Bitcoin's Value Continues to Decline

Bitcoin, the leading cryptocurrency, has experienced a further decline in value, dropping below the $39,000 mark as bearish trends continue to exert downward pressure. This comes after the cryptocurrency fell below the $40,000 barrier on Monday. Within the last 24 hours, bitcoin's value has depreciated by 5.3% against the U.S. dollar.

From Boom to Gloom: Bitcoin's Value Sinks Below $39,000 Amid Market Speculations

Bitcoin's market value has seen better days. After surpassing the $40,000 level on January 22, it has now fallen below $39,000. On Tuesday, the value of bitcoin hit a low of $38,600, representing a 5.3% decrease in just one day and a 9.8% decline over the week. Over a two-week period, bitcoin has depreciated by 16.8% compared to the greenback.

Speculations Surrounding Bitcoin's Price Decline

The current decline in bitcoin's price is generating speculation, particularly regarding Grayscale's GBTC outflows and the potential impact of spot bitcoin exchange-traded funds (ETFs) as a "sell the news event." Simon Peters, a market analyst at Etoro, commented on the recent outflows from GBTC. Previously, GBTC held the largest share of bitcoin among spot ETFs, but since its conversion to an ETF, it has experienced net outflows of 66,500 BTC (approximately $2.6 billion at current market prices). Peters attributes this to the high fees associated with GBTC, prompting investors to switch to lower fee alternatives.

In addition to GBTC outflows, Antonio Ernesto Di Giacomo, a market analyst at xs.com, suggests that other factors may be influencing the situation. Di Giacomo points out that the significant price growth of more than 90% in less than a year could have triggered massive sales, leading to the price decline. Furthermore, he suggests that miners selling their bitcoins, in anticipation of the upcoming Halving event in April 2024, may also be contributing to the downward pressure on price.

Share Your Thoughts

What are your thoughts on bitcoin's price dropping below the $39,000 mark? Feel free to share your opinions in the comments section below.

Frequently Asked Questions

How can I withdraw from a Precious metal IRA?

First, you must decide if you wish to withdraw money from your IRA account. Then make sure you have enough cash to cover any fees or penalties that may come with withdrawing funds from your retirement plan.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, figure out how much money will be taken out of your IRA. This calculation is dependent on several factors like your age when you take the money out, how long you have had the account, and whether or not your plan to continue contributing.

Once you know what percentage of your total savings you'd like to convert into cash, you'll need to determine which type of IRA you want to use. Traditional IRAs let you withdraw money tax-free after you turn 59 1/2, while Roth IRAs require you to pay income taxes upfront but allow you access the earnings later without paying any additional taxes.

Once the calculations have been completed, it's time to open a brokerage accounts. Brokers often offer promotional offers and signup bonuses to encourage people into opening accounts. However, a debit card is better than a card. This will save you unnecessary fees.

When you do finally decide to withdraw from your precious metallic IRA, you will need a safe space where you can safely store your coins. Some storage facilities can accept bullion bar, while others require you buy individual coins. Either way, you'll need to weigh the pros and cons of each before choosing one.

Because you don't have to store individual coins, bullion bars take up less space than other items. But, each coin must be counted separately. On the flip side, storing individual coins allows you to easily track their value.

Some people prefer to keep their coins in a vault. Others prefer to store them in a safe deposit box. No matter what method you use, it is important to keep your bullion safe so that you can reap its benefits for many more years.

What amount should I invest in my Roth IRA?

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. You can't withdraw money from these accounts before you reach the age of 59 1/2. If you decide to withdraw some of your contributions, you will need to follow certain rules. You cannot touch your principal (the amount you originally deposited). No matter how much money you contribute, you cannot take out more than was originally deposited to the account. You must pay taxes on the difference if you want to take out more than what you initially contributed.

The second rule states that income taxes must be paid before you can withdraw earnings. You will pay income taxes when you withdraw your earnings. Let's assume that you contribute $5,000 each year to your Roth IRA. In addition, let's assume you earn $10,000 per year after contributing. This would mean that you would have to pay $3,500 in federal income tax. The remaining $6,500 is yours. You can only take out what you originally contributed.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. You would also lose half of your earnings because they are subject to another 50% tax (half off 40%). So even though you received $7,000 in Roth IRA contributions, you only received $4,000.

There are two types if Roth IRAs: Roth and Traditional. Traditional IRAs allow for pre-tax deductions from your taxable earnings. Your traditional IRA can be used to withdraw your balance and interest when you are retired. You can withdraw as much as you want from a traditional IRA.

A Roth IRA doesn't allow you to deduct your contributions. But once you've retired, you can withdraw the entire contribution amount plus any accrued interest. There is no minimum withdrawal required, unlike a traditional IRA. You don’t have to wait for your turn 70 1/2 years before you can withdraw your contributions.

How much gold should your portfolio contain?

The amount of money you need to make depends on how much capital you are looking for. Start small with $5k-10k. You could then rent out desks and office space as your business grows. Renting out desks and other equipment is a great way to save money on rent. Only one month's rent is required.

You also need to consider what type of business you will run. In my case, we charge clients between $1000-2000/month, depending on what they order. You should also consider the expected income from each client when you do this type of thing.

You won't get a monthly paycheck if you work freelance. This is because freelancers are paid. This means that you may only be paid once every six months.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

Can I buy or sell gold from my self-directed IRA

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. You can also transfer funds from an existing retirement fund.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

You should consider buying physical gold bullion if you decide to invest in it. Futures contracts can be described as financial instruments that are determined by the gold price. These contracts allow you to speculate on future gold prices without actually owning it. However, physical bullion is real gold or silver bars you can hold in your hands.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

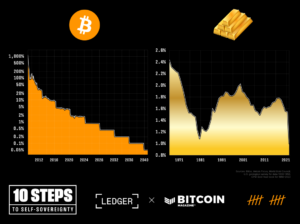

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

finance.yahoo.com

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Do you want to keep your IRA gold at home? It's not exactly legal – WSJ

How To

Tips to Invest in Gold

One of the most sought-after investment strategies is investing in gold. This is because there are many benefits if you choose to invest in gold. There are many ways you can invest in gold. Some people purchase physical gold coins. Others prefer to invest their money in gold ETFs.

Before you purchase any type or gold, here are some things to think about.

- First, find out if your country allows gold ownership. If it is, you can move on. You might also consider buying gold in foreign countries.

- Secondly, you should know what kind of gold coin you want. You have options: you can choose from yellow gold, white or rose gold.

- You should also consider the price of gold. It is best to start small and work your way up. It is important to diversify your portfolio whenever you purchase gold. Diversifying assets should include stocks, bonds real estate mutual funds and commodities.

- Don't forget to keep in mind that gold prices often change. Be aware of the current trends.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Bitcoin Price Falls Below $39,000 as Market Pressure Mounts

Sourced From: news.bitcoin.com/bitcoin-sinks-below-39000-as-market-pressure-intensifies/

Published Date: Tue, 23 Jan 2024 13:15:30 +0000