BlackRock, a leading financial institution, is set to launch its spot Bitcoin exchange-traded fund (ETF) in Brazil tomorrow, marking a significant milestone in the country's financial market. According to a report by InfoMoney, Brazil's largest financial news platform, BlackRock's iShares Bitcoin Trust ETF (IBIT39) will be available for trading on B3, Brazil's stock exchange, starting Friday.

Empowering Investors with Accessible Investment Opportunities

Karina Saade, the president of BlackRock in Brazil, expressed the institution's commitment to providing high-quality investment options to investors. She stated, "Our digital asset journey aims to offer accessible investment options to investors. IBIT39 represents a significant step in our ongoing efforts to enhance our presence in the digital asset market."

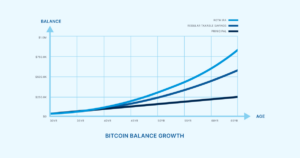

The initial availability of IBIT39 will be limited to qualified investors, with plans to expand access to retail investors in the upcoming weeks. The management fee for IBIT39 is set at 0.25%, with a one-year waiver and a subsequent reduction to 0.12% once the assets under management reach $5 billion.

Building on Success: Lessons from the US Market

In the United States, BlackRock's Bitcoin ETF has gained significant traction since its regulatory approval in January. With over $9 billion in assets under management, BlackRock's ETF has emerged as a popular choice among investors. Bloomberg data reveals that the ETF witnessed a record-breaking $612 million in inflows in a single day recently.

However, Karina Saade clarified that BlackRock's foray into the Brazilian and US markets should not be perceived as an endorsement of Bitcoin itself. Instead, it highlights the institution's recognition of Bitcoin as a valuable asset class. Saade emphasized, "Our priority is to offer our customers secure and transparent investment products. We do not provide recommendations or make predictions about Bitcoin."

The launch of BlackRock's spot Bitcoin ETF in Brazil signals a new era for Brazilian investors, providing them with an opportunity to diversify their portfolios and explore the potential of digital assets. As the financial landscape continues to evolve, BlackRock remains committed to empowering investors with innovative investment solutions.

Frequently Asked Questions

What Is a Precious Metal IRA?

An IRA with precious metals allows you to diversify retirement savings into gold and silver, palladium, rhodiums, iridiums, osmium, or other rare metals. These rare metals are often called “precious” as they are very difficult to find and highly valuable. These are excellent investments that will protect your wealth from inflation and economic instability.

Bullion is often used for precious metals. Bullion refers actually to the metal.

Bullion can be purchased via a variety of channels including online sellers, large coin dealers, and grocery stores.

You can invest directly in bullion with a precious metal IRA instead of buying shares of stock. This ensures that you will receive dividends each and every year.

Unlike regular IRAs, precious metal IRAs don’t require paperwork or annual fees. Instead, your gains are subject to a small tax. You also have unlimited access to your funds whenever and wherever you wish.

What are the pros and cons of a gold IRA?

The main advantage of an Individual Retirement Account (IRA) over a regular savings account is that you don’t have to pay taxes on any interest earned. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. But, this type of investment comes with its own set of disadvantages.

To give an example, if your IRA is withdrawn too often, you can lose all your accumulated funds. You might also not be able to withdraw from your IRA until the IRS deems you to be 59 1/2. If you do withdraw funds, you’ll need to pay a penalty.

Another disadvantage is that you must pay fees to manage your IRA. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management fees ranging from $10 to $50.

If you prefer your money to be kept out of a bank, then you will need insurance. In order to make a claim, most insurers will require that you have a minimum amount in gold. You may be required by some insurers to purchase insurance that covers losses as high as $500,000.

If you choose to go with a gold IRA, you’ll need to determine how much gold you want to use. Some providers limit the amount of gold that you are allowed to own. Others allow you the freedom to choose your own weight.

You will also have to decide whether to purchase futures or physical gold. Physical gold is more expensive than gold futures contracts. Futures contracts allow you to buy gold with more flexibility. They let you set up a contract that has a specific expiration.

