NFT Market Faces Sharp Decline

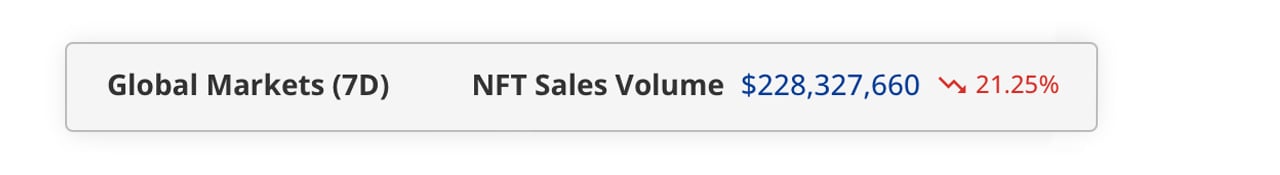

In the span between Jan. 20 to Jan. 27, 2024, there was a notable decline in the sales volume stemming from non-fungible tokens (NFTs), plunging 21.25% from the week before. The leading blockchains in seven-day sales, Ethereum and Bitcoin, experienced substantial decreases, ranging from 28.78% to 12.62%, respectively.

At the onset of 2024, NFT sales dipped by 1.31%, falling below the last week's figures of 2023. The subsequent week witnessed a marginal rise in NFT sales, approximately 0.05%, but last week experienced a 5.05% drop in digital collectible sales.

This week marked the steepest decline in 2024, with sales plunging over 21% compared to the previous seven days. According to metrics from cryptoslam.io, the total amounted to $228,327,660.

Shift in Blockchain Dominance

This downturn contrasts with the year-end surge in NFT sales during 2023, largely driven by Bitcoin blockchain-based NFT transactions. In November and December of 2023, Bitcoin's NFT sales dominated, continuing to lead in the first week of January 2024.

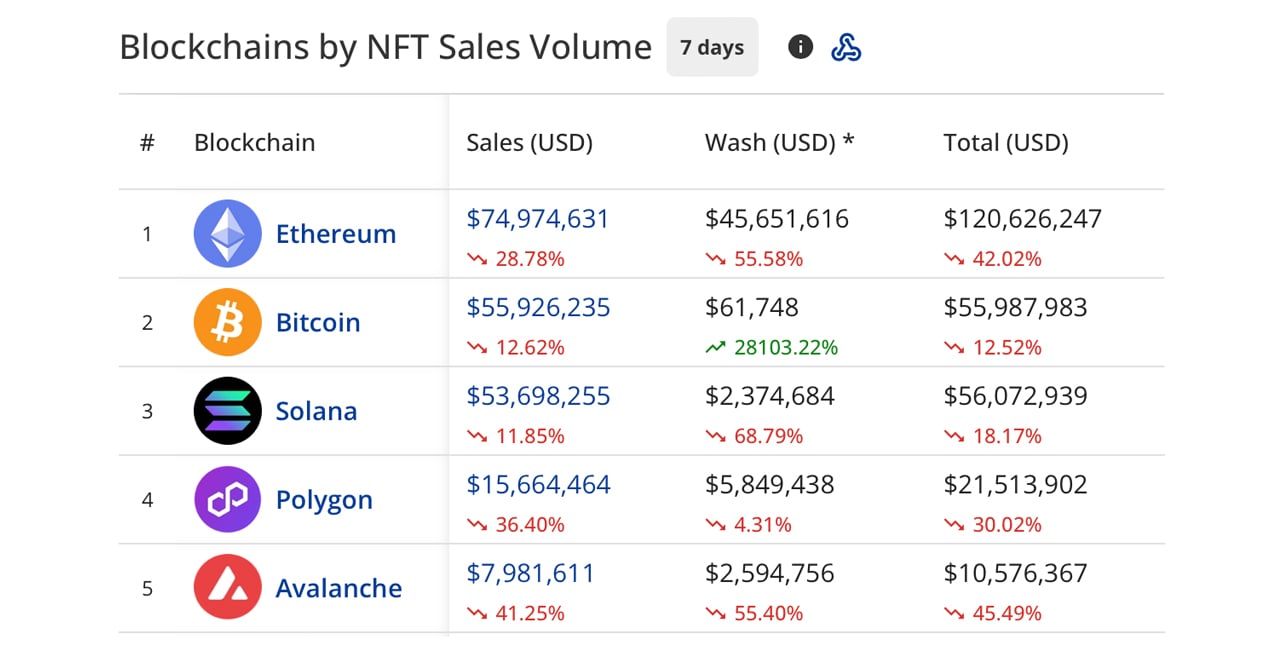

However, recent weeks have shown a shift, with Ethereum reclaiming its position as the frontrunner in NFT sales volume. Over the past seven days, Ethereum's NFT sales amounted to $74.97 million, marking a 28.78% decrease from the previous week.

Meanwhile, Bitcoin experienced a 12.62% week-over-week drop, with $55.92 million in sales over the same seven-day period. Solana secured the third rank, recording $53.69 million in sales, which is a decrease of 11.85%.

