Exploring the potential benefits of combining Bitcoin with a Roth IRA can provide valuable insights into optimizing your financial future. Below are four case studies that delve into the advantages of holding Bitcoin in a Roth IRA and how it can align with your retirement and inheritance goals.

1. Sally the Super Stacker: Strategic Retirement Planning

Sally, a young enthusiast in her early 30s, recognizes the potential of Bitcoin as a superior savings vehicle. She aims to accumulate wealth steadily and leverage Bitcoin's fixed supply to secure her financial future.

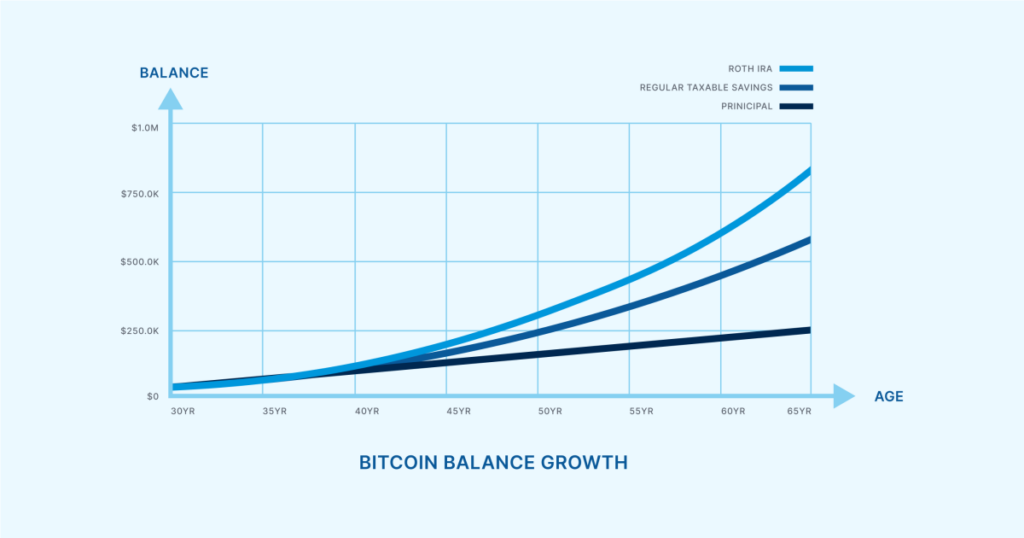

The Significance of Tax-Free Growth

Sally, like many Bitcoin investors, accumulates post-tax income into Bitcoin. However, by opening a Roth IRA, she can benefit from tax-free growth, reducing her overall tax burden and maximizing her savings potential.

Utilizing Roth IRA Flexibility

Aside from retirement planning, Sally can withdraw her contributions tax-free at any time for essential life milestones, showcasing the flexibility and advantages offered by a Roth IRA.

Key Takeaways

A Roth IRA presents a powerful tool for tax-efficient wealth accumulation, offering not only retirement benefits but also financial flexibility for various life events.

2. Rod's Retirement Readiness: Financial Stability in Retirement

Rod, on the brink of retirement, values financial stability and diversity in his investment portfolio. While Bitcoin plays a crucial role, he needs a strategic approach to manage his tax liabilities effectively.

