Introduction

SEC Commissioner Caroline A. Crenshaw has expressed her dissent against the commission's approval of spot bitcoin ETFs, citing concerns over market manipulation, concentration of bitcoin ownership, and inadequate regulatory measures to protect investors.

Crenshaw Critiques Spot Bitcoin ETF Approval

Commissioner Caroline A. Crenshaw has released a letter voicing her dissent following the SEC's mass approval of spot bitcoin ETFs. She raises serious concerns regarding investor protection and market integrity in relation to these approvals.

Concerns Over Market Manipulation

Crenshaw's primary concern lies in the underlying global spot markets for bitcoin, which she believes are plagued by fraud and manipulation. She highlights the alleged bitcoin price manipulation by the former CEO of FTX to keep its price under $20,000 for personal gain as an example. Additionally, she mentions the recent hacking of an SEC social media account and the subsequent false announcement of spot bitcoin ETFs, which resulted in volatile bitcoin prices. Crenshaw suggests that these incidents indicate potential market manipulation.

Bitcoin Ownership Concentration

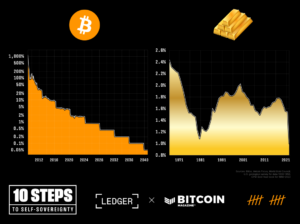

Crenshaw also expresses concern over the concentration of bitcoin ownership. She argues that the ownership concentration among spot bitcoin holders exposes bitcoin and spot bitcoin ETP investors to the trading practices of a select few. Analysis shows that mining and holdings of bitcoin are highly concentrated, further exacerbating this issue.

Inadequate Investor Protection

Citing the recent Grayscale vs. SEC case, Crenshaw critiques the correlation analysis used to justify the approval of spot bitcoin ETPs. She argues that the investor protection provided by futures is significantly different from that of spot bitcoin ETPs, which she likens to an unregulated, global free-for-all. She questions the reliability of the data used in the SEC's correlation analysis and raises concerns about the lack of clear guidelines for the new regulatory standard.

Diversion from Original Bitcoin Ideals

In a broader critique of the cryptocurrency ecosystem, Crenshaw questions the trend of recreating the existing financial system with less regulation and more risk. She believes that this approach diverges from the original ideals of Bitcoin as a peer-to-peer, censorship-resistant digital currency. Crenshaw fears that closely linking Bitcoin to the traditional financial system may inflate the prices of investment products, potentially to the detriment of investors.

Share Your Thoughts

What are your thoughts on Commissioner Crenshaw's concerns? Feel free to share your opinions and perspectives on this subject in the comments section below.

Frequently Asked Questions

How much should I contribute to my Roth IRA account?

Roth IRAs can be used to save taxes on your retirement funds. You can’t withdraw money from these accounts before you reach the age of 59 1/2. You must adhere to certain rules if you are going to withdraw any of your contributions prior. You cannot touch your principal (the amount you originally deposited). You cannot withdraw more than the original amount you contributed. If you are able to take out more that what you have initially contributed, you must pay taxes.

The second rule is that you cannot withdraw your earnings without paying income taxes. So, when you withdraw, you’ll pay taxes on those earnings. Consider, for instance, that you contribute $5,000 per year to your Roth IRA. Let’s say you earn $10,000 each year after contributing. This would mean that you would have to pay $3,500 in federal income tax. That leaves you with only $6,500 left. You can only take out what you originally contributed.

The $4,000 you take out of your earnings would be subject to taxes. You’d still owe $1,500 in taxes. In addition, 50% of your earnings will be subject to tax again (half of 40%). So even though you received $7,000 in Roth IRA contributions, you only received $4,000.

There are two types if Roth IRAs, Roth and Traditional. Traditional IRAs allow pre-tax contributions to be deducted from your taxable tax income. You can withdraw your contributions plus interest from your traditional IRA when you retire. You have the option to withdraw any amount from a traditional IRA.

Roth IRAs won’t let you deduct your contributions. However, once you retire, you can withdraw your entire contribution plus accrued interest. There is no minimum withdrawal limit, unlike traditional IRAs. Your contribution can be withdrawn at any age, not just when you reach 70 1/2.

Should You Get Gold?

