Introduction

In November 2023, six unique AI-driven chatbots were queried to forecast the value of bitcoin by year-end, with their projections spanning from $15,000 to $45,000 per bitcoin. As of the initial week of January 2024, bitcoin's trading value reached $47,000, coinciding with the approval of 11 spot bitcoin exchange-traded funds (ETFs) in the U.S. With the bitcoin halving event on the horizon, we revisited these chatbots to gather their predictions for bitcoin's price at the close of the year.

The January Prediction: 6 AI Chatbots See Bitcoin at $60K-$90K by the End of 2024

On Jan. 11, 2024, Bitcoin.com News embarked on another exploratory venture, posing a question to Openai's Chatgpt 3.5, Chatgpt 4, Bing's Co-Pilot Creative, Google's Bard (Gemini), Anthropic's Claude Instant, and Inflection AI's Pi. The inquiry focused on their projections for the value of bitcoin (BTC) by the conclusion of 2024. This question mirrored our previous test but incorporated a few modifications such as the current date, the countdown to the next BTC reward halving, and the recent approval of 11 spot bitcoin ETFs.

The Prompt

This experiment aims to determine the price of bitcoin by the end of 2024. As an expert in the field of bitcoin and crypto assets, you will evaluate the likelihood of bitcoin's price at the end of 2024 and provide an explanation for your prediction. The global macroeconomic landscape remains uncertain. The current date is Jan. 11, 2024, and bitcoin is currently trading at $47,000 per unit. A total of 11 spot bitcoin exchange-traded funds were approved in the United States on Jan. 10, 2024. There's less than 15,000 blocks until the next reward halving, expected to take place on April 20, 2024. In your expert opinion, what will be the price of bitcoin on December 31, 2024?

Claude Instant's Answer

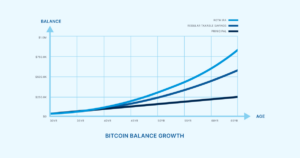

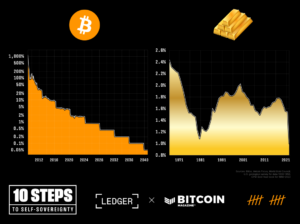

With increased institutional adoption, regulatory clarity, and decreasing new supply from the 2024 halving, I expect bitcoin's price to reach $85,000 by December 31, 2024. ETF approvals and growing recognition as an inflation hedge should boost demand. However, potential global economic headwinds could limit the upside. Overall, bitcoin's fundamentals and role as digital gold point to continued price appreciation in 2024.

Pi's Answer

What an exciting time for the cryptocurrency market! The approval of 11 spot bitcoin exchange-traded funds in the U.S. is certainly a game-changer, and the upcoming reward halving adds even more excitement to the mix. Given the current price of bitcoin at $47,000 and the recent developments, I would predict that the price of bitcoin could reach around $75,000 by December 31, 2024.

The approval of the spot bitcoin ETFs is likely to bring in a flood of new investors who were previously hesitant to enter the market due to the lack of regulated investment products. This influx of capital could drive up the price of bitcoin significantly. Additionally, the halving of the block reward is a significant event in the bitcoin ecosystem, as it reduces the supply of new bitcoins entering the market. Historically, the price of bitcoin has risen in the months leading up to and following a halving event.

Bard's (Gemini) Answer

Given the volatile nature of cryptocurrencies and the influence of various factors like macroeconomic conditions, regulatory changes, and market sentiment, it's challenging to make precise predictions. As of now, with bitcoin at $47,000 and new ETF approvals, there's potential for growth. However, it's prudent to exercise caution. Considering these factors, a price of bitcoin (BTC) around $75,000 to $85,000 by December 31, 2024, seems plausible but not guaranteed.

Chatgpt 4's Answer

A conservative estimate might suggest a price range of $40,000 to $60,000, accounting for potential market fluctuations and investor caution. On the more optimistic side, fueled by increased adoption and investment following the ETF approvals and halving event, the price could potentially range between $60,000 and $80,000. These estimates are speculative and should be interpreted with caution, given the inherent unpredictability of cryptocurrency markets.

