The main advantage of gold for IRA is that its worth is preserved. Unlike paper revenue, which depends on the governing administration and the global marketplace, gold's worth has always remained constant. Despite its ups and downs, it has maintained a consistent worth and has been projected to increase more in the future.

IRA vs. gold for IRA

Individual retirement accounts (IRAs) can be set up with various types of assets, such as precious metals. A gold IRA is a special type of IRA that holds physical gold or other approved precious metals. These accounts are similar to traditional IRAs in that they allow for pre-tax contributions and have similar income limits. However, gold IRAs require that the metals be stored in a secure depository.

A gold-backed IRA is an excellent way to diversify your portfolio by investing in precious metals instead of paper assets. Adding precious metals to your portfolio can help reduce overall volatility, protect your money during a downturn, and provide capital appreciation opportunities. Many financial planners recommend that people allocate five to ten percent of their portfolio to precious metals.

Tax-deferred

When you buy gold for your IRA, the gains you make are tax-deferred until the time you withdraw the cash from your account. At that time, you'll be taxed at your marginal tax rate. If you're rich, your marginal tax rate will be higher than that of a middle-class taxpayer.

The advantages of tax-deferred gold for IRA are similar to those of a traditional IRA. Your contributions are tax-deductible and earnings accrue tax-deferred, and you'll only be taxed on the withdrawals when you reach retirement age. One downside to investing in gold for an IRA is that it doesn't pay dividends or earnings. It's used in industrial processes and for jewelry, but most of it sits in bank vaults. People believe it's a safe asset, particularly during tough times.

Tax-exempt

An Individual Retirement Account (IRA) allows you to invest in a variety of investments. These accounts are tax-protected investments that you can use to fund your retirement. You will want to choose a portfolio that consists of assets that will grow in value over time. For instance, you will want to invest in stocks and bonds that will have a high rate of return. An IRA is an excellent way to protect your future and the future of your family. You can make contributions of up to a specified amount each year to your account. The IRS has strict guidelines regarding the types of assets you can invest in.

In addition to stocks and bonds, an IRA can invest in precious metal coins and bullion. Certain types of coins are allowed, including American Gold Eagle coins, Canadian Gold Maple Leaf coins, and American Silver Eagle coins. You can also invest in gold bars as long as they meet purity standards.

Portfolio diversifier

Gold is an attractive asset class for portfolio diversification. It has low correlation with all other market factors, including equities, bonds, and utilities. However, gold can be volatile. It peaked in 2011 at $1,800 an ounce, dropped to $1,000 in 2016, and now hovers at around $1,500.

Gold has long been an excellent investment option. Not only is it inert, but it is also relatively rare. The total amount of gold in the world is estimated to fit into a cube measuring 22 meters by 72 feet. While you should invest in productive investments that will increase your wealth, it's a good idea to diversify your investments with a small amount of gold.

Secure storage options

When it comes to storing IRA gold, secure storage options are essential. Home storage is not a good option unless you're storing a small amount of gold. In this case, you should consider storing your gold in a specialized vault. This type of storage is more secure and does not involve co-mingling. The gold will be stored in a large safe room and will not be tracked by the storage firm.

Secure storage facilities offer a variety of services, ranging from onsite storage to insurance. Some storage facilities partner with IRA custodians to offer secure storage options. These companies typically offer two types of storage: allocated and commingled. As the name implies, allocated storage keeps your gold separate from other metals.

Frequently Asked Questions

How much are gold IRA fees?

A monthly fee of $6 for an Individual Retirement Account is charged. This fee includes account maintenance fees as well as any investment costs related to your selected investments.

You may have to pay additional fees if you want to diversify your portfolio. These fees can vary depending on which type of IRA account you choose. Some companies offer free checking, but charge monthly fees for IRAs.

Most providers also charge an annual management fee. These fees range between 0% and 1 percent. The average rate per year is.25%. These rates can be waived if the broker is TD Ameritrade.

Is gold a good choice for an investment IRA?

Anyone who is looking to save money can make gold an excellent investment. It is also an excellent way to diversify you portfolio. But gold is not all that it seems.

It has been used as a currency throughout history and is still a popular method of payment. It's sometimes called “the world's oldest money”.

But unlike paper currencies, which governments create, gold is mined out of the earth. It's hard to find and very rare, making it extremely valuable.

The supply-demand relationship determines the gold price. When the economy is strong, people tend to spend more money, which means fewer people mine gold. The result is that gold's value increases.

The flip side is that people tend to save money when the economy slows. This results in more gold being produced, which drives down its value.

This is why it makes sense to invest in gold for individuals and companies. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

In addition to earning interest on your investments, this will allow you to grow your wealth. Plus, you won't lose money if the value of gold drops.

What Does Gold Do as an Investment Option?

Supply and demand determine the gold price. Interest rates are also a factor.

Due to their limited supply, gold prices fluctuate. Additionally, physical gold can be volatile because it must be stored somewhere.

Is gold buying a good retirement option?

Although it may not look appealing at first, buying gold for investment is worth considering when you consider the global average gold consumption per year.

Physical bullion bar is the best way to invest in precious metals. But there are many other options for investing in gold. You should research all options thoroughly before making a decision on which option you prefer.

If you don’t need a safe place for your wealth, then buying shares of mining companies or companies that extract it might be a better alternative. If you are looking for cash flow from your investment, buying gold stocks will work well.

ETFs allow you to invest in exchange-traded funds. These funds give you exposure, but not actual gold, by investing in gold-related securities. These ETFs typically include stocks from gold miners, precious metallics refiners, commodity trading companies, and other commodities.

How much gold do you need in your portfolio?

The amount of money you need to make depends on how much capital you are looking for. For a small start, $5k to $10k is a good range. As you grow, it is possible to rent desks or office space. Renting out desks and other equipment is a great way to save money on rent. Rent is only paid per month.

Also, you need to think about the type of business that you are going to run. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. You should also consider the expected income from each client when you do this type of thing.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. So you might only get paid once every 6 months or so.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I suggest starting with $1k-2k gold and building from there.

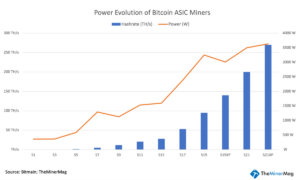

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

finance.yahoo.com

- Yahoo Finance: Barrick Gold Corporation, (GOLD), Stock Prices, News, Quotes & History

irs.gov

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Lawful – WSJ

How To

Three ways to invest in gold for retirement

It is important to understand the role of gold in your retirement plan. There are many ways to invest in gold if you have a 401k account at work. You may also want to consider investing in gold outside of your workplace. You could, for example, open a custodial bank account at Fidelity Investments if your IRA (Individual Retirement Account) is open. Or, if you don't already own any precious metals, you may want to consider buying them directly from a reputable dealer.

These are the rules for gold investing:

- Buy Gold with Cash – Avoid using credit cards or borrowing money to fund investments. Instead, instead, transfer cash to your accounts. This will protect you from inflation and help keep your purchasing power high.

- Physical Gold Coins to Own – Physical gold coin ownership is better than having a paper certificate. The reason for this is that physical gold coins are much more easily sold than certificates. You don't have to store physical gold coins.

- Diversify Your Portfolio. Never place all your eggs in the same basket. This means that you should diversify your wealth by investing in different assets. This helps to reduce risk and provides more flexibility when markets are volatile.