It is also important to choose the type of insurance coverage that you need. The standard policy does NOT include theft protection and loss due to fire or flood. It does include coverage for damage due to natural disasters. You might consider purchasing additional coverage if your area is at high risk.

Additional to your insurance, you will need to consider how much it costs to store your gold. Storage costs are not covered by insurance. Additionally, safekeeping is usually charged by banks at around $25-$40 per monthly.

To open a IRA in gold, you will need to first speak with a qualified custodian. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians don’t have the right to sell assets. Instead, they must keep your assets for as long you request.

After you’ve determined which type of IRA is best for you, fill out the paperwork indicating your goals. Your plan should include information about the investments you want to make, such as stocks, bonds, mutual funds, or real estate. The plan should also include information about how much you are willing to invest each month.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. After reviewing your application, the company will send you a confirmation mail.

You should consult a financial planner before opening a Gold IRA. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can also help reduce your costs by suggesting cheaper options for purchasing insurance.

Are gold investments a good idea for an IRA?

Anyone who is looking to save money can make gold an excellent investment. It’s also a great way to diversify your portfolio. There is much more to gold than meets your eye.

It’s been used as a form of payment throughout history. It’s sometimes called “the world’s oldest money”.

Gold is not created by governments, but it is extracted from the earth. Because it is rare and difficult to make, it is extremely valuable.

The supply-demand relationship determines the gold price. The strength of the economy means people spend more, and so, there is less demand for gold. As a result, the value of gold goes up.

On the flip side, people save cash for emergencies and don’t spend it. This increases the production of gold, which in turn drives down its value.

It is this reason that gold investing makes sense for businesses and individuals. If you invest in gold, you’ll benefit whenever the economy grows.

In addition to earning interest on your investments, this will allow you to grow your wealth. Plus, you won’t lose money if the value of gold drops.

Should You Buy Gold?

In times past, gold was considered a safe haven for investors in times of economic trouble. Many people are shifting away from traditional investments like bonds or stocks to instead look toward precious metals such gold.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

Some experts believe that this could change very soon. Experts predict that gold prices will rise sharply in the wake of another global financial collapse.

They also mention that gold is becoming more popular due to its perceived worth and potential return.

Here are some things to consider if you’re considering investing in gold.

- Before you start saving money for retirement, think about whether you really need it. It’s possible to save for retirement without putting your savings into gold. However, you can still save for retirement without putting your savings into gold.

- Second, be sure to understand your obligations before you purchase gold. Each offer varying degrees of security and flexibility.

- Finally, remember that gold doesn’t offer the same level of safety as a bank account. If you lose your gold coins, you may never recover them.

If you are thinking of buying gold, do your research. You should also ensure that you do everything you can to protect your gold.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item’s value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you’ll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

bbb.org

irs.gov

forbes.com

finance.yahoo.com

How To

Tips for Investing in Gold

One of the most sought-after investment strategies is investing in gold. This is due to the many benefits of investing in gold. There are several ways to invest in gold. Some people choose to purchase gold coins physically, while some prefer to invest with gold ETFs.

You should consider some things before you decide to purchase any type of gold.

- First, make sure you check if your country allows you own gold. If the answer is yes, you can go ahead. If not, you may want to consider purchasing gold from overseas.

- The second is to decide which kind of gold coin it is you want. You can go for yellow gold, white gold, rose gold, etc.

- The third factor to consider is the price for gold. It is better to start small, and then work your way up. It is important to diversify your portfolio whenever you purchase gold. Diversifying assets should include stocks, bonds real estate mutual funds and commodities.

- You should also remember that gold prices can change often. It is important to stay up-to-date with the latest trends.

—————————————————————————————————————————————————————————————-

By: Nik Hoffman

Title: BlackRock’s Spot Bitcoin ETF: A Game Changer for Brazilian Investors

Sourced From: bitcoinmagazine.com/markets/blackrocks-spot-bitcoin-etf-to-start-trading-in-brazil-tomorrow

Published Date: Thu, 29 Feb 2024 17:38:16 GMT