In a groundbreaking move, the U.S. Securities and Exchange Commission (SEC) has given its approval for the listing and trading of 11 spot bitcoin exchange-traded funds (ETFs) on major U.S. stock exchanges. This long-awaited decision comes after years of anticipation and regulatory challenges. The approved spot bitcoin ETFs are set to begin trading on Thursday on NYSE Arca, Nasdaq, and Cboe BZX Exchange.

Spot Bitcoin ETFs Set to Launch

The SEC announced on Wednesday that it has granted approval for 11 spot bitcoin exchange-traded fund (ETF) applications to be listed and traded on NYSE Arca, the Nasdaq Stock Market, and Cboe BZX Exchange.

The approved spot bitcoin ETFs include ARK 21shares Bitcoin ETF (ARKB), Fidelity Wise Origin Bitcoin Fund (FBTC), Franklin Bitcoin ETF (EZBC), Invesco Galaxy Bitcoin ETF (BTCO), Vaneck Bitcoin Trust (HODL), Wisdomtree Bitcoin Fund (BTCW), Bitwise Bitcoin Trust (BITB), Ishares Bitcoin Trust (IBIT), Valkyrie Bitcoin Fund (BRRR), Hashdex Bitcoin ETF (DEFI), and Grayscale Bitcoin Trust (GBTC).

These 11 applicants filed their final registration statements (S-1) with the SEC this week, revealing a fierce competition to offer the lowest fees. Blackrock, the world's largest asset manager, reduced its fee to 0.25% (0.12% for the first $5 billion) in its latest filing. Ark Invest and 21shares also joined the fee-cutting frenzy, offering an ETF fee of 0.21% with a 0% waiver for the first six months or $1 billion. Bitwise currently holds the lowest fee at 0.20%, while Grayscale remains the most expensive option at 1.5%.

Spot Bitcoin ETFs and the Cash Creation Model

All approved spot bitcoin ETFs follow the cash creation model, which aligns with the SEC's preference. Cathie Wood, the CEO of Ark Invest, believes that spot bitcoin ETFs will have a significant positive impact on the price of bitcoin. Vaneck's director of digital assets also emphasized the long-term influence of spot bitcoin ETFs, stating that it is often underestimated.

Crypto exchange Coinbase, which will act as the custodian for most U.S. spot bitcoin ETFs, has expressed its readiness for the approval of these ETFs.

What are your thoughts on the SEC's decision to approve spot bitcoin ETFs? Share your opinions in the comments section below.

Frequently Asked Questions

How Does Gold Perform as an Investment?

The supply and the demand for gold determine how much gold is worth. It is also affected negatively by interest rates.

Due to their limited supply, gold prices fluctuate. In addition, there is a risk associated with owning physical gold because you have to store it somewhere.

What are the advantages of a gold IRA

You can save money on retirement by putting your money into an Individual Retirement Account. You can withdraw it at any time, but it is tax-deferred. You can decide how much money you withdraw each year. There are many types available. Some are better suited for college students. Some are better suited for investors who want higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. These earnings don’t get taxed if they withdraw funds. This account is a good option if you plan to retire early.

The gold IRA allows you to invest in different asset classes, which is similar to other IRAs. Unlike a regular IRA that requires you to pay taxes on the gains you make while you wait to access them, a gold IRA does not have to do this. This makes gold IRA accounts excellent options for people who prefer to keep their money invested instead of spending it.

You can also enjoy automatic withdrawals, which is another benefit of owning your gold through an IRA. You won’t have the hassle of making deposits each month. To ensure that you never miss a payment, you could set up direct debits.

Finally, gold is one the most secure investment options available. Its value is stable because it’s not tied with any one country. Even during economic turmoil the gold price tends to remain fairly stable. This makes it a great investment option to protect your savings from inflation.

What does a gold IRA look like?

For people who are looking to invest in precious materials, Gold Ira account accounts provide tax-free investments.

You can buy physical gold bullion coins at any time. To invest in gold, you don’t need to wait for retirement.

You can keep gold in an IRA forever. You won’t have to pay taxes on your gold investments when you die.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. Because your gold doesn’t belong to the estate, it’s not necessary to include it on your final estate plan.

To open a Gold IRA, you’ll need to first set up an Individual Retirement Account (IRA). After you have done this, an IRA custodian will be assigned to you. This company acts as a middleman between you and the IRS.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reports.

Once you’ve set up your gold IRA, it’s possible to buy gold bullion. The minimum deposit is $1,000. You’ll get a higher rate of interest if you deposit more.

When you withdraw your gold from your IRA, you’ll pay taxes on it. If you are withdrawing your entire balance, you will owe income tax plus a 10% penalty.

Even if your contribution is small, you might not have to pay any taxes. There are some exceptions, though. However, there are exceptions. If you take 30% or more of your total IRA asset, you’ll owe federal Income Taxes plus a 20% penalty.

It is best to not take out more than 50% annually of your total IRA assets. Otherwise, you’ll face steep financial consequences.

