Before deciding whether to open an IRA Gold or a traditional IRA, it is important to know a few important facts. First, you should know that Gold is the same metal as a traditional IRA. You should also know that you can choose from several different options, including a Roth IRA or a self-directed IRA.

IRA gold

When investing in precious metals, it is important to diversify your portfolio. This allows you to diversify the risks that you are exposed to and also protects your investment from fluctuations in market value. Fortunately, there are many different ways to invest in precious metals, including IRA gold. Here are a few examples.

Before selecting a gold IRA provider, you should do a little research on the company. The internet is an excellent resource for this. You can use sites such as Yelp, Google Business, Facebook, the Better Business Bureau, and Trustlink to read reviews. It is also a good idea to check accreditation sites such as the Business Consumer Alliance (BBB).

IRA gold vs traditional IRA

The primary difference between a traditional and gold IRA is the rules for determining when to begin making distributions. With a traditional IRA, you may be required to begin taking distributions when you reach age 59 1/2. However, there are exceptions to this rule. For instance, you can take withdrawals before that age if you are using the money for qualified higher education or certain medical expenses.

A gold IRA is a type of self-directed individual retirement account that allows you to invest in physical gold or precious metals-related securities. Because it is self-directed, a gold IRA allows you to enjoy tax benefits that are not available with a traditional IRA. However, the IRS requires that your gold IRA investments be held in an IRS-approved depository. For this reason, you cannot store your gold in your home.

IRA gold vs Roth IRA

IRA gold accounts are like a traditional IRA, but the difference is in how they are funded. A traditional IRA requires you to pay taxes on your contributions and gains, but a gold IRA does not. Those who are self-employed or own a small business can open a SEP gold IRA, which requires you to pay taxes only when you withdraw your funds in retirement. The advantage of a SEP is that you can contribute up to 25% of your income.

You can use a Roth IRA to invest in gold or other assets. A Roth IRA allows you to contribute tax-deductible money to your account and earn tax-free interest. You also do not pay taxes on withdrawals from a Roth IRA. A Roth IRA can be funded through your bank account, although you may need to work with a custodian or trustee to do this.

IRA gold vs self-directed IRA

When it comes to retirement savings, there are two major types of accounts available: traditional and self-directed. A traditional IRA is funded with pre-tax dollars, while a self-directed IRA requires you to pay income tax on your contributions. The tax benefits of a traditional IRA can be quite attractive, but the downside is that the money you withdraw from your IRA will not be tax-free.

If you’re unsure of which option is right for you, a self-directed IRA can help you get the metals you want, at the right price. You can choose from a wide range of bullion, including rare coins. These are, however, generally poor investments and carry a high degree of risk. With a self-directed IRA, you have more control over the purchase and will not have to deal with a third party’s vaults. You can also keep track of your shipment, which ensures safety and security.

Tax benefits of IRA gold

Gold-backed IRAs are a great way to diversify your retirement portfolio. They offer tax benefits on growth and distribution, and you don’t have to pay taxes on the money until retirement age. However, you should understand that there are some risks associated with gold investments. Despite this, many financial experts recommend holding as much as 10% of your portfolio in gold.

A gold IRA is a great way to diversify your retirement fund and can be a wonderful way to protect your savings from inflation. It also provides a hedge against a possible drop in the value of other investments. And because it has a higher market value, investing in gold will help you compensate for any losses in other investment types. Opening a gold IRA account is as simple as choosing the right provider, filling out an application, and making your first deposit.

Frequently Asked Questions

How is gold taxed by Roth IRA?

An investment account’s tax is calculated based on the current value of the account, and not on what you paid originally. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. Taxes are only charged on capital gains or dividends earned, which only apply to investments longer than one calendar year.

The rules that govern these accounts differ from one state to the next. In Maryland, for example, withdrawals must be made within 60 days of reaching the age of 59 1/2 in order to qualify. In Massachusetts, you can wait until April 1st. New York is open until 70 1/2. To avoid penalty fees, it is important to plan and take distributions in time to pay all your retirement savings.

How is gold taxed in an IRA?

The fair market value of gold sold is the basis for tax. You don’t have tax to pay when you buy or sell gold. It’s not considered income. If you sell it later, you’ll have a taxable gain if the price goes up.

As collateral for loans, gold is possible. Lenders will seek the highest return on your assets when you borrow against them. In the case of gold, this usually means selling it. However, there is no guarantee that the lender would do this. They may hold on to it. Or, they may decide to resell the item themselves. In either case, you risk losing potential profits.

