Introduction

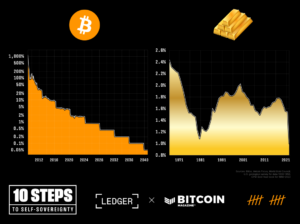

Ninety-one years ago today, President Franklin D. Roosevelt executed the most significant heist in American history, all within the bounds of the law. On April 5, 1933, FDR enacted Executive Order 6102, mandating the surrender of all gold held by individuals in the United States. This order, marking a shift from the gold standard to a fiat system, played a crucial role in the country's monetary evolution.

Executive Order 6102: A Cautionary Tale

EO 6102 serves as a cautionary tale of government overreach, highlighting the arbitrary seizure of personal assets. It underscores the importance of self-custody, resonating with Bitcoin enthusiasts. Understanding the implications of governmental actions on personal wealth is vital in navigating financial landscapes.

Legal Maneuvers of FDR

Despite FDR's authoritative presidency, the execution of EO 6102 was legally nuanced. By leveraging existing legal frameworks and executive powers, FDR orchestrated a seemingly legitimate gold confiscation. This legality, albeit a veil for tyranny, set a precedent for future administrations to misuse emergency powers.

The Role of National Emergencies

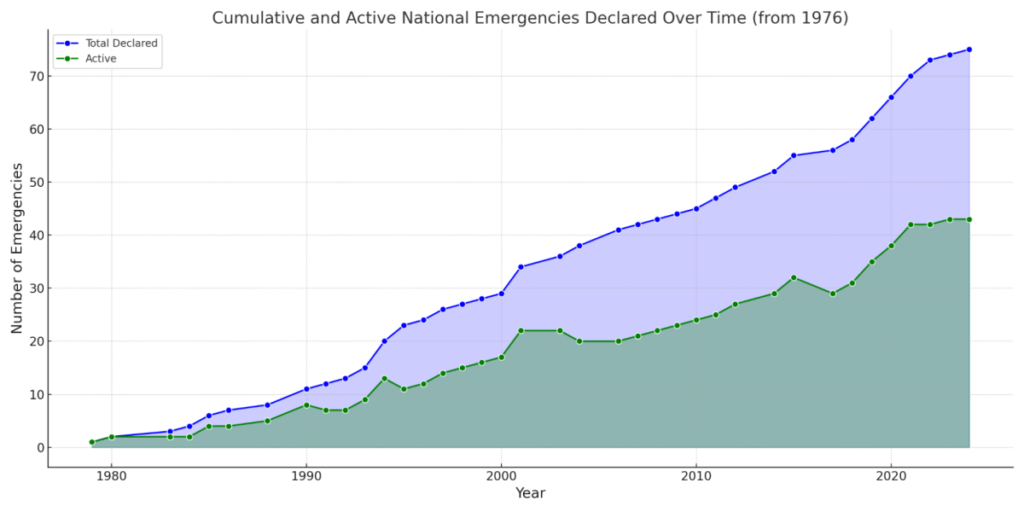

The concept of "national emergency" has been a recurring tool in the hands of American Presidents since Abraham Lincoln's era. Over time, this phrase has been instrumental in justifying executive actions that infringe on individual rights. The 1976 National Emergencies Act formalized the use of such measures, leading to numerous emergency declarations that persist to this day.

Evolution of Emergency Powers

The genesis of Executive Order 6102 can be traced back to wartime legislation like the Trading with the Enemy Act of 1917. Subsequent amendments and acts, such as the Emergency Banking Relief Act of 1933, expanded presidential authority during crises. This evolution solidified the national emergency exception as a prevalent feature of executive governance.

FDR's Financial Dilemma

Amidst the Great Depression, FDR faced a dire financial predicament in 1933. A dwindling gold reserve and escalating crisis prompted drastic measures. The Emergency Banking Relief Act granted FDR sweeping control over the banking system, culminating in the issuance of EO 6102 to address the gold shortage.

Potential Repercussions

Reflecting on the past prompts the question: could a similar scenario unfold in the present day? Examining the parallels between historical events and current circumstances offers insights into the vulnerability of personal assets. The prospect of governmental overreach remains a concern, necessitating vigilance and prudent asset management.

Securing Wealth in Uncertain Times

As uncertainties loom, the significance of self-custody, particularly in assets like Bitcoin, becomes paramount. Sovereign control over assets offers a shield against potential expropriation during times of crisis. The lesson learned from history is clear: safeguarding one's wealth is essential in an ever-evolving financial landscape.

In conclusion, the narrative of Executive Order 6102 underscores the enduring relevance of individual autonomy in financial matters. As the state grapples with economic challenges, the need for private asset protection intensifies. By embracing self-custody, individuals can fortify their financial resilience against unforeseen adversities.

Frequently Asked Questions

Can I buy gold using my self-directed IRA

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. You can also transfer funds from an existing retirement fund.

