LBank's Fourth Launchpad: EchoLink

LBank, a leading global crypto exchange, has announced the launch of its fourth Launchpad on January 26, 2024. This exciting launch will feature the project EchoLink, which has already garnered widespread market attention. LBank's previous Launchpad projects, including PINs Network, UMM, and ACGN Protocol's token AIMEME, have been highly successful, further raising the anticipation for EchoLink's launch.

LBank's Commitment to Global Crypto Asset Trading

LBank is dedicated to promoting the globalization of crypto asset trading, and the launch of EchoLink is a testament to this commitment. Through its Launchpad, LBank provides global users with a broader range of crypto asset investment opportunities, accelerating the development of the global digital economy. LBank has been at the forefront of market trends, launching high-profile projects such as $Ordi and BRC20 concept leaders SATS, RATS, MUDI, offering users optimal prices to participate in the hottest market projects.

The Power of LBank Launchpad

LBank Launchpad is a key feature of the LBank trading platform, designed to provide users with a wider range of crypto asset investment opportunities. With LBank Launchpad, users can easily participate in high-quality blockchain projects and share in their growth and success. The continuous growth of LBank's global user base showcases its competitive strength in the global digital asset trading platform market. LBank's global strategy focuses on providing users with a broader and more diverse selection of digital assets, enabling global investors to participate in and benefit from the crypto economy's development.

Introducing EchoLink: Decentralized Physical Infrastructure Network (DePIN)

EchoLink is a decentralized physical infrastructure network (DePIN) based on Solana and oriented towards the Internet of Things (IoT) oracle. It utilizes advanced proof mechanisms to provide data capture, measurement, and verification services for numerous IoT devices. EchoLink leverages zero-knowledge proofs and homomorphic encryption technologies to ensure secure data transmission to oracle nodes while maintaining integrity. By bridging data and blockchain, EchoLink creates a toolkit for DePIN projects, laying the foundation for the future integration of IoT with blockchain.

The Advantages of EchoLink

EchoLink sets itself apart in the DePIN sector through its innovative approach. It not only acts as a platform bridging IoT devices with blockchain but also provides data capture, measurement, and verification services for IoT devices. The launch of EchoLink signifies a deep integration of IoT with blockchain technology, offering users a secure and efficient data interaction environment.

As the tokens of EchoLink, $ECHO holds significant potential for market appreciation. With the continuous development and expansion of the EchoLink ecosystem, these tokens are expected to become popular investment choices in the digital asset field. Holders of $ECHO tokens will have the right to participate in the governance decisions of the EchoLink community. This decentralized governance model allows community members to directly participate in the ecosystem's development and decision-making processes. Overall, $ECHO tokens are not only integral to the EchoLink ecosystem but also serve as a link connecting community members, creators, and investors, jointly promoting the integration and development of IoT with blockchain technology.

LBank Launchpad's Strong Market Performance

LBank Launchpad offers users a diverse selection of projects, covering innovative and forward-looking projects in various fields. LBank is committed to providing users with a safe and reliable trading environment. LBank Launchpad follows high-standard security measures and employs a fair project allocation mechanism, ensuring every user has an equal opportunity to participate in projects and the security of user assets. Global users can conveniently participate in Launchpad projects through the LBank platform, enjoying the benefits brought by project growth.

Participation Guide for EchoLink Token Contribution

Interested participants can contribute to EchoLink's token allocation by following the guidelines below:

Subscription:

Based on 7-day averages of specified coins

Snapshot:

Jan 18-24, 2024

Conditions:

At least conduct one transaction on LBank during this period

Holding Conditions:

BTC ≥ 0.027, ETH ≥ 0.5, USDT ≥ 1000, LBK ≥ 97000, XRP ≥ 1615, TRX ≥ 9650

Token Info:

Token: ECHO

Quota: 10M ECHO (1% of total)

Cap: 50K ECHO

Supply: 1B ECHO

Ratio: 1ECHO = 0.01 USDT

Mode: Contribution

Currency: USDT

Contribution Timeline:

From 00:00 on January 18, 2024, to 24:00 on January 24, 2024, record the 7-day average daily holdings of BTC, ETH, USDT, LBK, XRP, and TRX. The sum of 7-day average holdings divided by 7 days determines the maximum USDT amount that can be contributed.

Contribution opens at 14:00 on January 25, 2024. Users need to sign a purchase agreement when contributing. Please contribute within 5 hours; contributions cannot be made after this period.

Note: USDT can only be contributed from the spot account, and once contributed, it cannot be withdrawn. Please confirm before proceeding.

The contribution channel will close at 19:00 on January 25, 2024.

From 19:00 to 21:00 on January 25, 2024, the token allocation results will be calculated.

At 21:00 on January 25, 2024, the token allocation results will be announced. ECHO tokens and the remaining USDT will be distributed to the users' spot wallets.

About LBank

Established in 2015, LBank is a leading crypto asset trading platform globally. It is dedicated to providing users with secure, convenient, and professional services for crypto asset trading. The platform offers a wide range of digital asset trading pairs and regularly introduces innovative financial products and services to enhance the trading experience. The introduction of LBank's Launchpad demonstrates the platform's commitment to progress and innovation in the blockchain sector. Global users eagerly anticipate engaging in diverse projects through the Launchpad, witnessing the thriving evolution of the crypto asset industry.

