One of the best ways to invest in gold is through a gold IRA. It is a safe haven asset and offers high returns. However, the process is not easy. Investing in gold requires some knowledge of the market and can be complicated, but technology platforms have made it easier for investors.

Investing in gold

One way to invest in gold is to buy stocks of gold mining companies. This is an easy way to earn good returns without having to handle physical gold. However, if you want to avoid losing your money, you must do some research to identify the best companies.

You can invest in gold as part of your Individual Retirement Account. However, there are some requirements you should know before you can start. First, you must contact a brokerage. Your broker should be able to explain what types of investments are allowed. You must also explain to your broker the amount of money you want to invest.

Next, you must research the gold mining companies. You can do this by checking gold prices on various stock exchanges. You can purchase the shares when prices are good, or wait for a better opportunity. Buying gold stocks is a great way to invest in gold and you only have to pay taxes on your capital gains if you sell them within a year.

Investing in rare-earth elements

Investing in rare-earth elements can be an excellent choice for people looking for long-term investment opportunities. These types of investments are generally less risky than many other kinds of investments. Investing in rare-earth elements can be done in a self-directed IRA. To make sure your investment meets the requirements of the internal revenue service, you should make sure to use an IRA-approved business to manage your account.

When investing in rare-earth elements in your individual retirement account, it’s important to choose a firm that provides secure storage for your rare-earth elements. You don’t want your precious metals to be stolen. Using a vault that’s regulated by the IRS will ensure your rare-earth elements are secure from thieves. This is especially important if you have a large collection of rare-earth elements.

TD Ameritrade offers investors a variety of options for investing in rare-earth elements. Besides investing in individual stocks, you can also invest in physical gold and silver. These include gold coins and gold bullion.

Transferring funds to a gold IRA

If you’ve been saving for retirement and have finally decided to buy some gold, there are several ways you can do so with TD Ameritrade. The first option is to roll over your 401(k) funds into an IRA. Then, you can choose between a self-directed or standard IRA. In addition, TD offers a wide range of physical gold bullion options, such as gold coins.

If you’re still unsure about the process, you can always choose an indirect transfer where you receive a check from the account company. You should be aware that you must send this check within 60 days or pay a 10% early withdrawal tax penalty if you’re younger than 59.5 years old.

While you’re transferring funds to a gold IRA, there are certain rules you must follow to keep your money safe. It’s important to look for reviews and testimonials about gold IRA companies on online sites. These can help you avoid scams and get the best value for your money. However, you should beware of fake testimonials based on paid advertisements or republished sites.

Frequently Asked Questions

Should You Buy or Sell Gold?

Gold was a safe investment option for those who were in financial turmoil. Today, many people are looking to precious metals like gold and avoiding traditional investments like bonds and stocks.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

Experts believe this could change soon. Experts predict that gold prices will rise sharply in the wake of another global financial collapse.

They also pointed out that gold is gaining popularity due to its perceived value, and potential return.

These are some important things to remember if your goal is to invest in gold.

- The first thing to do is assess whether you actually need the money you’re putting aside for retirement. It is possible to save for retirement while still investing your gold savings. That said, gold does provide an additional layer of protection when you reach retirement age.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each type offers varying levels and levels of security.

- Finally, remember that gold doesn’t offer the same level of safety as a bank account. You may lose your gold coins and never be able to recover them.

Do your research before you buy gold. If you already have gold, make sure you protect it.

What precious metals do you have that you can invest in for your retirement?

Gold and silver are the best precious metal investments. Both are easy to sell and can be bought easily. You should add them to your portfolio if you are looking to diversify.

Gold: The oldest form of currency known to man is gold. It’s also very safe and stable. It is a good way for wealth preservation during uncertain times.

Silver: The popularity of silver has always been a concern for investors. It is an excellent choice for investors who wish to avoid volatility. Unlike gold, silver tends to go up instead of down.

Platinium: Another form of precious metal is platinum, which is becoming more popular. It’s resistant to corrosion and durable, similar to gold and silver. It is, however, more expensive than its competitors.

Rhodium – Rhodium is used to make catalytic conversions. It’s also used in jewelry making. It is also quite affordable compared with other types of precious metals.

Palladium – Palladium is an alternative to platinum that’s more common but less scarce. It’s also more accessible. For these reasons, it’s become a favorite among investors looking to add precious metals to their portfolios.

Is gold a good IRA investment?

For anyone who wants to save some money, gold can be a good investment. It can be used to diversify your portfolio. But gold has more to it than meets the eyes.

It has been used as a currency throughout history and is still a popular method of payment. It’s often referred to as “the world’s oldest currency.”

But unlike paper currencies, which governments create, gold is mined out of the earth. It is very valuable, as it is rare and hard to create.