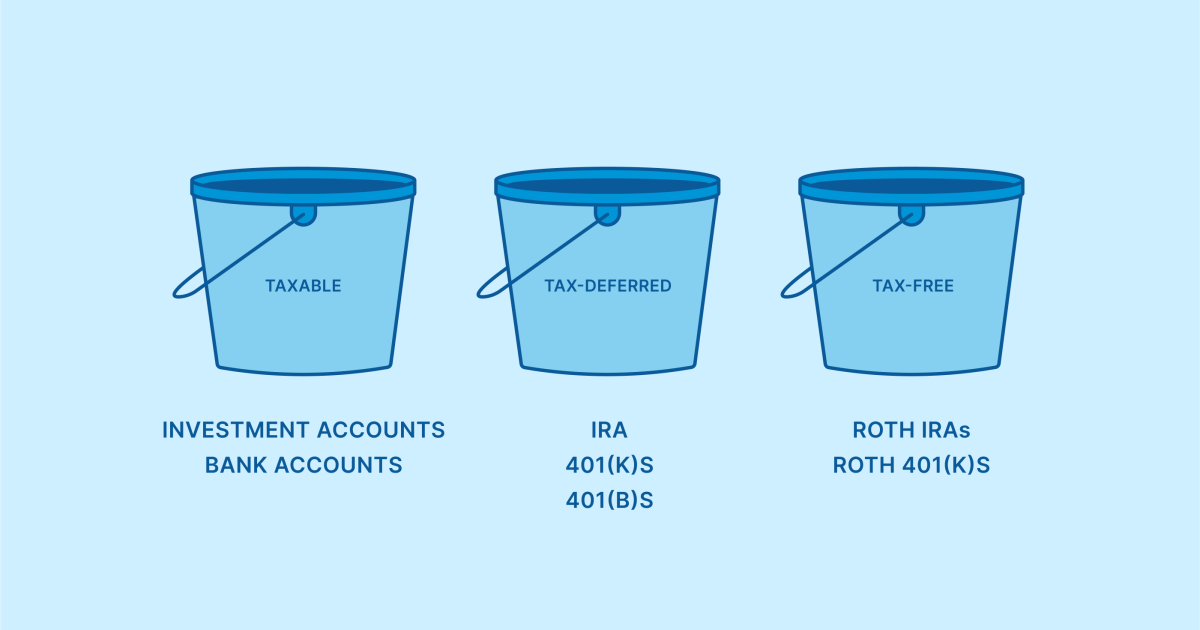

Strategic Tax Bracket Management

By understanding his tax brackets and utilizing different "tax buckets," Rod can optimize his income sources during retirement, ensuring a balanced and tax-efficient financial plan.

Planning for Tax-Efficient Income

Adding a Roth IRA to his retirement strategy provides Rod with additional tax-free income options, enhancing his overall financial resilience during retirement.

Key Takeaways

Effective tax bracket management and diversified income sources are essential for a stable and tax-efficient retirement, highlighting the value of incorporating a Roth IRA into retirement planning.

3. Larry's Legacy Plan: Inheriting Wealth with Bitcoin

Larry, focusing on legacy planning, aims to pass on his wealth, including Bitcoin, to future generations. By leveraging a Roth IRA, he can safeguard his assets and ensure tax-efficient wealth transfer.

Strategic Inheritance Considerations

Through a Roth IRA, Larry can secure tax-free growth for his assets, enabling seamless wealth transfer to his beneficiaries while minimizing tax implications.