Gold was once considered an investment safe haven during times of economic crisis. Many people today are moving away from stocks and bonds to look at precious metals, such as gold, as a way to diversify their investments.

Gold prices have been on an upward trend over recent years, but they remain relatively low compared to other commodities such as oil and silver.

Experts believe this could change soon. They believe gold prices could increase dramatically if there is another global financial crises.

They also pointed out that gold is gaining popularity due to its perceived value, and potential return.

If you are considering investing in gold, here are some things that you need to keep in mind.

- Consider first whether you will need the money to save for retirement. You can save money for retirement even if you don’t invest in gold. However, when you retire at age 65, gold can provide additional protection.

- Second, make sure you understand what you’re getting yourself into before you start buying gold.There are several different types of gold IRA accounts available. Each one offers different levels security and flexibility.

- Remember that gold is not as safe as a bank account. You may lose your gold coins and never be able to recover them.

You should do your research before buying gold. Make sure to protect any gold you already own.

How much gold can you keep in your portfolio

The amount that you want to invest will dictate how much money it takes. Start small with $5k-10k. As your business grows, you might consider renting out office space or desks. So you don’t have all the hassle of paying rent. You just pay per month.

It is also important to decide what kind of business you want to run. In my case, we charge clients between $1000-2000/month, depending on what they order. You should also consider the expected income from each client when you do this type of thing.

You won’t get a monthly paycheck if you work freelance. This is because freelancers are paid. So you might only get paid once every 6 months or so.

Decide what kind of income do you want before you calculate how much gold is needed.

I suggest starting with $1k-2k gold and building from there.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you’ll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item’s value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

irs.gov

investopedia.com

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 90 – WSJ

- Want to Keep Gold in Your IRA at Home? It’s not legal – WSJ

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement plans

How To

Investing in gold or stocks

Investing in gold as an investment vehicle might seem like a very risky proposition these days. This is because many people believe gold is no longer financially profitable. This belief is based on the fact that gold prices are being driven down by global economic conditions. They think that they would lose money if they invested in gold. There are many benefits to investing in gold. Here are some examples.

One of the oldest currencies known to man is gold. Its use can be traced back to thousands of years ago. It was used all around the world as a reserve of value. It’s still used by countries like South Africa as a method of payment.

You must first decide how much you are willing and able to pay per gram to decide whether or not gold should be your investment. When looking into buying gold bullion, you must decide how much you are willing to spend per gram. You could contact a local jeweler to find out what their current market rate is.

It’s also important to note that, although gold prices are down in recent months, the costs of producing it have risen. Although the price of gold has dropped, production costs have not.

It is important to keep in mind the amount you plan to purchase of gold when you’re weighing whether or not it is worth your time. If you plan to buy enough gold to cover your wedding rings then it is probably a good idea to wait before buying any more. If you plan to do so as long-term investments, it is worth looking into. It is possible to make a profit by selling your gold at higher prices than when you purchased it.

We hope that this article has helped you gain a better understanding and appreciation for gold as an investment option. We strongly recommend that you research all available options before making any decisions. Only then can you make informed decisions.

—————————————————————————————————————————————————————————————-

By: David Sencil

Title: SEC Commissioner Voices Dissent Over Approval of Spot Bitcoin ETFs

Sourced From: news.bitcoin.com/sec-commissioner-crenshaw-dissents-from-spot-bitcoin-etf-approval/

Published Date: Fri, 12 Jan 2024 09:00:57 +0000

Related posts:

SEC Commissioner Criticizes Delay in Spot Bitcoin ETF Approval — ‘We Squandered a Decade of Opportunities’

SEC Commissioner Criticizes Delay in Spot Bitcoin ETF Approval — ‘We Squandered a Decade of Opportunities’

7 Best Gold IRA Companies 2023 (ranked by customer reviews).

7 Best Gold IRA Companies 2023 (ranked by customer reviews).

The Growing Probability of Institutional Involvement in Spot Bitcoin ETFs

The Growing Probability of Institutional Involvement in Spot Bitcoin ETFs

Former SEC Official Warns Spot Bitcoin ETFs Will Create ‘Wall Street Fee-Sucking Scam of Epic Proportions’

Former SEC Official Warns Spot Bitcoin ETFs Will Create ‘Wall Street Fee-Sucking Scam of Epic Proportions’