As 2024 unfolds, the excitement in the cryptocurrency community is reaching a peak as the Bitcoin halving event approaches. This event has the potential to reshape the market landscape and has historically had a significant impact on the crypto scene. With insights from past halvings in mind, let's explore what the upcoming 2024 halving might entail.

Bitcoin's Journey: From Digital Gold to Rare Platinum

The essence of Bitcoin lies in its design to become increasingly scarce over time, effectively managing inflation. With a maximum cap of 21 million Bitcoins, we are nearing the limit at 19.62 million. The controlled release of Bitcoin into the market contributes to its scarcity, earning it the moniker "digital gold" due to its rarity, akin to physical gold.

Viewing the Bitcoin blockchain as a clock, halving takes place approximately every four years or every 210,000 blocks. This process involves halving the reward for mining new blocks, starting at 50 BTC per block in 2009 and decreasing to 3.125 BTC by 2024.

Stock-to-Flow Ratio and Bitcoin's Scarcity

The Stock-to-Flow ratio, comparing the existing Bitcoin supply to new coins entering circulation, indicates that Bitcoin is set to become rarer than platinum. Following the 2024 and 2030 halvings, Bitcoin's scarcity will elevate, making it even more precious than gold by 2032.

Bitcoin's Growth Post-Halving

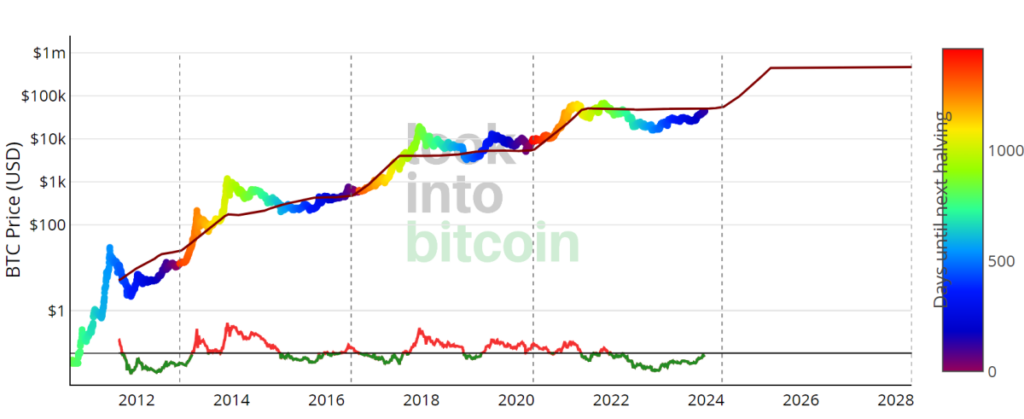

Historically, Bitcoin has seen significant price surges after each halving event. The market cap soared by 342% within 100 days of the 2012 halving, reaching a peak price increase of 8,761% the following year. Subsequent halvings in 2016 and 2020 also led to substantial price jumps, showcasing the post-halving growth patterns of Bitcoin.

By analyzing past growth rates post-halving, we can speculate a growth rate of around 155.79% following the 2024 halving, potentially propelling Bitcoin to approximately $111,807 within a year and a half post-event. However, it's crucial to note that these figures are speculative and should not be the sole basis for investment decisions.

