Delving into the Bitcoin World

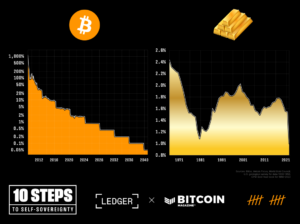

My foray into Bitcoin began in late 2022, where I started exploring the world of cryptocurrency investments. To my surprise, Bitcoin emerged as the best performing asset among the options I had been monitoring for 2023. This trend continued as I included Bitcoin once again in my list of 24 stocks to watch for 2024.

Embracing Change and Growth

Recently, I publicly announced a shift in my perspective on Bitcoin, signaling the end of my skepticism towards the digital currency. This transition might have caught many of my followers off guard, but the overwhelming support and positive feedback I received were truly heartening. Recognizing the wisdom of those more knowledgeable in the field, I acknowledged the valuable insights shared by experts like Lawrence Lepard, Luke Gromen, and Lyn Alden.

Unlocking the Intricacies of Bitcoin

My journey towards understanding Bitcoin's significance was a gradual process. Listening to experts like Lawrence Lepard shed light on the concept of "digital scarcity" and the innovative nature of Bitcoin sparked a shift in my perception. By comprehending the cryptography and security features of the network, I began to appreciate the intrinsic value and resilience of Bitcoin.

Navigating the Complexities of Cryptocurrency

As I delved deeper into the intricacies of Bitcoin, I unraveled the decentralized nature of the network and the robust mechanisms that safeguard its integrity. The concept of forks and the collective consensus of nodes in preserving the original Bitcoin code highlighted the resilience and immutability of the cryptocurrency.

Embracing the Future of Money

Recognizing the potential of Bitcoin as a transformative force in the financial landscape, I embraced the idea of reserving a place on the decentralized ledger that underpins the digital currency. While maintaining a larger position in gold, I acknowledged the unique advantages of Bitcoin in terms of portability, verifiability, and potential for global adoption.

Challenging Conventional Perspectives

Despite the volatility and uncertainties surrounding Bitcoin, I acknowledged the compelling arguments for its continued growth and adoption. The evolving regulatory landscape and institutional endorsements further reinforced the credibility of Bitcoin as a sound investment and a hedge against traditional monetary systems.

Anticipating Future Trends

Looking ahead, I anticipate a surge in adoption and institutional interest in Bitcoin, driven by its unique value proposition and growing recognition as a legitimate asset class. As the network expands and evolves, the prospect of widespread adoption and integration into mainstream financial systems appears increasingly plausible.

Disclaimer: The views expressed in this article are personal opinions and do not constitute financial advice. Cryptocurrency investments are subject to risks, and individuals should conduct thorough research before making investment decisions.

Frequently Asked Questions

What are some of the benefits of a gold IRA

An Individual Retirement Account (IRA) is the best way to put money towards retirement. It's tax-deferred until you withdraw it. You have total control over how much each year you take out. There are many types available. Some are better suited for college students. Others are made for investors seeking higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. But once they start withdrawing funds, those earnings aren't taxed again. This account may be worth considering if you are looking to retire earlier.

A gold IRA is similar to other IRAs because it allows you to invest money in various asset classes. Unlike a regular IRA where you pay taxes on gains, a gold IRA doesn't require you to worry about taxation while you wait to get them. This makes gold IRA accounts excellent options for people who prefer to keep their money invested instead of spending it.

An additional benefit to owning gold through an IRA, is the ease of automatic withdrawals. That means you won't have to think about making deposits every month. To make sure you don't miss any payments, you can also set up direct deductions.

Finally, gold is one of the safest investment choices available today. Because it isn't tied to any particular country its value tends be steady. Even in times of economic turmoil, gold prices tend not to fluctuate. Gold is a good option for protecting your savings from inflation.

How is gold taxed by Roth IRA?

Investment accounts are subject to tax based only on their current value and not the amount you originally paid. If you invest $1,000 in mutual funds or stocks and then later sell them, all gains are subjected to taxes.

But if you put the money into a traditional IRA or 401(k), there's no tax when you withdraw the money. Taxes are only charged on capital gains or dividends earned, which only apply to investments longer than one calendar year.

