Vanguard's Anti-Crypto/Bitcoin Policy Intensifies

Investing giant Vanguard has reaffirmed its anti-crypto and anti-bitcoin stance by blocking investors from accessing spot bitcoin exchange-traded funds (ETFs) recently approved by the U.S. Securities and Exchange Commission (SEC). Furthermore, Vanguard has announced that it will no longer accept purchases of cryptocurrency products, including bitcoin futures ETFs. This decision has drawn criticism from industry experts, including Ark Invest CEO Cathie Wood.

Cathie Wood Criticizes Vanguard's Decision

Cathie Wood, CEO of Ark Invest, has described Vanguard's decision as a "terrible mistake" and "a strategic blunder." Wood believes that Vanguard's refusal to allow its customers to trade spot bitcoin ETFs reflects a lack of faith in the potential of new financial rails and the transformative power of bitcoin and blockchain technology.

Wood argues that Vanguard's decision denies investors the opportunity to participate in the first global, decentralized, private, and rules-based monetary system in history. She believes that bitcoin and blockchain technology have the potential to reduce friction in the financial system and solve many existing problems.

Vanguard's Perspective

According to a spokesperson for Vanguard, the company's decision to block access to spot bitcoin ETFs and cease accepting purchases of cryptocurrency products is part of its strategy to focus on offering a core set of products and services. Vanguard aims to serve the needs of long-term investors and believes that asset classes such as equities, bonds, and cash are the building blocks of a well-balanced investment portfolio.

Vanguard maintains that spot bitcoin ETFs and other crypto-related products do not align with its investment philosophy. The company sees greater value in traditional asset classes and does not believe that the new financial rails offered by cryptocurrencies will be successful in the long run.

Implications and Reactions

Vanguard's decision to double down on its anti-bitcoin and anti-crypto policy has sparked debate within the investment community. Some applaud Vanguard's commitment to its investment principles, while others criticize the company for being closed-minded and missing out on the potential benefits of cryptocurrencies.

The SEC recently approved 11 spot bitcoin ETFs, including the Ark 21shares Bitcoin ETF. The denial of access to these ETFs by Vanguard has disappointed investors who were eager to participate in the growing crypto market.

Share Your Opinion

What are your thoughts on Vanguard's anti-bitcoin and anti-crypto stance? Do you agree with Cathie Wood's criticism of the company's decision? Share your opinions in the comments section below.

Frequently Asked Questions

Should You Buy Gold?

In times past, gold was considered a safe haven for investors in times of economic trouble. Many people are now turning their backs on traditional investments like stocks and bonds, and instead look to precious metals like Gold.

Gold prices have been on an upward trend over recent years, but they remain relatively low compared to other commodities such as oil and silver.

This could be changing, according to some experts. They believe gold prices could increase dramatically if there is another global financial crises.

They also point out that gold is becoming popular because of its perceived value and potential return.

Consider these things if you are thinking of investing in gold.

- The first thing to do is assess whether you actually need the money you’re putting aside for retirement. You can save money for retirement even if you don’t invest in gold. However, you can still save for retirement without putting your savings into gold.

- Second, you need to be clear about what you are buying before you decide to buy gold. Each one offers different levels security and flexibility.

- Last but not least, gold doesn’t provide the same level security as a savings account. If you lose your gold coins, you may never recover them.

If you are thinking of buying gold, do your research. You should also ensure that you do everything you can to protect your gold.

What is the Performance of Gold as an Investment?

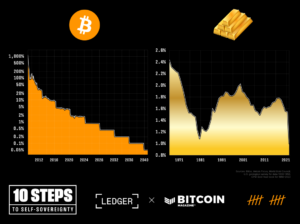

The supply and the demand for gold determine how much gold is worth. Interest rates are also a factor.

Due to their limited supply, gold prices fluctuate. You must also store physical gold somewhere to avoid the risk of it becoming stale.

What is a Precious Metal IRA and How Can You Benefit From It?

