All eyes on the Federal Reserve

This year, just like last year, market observers are eagerly awaiting decisions from the U.S. Federal Reserve regarding the federal funds rate. The focus is particularly on the potential rate cuts that may happen this year. According to Ellen Zentner, Morgan Stanley's lead economist in the U.S., rate reductions are expected in the coming months. However, she advises that the central bank is in no rush to make these changes and can afford to be patient.

Anticipation for rate increase

According to the CME Fedwatch tool, the market is currently anticipating a projected 25 basis points increase at the upcoming Federal Open Market Committee (FOMC) session. A significant 95.3% of the market predicts an increase, while only 4.7% believe that the federal target rate will maintain its current stance. These expectations align with the remarks made by Federal Reserve Bank of Dallas President Lorie Logan.

Importance of maintaining tight financial conditions

Addressing attendees at the American Economic Association conference in Texas, Logan emphasized the necessity for the central bank to maintain sufficiently tight financial conditions. She warned of the potential danger of inflation rebounding and undermining the progress that has been made so far. Logan also mentioned that, considering the recent easing in financial conditions, another rate increase should not be taken off the table just yet.

FOMC's minutes and monetary policy

Logan's remarks follow the minutes of the FOMC's meeting on December 14-15, 2023. These minutes highlighted the committee's discussions on restoring standard monetary policy. The committee examined ongoing inflation pressures and the impact they have on the central bank's asset acquisition initiatives. As inflation has consistently surpassed 2% for an extended period, the Fed decided to decrease the monthly rate of net asset purchases.

Expectations of rate reductions

Economists are expecting rate reductions in the near future, especially after Fed Chair Jerome Powell's dovish approach during the last FOMC meeting. Powell emphasized the central bank's focus on not keeping rates too high for too long. Ellen Zentner, Morgan Stanley's chief U.S. economist, confirmed these expectations and stated that rate reductions will occur this year. She mentioned this during a three-day summit in San Antonio.

Market expectations are leaning towards rate cuts, with a possible hike at the end of this month. Zentner predicts that the initial rate reduction will happen in June. Dante DeAntonio, senior director at Moody's Analytics, agrees with this expectation and believes that there will be a rate decrease in June 2024. According to DeAntonio, the Fed will likely be able to engineer a soft landing by discussing the outlook for possible rate cuts, while keeping the pace of cuts low and maintaining a "higher for longer" strategy.

What are your expectations for the Federal Reserve's actions this year? Do you anticipate rate cuts in 2024? Share your thoughts and opinions on this subject in the comments section below.

Frequently Asked Questions

What are the advantages of a gold IRA

It is best to put your retirement money in an Individual Retirement Account (IRA). You can withdraw it at any time, but it is tax-deferred. You have total control over how much each year you take out. There are many types available. Some are better suited to college savings. Others are designed for investors looking for higher returns. Roth IRAs are a way for individuals to make contributions after the age of 59 1/2, and then pay taxes on any earnings upon retirement. The earnings earned after they withdraw the funds aren't subject to any tax. This account is a good option if you plan to retire early.

A gold IRA is similar to other IRAs because it allows you to invest money in various asset classes. Unlike a regular IRA, you don't have to worry about paying taxes on your gains while you wait to access them. This makes gold IRA accounts a great choice for those who want their money to be invested, not spent.

An additional benefit to owning gold through an IRA, is the ease of automatic withdrawals. This means that you don't need to worry about making monthly deposits. Direct debits could be set up to ensure you don't miss a single payment.

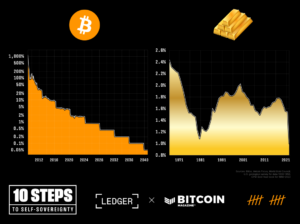

Finally, gold remains one of the best investment options today. Its value is stable because it's not tied with any one country. Even in economic turmoil, gold prices tends to remain relatively stable. Gold is a good option for protecting your savings from inflation.

Can I hold a gold ETF in a Roth IRA?

This option may not be available in a 401(k), but you should look into other options such as an Individual Retirement account (IRA).

Traditional IRAs allow contributions from both the employer and employee. An Employee Stock Ownership Plan (ESOP) is another way to invest in publicly traded companies.

An ESOP gives employees tax advantages as they share the stock of the company and the profits it makes. The money in the ESOP can then be subject to lower tax rates than if the money were in the individual's hands.

Also available is an Individual Retirement Annuity. An IRA lets you make regular, income-generating payments to yourself over your life. Contributions to IRAs don't have to be taxable

Can the government seize your gold?

The government cannot take your gold because you own it. You have earned it by working hard for it. It is yours. There may be exceptions to this rule. For example, if you were convicted of a crime involving fraud against the federal government, you can lose your gold. If you owe taxes, your precious metals could be taken away. You can keep your gold even if your taxes are not paid.

Who has the gold in a IRA gold?

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

You must have at least $10,000 in gold and keep it for at most five years to qualify for this tax-free status.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

A financial planner or accountant should be consulted to discuss your options.

What is the tax on gold in an IRA

The fair market value of gold sold is the basis for tax. You don't pay taxes when you buy gold. It's not considered income. If you decide to sell it later, there will be a taxable gain if its price rises.

As collateral for loans, gold is possible. Lenders try to maximize the return on loans that you take against your assets. In the case of gold, this usually means selling it. It's not guaranteed that the lender will do it. They may keep it. Or, they may decide to resell the item themselves. You lose potential profits in either case.

So to avoid losing money, you should only lend against your gold if you plan to use it as collateral. It's better to keep it alone.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Lawful – WSJ

finance.yahoo.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement funds

How To

How to hold physical gold in an IRA

An easy way to invest gold is to buy shares from gold-producing companies. But, this approach comes with risks. These companies may not survive the next few years. There is always the chance of them losing their money due to fluctuations of the gold price.

Another option is to purchase physical gold. This means that you will need to open an account at a bank, bullion seller online, or purchase gold from a trusted seller. This option has many advantages, including the ease of access (you don’t have to deal with stock markets) and the ability of making purchases at low prices. It is easier to view how much gold has been stored. A receipt will be sent to you indicating exactly how much you paid. This will allow you to see if there were any tax omissions. There's also less chance of theft than investing in stocks.

However, there are disadvantages. There are some disadvantages, such as the inability to take advantage of investment funds and interest rates from banks. You can't diversify your holdings, and you are stuck with the items you have bought. Finally, the tax man might ask questions about where you've put your gold!

BullionVault.com offers more information on buying gold for an IRA.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Market Awaits Federal Reserve's Target Rate Decisions

Sourced From: news.bitcoin.com/morgan-stanleys-chief-economist-predicts-rate-cuts-this-year-as-market-eyes-federal-reserves-next-move/

Published Date: Mon, 08 Jan 2024 18:30:30 +0000