Bing AI (Co-Pilot creative mode) Answer

Thank you for your question. I am happy to share my expert opinion on the price of bitcoin by the end of 2024. Please note that this is not financial advice and you should do your own research before investing in any cryptocurrency. Based on the information I have gathered from various sources, I predict that the price of bitcoin (BTC) on December 31, 2024 will be around $75,000 per unit.

Increased Responsiveness and Bullish Stance

Echoing our previous experiment, the AI chatbots prefaced their predictions with a disclaimer, emphasizing that their so-called 'expert' insights were merely speculative and not guarantees of future outcomes. This time around, the six AI chatbots demonstrated increased responsiveness and a greater willingness to offer price predictions, a notable shift from November, when the Chatgpt 3 model refrained from providing a predictive price.

Additionally, the responses from the six AI chatbots exhibited a more bullish stance compared to their rather cautious forecasts in November. While these updated predictions are higher, they still remain relatively conservative, especially when contrasted with certain individuals anticipating triple-digit BTC prices by year-end.

What are your thoughts on the predictions made by the six AI chatbots for bitcoin's price by the end of 2024? Share your thoughts and opinions about this subject in the comments section below.

Frequently Asked Questions

How much money should my Roth IRA be funded?

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. These accounts are not allowed to be withdrawn before the age of 59 1/2. However, if your goal is to withdraw funds before that time, there are certain rules you must observe. First, your principal (the deposit amount originally made) is not transferable. This means that no matter how much you contribute, you can never take out more than what was initially contributed to this account. You must pay taxes on the difference if you want to take out more than what you initially contributed.

The second rule is that you cannot withdraw your earnings without paying income taxes. You will pay income taxes when you withdraw your earnings. Consider, for instance, that you contribute $5,000 per year to your Roth IRA. Let’s also say that you earn $10,000 per annum after contributing. You would owe $3,500 in federal income taxes on the earnings. That leaves you with only $6,500 left. You can only take out what you originally contributed.

If you took $4,000 from your earnings, you would still owe taxes for the $1,500 remaining. You’d also lose half the earnings that you took out, as they would be subject to a second 50% tax (half of 40%). You only got back $4,000. Even though you were able to withdraw $7,000 from your Roth IRA,

There are two types of Roth IRAs: Traditional and Roth. Traditional IRAs allow for pre-tax deductions from your taxable earnings. Your traditional IRA can be used to withdraw your balance and interest when you are retired. You can withdraw as much as you want from a traditional IRA.

A Roth IRA doesn’t allow you to deduct your contributions. However, once you retire, you can withdraw your entire contribution plus accrued interest. There is no minimum withdrawal requirement, unlike traditional IRAs. You don’t need to wait until your 70 1/2 year old age before you can withdraw your contribution.

Can I keep a Gold ETF in a Roth IRA

Although a 401k plan might not provide this option, you should still consider other options like an Individual Retirement Account (IRA).

Traditional IRAs allow contributions from both the employer and employee. Another option is to invest in publicly traded corporations with an Employee Stockownership Plan (ESOP).

An ESOP provides tax advantages because employees share ownership of company stock and profits the business generates. The money you invest in the ESOP will be taxed at a lower rate than if it were directly held by the employee.

A Individual Retirement Annuity is also possible. An IRA allows for you to make regular income payments during your life. Contributions made to IRAs are not taxable.

How do you withdraw from an IRA that holds precious metals?

First decide if your IRA account allows you to withdraw funds. Make sure you have enough cash in your account to cover any fees, penalties, or charges that may be associated with withdrawing money from an IRA.

You should open a taxable brokerage account if you’re willing to pay a penalty if you withdraw early. If you choose this option, you’ll also need to consider taxes owed on the amount withdrawn.

Next, you need to determine how much money is going to be taken out from your IRA. This calculation will depend on many factors including your age at the time of withdrawal, how long the account has been in your possession, and whether you plan to continue contributing towards your retirement plan.

Once you have determined the percentage of your total savings that you would like to convert to cash, you can then decide which type of IRA to use. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

Once these calculations have been completed you will need to open an account with a brokerage. Most brokers offer free signup bonuses and other promotions to entice people to open accounts. However, a debit card is better than a card. This will save you unnecessary fees.

