An Overview of NFT Sales in 2023

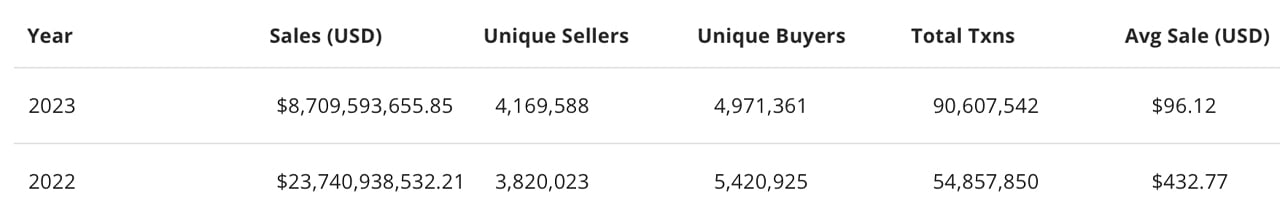

In 2023, the non-fungible token (NFT) market experienced a significant decline in sales compared to the previous year. According to recent statistics, NFT sales amounted to $8.70 billion, representing a 63.35% decrease from the $23.74 billion recorded in 2022.

A Closer Look at the Numbers

Despite the drop in overall sales, there was a surge in the quantity of NFT transactions. In 2023, a total of 90,607,554 NFT transactions took place, surpassing the 54,857,850 transactions recorded in 2022.

Data from cryptoslam.io reveals that there were 4.16 million sellers and 4.97 million buyers of NFTs in 2023. Although the number of sellers increased compared to the previous year, it did not surpass the 5,420,925 buyers in 2022.

The Rise of Bitcoin and Solana in NFT Sales

While Ethereum has maintained its dominance in the NFT market, Bitcoin and Solana experienced a significant increase in sales towards the end of 2023. In fact, Bitcoin outperformed Ethereum in November and December, climbing to the fourth rank with $1.83 billion in total sales.

At present, Ethereum remains the leader with a staggering $42.12 billion in sales, followed by Solana at $4.62 billion and the Ronin blockchain, known for hosting Axie Infinity, at $4.25 billion. Despite the late surge in Bitcoin-related NFTs, Axie Infinity maintains its position as the top-selling collection overall.

The Decline of Bored Ape Yacht Club and Cryptopunks

While Axie Infinity continues to lead the way, other notable collections such as Bored Ape Yacht Club (BAYC) and Cryptopunks experienced a significant decrease in value. On January 1, 2023, the floor value of BAYC stood at 69.49 ether, equivalent to approximately $84K. However, by January 1, 2024, the BAYC floor had dropped to 26.17 ETH, with the value amounting to about $60K.

The Resilience and Evolution of the NFT Market

Despite the decline in overall NFT sales, the increased activity and diversification of platforms and collections highlight the resilience and evolution of the sector. The shifting demographics of buyers and sellers, coupled with the rise of Bitcoin-centric NFTs, indicate a market that is far from stagnant. While Ethereum continues to dominate, the emergence of new contenders suggests a broadening horizon for the NFT ecosystem.

What are your thoughts on the significant dip in NFT sales in 2023 compared to the previous year? Share your opinions in the comments section below.

Frequently Asked Questions

What are the advantages of a gold IRA

The best way to invest money for retirement is by putting it into an Individual Retirement Account (IRA). It's not subject to tax until you withdraw it. You can decide how much money you withdraw each year. And there are many different types of IRAs. Some are better suited for people who want to save for college expenses. Others are made for investors seeking higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. The earnings earned after they withdraw the funds aren't subject to any tax. So if you're planning to retire early, this type of account may make sense.

Because it allows you money to be invested in multiple asset classes, a ‘gold IRA' is similar to any other IRAs. Unlike a regular IRA you don't need to worry about taxes while you wait for your gains to be available. For people who would rather invest than spend their money, gold IRA accounts are a good option.

An additional benefit to owning gold through an IRA, is the ease of automatic withdrawals. This eliminates the need to constantly make deposits. To make sure you don't miss any payments, you can also set up direct deductions.

Finally, gold is one the most secure investment options available. Because it's not tied to any particular country, its value tends to remain steady. Even in times of economic turmoil gold prices tend to remain stable. This makes it a great investment option to protect your savings from inflation.

Can the government take your gold

Because you have it, the government can't take it. You have earned it by working hard for it. It belongs exclusively to you. But, this rule is not universal. You could lose your gold if convicted of fraud against a federal government agency. If you owe taxes, your precious metals could be taken away. However, even though your taxes have not been paid, you can still keep your precious metals, even though they are considered the property of United States Government.

What precious metal should I invest in?

The answer to this question depends on how much risk you are willing to take and what type of return you want. While gold is considered a safe investment option, it can also be a risky choice. Gold may not be right for you if you want quick profits. Silver is a better investment if you have patience and the time to do it.