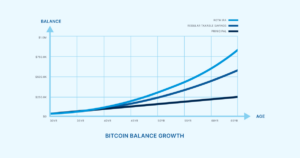

The supply and demand factors determine how much gold is worth. People tend to spend more when the economy is healthy, which means that fewer people are able to mine gold. This results in gold prices rising.

On the flip side, people save cash for emergencies and don’t spend it. This means that more gold is produced, which reduces its value.

This is why gold investment makes sense for both individuals and businesses. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

Additionally, you’ll earn interest on your investments which will help you grow your wealth. Additionally, you won’t lose cash if the gold price falls.

What are some of the advantages and disadvantages to a gold IRA

An Individual Retirement Account is a more beneficial option than regular savings accounts. You don’t pay taxes on any interest earned. An IRA is a great way to save money and not have to pay taxes on the interest you earn. There are some disadvantages to this investment.

If you withdraw too many funds from your IRA at once, you may lose all your accumulated assets. You might also not be able to withdraw from your IRA until the IRS deems you to be 59 1/2. If you do withdraw funds, you’ll need to pay a penalty.

The downside is that managing your IRA requires fees. Many banks charge between 0.5% and 2.0% per year. Other providers charge monthly management fees ranging from $10 to $50.

Insurance will be required if you would like to keep your cash out of banks. Many insurers require that you own at least one ounce of gold before you can make a claim. You may be required by some insurers to purchase insurance that covers losses as high as $500,000.

If you choose to have a gold IRA you will need to establish how much gold to use. Some providers limit the number of ounces of gold that you can own. Others let you pick your weight.

You’ll also need to decide whether to buy physical gold or futures contracts. Futures contracts for gold are less expensive than physical gold. Futures contracts, however, allow for greater flexibility in buying gold. You can set up futures contracts with a fixed expiration date.

Also, you will need to decide on the type of insurance coverage you would like. The standard policy doesn’t include theft protection or loss due to fire, flood, or earthquake. It does provide coverage for damage from natural disasters, however. If you live in a high-risk area, you may want to add additional coverage.

You should also consider the cost of storage for your gold. Insurance won’t cover storage costs. Additionally, safekeeping is usually charged by banks at around $25-$40 per monthly.

To open a IRA in gold, you will need to first speak with a qualified custodian. A custodian keeps track of your investments and ensures that you comply with federal regulations. Custodians cannot sell your assets. Instead, they must retain them for as long and as you require.

After you’ve determined which type of IRA is best for you, fill out the paperwork indicating your goals. You should also include information about your desired investments, such as stocks or bonds, mutual funds, real estate, and mutual funds. It is also important to specify how much money you will invest each month.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. After receiving your application, the company will review it and mail you a confirmation letter.

Consider consulting a financial advisor when opening a golden IRA. Financial planners have extensive knowledge in investing and can help determine the best type of IRA to suit your needs. They can help you find cheaper insurance options to lower your costs.

Should You Open a Precious Metal IRA?

Before opening an IRA, it is important to understand that precious metals aren’t covered by insurance. If you lose money in your investment, nothing can be done to recover it. This includes losing all your investments due to theft, fire, flood, etc.

Investing in physical gold and silver coins is the best way to protect yourself from this type of loss. These items are timeless and have a lifetime value. If you were to sell them today, you would likely receive more than what you paid for them when they were first minted.

Consider a reputable business that offers low rates and good products when opening an IRA. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

Remember that you will not see any returns unless you are retired if you open an Account. Keep your eyes open for the future.

What is the best precious-metal to invest?

This depends on what risk you are willing take and what kind of return you desire. Although gold has been considered a safe investment, it is not always the most lucrative. For example, if you need a quick profit, gold may not be for you. Silver is a better investment if you have patience and the time to do it.

If you’re not looking to make quick money, gold is probably your best choice. Silver might be a better investment option if steady returns are desired over a long period of time.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item’s value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you’ll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

finance.yahoo.com

investopedia.com

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement account

How To

How to Keep Physical Gold in an IRA

The best way of investing in gold is to purchase shares from companies that produce gold. But this investment method has many risks as there is no guarantee of survival. Even if they survive, there’s always the risk that they will lose money due fluctuations in gold prices.

An alternative option would be to buy physical gold itself. You’ll need to open a bank account, buy gold online from a trusted seller, or open an online bullion trading account. These options offer the convenience of easy access, as you don’t need stock exchanges to do so. You can also make purchases at lower prices. It is also easier to check how much gold you have stored. A receipt will be sent to you indicating exactly how much you paid. This will allow you to see if there were any tax omissions. You have less risk of theft when investing in stocks.

However, there are disadvantages. You won’t be able to benefit from investment funds or interest rates offered by banks. It won’t allow you to diversify any of your holdings. Instead, you’ll be stuck with what’s been bought. Finally, tax man may want to ask where you put your gold.

BullionVault.com is the best website to learn about gold purchases in an IRA.