The IRS allows individuals contributing up to $5.500 each ($6,500 if married, filing jointly) into a traditional IRA. Individuals can contribute up $1,000 per annum ($2,000 if they are married and jointly) directly to a Roth IRA.

You should consider buying physical gold bullion if you decide to invest in it. Futures contracts can be described as financial instruments that are determined by the gold price. These contracts allow you to speculate on future gold prices without actually owning it. But, physical bullion is real bars of gold or silver that you can hold in one's hand.

Do you need to open a Precious Metal IRA

Precious metals are not insured. This is the most important fact to know before you open an IRA account. You cannot recover any money you have invested. This includes any loss of investments from theft, fire, flood or other circumstances.

This type of loss can be avoided by investing in physical silver and gold coins. These coins have been around for thousands and represent a real asset that can never be lost. These items are worth more today than they were when first produced.

Choose a reputable company with competitive rates and quality products if you are looking to open an IRA. It is also a smart idea to use a third-party trustee who will help you have access to your assets at all times.

When you open an account, keep in mind that you won't receive any returns until your retirement. Do not forget about the future!

What does a gold IRA look like?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

You can purchase physical gold bullion coins anytime. You don't have a retirement date to invest in gold.

An IRA allows you to keep your gold forever. Your gold holdings will not be subject to tax when you are gone.

Your heirs inherit your gold without paying capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

To open a Gold IRA, you'll need to first set up an Individual Retirement Account (IRA). After you have done this, an IRA custodian will be assigned to you. This company acts as an intermediary between you and IRS.

Your gold IRA custodian can handle all paperwork and submit necessary forms to IRS. This includes filing annual returns.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. Minimum deposit required is $1,000 A higher interest rate will be offered if you invest more.

When you withdraw your gold from your IRA, you'll pay taxes on it. If you take out the whole amount, you'll be subject to income taxes as well as a 10 percent penalty.

If you only take out a very small percentage of your income, you may not need to pay tax. However, there are some exceptions. For example, taking out 30% or more of your total IRA assets, you'll owe federal income taxes plus a 20 percent penalty.

You shouldn't take out more then 50% of your total IRA assets annually. Otherwise, you'll face steep financial consequences.

What are the fees for an IRA that holds gold?

A monthly fee of $6 for an Individual Retirement Account is charged. This fee includes account maintenance fees as well as any investment costs related to your selected investments.

To diversify your portfolio you might need to pay additional charges. These fees will vary depending upon the type of IRA chosen. Some companies offer free check accounts, but charge monthly fee for IRA accounts.

Many providers also charge annual management fees. These fees range between 0% and 1 percent. The average rate per year is.25%. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement plans

cftc.gov

finance.yahoo.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Want to Keep Gold in Your IRA at Home? It's not legal – WSJ

How To

The best place online to buy silver and gold

To buy gold, you must first understand how it works. It is a precious metal that is very similar to platinum. It's very rare and is used as money because of its durability and resistance to corrosion. It is hard to use, so most people prefer jewelry made of it to real bars of gold.

Two types of gold coins are available today: the legal tender type and the bullion type. Legal tender coins are those that are intended for circulation in a country. They typically have denominations of $1, $5 or $10.

Bullion coin are not intended for investment. However, their value will increase with inflation.

They cannot be used in currency exchanges. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. Every dollar spent on gold purchases, the buyer receives one gram of gold.

You should also know where to buy your gold. You have a few options to choose from if you are looking to buy gold directly through a dealer. You can start by visiting your local coin shop. You could also look into eBay or other reputable websites. You might also consider buying gold from an online private seller.

Private sellers are individuals who offer gold for sale, either at wholesale prices or retail prices. When selling gold through private sellers, you pay a commission fee of 10% to 15% per transaction. That means you would get back less money from a private seller than from a coin shop or eBay. However, this option is often a great choice when investing in gold since it gives you more control over the item's price.

Another option for buying gold is to invest in physical gold. It is easier to store physical gold than paper certificates. But, you still have to take care of it. Physical gold must be kept safe in an impassible container, such as a vault.

You can either visit a bank, pawnshop or bank to buy gold. A bank will provide you with a loan that allows you to purchase the amount of gold you desire. Customers can borrow money from pawnshops to purchase items. Banks often charge higher interest rates then pawnshops.

The final option is to ask someone to buy your gold! Selling gold can be as easy as selling. Contact a company such as GoldMoney.com, and you can set up a simple account and start receiving payments immediately.

—————————————————————————————————————————————————————————————-

By: Julian Fahrer

Title: National Emergency: Executive Order 6102 and the Heist of the Century

Sourced From: bitcoinmagazine.com/culture/national-emergency-executive-order-6102-and-the-heist-of-the-century-

Published Date: Fri, 05 Apr 2024 16:30:00 GMT