Frequently Asked Questions

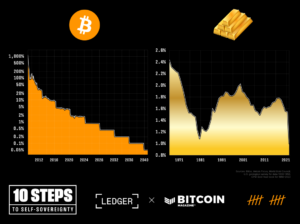

Should you open a Precious Metal IRA

The most important thing you should know before opening an IRA account is that precious metals are not covered by insurance. It is impossible to get back money if you lose your investment. This includes all investments that are lost to theft, fire, flood, or other causes.

You can protect yourself against such losses by purchasing physical gold and silver coins. These items can be lost because they have real value and have been around for thousands years. These items are worth more today than they were when first produced.

If you decide to open an IRA account, choose a reputable company that offers competitive rates and products. It's also wise to consider using a third-party custodian who will keep your assets safe while giving you access to them anytime.

You won't get any returns until you retire if you open an account. Remember the future.

Should You Invest Gold in Retirement?

The answer depends on how much money you have saved and whether gold was an investment option available when you started saving. If you are unsure of which option to invest in, consider both.

Gold offers potential returns and is therefore a safe investment. It is a good choice for retirees.

While many investments promise fixed returns, gold is subject to fluctuations. This causes its value to fluctuate over time.

This doesn't mean that you should not invest in gold. It is important to consider the fluctuations when planning your portfolio.

Another advantage of gold is its tangible nature. Gold can be stored more easily than stocks and bonds. It's also portable.

Your gold will always be accessible as long you keep it in a safe place. There are no storage charges for holding physical gold.

Investing in gold can help protect against inflation. Because gold prices tend to rise along with other commodities, it's a good way to hedge against rising costs.

You'll also benefit from having a portion of your savings invested in something that isn't going down in value. Gold tends to rise when the stock markets fall.

Another advantage to investing in gold is the ability to sell it whenever you wish. You can also liquidate your gold position at any time you need cash, just like stocks. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all of your eggs in one basket.

Do not buy too much at one time. Start with a few ounces. Then add more as needed.

The goal is not to become rich quick. Instead, the goal is to accumulate enough wealth that you don't have to rely on Social Security.

Although gold might not be the right investment for everyone it could make a great addition in any retirement plan.

Is it a good retirement strategy to buy gold?

Although buying gold as an investment might not sound appealing at first, when you look at the average annual gold consumption worldwide, it is worth looking into.

The most popular form of investing in gold is through physical bullion bars. There are many ways to invest your gold. It is best to research all options and make informed decisions based on your goals.

If you don't want to keep your wealth safe, buying shares in companies that extract gold and mining equipment could be a better choice. Owning gold stocks should work well if you need cash flow from your investment.

You can also put your money in exchange traded funds (ETFs). These funds allow you to be exposed to the price and value of gold by holding gold related securities. These ETFs usually include stocks of precious metals refiners or gold miners.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement plans

investopedia.com

cftc.gov

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

The best place to buy silver or gold online

You must first understand the workings of gold before you can purchase it. It is a precious metal that is very similar to platinum. It's very rare and is used as money because of its durability and resistance to corrosion. It's hard to use, so most people prefer buying jewelry made out of it to actual bars of gold.

Two types of gold coins are available today: the legal tender type and the bullion type. Legal tender coins can be used for circulation within a country. These coins usually come in denominations such $1, $5 and $10.

Bullion coin are not intended for investment. However, their value will increase with inflation.

They can't be exchanged in currency exchange systems. One example is that if someone buys $100 worth gold, they get 100 grams with a $100 value. Each dollar spent earns the buyer 1 gram gold.

Next, you need to find out where to buy gold. There are a few options if you wish to buy gold directly from a dealer. You can start by visiting your local coin shop. You can also go to a reputable website such as eBay. You might also consider buying gold from an online private seller.

Individuals who sell gold at wholesale and retail prices are called private sellers. Private sellers typically charge 10% to 15% commission on each transaction. That means you would get back less money from a private seller than from a coin shop or eBay. This option can be a good choice for investing in gold because it allows you to control the price.

Another way to buy gold is by investing in physical gold. It is easier to store physical gold than paper certificates. But, you still have to take care of it. It is important to keep your physical gold safe in an impenetrable box such as a vault, safety deposit box or other secure container.

When buying gold on your own, you can visit a bank or a pawnshop. A bank can give you a loan up to the amount you intend to invest in Gold. Customers can borrow money from pawnshops to purchase items. Banks usually charge higher interest rates that pawn shops.

Another way to purchase gold is to ask another person to do it. Selling gold can be as easy as selling. Set up a simple account with GoldMoney.com and you will start receiving payments instantly.

—————————————————————————————————————————————————————————————-

By: Media

Title: LBank Announces Fourth Launchpad, Featuring EchoLink

Sourced From: news.bitcoin.com/lbank-announces-fourth-launchpad-featuring-echolink/

Published Date: Mon, 15 Jan 2024 07:45:58 +0000