But you will have to count each coin separately. However, individual coins can be stored to make it easy to track their value.

Some people prefer to keep their coins in a vault. Some people prefer to store their coins safely in a vault. No matter what method you use, it is important to keep your bullion safe so that you can reap its benefits for many more years.

What is a Precious Metal IRA?

A precious metal IRA lets you diversify your retirement savings to include gold, silver, palladium, rhodium, iridium, osmium, osmium, rhodium, iridium and other rare metallics. These are “precious metals” because they are hard to find, and therefore very valuable. These are excellent investments that will protect your wealth from inflation and economic instability.

Bullion is often used for precious metals. Bullion refers to the actual physical metal itself.

Bullion can be purchased via a variety of channels including online sellers, large coin dealers, and grocery stores.

A precious metal IRA allows you to invest directly in bullion, rather than buying stock shares. This ensures that you will receive dividends each and every year.

Precious metal IRAs have no paperwork or annual fees. Instead, you only pay a small percentage on your gains. You can also access your funds whenever it suits you.

Can I purchase gold with my self directed IRA?

Although you can buy gold using your self-directed IRA account, you will need to open an account at a brokerage like TD Ameritrade. If you have an existing retirement account, you can transfer funds to another one.

The IRS allows individuals contributing up to $5.500 each ($6,500 if married, filing jointly) into a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

If you do decide to invest in gold, you'll want to consider purchasing physical bullion rather than investing in futures contracts. Futures contracts are financial instruments that are based on gold's price. They let you speculate on future price without having to own the metal. But physical bullion refers to real gold and silver bars you can carry in your hand.

Do you need to open a Precious Metal IRA

Before opening an IRA, it is important to understand that precious metals aren't covered by insurance. If you lose money in your investment, nothing can be done to recover it. This includes investments that have been damaged by fire, flooding, theft, and so on.

It is best to invest in physical gold coins and silver coins to avoid this type loss. These items have been around for thousands of years and represent real value that cannot be lost. You would probably get more if you sold them today than you paid when they were first created.

Consider a reputable business that offers low rates and good products when opening an IRA. You should also consider using a third party custodian to protect your assets and give you access at any time.

If you decide to open an account, remember that you won't see any returns until after you retire. Do not forget about the future!

What are some of the advantages and disadvantages to a gold IRA

An Individual Retirement Account is a more beneficial option than regular savings accounts. You don't pay taxes on any interest earned. An IRA is a great option for those who want to save money, but don't want tax on any interest earned. This type of investment has its downsides.

For example, if you withdraw too much from your IRA once, you could lose all your accumulated funds. You may also be prohibited by the IRS from making withdrawals from an IRA after you turn 59 1/2. If you do withdraw funds from your IRA you will most likely be required to pay a penalty.

Another problem is the cost of managing your IRA. Most banks charge 0.5% to 2.0% per annum. Other providers charge monthly management costs ranging from $10-50.

Insurance will be required if you would like to keep your cash out of banks. Insurance companies will usually require that you have at least $500,000. Insurance that covers losses upto $500,000.

You will need to decide how much gold you wish to use if you opt for a gold IRA. Some providers limit the amount of gold that you are allowed to own. Some providers allow you to choose your weight.

You'll also need to decide whether to buy physical gold or futures contracts. The price of physical gold is higher than that of gold futures. Futures contracts allow you to buy gold with more flexibility. They let you set up a contract that has a specific expiration.

You will also have to decide which type of insurance coverage is best for you. The standard policy does NOT include theft protection and loss due to fire or flood. It does provide coverage for damage from natural disasters, however. You might consider purchasing additional coverage if your area is at high risk.

In addition to insurance, you'll need to consider the cost of storing your gold. Storage costs are not covered by insurance. Banks charge between $25 and $40 per month for safekeeping.

If you decide to open a gold IRA, you must first contact a qualified custodian. A custodian keeps track of your investments and ensures that you comply with federal regulations. Custodians cannot sell your assets. They must instead keep them for as long as you ask.

Once you have chosen the right type of IRA to suit your needs, it is time to fill out paperwork defining your goals. The plan should contain information about the types of investments you wish to make such as stocks, bonds or mutual funds. Also, you should specify how much each month you plan to invest.

After filling out the forms, you'll need to send them to your chosen provider along with a check for a small deposit. After receiving your application, the company will review it and mail you a confirmation letter.

When opening a gold IRA, you should consider using a financial planner. A financial planner can help you decide the type of IRA that is right for your needs. They can help reduce your expenses by helping you find cheaper alternatives to buying insurance.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

irs.gov

finance.yahoo.com

How To

The best place online to buy silver and gold

To buy gold, you must first understand how it works. Gold is a precious metallic similar to Platinum. It is rare and used as money due to its durability and resistance against corrosion. It's hard to use, so most people prefer buying jewelry made out of it to actual bars of gold.

There are two types today of gold coins. One is legal tender while the other is bullion. The legal tender coins are issued for circulation in a country. They usually have denominations such as $1, $5, $10, and so on.

Bullion coins are minted for investment purposes only, and their values increase over time due to inflation.

They aren't circulated in any currency exchange systems. If a person purchases $100 worth of gold, 100 grams of the gold will be given to him/her. The $100 value is $100. The buyer receives 1 gram of gold for every dollar spent.

The next thing you should know when looking to buy gold is where to do it from. You have a few options to choose from if you are looking to buy gold directly through a dealer. First, go to your local coin shop. You can also try going through a reputable website like eBay. You might also consider buying gold from an online private seller.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. Private sellers will charge you a 10% to 15% commission for every transaction. A private seller will usually return less money than a coin shop and eBay. This option is often a great one for investors in gold, as it gives you greater control over the item's value.

You can also invest in gold physical. Physical gold is much easier to store than paper certificates, but you still have to worry about storing it safely. Physical gold should be stored in an impenetrable container, such a vault and safety deposit box to ensure its safety.

A bank or pawnshop can help you buy gold. A bank can provide you with a loan to cover the amount you wish to invest in gold. These are small businesses that let customers borrow money against the items they bring to them. Banks typically charge higher interest rates than pawn shops.

Finally, another way to buy gold is to simply ask someone else to do it! Selling gold can also be done easily. You can contact a company like GoldMoney.com to set up an account and receive payments right away.

—————————————————————————————————————————————————————————————-

By: Mark Mason

Title: Mysterious 2010 Bitcoin Whale Launches Bitcoin-Only Market-Making Certificate

Sourced From: bitcoinmagazine.com/markets/mysterious-2010-bitcoin-whale-launches-bitcoin-only-market-making-certificate

Published Date: Mon, 29 Apr 2024 14:02:16 GMT