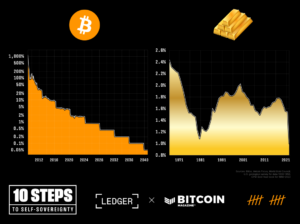

Bitcoin has proven to be one of the top-performing assets over the past decade. In 2023, it outperformed the S&P 500, high-yield corporate bonds, and gold, with a staggering 156 percent increase in value within a year.

The Rise of Bitcoin Demand

Today, Bitcoin's demand is skyrocketing as new spot Bitcoin ETF approvals have piqued institutional interest, highlighting its status as a profitable investment.

A Lucrative Investment

Despite being considered risky and volatile, Bitcoin has been a profitable investment for early adopters. Launched in 2009 at virtually no value, it reached $0.10 in 2010. By 2013, it hit highs of $250, marking a 250,000 percent growth for early investors.

Bitcoin Loans: A Novel Approach

Bitcoin loans offer a unique solution for investors to access funds without selling their BTC holdings. This innovative approach allows individuals to secure loans while retaining the potential for higher returns in the future.

How Bitcoin and Crypto Lending Works

Bitcoin loans fall under the umbrella of crypto lending. Crypto lending platforms enable BTC investors to borrow against their assets or lend out their holdings to earn crypto rewards. These platforms have gained traction since 2020, holding billions in total value locked across various platforms.

Securing a Bitcoin Loan

To secure a Bitcoin-backed loan, investors collateralize their BTC to receive a USD loan. This process eliminates the need for extensive credit checks, streamlining the borrowing process.

Factors to Consider When Applying for a Bitcoin Loan

Before opting for a Bitcoin loan, it's essential to assess the associated risks, including rehypothecation and annual percentage rates. Understanding loan-to-value requirements and tax implications can help borrowers make informed decisions.

Benefits of Bitcoin Loans

Bitcoin-backed loans offer advantages such as liquidity access without selling BTC holdings, enhanced privacy, and expedited loan processing times. These loans serve as an alternative to selling Bitcoin while meeting short-term financial needs.

Bitcoin Loans: A Financial Strategy

By exploring Bitcoin-backed loans, investors can leverage their BTC holdings to address financial needs, invest in other assets, and capitalize on business opportunities. These loans provide a bridge between holding a valuable investment and managing immediate expenses.

Frequently Asked Questions

How much should you have of gold in your portfolio

The amount you make will depend on the amount of capital you have. You can start small by investing $5k-10k. Then as you grow, you could move into an office space and rent out desks, etc. So you don't have all the hassle of paying rent. You only pay one month.

It is also important to decide what kind of business you want to run. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. So if you do this kind of thing, you need to consider how much income you expect from each client.

Freelance work is not likely to pay a monthly salary. The project pays freelancers. You might get paid only once every six months.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I recommend starting with $1k-$2k in gold and working my way up.

Is it a good retirement strategy to buy gold?

Although it may not look appealing at first, buying gold for investment is worth considering when you consider the global average gold consumption per year.

Physical bullion bars are the most popular way to invest in gold. But there are many other options for investing in gold. The best thing to do is research all options thoroughly and then make an informed decision based on what you want from your investments.

If you don’t need a safe place for your wealth, then buying shares of mining companies or companies that extract it might be a better alternative. If you are looking for cash flow from your investment, buying gold stocks will work well.

You can also put your money in exchange traded funds (ETFs). These funds allow you to be exposed to the price and value of gold by holding gold related securities. These ETFs usually include stocks of precious metals refiners or gold miners.

What are the benefits of a Gold IRA?

An Individual Retirement Account (IRA) is the best way to put money towards retirement. It is tax-deferred until it's withdrawn. You control how much you take each year. There are many types of IRAs. Some are more suitable for students who wish to save money for college. Others are designed for investors looking for higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. Once they start withdrawing money, however, the earnings aren’t subject to tax again. This type of account might be a good choice if your goal is to retire early.

Because it allows you money to be invested in multiple asset classes, a ‘gold IRA' is similar to any other IRAs. Unlike a regular IRA, you don't have to worry about paying taxes on your gains while you wait to access them. This makes gold IRA accounts a great choice for those who want their money to be invested, not spent.

Another benefit of owning gold through an IRA is that you get to enjoy the convenience of automatic withdrawals. It means that you don’t have to remember to make deposits every month. To ensure that you never miss a payment, you could set up direct debits.

Gold is one of today's most safest investments. Because it's not tied to any particular country, its value tends to remain steady. Even in times of economic turmoil, gold prices tend not to fluctuate. Therefore, gold is often considered a good investment to protect your savings against inflation.

How is gold taxed in Roth IRA?

Investment accounts are subject to tax based only on their current value and not the amount you originally paid. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

However, if the money is deposited into a traditional IRA/401(k), the tax on the withdrawal of the money is not applicable. Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

The rules governing these accounts vary by state. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. Massachusetts allows you up to April 1st. New York is open until 70 1/2. To avoid any penalties, plan your retirement savings and take your distributions as early as possible.