How to Open a Precious Metal IRA?

First, you must decide if your Individual Retirement Account (IRA) is what you want. You must complete Form 8606 to open an account. Next, fill out Form 5204. This will determine the type of IRA that you are eligible for. This form should be filled within 60 calendar days of opening the account. You can then start investing once you have this completed. You might also be able to contribute directly from the paycheck through payroll deduction.

To get a Roth IRA, complete Form 8903. The process for an ordinary IRA will not be affected.

To qualify for a precious Metals IRA, there are specific requirements. The IRS requires that you are at least 18 years old and have earned an income. For any tax year, your earnings must not exceed $110,000 ($220,000 for married filing jointly). Additionally, you must make regular contributions. These rules apply whether you’re contributing through an employer or directly from your paychecks.

You can invest in precious metals IRAs to buy gold, palladium and platinum. However, you can’t purchase physical bullion. You won’t have the ability to trade stocks or bonds.

Your precious metals IRA may also be used to invest in precious-metal companies. This option is offered by some IRA providers.

There are two major drawbacks to investing via an IRA in precious metals. They aren’t as liquid as bonds or stocks. They are therefore more difficult to sell when necessary. They also don’t pay dividends, like stocks and bonds. Therefore, you will lose more money than you gain over time.

What amount should I invest in my Roth IRA?

Roth IRAs can be used to save taxes on your retirement funds. You cannot withdraw funds from these accounts until you reach 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. First, you can’t touch your principal (the initial amount that was deposited). This means that you can’t take out more money than you originally contributed. If you are able to take out more that what you have initially contributed, you must pay taxes.

The second rule is that your earnings cannot be withheld without income tax. You will pay income taxes when you withdraw your earnings. Let’s suppose that you contribute $5,000 annually to your Roth IRA. In addition, let’s assume you earn $10,000 per year after contributing. The federal income tax on your earnings would amount to $3,500. This leaves you with $6,500 remaining. Since you’re limited to taking out only what you initially contributed, that’s all you could take out.

Therefore, even if you take $4,000 out of your earnings you still owe taxes on $1,500. On top of that, you’d lose half of the earnings you had taken out because they would be taxed again at 50% (half of 40%). So even though your Roth IRA ended up having $7,000, you only got $4,000.

There are two types: Roth IRAs that are traditional and Roth. Traditional IRAs allow for pre-tax deductions from your taxable earnings. Your traditional IRA can be used to withdraw your balance and interest when you are retired. You have the option to withdraw any amount from a traditional IRA.

Roth IRAs don’t allow you deduct contributions. However, once you retire, you can withdraw your entire contribution plus accrued interest. Unlike a traditional IRA, there is no minimum withdrawal requirement. You don’t have to wait until you turn 70 1/2 years old before withdrawing your contribution.

Statistics

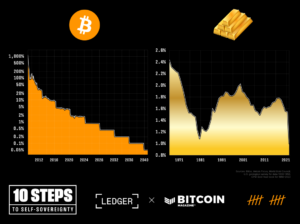

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item’s value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Do you want to keep your IRA gold at home? It’s not legal – WSJ

irs.gov

bbb.org

cftc.gov

How To

Investing gold vs. stocks

These days, it might seem quite risky to invest your money in gold. The reason behind this is that many people believe that gold is no longer profitable to invest in. This belief is due to the fact that many people see gold prices dropping because of the global economy. They think that they would lose money if they invested in gold. In reality, however, there are still significant benefits that you can get when investing in gold. Let’s take a look at some of the benefits.

Gold is the oldest known form of currency. There are records of its use going back thousands of years. It was used all around the world as a reserve of value. Even today, countries such as South Africa continue to rely heavily on it as a form of payment for their citizens.

It is important to determine the price per Gram that you will pay for gold when making a decision about whether or not to invest. When looking into buying gold bullion, you must decide how much you are willing to spend per gram. You can always ask a local jeweler what the current market rate is if you don’t have it.

It’s worth noting, however, that while gold prices have fallen recently the cost of producing gold is on the rise. So, although gold prices have declined in recent years, the cost of producing it has not changed.

The amount of gold that you are planning to purchase is another important consideration when deciding whether or not gold should be bought. If you plan to buy enough gold to cover your wedding rings then it is probably a good idea to wait before buying any more. But, if your goal is to make long-term investments in gold, this might be worth considering. If you sell your gold for more than you paid, you can make a profit.

We hope that this article has helped you gain a better understanding and appreciation for gold as an investment option. We recommend that you investigate all options before making any major decisions. Only then will you be able to make an informed decision.

—————————————————————————————————————————————————————————————-

By: Kevin Helms

Title: SEC Approves 11 Spot Bitcoin ETFs for U.S. Stock Exchanges

Sourced From: news.bitcoin.com/mass-approvals-sec-green-lights-11-spot-bitcoin-etfs/

Published Date: Wed, 10 Jan 2024 21:21:26 +0000