To avoid losing money, only lend against gold if you intend to use it for collateral. It is better to leave it alone.

What does gold do as an investment?

Supply and demand determine the gold price. Interest rates are also a factor.

Due to their limited supply, gold prices fluctuate. There is also a risk in owning gold, as you must store it somewhere.

What is the value of a gold IRA

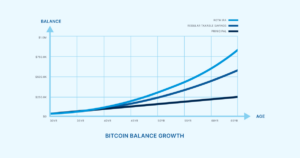

There are many benefits to a gold IRA. It’s an investment vehicle that lets you diversify your portfolio. You have control over how much money goes into each account.

You can also rollover funds from other retirement accounts to a gold IRA. If you are planning to retire early, this makes it easy to transition.

The best part? You don’t need to have any special skills to invest into gold IRAs. These IRAs are available at all banks and brokerage houses. Withdrawals are made automatically without having to worry about fees or penalties.

There are, however, some drawbacks. Gold has always been volatile. Understanding why you want to invest in gold is essential. Is it for growth or safety? Do you want to use it as an insurance strategy or for long-term growth? Only once you know, that will you be able to make an informed decision.

If you plan to keep your gold IRA indefinitely, you’ll probably want to consider buying more than one ounce of gold. You won’t need to buy more than one ounce of gold to cover all your needs. Depending on your plans for using your gold, you may need multiple ounces.

You don’t necessarily need a lot if you’re looking to sell your gold. Even a single ounce can suffice. These funds won’t allow you to purchase anything else.

How much money should I put into my Roth IRA?

Roth IRAs are retirement accounts where you deposit your own money tax-free. The account cannot be withdrawn from until you are 59 1/2. However, if your goal is to withdraw funds before that time, there are certain rules you must observe. First, you can’t touch your principal (the initial amount that was deposited). This means that regardless of how much you contribute to an account, you cannot take out any more than you initially contributed. If you are able to take out more that what you have initially contributed, you must pay taxes.

The second rule is that you cannot withdraw your earnings without paying income taxes. Also, taxes will be due on any earnings you take. Consider, for instance, that you contribute $5,000 per year to your Roth IRA. In addition, let’s assume you earn $10,000 per year after contributing. On the earnings, you would be responsible for $3,500 federal income taxes. You would have $6,500 less. Since you’re limited to taking out only what you initially contributed, that’s all you could take out.

If you took $4,000 from your earnings, you would still owe taxes for the $1,500 remaining. On top of that, you’d lose half of the earnings you had taken out because they would be taxed again at 50% (half of 40%). So even though you received $7,000 in Roth IRA contributions, you only received $4,000.

There are two types if Roth IRAs: Roth and Traditional. A traditional IRA allows you to deduct pre-tax contributions from your taxable income. When you retire, you can use your traditional IRA to withdraw your contribution balance plus interest. A traditional IRA can be withdrawn up to the maximum amount allowed.

Roth IRAs don’t allow you deduct contributions. However, once you retire, you can withdraw your entire contribution plus accrued interest. There is no minimum withdrawal requirement, unlike traditional IRAs. It doesn’t matter if you are 70 1/2 or older before you withdraw your contribution.

Statistics

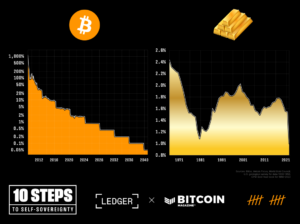

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you take distributions before hitting 59.5, you’ll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

forbes.com

irs.gov

cftc.gov

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads, Example, and Risk Metrics

How To

How to Keep Physical Gold in an IRA

The best way of investing in gold is to purchase shares from companies that produce gold. But, this approach comes with risks. These companies may not survive the next few years. If they survive, there’s still the risk of losing money due to fluctuations in the price of gold.

You can also buy gold directly. You can either open an account with a bank, online bullion dealer, or buy gold directly from a seller you trust. The advantages of this option include the ease of access (you don’t need to deal with stock exchanges) and the ability to make purchases when prices are low. It’s also easy to see how many gold you have. You will receive a receipt detailing exactly what you paid. You also have a lower chance of theft than stocks.

However, there are some disadvantages too. You won’t be able to benefit from investment funds or interest rates offered by banks. Also, you won’t be able to diversify your holdings – you’re stuck with whatever you bought. Finally, the tax man might ask questions about where you’ve put your gold!

BullionVault.com has more information about how to buy gold in an IRA.