Each state has its own rules regarding these accounts. For example, in Maryland, you must take withdrawals within 60 days after reaching age 59 1/2 . Massachusetts allows you to wait until April 1. New York allows you to wait until age 70 1/2. To avoid penalty fees, it is important to plan and take distributions in time to pay all your retirement savings.

Can I have a gold ETF in a Roth IRA

A 401(k) plan may not offer this option, but you should consider other options, such as an Individual Retirement Account (IRA).

Traditional IRAs allow for contributions from both employees and employers. You can also invest in publicly traded businesses by creating an Employee Stock Ownership Plan (ESOP).

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The money invested in ESOPs is taxed at a lower rate that if it were owned directly by an employee.

A Individual Retirement Annuity is also possible. An IRA allows for you to make regular income payments during your life. Contributions made to IRAs are not taxable.

What precious metals do you have that you can invest in for your retirement?

Gold and silver are the best precious metal investments. They are both simple to purchase and sell, and they have been around for a long time. Consider adding them to the list if you're looking to diversify and expand your portfolio.

Gold: The oldest form of currency known to man is gold. It's stable and safe. Because of this, it's considered a good way to preserve wealth during times of uncertainty.

Silver: Silver has been a favorite among investors for years. It is an excellent choice for investors who wish to avoid volatility. Silver, unlike gold, tends not to go down but up.

Platinium: Platinum is another form of precious metal that's becoming increasingly popular. It's like silver or gold in that it is durable and resistant to corrosion. It's also more expensive than the other two.

Rhodium. Rhodium is used as a catalyst. It is also used in jewelry-making. It is relatively affordable when compared to other types.

Palladium: Palladium, which is a form of platinum, is less common than platinum. It is also cheaper. It is a preferred choice among investors who are looking to add precious materials to their portfolios.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

forbes.com

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement funds

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Do you want to keep your IRA gold at home? It's not exactly legal – WSJ

bbb.org

How To

The best way to buy gold (or silver) online

To buy gold, you must first understand how it works. It is a precious metal that is very similar to platinum. It's very rare and is used as money because of its durability and resistance to corrosion. It is hard to use, so most people prefer jewelry made of it to real bars of gold.

There are two types currently available: legal tender and bullion. The legal tender coins are issued for circulation in a country. They usually have denominations such as $1, $5, $10, and so on.

Bullion coins should only be used for investment purposes. Inflation can cause their value to increase.

They are not exchangeable in any currency exchange system. If a person purchases $100 worth of gold, 100 grams of the gold will be given to him/her. The $100 value is $100. Each dollar spent earns the buyer 1 gram gold.

You should also know where to buy your gold. There are a few options if you wish to buy gold directly from a dealer. First, you can visit your local coin store. You might also consider going through a reputable online seller like eBay. You may also be interested in buying gold through private sellers online.

Individuals selling gold at wholesale prices and retail prices are known as private sellers. Private sellers typically charge 10% to 15% commission on each transaction. That means you would get back less money from a private seller than from a coin shop or eBay. However, this option is often a great choice when investing in gold since it gives you more control over the item's price.

The other option is to purchase physical gold. Although physical gold is easier to store than paper certificates you will still need to ensure it is safe. To ensure that your physical gold remains safe, you need to secure it in an impenetrable container such as a vault or safety deposit box.

To purchase gold by yourself, you can visit a bank and a pawnshop. A bank can give you a loan up to the amount you intend to invest in Gold. Small establishments that allow customers to borrow money for items they have brought are called pawnshops. Banks tend to charge higher interest rates, while pawnshops are typically lower.

A third way to buy gold? Simply ask someone else! Selling gold can also be done easily. You can contact a company like GoldMoney.com to set up an account and receive payments right away.

—————————————————————————————————————————————————————————————-

By: Quoth the Raven

Title: The Evolution of My Bitcoin Journey: Understanding the Intricacies of Crypto

Sourced From: bitcoinmagazine.com/culture/why-i-bitcoin

Published Date: Thu, 22 Feb 2024 15:00:12 GMT