Challenges for Miners Post-2024 Halving

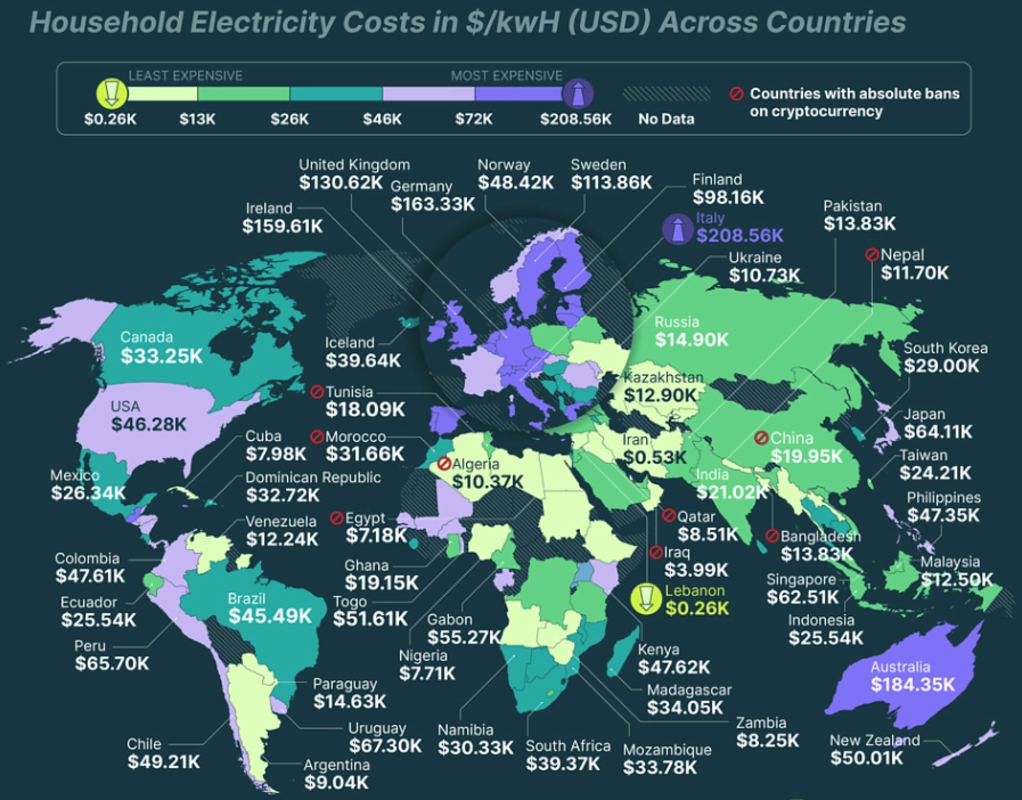

For Bitcoin miners, the 2024 halving poses challenges, especially with reduced rewards. Miners using outdated equipment and facing high electricity costs may struggle to remain profitable. The halving will separate the most efficient and cost-effective miners from the rest, creating a competitive landscape akin to 'The Hunger Games.'

Closing Thoughts on the 2024 Bitcoin Halving

The 2024 Bitcoin halving is anticipated to bring significant changes to the mining industry and potentially impact Bitcoin's price trajectory. This event combines economic theories with technological advancements, adding to the allure of the crypto space. Whether you are actively involved in mining or simply observing, the 2024 halving is set to be a noteworthy event in the history of Bitcoin.

Author: Maria Carola. The views and opinions expressed in this article are solely those of the author and do not reflect the official policy or position of BTC Inc or Bitcoin Magazine.

Frequently Asked Questions

Can I buy or sell gold from my self-directed IRA

Although you can buy gold using your self-directed IRA account, you will need to open an account at a brokerage like TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals to contribute up to $5,500 annually ($6,500 if married and filing jointly) to a traditional IRA. Individuals can contribute up $1,000 per annum ($2,000 if they are married and jointly) directly to a Roth IRA.

You should consider buying physical gold bullion if you decide to invest in it. Futures contracts can be described as financial instruments that are determined by the gold price. They let you speculate on future price without having to own the metal. You can only hold physical bullion, which is real silver and gold bars.

Is gold a good investment IRA?

Anyone who is looking to save money can make gold an excellent investment. You can also diversify your portfolio by investing in gold. There is much more to gold than meets your eye.

It has been used throughout the history of currency and remains a popular payment method. It is often called “the oldest currency in the world.”

Gold, unlike other paper currencies created by governments is mined directly from the earth. It's hard to find and very rare, making it extremely valuable.

The price of gold fluctuates based on supply and demand. People tend to spend more when the economy is healthy, which means that fewer people are able to mine gold. Gold's value rises as a result.

The flip side is that people tend to save money when the economy slows. This increases the production of gold, which in turn drives down its value.

It is this reason that gold investing makes sense for businesses and individuals. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

In addition to earning interest on your investments, this will allow you to grow your wealth. If gold's value falls, you don't have to lose any of your investments.

What proportion of your portfolio should you have in precious metals

To answer this question, we must first understand what precious metals are. Precious metals refer to elements with a very high value relative other commodities. This makes them extremely valuable for trading and investing. Gold is currently the most widely traded precious metal.

There are many other precious metals, such as silver and platinum. While gold's price fluctuates during economic turmoil, it tends to remain relatively stable. It also remains relatively unaffected by inflation and deflation.

All precious metals prices tend to rise with the overall market. However, they may not always move in synchrony with each other. If the economy is struggling, the gold price tends to rise, while the prices for other precious metals tends to fall. This is because investors expect lower interest rates, making bonds less attractive investments.

Contrary to this, when the economy performs well, the opposite happens. Investors want safe assets such Treasury Bonds and are less inclined to demand precious metals. Since these are scarce, they become more expensive and decrease in value.

To maximize your profits when investing in precious metals, diversify across different precious metals. Additionally, since the prices of precious metals tend to rise and fall together, it's best to invest in several different types of precious metals rather than just focusing on one type.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Legal – WSJ

bbb.org

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options Types, Spreads. Example. And Risk Metrics

How To

Tips for Investing in Gold

Investing in Gold remains one of the most preferred investment strategies. There are many benefits to investing in gold. There are many ways you can invest in gold. Some people buy physical gold coins, while others prefer investing in gold ETFs (Exchange Traded Funds).

Before you purchase any type or gold, here are some things to think about.

- First, find out if your country allows gold ownership. If so, then you can proceed. Otherwise, you can look into buying gold from abroad.

- Secondly, you should know what kind of gold coin you want. There are many options for gold coins: yellow, white, and rose.

- You should also consider the price of gold. Start small and move up. You should diversify your portfolio when buying gold. Diversifying assets should include stocks, bonds real estate mutual funds and commodities.

- You should also remember that gold prices can change often. Therefore, you have to be aware of current trends.

—————————————————————————————————————————————————————————————-

By: Maria Carola

Title: The 2024 Bitcoin Halving: What to Expect for BTC Value and Miners

Sourced From: bitcoinmagazine.com/markets/the-2024-bitcoin-halving-a-btc-value-boom-or-a-survival-crisis-for-miners

Published Date: Mon, 19 Feb 2024 17:30:02 GMT