A precious metal IRA allows for you to diversify your retirement savings in gold, silver, palladium and iridium. These rare metals are often called “precious” as they are very difficult to find and highly valuable. These are good investments for your cash and will help you protect yourself from economic instability and inflation.

Precious metals often refer to themselves as “bullion.” Bullion is the physical metal.

Bullion can be bought through many channels, including online retailers, large coins dealers, and some grocery shops.

A precious metal IRA allows you to invest directly in bullion, rather than buying stock shares. This means you’ll receive dividends every year.

Precious metal IRAs have no paperwork or annual fees. Instead, you only pay a small percentage on your gains. You also have unlimited access to your funds whenever and wherever you wish.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you’ll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item’s value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China’s Evergrande Crisis – Forbes Advisor

finance.yahoo.com

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1991 – WSJ

- How do you keep your IRA Gold at Home? It’s Not Exactly Legal – WSJ

cftc.gov

How To

Online buying gold and silver is the best way to purchase it.

Understanding how gold works is essential before you buy it. Gold is a precious metal similar to platinum. Because of its resistance to corrosion and durability, it is very rare. It is difficult to use so people prefer to buy jewelry made from it to gold bars.

There are two types of gold coins available today – one type is legal tender, while the other is called bullion. The legal tender coins are issued for circulation in a country. They usually have denominations such as $1, $5, $10, and so on.

Bullion coins should only be used for investment purposes. Inflation can cause their value to increase.

They aren’t exchangeable in any currency exchange. If a person purchases $100 worth of gold, 100 grams of the gold will be given to him/her. The $100 value is $100. Each dollar spent by the buyer is worth 1 gram.

You should also know where to buy your gold. If you want to purchase gold directly from a dealer, then a few options are available. First off, you can go through your local coin shop. You can also try going through a reputable website like eBay. You can also look into buying gold online from private sellers.

Individuals who sell gold at wholesale and retail prices are called private sellers. You pay a commission fee between 10% and 15% for each transaction when you sell gold through private sellers. That means you would get back less money from a private seller than from a coin shop or eBay. This is a great option for gold investing because you have more control over the item’s price.

An alternative option to buying gold is to buy physical gold. Physical gold is much easier to store than paper certificates, but you still have to worry about storing it safely. Physical gold should be stored in an impenetrable container, such a vault and safety deposit box to ensure its safety.

You can either visit a bank, pawnshop or bank to buy gold. A bank will be able to provide you with a loan for the amount of money you want to invest in gold. Pawnshops are small establishments allowing customers to borrow money against items they bring. Banks often charge higher interest rates then pawnshops.

A third way to buy gold? Simply ask someone else! Selling gold is also easy. Contact a company such as GoldMoney.com, and you can set up a simple account and start receiving payments immediately.

—————————————————————————————————————————————————————————————-

By: Kevin Helms

Title: Vanguard Doubles Down on Anti-Bitcoin and Anti-Crypto Policy, Blocks Access to Spot Bitcoin ETFs

Sourced From: news.bitcoin.com/vanguard-deepens-anti-crypto-stance-after-disallowing-spot-bitcoin-etf-trading-ark-ceo-says-its-a-terrible-mistake/

Published Date: Sun, 14 Jan 2024 07:30:42 +0000

Related posts:

Vanguard Explains Why Spot Bitcoin ETFs Are Not Available on Its Trading Platform

Vanguard Explains Why Spot Bitcoin ETFs Are Not Available on Its Trading Platform

Vanguard Blocks Customers from Trading Spot Bitcoin ETFs, Prompting Dissatisfaction and Account Closures

Vanguard Blocks Customers from Trading Spot Bitcoin ETFs, Prompting Dissatisfaction and Account Closures

7 Best Gold IRA Companies 2023 (ranked by customer reviews).

7 Best Gold IRA Companies 2023 (ranked by customer reviews).

7 Best Bitcoin IRA Companies 2023 – Ranked by the lowest fees

7 Best Bitcoin IRA Companies 2023 – Ranked by the lowest fees