Maximizing Tax Efficiency

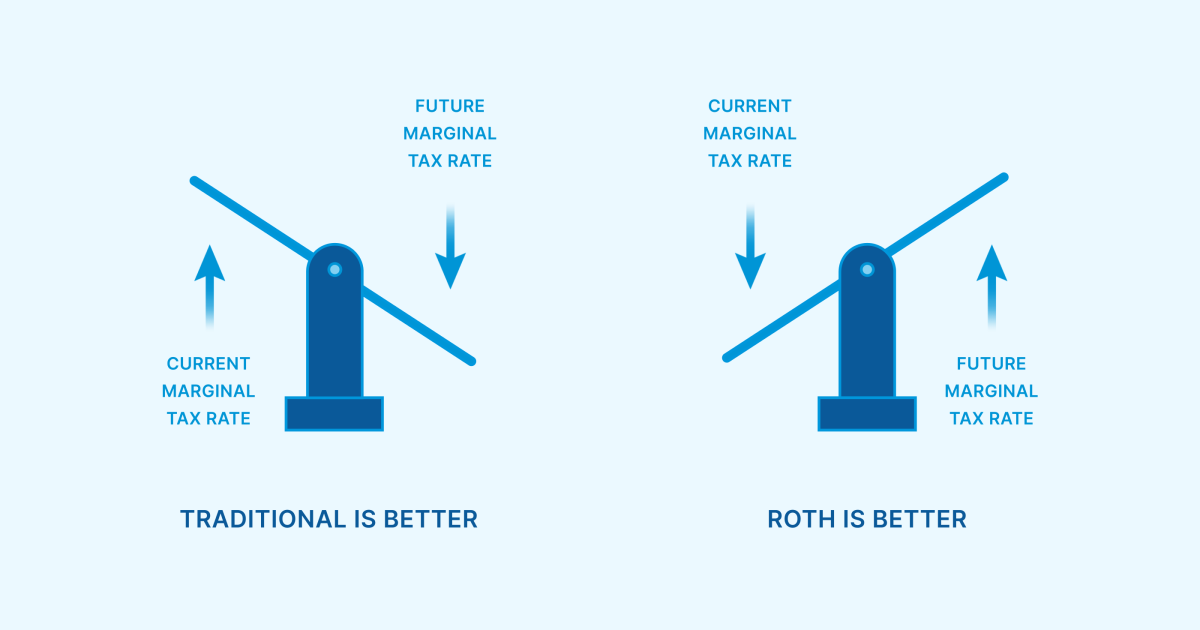

Considering a Roth conversion for existing retirement funds can further enhance tax efficiency, ensuring that future generations receive the benefits of his legacy with minimal tax burdens.

Key Takeaways

By strategically utilizing a Roth IRA and planning for tax-efficient wealth transfer, Larry can leave a lasting legacy for his loved ones, emphasizing the importance of effective inheritance planning.

4. "Why Would I?" Wayne's Perspective: Evaluating Alternative Strategies

Wayne, content with his current financial standing and charitable intentions, explores the nuances of a Roth IRA in comparison to his existing investment structure. By evaluating tax implications and charitable contributions, Wayne can make informed decisions about his financial future.

Assessing Tax Implications

Considering his income levels and charitable intentions, Wayne weighs the benefits of a Roth IRA against alternative strategies, ensuring that his financial decisions align with his long-term goals.

Exploring Charitable Contributions

With a focus on charitable giving, Wayne navigates the complexities of estate taxes and income tax implications, highlighting the importance of aligning financial strategies with philanthropic goals.

Key Takeaways

Understanding the tax implications of different financial strategies and aligning investment decisions with personal values are crucial for effective wealth management and legacy planning, emphasizing the significance of a tailored approach to financial planning.

By examining these case studies, you can gain valuable insights into the potential benefits of integrating Bitcoin into a Roth IRA and how it can align with your unique financial goals. Whether planning for retirement, inheritance, or charitable contributions, a strategic approach to wealth management can pave the way for a secure financial future.

Frequently Asked Questions

What are the pros and cons of a gold IRA?

The main advantage of an Individual Retirement Account (IRA) over a regular savings account is that you don't have to pay taxes on any interest earned. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. But, this type of investment comes with its own set of disadvantages.

You may lose all your accumulated savings if you take too much out of your IRA. You may also be prohibited by the IRS from making withdrawals from an IRA after you turn 59 1/2. A penalty fee will be charged if you decide to withdraw funds.

Another disadvantage is that you must pay fees to manage your IRA. Many banks charge between 0.5%-2.0% per year. Others charge management fees that range from $10 to $50 per month.

Insurance will be required if you would like to keep your cash out of banks. In order to make a claim, most insurers will require that you have a minimum amount in gold. Some insurers may require you to have insurance that covers losses up $500,000.

If you decide to open a gold IRA, it is important to know how much you can use. Some providers restrict the amount you can own in gold. Others allow you to pick your weight.

