Brandt Questions Maximalists' Commitment to the Values of Bitcoin

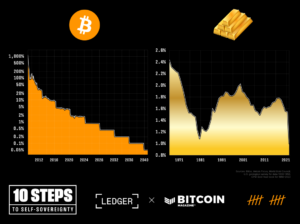

Veteran trader Peter Brandt believes that the expected approval of spot Bitcoin exchange-traded funds (ETF) may lead to a classic trading strategy known as "buy the rumor, sell the news." Brandt's observation is based on the enthusiasm of bitcoin maximalists who eagerly await the approval of spot bitcoin ETFs, despite the underlying values of bitcoin being outside government control.

Buy the Rumor, Sell the News

In traditional stock trading, "buy the rumor, sell the news" refers to a strategy where traders speculate on an upcoming event and sell their positions when the event is announced. Many believe that the anticipated approval of spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) falls into this category of events.

Brandt, in a post on X, points out the irony of BTC maximalists embracing the SEC and ETFs as the saviors of their financial future, considering that one of the core values of bitcoin is its independence from government control.

Time for Experienced Traders to Get Out

Brandt compares the current hype around bitcoin ETFs to a common guide used by experienced traders. When the average person is eager to enter the market, it often signals that it's time for the seasoned traders to exit. However, Brandt acknowledges that his observations could be wrong and invites others to share their thoughts on the matter.

Social media users have responded to Brandt's post, with some disagreeing and others offering alternative perspectives. One user suggests that if the SEC approves multiple spot Bitcoin ETFs, the price of bitcoin will rise, and countries may even adopt it as a reserve currency. Another user highlights that for bitcoiners from other parts of the world, the ETF approvals are not as significant, as they value bitcoin for its ability to protect their savings from local fiat currency devaluation.

What are your thoughts on Peter Brandt's comments about BTC maximalists? Share your opinion in the comments section below.

Frequently Asked Questions

Should You Invest Gold in Retirement?

The answer will depend on how many dollars you have saved so far and whether you had gold as an investment option at the time. If you are unsure which option to choose, consider investing in both options.

You can earn potential returns on your investment of gold. Retirees will find it an attractive investment.

While many investments promise fixed returns, gold is subject to fluctuations. Because of this, gold's value can fluctuate over time.

This does not mean you shouldn’t invest in gold. Instead, it just means you should factor the fluctuations into your overall portfolio.

Another benefit of gold is that it's a tangible asset. Gold can be stored more easily than stocks and bonds. It is also easily portable.

You can always access gold as long your place it safe. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. As gold prices rise in tandem with other commodities it can be a good hedge against rising cost.

Additionally, it will be a benefit to have some of your savings invested into something that won't lose value. Gold rises in the face of a falling stock market.

Another advantage to investing in gold is the ability to sell it whenever you wish. Like stocks, you can sell your position anytime you need cash. You don’t even need to wait until retirement to liquidate your position.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Also, don't buy too much at once. Start small, buying only a few ounces. Continue adding more as necessary.

Keep in mind that the goal is not to quickly become wealthy. Instead, the goal is to accumulate enough wealth that you don't have to rely on Social Security.

Gold may not be the most attractive investment, but it could be a great complement to any retirement strategy.

Can I buy Gold with my Self-Directed IRA?

However, gold can only be purchased with your self-directed IRA. To do so, you must first open a brokerage account at TD Ameritrade. If you have an existing retirement account, you can transfer funds to another one.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

You might want to purchase physical bullion, rather than futures contracts if you are going to invest in gold. Futures contracts, which are financial instruments based upon the price of gold, are financial instruments. These contracts allow you to speculate on future gold prices without actually owning it. But physical bullion refers to real gold and silver bars you can carry in your hand.

What are the pros and cons of a gold IRA?

An Individual Retirement account (IRA) is a better option than regular savings accounts in that interest earned is exempted from tax. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. However, there are disadvantages to this type investment.

For example, if you withdraw too much from your IRA once, you could lose all your accumulated funds. You may also be prohibited by the IRS from making withdrawals from an IRA after you turn 59 1/2. If you do withdraw funds from your IRA you will most likely be required to pay a penalty.

Another problem is the cost of managing your IRA. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management costs ranging from $10-50.

You can purchase insurance if you want to keep your money out of a bank. A majority of insurance companies require that you possess a minimum amount gold to be eligible for a claim. Insurance that covers losses upto $500,000.

You will need to decide how much gold you wish to use if you opt for a gold IRA. Some providers limit how many ounces you can keep. Some providers allow you to choose your weight.

You'll also need to decide whether to buy physical gold or futures contracts. Physical gold is more expensive than gold futures contracts. Futures contracts, however, allow for greater flexibility in buying gold. Futures contracts allow you to create a contract with a specified expiration date.

It is also important to choose the type of insurance coverage that you need. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. It does include coverage for damage due to natural disasters. You might consider purchasing additional coverage if your area is at high risk.

In addition to insurance, you'll need to consider the cost of storing your gold. Insurance won't cover storage costs. For safekeeping, banks typically charge $25-40 per month.