Polygon's NFT sales claimed the fourth position, amounting to $15.66 million, yet experienced a 36.40% drop. In the fifth spot, Avalanche garnered $7.98 million in sales, with a notable 41.25% decline in its NFT market.

All five of the top blockchains leading the week's sales saw double-digit losses. Among the top ten this week, Ronin, notably the blockchain supporting Axie Infinity, witnessed a significant 209.09% surge, achieving $1.76 million in NFT sales.

High-Ranking NFT Collections and Top Sales

In the realm of unique digital collectible collections, the Cryptopunks series clinched the highest position in sales this week. Cryptopunks amassed $13.67 million in sales during the past seven days, marking an increase of 32.23% from the previous week.

Bitcoin's Uncategorized Ordinals experienced $9 million in sales, witnessing a 3.75% decline from the week prior. In the third spot, Solana's Froganas reported $7.04 million in sales, a significant increase of 420.77% compared to last week.

Occupying the fourth rank, Solana's Cryptoundeads achieved $6.75 million in sales, yet faced a 58.82% decrease. In the fifth position, Avalanche's Dokyo NFT collection registered $5.85 million in sales, experiencing a 33.70% drop in sales volume from the previous week.

The past week's highest-priced digital collectible was Cryptopunk #6,940, fetching $507,618 seven days ago. BNB's Lockdealnft #18,858 realized a sale of $147,157 four days ago, while an Axie Infinity NFT commanded a price of $143,559 this week.

An Uncategorized Ordinal was acquired for $88,386, and a Cardano's Meld Diamond Hand #2,813 went for $56,186. The sales of Cryptopunk #6,940 and the Axie Infinity NFT contributed significantly to the sales boost on their respective chains.

Challenging Period for NFT Sales

Sales of blockchain-based digital collectibles faced a challenging period throughout 2022, and most of 2023 also witnessed a downturn in NFT sales until the year's end. Bitcoin's entry into the NFT sales arena initially boosted overall sales, but BTC-focused NFT sales not only decreased this week but also experienced a 28.15% drop the week before.

NFTs based on Solana and Polygon showed an increase in the latter part of 2023, yet they have recently encountered modest falls in their overall digital collectible sales volume. Whether this downward trend in NFT sales continues or a resurgence occurs remains to be seen.

What do you think about this week's NFT sales action? Share your thoughts and opinions about this subject in the comments section below.

Frequently Asked Questions

How much of your portfolio should you hold in precious metals

This question can only be answered if we first know what precious metals are. Precious elements are those elements which have a high price relative to other commodities. This makes them extremely valuable for trading and investing. Gold is currently the most widely traded precious metal.

There are many other precious metals, such as silver and platinum. The price for gold is subject to fluctuations, but stays relatively stable in times of economic turmoil. It is also relatively unaffected both by inflation and deflation.

In general, prices for precious metals tend increase with the overall marketplace. They do not always move in the same direction. The price of gold tends to rise when the economy is not doing well, but the prices of the other precious metals tends downwards. Investors expect lower interest rate, making bonds less appealing investments.

The opposite effect happens when the economy is strong. Investors are more inclined to invest in safe assets, such as Treasury Bonds, and they will not demand precious metals. They are more rare, so they become more expensive and less valuable.

To maximize your profits when investing in precious metals, diversify across different precious metals. Because precious metals prices are subject to fluctuations, it is best to invest across multiple precious metal types, rather than focusing on one.

Is gold a good choice for an investment IRA?

Any person looking to save money is well-served by gold. It is also an excellent way to diversify you portfolio. There's more to gold that meets the eye.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It is often called “the most ancient currency in the universe.”

But gold is mined from the earth, unlike paper currencies that governments create. It is very valuable, as it is rare and hard to create.

The supply and demand factors determine how much gold is worth. People tend to spend more when the economy is healthy, which means that fewer people are able to mine gold. The result is that gold's value increases.

On the flip side, people save cash for emergencies and don't spend it. This results in more gold being produced, which drives down its value.

It is this reason that gold investing makes sense for businesses and individuals. You will benefit from economic growth if you invest in gold.

Additionally, you'll earn interest on your investments which will help you grow your wealth. Additionally, you won't lose cash if the gold price falls.

Can the government take your gold?

Your gold is yours and the government cannot take it. You have earned it by working hard for it. It belongs entirely to you. This rule may not apply to all cases. Your gold could be taken away if your crime was fraud against federal government. You can also lose precious metals if you owe taxes. However, even if taxes are not paid, gold is still your property.

What are the pros and disadvantages of a gold IRA

An Individual Retirement Account is a more beneficial option than regular savings accounts. You don't pay taxes on any interest earned. This makes an IRA great for people who want to save money but don't want to pay tax on the interest they earn. This type of investment has its downsides.

You may lose all your accumulated savings if you take too much out of your IRA. The IRS may prevent you from taking out your IRA funds until you reach 59 1/2. If you do decide to withdraw funds from your IRA, you'll likely need to pay a penalty fee.