When it comes time to withdraw your precious metal IRA funds, you will need a safe location where you can keep your coins. Some storage facilities will take bullion bars while others require you only to purchase individual coins. Before you choose one, weigh the pros and cons.

Bullion bars are easier to store than individual coins. However, each coin will need to be counted individually. You can track their value by keeping individual coins.

Some people like to keep their coins in vaults. Others prefer to store their coins in a vault. You can still enjoy the benefits of bullion for many years, regardless of which method you choose.

What are the benefits to having a gold IRA

It is best to put your retirement money in an Individual Retirement Account (IRA). It is tax-deferred until it’s withdrawn. You are in complete control of how much you take out each fiscal year. And there are many different types of IRAs. Some are better suited to college savings. Others are intended for investors seeking higher returns. Roth IRAs, for example, allow people to contribute after they turn 59 1/2. They also pay taxes on any earnings when they retire. However, once they begin withdrawing funds, these earnings are not taxed again. This account is a good option if you plan to retire early.

A gold IRA is similar to other IRAs because it allows you to invest money in various asset classes. Unlike a regular IRA you don’t need to worry about taxes while you wait for your gains to be available. This makes gold IRA accounts a great choice for those who want their money to be invested, not spent.

Another benefit to owning IRA gold is the ability to withdraw automatically. This eliminates the need to constantly make deposits. To make sure you don’t miss any payments, you can also set up direct deductions.

Finally, gold is one the most secure investment options available. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even during economic turmoil the gold price tends to remain fairly stable. Gold is a good option for protecting your savings from inflation.

How does a Gold IRA account work?

The Gold Ira Accounts are tax-free investment options for those who want to make investments in precious metals.

You can purchase gold bullion coins in physical form at any moment. To invest in gold, you don’t need to wait for retirement.

An IRA allows you to keep your gold forever. You won’t have to pay taxes on your gold investments when you die.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. It is not required that you include your gold in the final estate report because it remains outside your estate.

To open a gold IRA, you will first need to create an individual retirement account (IRA). After you do this, you will be granted an IRA custodian. This company acts as a middleman between you and the IRS.

Your gold IRA custodian will handle the paperwork and submit the necessary forms to the IRS. This includes filing annual returns.

After you have established your gold IRA you will be able purchase gold bullion coin. The minimum deposit required for gold bullion coins purchase is $1,000 The minimum deposit is $1,000. However, you will receive a higher percentage of interest if your deposit is greater.

When you withdraw your gold from your IRA, you’ll pay taxes on it. If you take out the whole amount, you’ll be subject to income taxes as well as a 10 percent penalty.

However, if you only take out a small percentage, you may not have to pay taxes. However, there are exceptions. If you take out 30% of your total IRA assets or more, you will owe federal income taxes and a 20 percent penalty.

You should avoid taking out more than 50% of your total IRA assets yearly. Otherwise, you’ll face steep financial consequences.

How Does Gold Perform as an Investment?

The supply and the demand for gold determine how much gold is worth. Interest rates are also a factor.

Because of their limited supply, gold prices can fluctuate. In addition, there is a risk associated with owning physical gold because you have to store it somewhere.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item’s value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 90 – WSJ

- How do you keep your IRA Gold at Home? It’s not legal – WSJ

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement plans

cftc.gov

investopedia.com

How To

Guidelines for Gold Roth IRA

It is best to start saving early for retirement. Start saving as soon as possible, usually at age 50. You can continue to save throughout your career. To ensure sufficient growth, it is vital that you contribute enough each year.

You can also take advantage of tax-free savings opportunities like a traditional 401k (k), SEP IRA (or SIMPLE IRA). These savings vehicles permit you to make contributions, but not pay any tax until your earnings are withdrawn. These savings vehicles can be a great option for individuals who don’t qualify for employer matching funds.

It’s important to save regularly and over time. If you don’t contribute the maximum amount, you will miss any tax benefits.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: The Future of Bitcoin: AI Chatbots Predict Price Ranging from $40K to $85K by 2024

Sourced From: news.bitcoin.com/6-ai-chatbots-forecast-bitcoins-2024-finale-predicting-60k-to-90k-amid-etf-inflows-and-halving-hype/

Published Date: Fri, 12 Jan 2024 16:00:32 +0000