How can you withdraw from an IRA of Precious Metals?

First, decide if it is possible to withdraw funds from an IRA. You should also ensure that you have enough money to cover any fees and penalties associated with withdrawing funds.

If you are willing to pay a penalty for early withdrawal, you should consider opening a taxable brokerage account instead of an IRA. This option will require you to pay taxes on the amount that you withdraw.

Next, figure out how much money will be taken out of your IRA. This calculation is dependent on several factors like your age when you take the money out, how long you have had the account, and whether or not your plan to continue contributing.

Once you have determined the percentage of your total savings that you would like to convert to cash, you can then decide which type of IRA to use. Traditional IRAs allow for you to withdraw funds without tax when you turn 59 1/2. Roth IRAs, on the other hand, charge income taxes upfront but you can access your earnings later and pay no additional taxes.

Once the calculations have been completed, it's time to open a brokerage accounts. Most brokers offer free signup bonuses and other promotions to entice people to open accounts. To avoid unnecessary fees, however, try opening an account using a debit card rather than a credit card.

When it comes time to withdraw your precious metal IRA funds, you will need a safe location where you can keep your coins. Some storage areas will accept bullion, while others require you to purchase individual coins. You'll have to weigh the pros of each option before you make a decision.

Bullion bars are easier to store than individual coins. But you will have to count each coin separately. You can track their value by keeping individual coins.

Some people prefer to keep coins safe in a vault. Others prefer to store their coins in a vault. No matter what method you use, it is important to keep your bullion safe so that you can reap its benefits for many more years.

How does a gold IRA work?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

You can purchase physical bullion gold coins at any point in time. To start investing in gold, it doesn't matter if you are retired.

The beauty of owning gold as an IRA is you can hold on to it forever. You won't have to pay taxes on your gold investments when you die.

Your gold is passed to your heirs without capital gains tax. It is not required that you include your gold in the final estate report because it remains outside your estate.

You'll first have to set up an individual retirement account (IRA) to open a gold IRA. After you do this, you will be granted an IRA custodian. This company acts as a middleman between you and the IRS.

Your gold IRA custodian will handle the paperwork and submit the necessary forms to the IRS. This includes filing annual reports.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. The minimum deposit is $1,000. A higher interest rate will be offered if you invest more.

You will pay taxes when you withdraw your gold from your IRA. If you take out the whole amount, you'll be subject to income taxes as well as a 10 percent penalty.

However, if you only take out a small percentage, you may not have to pay taxes. There are exceptions. For example, taking out 30% or more of your total IRA assets, you'll owe federal income taxes plus a 20 percent penalty.

Avoid taking out more that 50% of your total IRA assets each year. You'll be facing severe financial consequences if you do.

Should You Invest Gold in Retirement?

The answer will depend on how many dollars you have saved so far and whether you had gold as an investment option at the time. If you are unsure which option to choose, consider investing in both options.

Not only is it a safe investment but gold can also provide potential returns. Retirement investors will find gold a worthy investment.

Although most investments promise a fixed rate of return, gold is more volatile than others. This causes its value to fluctuate over time.

This doesn't mean that you should not invest in gold. This just means you need to account for fluctuations in your overall portfolio.

Another advantage of gold is its tangible nature. Gold is less difficult to store than stocks or bonds. It's also portable.

Your gold will always be accessible as long you keep it in a safe place. You don't have to pay storage fees for physical gold.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

A portion of your savings can be invested in something that doesn't go down in value. Gold usually rises when the stock market falls.

Another advantage to investing in gold is the ability to sell it whenever you wish. Like stocks, you can sell your position anytime you need cash. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Don't purchase too much at once. Start by purchasing a few ounces. You can add more as you need.

It's not about getting rich fast. It's not to get rich quickly, but to accumulate enough wealth to no longer need Social Security benefits.

Gold may not be the most attractive investment, but it could be a great complement to any retirement strategy.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

irs.gov

cftc.gov

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Guidelines for Gold Roth IRA

Starting early is the best way to save for retirement. Start saving as soon as possible, usually at age 50. You can continue to save throughout your career. It is important to invest enough money each and every year to ensure you get adequate growth.

You also want to take advantage of tax-free opportunities such as a traditional 401(k), SEP IRA, or SIMPLE IRA. These savings vehicles permit you to make contributions, but not pay any tax until your earnings are withdrawn. They are a great option for those who do not have access to employer matching money.

It is important to save consistently over time. If you don't contribute the maximum amount, you will miss any tax benefits.

—————————————————————————————————————————————————————————————-

By: Ivan Serrano

Title: Understanding Bitcoin Loans: A Comprehensive Guide

Sourced From: bitcoinmagazine.com/markets/how-does-a-bitcoin-loan-work-

Published Date: Wed, 10 Apr 2024 17:01:53 GMT