A disadvantage to managing your IRA is the fact that fees must be paid. Many banks charge between 0.5% and 2.0% per year. Other providers may charge monthly management fees, ranging between $10 and $50.

If you prefer to keep your money outside a bank, you'll need to purchase insurance. Many insurers require that you own at least one ounce of gold before you can make a claim. Some insurers may require you to have insurance that covers losses up $500,000.

If you choose to have a gold IRA you will need to establish how much gold to use. Some providers restrict the amount you can own in gold. Others let you choose your weight.

You will also have to decide whether to purchase futures or physical gold. Gold futures contracts are more expensive than physical gold. Futures contracts provide flexibility for purchasing gold. You can set up futures contracts with a fixed expiration date.

Also, you will need to decide on the type of insurance coverage you would like. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. It does offer coverage for natural disasters. If you live in a high-risk area, you may want to add additional coverage.

You should also consider the cost of storage for your gold. Storage costs are not covered by insurance. Safekeeping costs can be as high as $25-40 per month at most banks.

If you decide to open a gold IRA, you must first contact a qualified custodian. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians don't have the right to sell assets. Instead, they must maintain them for as long a time as you request.

After you have decided on the type of IRA that best suits you, you will need to complete paperwork detailing your goals. You should also include information about your desired investments, such as stocks or bonds, mutual funds, real estate, and mutual funds. Your monthly investment goal should be stated.

After filling in the forms, please send them to the provider. The company will review your application and send you a confirmation letter.

Consider consulting a financial advisor when opening a golden IRA. Financial planners are experts at investing and can help you determine which type of IRA is best for you. They can help reduce your expenses by helping you find cheaper alternatives to buying insurance.

What is the tax on gold in Roth IRAs?

The tax on an investment account is based on its current value, not what you originally paid. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

But if you put the money into a traditional IRA or 401(k), there's no tax when you withdraw the money. Taxes are only charged on capital gains or dividends earned, which only apply to investments longer than one calendar year.

These accounts are subject to different rules depending on where you live. Maryland requires that you withdraw funds within 60 business days after reaching the age of 59 1/2. In Massachusetts, you can wait until April 1st. New York has a maximum age limit of 70 1/2. To avoid penalties, plan ahead so you can take distributions at the right time.

How much gold should you have in your portfolio?

The amount of money you need to make depends on how much capital you are looking for. Start small with $5k-10k. As your business grows, you might consider renting out office space or desks. This way, you don't have to worry about paying rent all at once. Only one month's rent is required.

Also, you need to think about the type of business that you are going to run. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. Consider how much you expect to make from each client, if you decide to do this kinda thing.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. You might get paid only once every six months.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I recommend starting with $1k to $2k of gold, and then growing from there.

How much are gold IRA fees?

An Individual Retirement Account (IRA) fee is $6 per month. This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

To diversify your portfolio you might need to pay additional charges. The fees you pay will vary depending on the type of IRA that you choose. Some companies offer free check accounts, but charge monthly fee for IRA accounts.

Most providers also charge an annual management fee. These fees range from 0% to 1%. The average rate is.25% per year. However, these rates are typically waived if you use a broker like TD Ameritrade.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

bbb.org

irs.gov

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

finance.yahoo.com

How To

Guidelines for Gold Roth IRA

The best way to invest for retirement is by starting early. Start saving as soon and as often as you're eligible (usually around 50 years old) and keep going until retirement. To ensure sufficient growth, it is vital that you contribute enough each year.

Additionally, tax-free opportunities like a traditional 401k or SEP IRA are available. These savings vehicles permit you to make contributions, but not pay any tax until your earnings are withdrawn. This makes them great options for people who don't have access to employer matching funds.

Savings should be done consistently and regularly over time. If you aren't contributing the maximum amount permitted, you could miss out on tax benefits.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: 2024 Sees Steepest Weekly Plunge in NFT Sales, 5 Major Blockchains Register Double-Digit Losses

Sourced From: news.bitcoin.com/2024-sees-steepest-weekly-plunge-in-nft-sales-5-major-blockchains-register-double-digit-losses/

Published Date: Sun, 28 Jan 2024 19:00:53 +0000

Related posts:

Bitcoin Dominates NFT Market with $853 Million in December Sales

Bitcoin Dominates NFT Market with $853 Million in December Sales

Sales of Non-Fungible Tokens (NFTs) Surge in November, Bitcoin Climbs Past Ethereum

Sales of Non-Fungible Tokens (NFTs) Surge in November, Bitcoin Climbs Past Ethereum

Surge in NFT Sales: Bitcoin Outperforms Ethereum in Thriving Market

Surge in NFT Sales: Bitcoin Outperforms Ethereum in Thriving Market

This Week’s NFT Prices Slide, Bored Ape Market Cap Falls 21%, Floor Pricing Sinks Lower

This Week’s NFT Prices Slide, Bored Ape Market Cap Falls 21%, Floor Pricing Sinks Lower