Robert Kiyosaki, the author of the best-selling book Rich Dad Poor Dad, has opened up about his continued investments in gold, silver, and bitcoin. He emphasized that these three investment types offer lifelong financial security and freedom, attributing his decision to the desire for more war and poverty by world leaders. Kiyosaki has recently made optimistic predictions about the future price of bitcoin, ranging from $135,000 to $1 million.

Robert Kiyosaki Shares Why He Keeps Investing in Bitcoin

Robert Kiyosaki, the renowned author of the book Rich Dad Poor Dad, has made public the reason behind his ongoing investments in gold, silver, and bitcoin. With over 32 million copies sold in more than 109 countries and translated into 51 languages, Rich Dad Poor Dad, co-authored by Kiyosaki and Sharon Lechter, has remained on the New York Times Best Seller List for over six years.

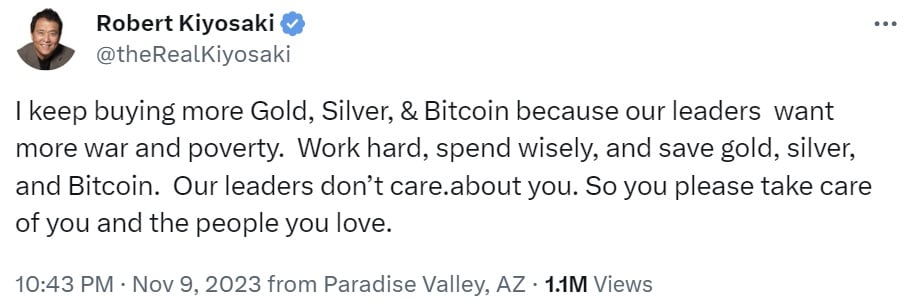

Through a social media post on platform X, Kiyosaki expressed his belief that U.S. leaders aim for more war and poverty, which is why he advises people to secure their wealth in gold, silver, and bitcoin.

Kiyosaki has long been recommending gold, silver, and bitcoin as investment options. In recent times, he has reiterated that these asset classes provide lifelong financial security and freedom, particularly during unstable times.

In order to survive the greatest crash in world history, Kiyosaki suggests allocating 75% of investment portfolios to gold, silver, and bitcoin, and the remaining 25% to real estate and oil stocks. He also recommends using dollar cost averaging instead of trying to pick stocks individually, emphasizing that his strategy differs from that of Warren Buffett.

Kiyosaki has made several bullish predictions about the price of BTC, ranging from $135,000 to $1 million in the event of a global economic crisis. Additionally, he has forecasted that gold could reach $75,000 and silver could reach $60,000 under the same circumstances. In February, he projected that the price of bitcoin would reach $500,000 by 2025, with gold rising to $5,000 and silver reaching $500 within the same timeframe.

Recently, Kiyosaki urged investors to buy bitcoin immediately, anticipating a surge in demand as stock, bond, and real estate markets collapse. He has also expressed his confidence in the future of cryptocurrency, referring to fiat money as "fake money" and predicting its demise. Alongside multiple warnings about the impending crash in real estate, stocks, and bonds, he has cautioned that an increase in interest rates by the Federal Reserve would lead to a crash in the U.S. dollar.

What are your thoughts on Robert Kiyosaki's explanation for his continued investments in gold, silver, and bitcoin? Let us know in the comments section below.

Frequently Asked Questions

Can I buy gold using my self-directed IRA

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals may contribute up to $1,000 ($2,000 if married, filing jointly) directly into a Roth IRA.

You should consider buying physical gold bullion if you decide to invest in it. Futures contracts are financial instruments based on the price of gold. These contracts allow you to speculate on future gold prices without actually owning it. However, physical bullion is real gold or silver bars you can hold in your hands.

Can I hold physical gold in my IRA?

Not just paper money or coins, gold is money. Gold is an asset people have used for thousands years as a place to store value and protect their wealth from economic uncertainty and inflation. Today, investors invest in gold as part a diversified portfolio. This is because gold tends do better in financial turmoil.

Many Americans are now more inclined to invest in precious metals like gold and silver than stocks or bonds. Although owning gold does not guarantee that you will make money investing in it, there are many reasons to consider adding gold into your retirement portfolio.