To open a IRA in gold, you will need to first speak with a qualified custodian. Custodians keep track of your investments and ensure compliance with federal regulations. Custodians aren't allowed to sell your assets. Instead, they must maintain them for as long a time as you request.

After you have decided on the type of IRA that best suits you, you will need to complete paperwork detailing your goals. Information about your investments such as stocks and bonds, mutual fund, or real property should be included in your plan. You should also specify how much you want to invest each month.

After filling in the forms, please send them to the provider. The company will review your application and send you a confirmation letter.

You should consult a financial planner before opening a Gold IRA. Financial planners have extensive knowledge in investing and can help determine the best type of IRA to suit your needs. They can also help reduce your costs by suggesting cheaper options for purchasing insurance.

Is it a good retirement strategy to buy gold?

Although buying gold as an investment might not sound appealing at first, when you look at the average annual gold consumption worldwide, it is worth looking into.

Physical bullion bar is the best way to invest in precious metals. There are many ways to invest your gold. The best thing to do is research all options thoroughly and then make an informed decision based on what you want from your investments.

If you don't want to keep your wealth safe, buying shares in companies that extract gold and mining equipment could be a better choice. Owning gold stocks should work well if you need cash flow from your investment.

ETFs allow you to invest in exchange-traded funds. These funds give you exposure, but not actual gold, by investing in gold-related securities. These ETFs can include stocks of precious metals refiners and gold miners.

What's the advantage of a Gold IRA?

There are many benefits to a gold IRA. It's an investment vehicle that allows you to diversify your portfolio. You can control how much money is deposited into each account as well as when it's withdrawn.

You also have the option to transfer funds from other retirement plans into a IRA. If you are planning to retire early, this makes it easy to transition.

The best thing is that investing in gold IRAs doesn't require any special skills. They are readily available at most banks and brokerages. Withdrawals can happen automatically, without any fees or penalties.

But there are downsides. Gold is known for being volatile in the past. So it's essential to understand why you're investing in gold. Is it for growth or safety? Is it for security or long-term planning? Only when you are clear about the facts will you be able take an informed decision.

If you want to keep your gold IRA open for life, you might consider purchasing more than one ounce. A single ounce will not be sufficient to meet all your requirements. You could need several ounces depending on what you plan to do with your gold.

If you're planning to sell off your gold, you don't necessarily need a large amount. You can even get by with less than one ounce. However, you will not be able buy any other items with those funds.

Can I keep physical gold in an IRA?

Not only is gold paper currency, but it's also money. Gold is an asset people have used for thousands years as a place to store value and protect their wealth from economic uncertainty and inflation. Gold is a part of a diversified portfolio that investors can use to protect their wealth from financial uncertainty.

Many Americans today prefer to invest in precious metals, such as silver and gold, over stocks and bonds. While owning gold doesn't guarantee you'll make money investing in gold, there are several reasons why it may make sense to consider adding gold to your retirement portfolio.

One reason is that gold historically performs better than other assets during financial panics. Between August 2011 to early 2013, gold prices rose close to 100 percent while the S&P 500 fell 21 per cent. During these turbulent market times, gold was among few assets that outperformed the stocks.

Gold is one of the few assets that has virtually no counterparty risks. If your stock portfolio goes down, you still own your shares. You can still own your gold even if the company where you invested fails to pay its debt.

Finally, gold is liquid. This means you can easily sell your gold any time, unlike other investments. The liquidity of gold makes it a good investment. This allows you to take advantage of short-term fluctuations in the gold market.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

finance.yahoo.com

cftc.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Three Ways to Invest In Gold For Retirement

It is crucial to understand how you can incorporate gold into your retirement plans. You have many options for investing in gold if there is a 401K account at your workplace. It is also possible to invest in gold from outside of your work environment. You could, for example, open a custodial bank account at Fidelity Investments if your IRA (Individual Retirement Account) is open. Or, if you don't already own any precious metals, you may want to consider buying them directly from a reputable dealer.

These are the rules for gold investing:

- Buy Gold with Cash – Avoid using credit cards or borrowing money to fund investments. Instead, put cash into your accounts. This will protect your against inflation and increase your purchasing power.

- Own Physical Gold Coins – You should buy physical gold coins rather than just owning a paper certificate. Physical gold coins can be sold much faster than paper certificates. Also, there are no storage fees associated with physical gold coins.

- Diversify Your Portfolio. Never place all your eggs in the same basket. This is how you spread your wealth. You can invest in different assets. This helps to reduce risk and provides more flexibility when markets are volatile.

—————————————————————————————————————————————————————————————-

By: Terence Zimwara

Title: The Rise of Bitcoin ETF Hype: Is it Time for Experienced Traders to Sell?

Sourced From: news.bitcoin.com/veteran-trader-peter-brandt-labels-bitcoin-etf-a-classic-buy-the-rumor-sell-the-news-event/

Published Date: Wed, 10 Jan 2024 19:40:15 +0000