The world of cryptocurrency has experienced a surge in popularity over the past few years, with many investors looking to diversify their portfolios by exploring digital currencies. However, with the increasing number of cryptocurrencies available, it can be challenging to make well-informed investment decisions. This is where AI technology steps in.

Introducing Cogwise: A Revolutionary Project in the World of Cryptocurrency

Cogwise is the latest project that aims to revolutionize the crypto industry through the use of AI technology. Its primary goal is to provide investors with real-time data and insights to help them make informed investment decisions. By leveraging AI technology, Cogwise sets itself apart from other projects in the market.

Why Cogwise (COGW) is Projected to Reach the Top 30 Tokens on CoinMarketCap

Cogwise (COGW) may be relatively new to the cryptocurrency space, but it has already made a significant impact during its presale stages. The native token of the Cogwise platform and ecosystem is COGW, which grants users access to various features and services, including staking, yield farming, and governance. COGW token holders can also enjoy exclusive benefits and rewards, such as early access to new features and products.

Due to its strong community and impressive growth potential, Cogwise has attracted a lot of attention from investors. Experts predict that Cogwise (COGW) will achieve a spot among the top 30 tokens by 2024, which would be a remarkable accomplishment for such a new project.

Currently, Cogwise is in the midst of its Presale, where it has already raised over $2 million. The funds collected during this phase will be utilized to further enhance Cogwise's AI technology, driving its growth and influence in the market.

If you are interested in participating, you can visit their website at cogwise.io. Additionally, you can explore their comprehensive whitepaper, which outlines Cogwise's approach, methodology, and the transformative impact they aim to achieve.

Unlocking the Potential of Cogwise

Cogwise is not just another AI model; it is a game-changer for individuals, developers, and businesses deeply involved in the blockchain sector. This platform offers a range of unique features that empower users, including:

- No-code smart contract generator

- Smart-contract auditor

- Technical analysis tools

- Wallet tracking capabilities

- Real-time alerts

- News aggregator

Decoding the Magic Behind Cogwise

At the core of Cogwise lies its impressive AI engine, the Cogwise Core. This intelligent core takes commands from prompts and provides comprehensive answers, assisting users with various tasks. Whether you need assistance with technical analysis, insights on crypto trends, or understanding smart contracts, the Cogwise Core is your guiding light.

Real-Time Trading Made Easier

In the fast-paced world of trading, having access to accurate market data and the ability to analyze it quickly can make a significant difference in profitability. This is where Cogwise's AI-powered market scanner comes in. It ranks trading opportunities based on relative volume, percental price change, momentum, and float, allowing traders to make informed decisions.

The automated system executes trades at exceptional speed, surpassing human traders and potentially increasing profits. Traders can also backtest strategies using historical data, ensuring profitability and responsiveness to market shifts. This focused approach allows for efficient trading within the cryptocurrency market, saving time and resources while maximizing profitability.

Join the Revolution: Invest in Cogwise

The private round sale of the Crypto AI Project presents an unparalleled opportunity to invest in a game-changing project that merges AI and the world of finance. Cogwise offers investors the chance to get involved at the ground floor of the next crypto sensation.

Frequently Asked Questions

What is the best precious-metal to invest?

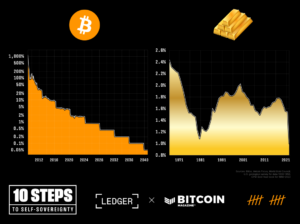

This depends on what risk you are willing take and what kind of return you desire. While gold is considered a safe investment option, it can also be a risky choice. For example, if you need a quick profit, gold may not be for you. If you have the patience to wait, then you might consider investing in silver.

If you're not looking to make quick money, gold is probably your best choice. If you are looking for a long-term investment that will provide steady returns, silver may be a better choice.

Is gold a good investment IRA?

If you are looking for a way to save money, gold is a great investment. It is also an excellent way to diversify you portfolio. There's more to gold that meets the eye.

It has been used as a currency throughout history and is still a popular method of payment. It's sometimes called “the world's oldest money”.

But gold, unlike paper currency, which is created by governments, is mined out from the ground. It's hard to find and very rare, making it extremely valuable.

The supply and demand for gold determine the price of gold. The economy that is strong tends to be more affluent, which means there are less gold miners. The value of gold rises as a consequence.

On the flip side, when the economy slows down, people hoard cash instead of spending it. This leads to more gold being produced which decreases its value.

This is why it makes sense to invest in gold for individuals and companies. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

Your investments will also generate interest, which can help you increase your wealth. Additionally, you won't lose cash if the gold price falls.

Can I buy or sell gold from my self-directed IRA

Although you can buy gold using your self-directed IRA account, you will need to open an account at a brokerage like TD Ameritrade. You can also transfer funds from an existing retirement fund.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

If you do decide that you want to invest, it is a good idea to buy physical bullion and not in futures. Futures contracts can be described as financial instruments that are determined by the gold price. These contracts allow you to speculate on future gold prices without actually owning it. You can only hold physical bullion, which is real silver and gold bars.

What Precious Metals Can You Invest in for Retirement?

Silver and gold are two of the most valuable precious metals. They are both simple to purchase and sell, and they have been around for a long time. If you want to diversify your portfolio, you should consider adding them to your list.

Gold: This is the oldest form of currency that man has ever known. It is stable and very secure. It is a good way for wealth preservation during uncertain times.

Silver: Silver has been a favorite among investors for years. It's a good choice for those who want to avoid volatility. Silver tends to move up, not down, unlike gold.

Platinium: Platinum is another form of precious metal that's becoming increasingly popular. Like gold and silver, it's very durable and resistant to corrosion. It's also more expensive than the other two.

Rhodium. Rhodium is used as a catalyst. It is also used for jewelry making. And, it's relatively cheap compared to other types of precious metals.

Palladium – Palladium is an alternative to platinum that's more common but less scarce. It's also more accessible. It's a popular choice for investors who want to add precious metals into their portfolios.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

bbb.org

finance.yahoo.com

irs.gov

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- You want to keep gold in your IRA at home? It's not legal – WSJ

How To

Tips for Investing in Gold

One of the most sought-after investment strategies is investing in gold. There are many benefits to investing in gold. There are several options to invest in the gold. Some people buy physical gold coins, while others prefer investing in gold ETFs (Exchange Traded Funds).

Before buying any type gold, it is important to think about these things.

- First, you must check whether your country allows you to own gold. If the answer is yes, you can go ahead. You might also consider buying gold in foreign countries.

- You should also know the type of gold coin that you desire. You can go for yellow gold, white gold, rose gold, etc.

- Third, consider the cost of gold. Start small and build up. When purchasing gold, diversify your portfolio. Diversifying your portfolio should be a priority, including stocks, bonds and real estate.

- Remember that gold prices are subject to change regularly. Keep an eye on current trends.

—————————————————————————————————————————————————————————————-

By: Media

Title: How AI-Powered Cogwise is Revolutionizing the Cryptocurrency Industry

Sourced From: news.bitcoin.com/cogwise-cogw-projected-to-reach-top-30-tokens-on-coinmarketcap-in-2024/

Published Date: Sat, 20 Jan 2024 12:00:19 +0000