It's also important to decide whether or not to buy gold futures contracts. The price of physical gold is higher than that of gold futures. Futures contracts allow you to buy gold with more flexibility. Futures contracts allow you to create a contract with a specified expiration date.

You will also have to decide which type of insurance coverage is best for you. The standard policy doesn't include theft protection or loss due to fire, flood, or earthquake. It does offer coverage for natural disasters. If you live near a high-risk region, you might want to consider additional coverage.

Additional to your insurance, you will need to consider how much it costs to store your gold. Insurance doesn't cover storage costs. In addition, most banks charge around $25-$40 per month for safekeeping.

A qualified custodian is required to help you open a Gold IRA. A custodian keeps track of your investments and ensures that you comply with federal regulations. Custodians aren't allowed to sell your assets. They must instead keep them for as long as you ask.

After you've determined which type of IRA is best for you, fill out the paperwork indicating your goals. Your plan should include information about the investments you want to make, such as stocks, bonds, mutual funds, or real estate. Also, you should specify how much each month you plan to invest.

After completing the forms, send them along with a check or a small deposit to your chosen provider. The company will then review your application and mail you a letter of confirmation.

Consider consulting a financial advisor when opening a golden IRA. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can help reduce your expenses by helping you find cheaper alternatives to buying insurance.

Can I buy gold with my self-directed IRA?

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

If you do decide that you want to invest, it is a good idea to buy physical bullion and not in futures. Futures contracts are financial instruments based on the price of gold. They let you speculate on future price without having to own the metal. However, physical bullion is real gold or silver bars you can hold in your hands.

What are the benefits of a Gold IRA?

It is best to put your retirement money in an Individual Retirement Account (IRA). It's tax-deferred until you withdraw it. You are in complete control of how much you take out each fiscal year. And there are many different types of IRAs. Some are better suited to college savings. Some are better suited for investors who want higher returns. For example, Roth IRAs allow individuals to contribute after age 59 1/2 and pay taxes on any earnings at retirement. These earnings don't get taxed if they withdraw funds. This type account may make sense if it is your intention to retire early.

Because it allows you money to be invested in multiple asset classes, a ‘gold IRA' is similar to any other IRAs. Unlike a regular IRA, you don't have to worry about paying taxes on your gains while you wait to access them. This makes gold IRA accounts excellent options for people who prefer to keep their money invested instead of spending it.

Another benefit of owning gold through an IRA is that you get to enjoy the convenience of automatic withdrawals. That means you won't have to think about making deposits every month. To avoid missing a payment, direct debits can be set up.

Finally, gold is one of the safest investment choices available today. Because it isn't tied to any particular country its value tends be steady. Even in times of economic turmoil, gold prices tend not to fluctuate. Gold is a good option for protecting your savings from inflation.

How Does Gold Perform as an Investment?

Supply and demand determine the gold price. It is also affected by interest rates.

Due to limited supplies, gold prices are subject to volatility. You must also store physical gold somewhere to avoid the risk of it becoming stale.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

cftc.gov

forbes.com

bbb.org

irs.gov

How To

Guidelines for Gold Roth IRA

You should start investing early to ensure you have enough money for retirement. You should start as soon as you are eligible (usually at age 50) and continue saving throughout your career. It is important to invest enough money each and every year to ensure you get adequate growth.

Also, you want to take advantage tax-free options such as a traditional 401k, SEP IRA or SIMPLE IRA. These savings vehicles permit you to make contributions, but not pay any tax until your earnings are withdrawn. This makes them a great choice for people who don’t have access employer matching funds.

It is important to save consistently over time. You'll miss out on any potential tax benefits if you're not contributing the maximum amount allowed.

—————————————————————————————————————————————————————————————-

By: Unchained

Title: Should You Consider Including Bitcoin in Your Roth IRA? Four Case Studies

Sourced From: bitcoinmagazine.com/guides/four-case-studies-should-you-hold-bitcoin-in-a-roth-ira

Published Date: Sun, 17 Mar 2024 14:00:00 GMT