If you don’t want to be rich fast, gold might be the right choice. However, silver might be a better option if you're looking for an investment that provides steady returns over long periods.

How can you withdraw from an IRA of Precious Metals?

First decide if your IRA account allows you to withdraw funds. You should also ensure that you have enough money to cover any fees and penalties associated with withdrawing funds.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, you'll need to figure out how much money you will take out of your IRA. The calculation is influenced by several factors such as your age at withdrawal, the length of time you have owned the account and whether or not you plan to continue contributing to retirement plans.

Once you have determined the percentage of your total savings that you would like to convert to cash, you can then decide which type of IRA to use. Traditional IRAs let you withdraw money tax-free after you turn 59 1/2, while Roth IRAs require you to pay income taxes upfront but allow you access the earnings later without paying any additional taxes.

Once the calculations have been completed, it's time to open a brokerage accounts. Many brokers offer signup bonuses or other promotions to encourage people to open accounts. Avoid unnecessary fees by opening an account with your debit card, rather than your credit card.

When you finally get around to making withdrawals from your precious metal IRA, you'll need a safe place where you can store your coins. Some storage facilities can accept bullion bar, while others require you buy individual coins. You will need to weigh each one before making a decision.

Bullion bars, for example, require less space as you're not dealing with individual coins. However, each coin will need to be counted individually. However, you can easily track the value of individual coins by storing them in separate containers.

Some prefer to store their coins in a vault. Some people prefer to store their coins safely in a vault. Whichever method you choose, make sure you store your bullion safely so you can enjoy its benefits for years to come.

What are the fees associated with an IRA for gold?

$6 per month is the Individual Retirement Account Fee (IRA). This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

You may have to pay additional fees if you want to diversify your portfolio. The fees you pay will vary depending on the type of IRA that you choose. Some companies offer free check accounts, but charge monthly fee for IRA accounts.

Many providers also charge annual management fees. These fees are usually between 0% and 1%. The average rate for a year is.25%. However, these rates are typically waived if you use a broker like TD Ameritrade.

How much tax is gold subject to in an IRA

The fair value of gold sold to determines the price at which tax is due. You don't pay taxes when you buy gold. It is not income. If you decide to sell it later, there will be a taxable gain if its price rises.

Loans can be secured with gold. Lenders seek to get the best return when you borrow against your assets. For gold, this means selling it. It's not guaranteed that the lender will do it. They may keep it. They might decide that they want to resell it. The bottom line is that you could lose potential profit in any case.

In order to avoid losing your money, only lend against your precious metal if you plan to use it to secure other collateral. If you don't plan to use it as collateral, it is better to let it be.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

bbb.org

investopedia.com

How To

Investing in gold or stocks

Gold investing as an investment vehicle can seem extremely risky these days. The reason behind this is that many people believe that gold is no longer profitable to invest in. This belief comes from the fact most people see gold prices falling due to the global economy. They believe they would lose their money if they invested gold. In reality, however there are still many significant benefits to gold investing. Let's take a look at some of the benefits.

One of the oldest currencies known to man is gold. There are records of its use going back thousands of years. It is a valuable store of value that has been used by many people throughout the world. As a means of payment, South Africa and many other countries still rely on it.

You must first decide how much you are willing and able to pay per gram to decide whether or not gold should be your investment. If you're interested in buying gold bullion, it is crucial that you decide how much per gram. You could contact a local jeweler to find out what their current market rate is.

It's also important to note that, although gold prices are down in recent months, the costs of producing it have risen. Although the price of gold has dropped, production costs have not.

When deciding whether to buy gold, another thing to consider is how much gold you intend on buying. It makes sense to save any gold you don't need to purchase if your goal is to use it for wedding rings. But, if your goal is to make long-term investments in gold, this might be worth considering. You can profit if you sell your gold at a higher price than you bought it.

We hope this article helped you to gain a better appreciation of gold as a tool for investment. We recommend that you investigate all options before making any major decisions. Only then can you make informed decisions.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: The State of NFT Sales: A Deep Dive into the Numbers

Sourced From: news.bitcoin.com/market-dynamics-shift-as-nft-sales-tumble-63-year-over-year/

Published Date: Mon, 01 Jan 2024 21:13:39 +0000

Related posts:

2024 Sees Steepest Weekly Plunge in NFT Sales, 5 Major Blockchains Register Double-Digit Losses

2024 Sees Steepest Weekly Plunge in NFT Sales, 5 Major Blockchains Register Double-Digit Losses

7 Best Gold IRA Companies 2023 (ranked by customer reviews).

7 Best Gold IRA Companies 2023 (ranked by customer reviews).

Bitcoin Dominates NFT Market with $853 Million in December Sales

Bitcoin Dominates NFT Market with $853 Million in December Sales

Sales of Non-Fungible Tokens (NFTs) Surge in November, Bitcoin Climbs Past Ethereum

Sales of Non-Fungible Tokens (NFTs) Surge in November, Bitcoin Climbs Past Ethereum