Another reason is that gold has historically outperformed other assets in financial panic periods. Between August 2011 to early 2013, gold prices rose close to 100 percent while the S&P 500 fell 21 per cent. Gold was one of the few assets that performed better than stocks during turbulent market conditions.

Another benefit to investing in gold? It has virtually zero counterparty exposure. Your shares will still be yours even if your stock portfolio drops. However, if you have gold, your value will rise even if the company that you invested in defaults on its loans.

Finally, gold is liquid. This allows you to sell your gold whenever you want, unlike many other investments. Because gold is so liquid compared to other investments, buying it in small amounts makes sense. This allows for you to benefit from the short-term fluctuations of the gold market.

What precious metal should I invest in?

The answer to this question depends on how much risk you are willing to take and what type of return you want. Although gold has been considered a safe investment, it is not always the most lucrative. Gold may not be right for you if you want quick profits. If you have time and patience, you should consider investing in silver instead.

Gold is the best investment if you aren't looking to get rich quick. If you want to invest in long-term, steady returns, silver is a better choice.

Who is entitled to the gold in a IRA that holds gold?

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

You will need to declare the value of gold if you intend on selling it one day. This could impact how capital gains taxes you owe for cash investments.

A financial planner or accountant should be consulted to discuss your options.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- You want to keep gold in your IRA at home? It's Not Exactly Legal – WSJ

irs.gov

investopedia.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Investing gold vs. stocks

Investing in gold as an investment vehicle might seem like a very risky proposition these days. Many people believe that investing in gold is not profitable. This belief arises because most people believe that the global economy is driving down gold prices. People believe that investing in gold would result in them losing money. In reality, however there are still many significant benefits to gold investing. Below we'll look at some of them.

One of the oldest forms known of currency is gold. Its use can be traced back to thousands of years ago. It was used by many people around the globe as a currency store. It is still used as a payment method by South Africa and other countries.

You must first decide how much you are willing and able to pay per gram to decide whether or not gold should be your investment. When looking into buying gold bullion, you must decide how much you are willing to spend per gram. If you don’t know what the current market price is, you can always call a local jewelry store and ask them their opinion.

Noting that gold prices have fallen in recent years, it is worth noting that the cost to produce gold has gone up. Although gold's price has fallen, its production costs have not.

Another thing to remember when thinking about whether or not you should buy gold is the amount of gold you plan on purchasing. For example, if you only intend to purchase enough to cover your wedding rings, it probably makes sense to hold off on buying any gold. But, if your goal is to make long-term investments in gold, this might be worth considering. It is possible to make a profit by selling your gold at higher prices than when you purchased it.

We hope that this article has helped you gain a better understanding and appreciation for gold as an investment option. We recommend you do your research before making any final decisions. Only after doing so can you make an informed decision.

—————————————————————————————————————————————————————————————-

By: Kevin Helms

Title: Rich Dad Poor Dad Author Robert Kiyosaki Reveals Why He Keeps Buying Bitcoin

Sourced From: news.bitcoin.com/rich-dad-poor-dad-author-robert-kiyosaki-reveals-why-he-keeps-buying-bitcoin/

Published Date: Sun, 12 Nov 2023 01:30:42 +0000

Related posts:

Robert Kiyosaki Breaks Down Rich Dad’s Lesson One: The Importance of Tangible Assets for Lifelong Financial Security

Robert Kiyosaki Breaks Down Rich Dad’s Lesson One: The Importance of Tangible Assets for Lifelong Financial Security

Bitcoin Predicted to Surge to $135,000, Gold Expected to Skyrocket, According to Robert Kiyosaki

Bitcoin Predicted to Surge to $135,000, Gold Expected to Skyrocket, According to Robert Kiyosaki

Robert Kiyosaki Shares His Investment Strategy — Says He’s Not Trying to Be Warren Buffett

Robert Kiyosaki Shares His Investment Strategy — Says He’s Not Trying to Be Warren Buffett

Predictions of Bitcoin and World Markets at the Upcoming FOMC Meeting

Predictions of Bitcoin and World Markets at the Upcoming FOMC Meeting