Stablecoin Market Sees Varied Performances Last Month

In December 2023, the stablecoin market experienced a mix of ups and downs. While the overall market declined compared to the previous year, there were a few stablecoins that stood out with significant increases in supply. Tether (USDT), the leading stablecoin by market capitalization, saw a 2.5% boost in supply during the last 30 days. With a current market capitalization of $91.86 billion, USDT continues to dominate the stablecoin market.

On the other hand, some stablecoins witnessed a decline in supply. USDC experienced a slight 0.2% dip, while DAI encountered a 1.7% decline. TrueUSD (TUSD) saw a significant 22% contraction in its supply during December. However, there were two stablecoins that defied the trend and experienced substantial growth. First Digital USD (FDUSD) surged by 85.7%, reaching a market valuation of $1.8 billion. Meanwhile, Binance USD (BUSD) noted a supply reduction of approximately 39%, indicating a potential decline in its market presence.

Paypal's PYUSD and the Emerging FDUSD

December also witnessed the rise of new stablecoins that are making their mark in the crypto economy. Paypal's PYUSD, introduced by a giant in the payments sector, saw a significant 68.8% increase in supply, surpassing Liquity USD (LUSD) this month. With a total supply exceeding 264 million units, PYUSD is gaining traction among crypto users.

Meanwhile, First Digital USD (FDUSD) has emerged as a rapidly growing stablecoin, with an impressive 85.7% increase in supply throughout the end of 2023. Currently valued at $1.8 billion, FDUSD is proving to be a strong contender in the stablecoin market.

The Role of Stablecoins in the Crypto Economy

The stablecoin market continues to play a crucial role in the crypto economy, as evidenced by the significant trade volume involving stablecoins. In the last 24 hours alone, stablecoins accounted for over $42 billion out of a total global trade volume of around $64 billion. This indicates that stablecoins are being utilized in more than six out of every ten trades, highlighting their importance and widespread adoption.

Overall, the stablecoin market in December showcased a mix of performances, with some stablecoins experiencing growth while others faced declines. As the crypto economy evolves, it will be interesting to see how stablecoins continue to shape the landscape and provide stability to digital assets.

What are your thoughts on the stablecoin market action in December? Feel free to share your opinions and insights in the comments section below.

Frequently Asked Questions

Can I keep a Gold ETF in a Roth IRA

This option may not be available in a 401(k), but you should look into other options such as an Individual Retirement account (IRA).

Traditional IRAs allow contributions from both the employer and employee. Another option is to invest in publicly traded corporations with an Employee Stockownership Plan (ESOP).

An ESOP is a tax-saving tool because employees have a share of company stock as well as the profits that the business generates. The money invested in the ESOP is then taxed at lower rates than if it were held directly in the hands of the employee.

You can also get an Individual Retirement Annuity, or IRA. An IRA allows for you to make regular income payments during your life. Contributions to IRAs do not have to be taxable

Is it a good idea to open a Precious Metal IRA

Precious metals are not insured. This is the most important fact to know before you open an IRA account. You cannot recover any money you have invested. All your investments can be lost due to theft, fire or flood.

Investing in physical gold and silver coins is the best way to protect yourself from this type of loss. These items are timeless and have a lifetime value. If you were to offer them for sale today, they would likely fetch you more than you paid when you bought them.

Consider a reputable business that offers low rates and good products when opening an IRA. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

Remember that you will not see any returns unless you are retired if you open an Account. Do not forget about the future!

How much gold do you need in your portfolio?

The amount of money you need to make depends on how much capital you are looking for. For a small start, $5k to $10k is a good range. As you grow, you can move into an office and rent out desks. Renting out desks and other equipment is a great way to save money on rent. It's only one monthly payment.

You also need to consider what type of business you will run. My website design company charges clients $1000-2000 per month depending on the order. You should also consider the expected income from each client when you do this type of thing.

You won't get a monthly paycheck if you work freelance. This is because freelancers are paid. You might get paid only once every six months.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I recommend starting with $1k-$2k of gold and growing from there.

Should You Get Gold?

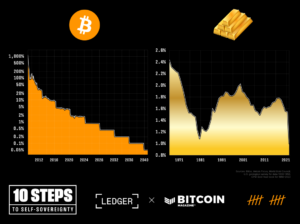

Gold was once considered an investment safe haven during times of economic crisis. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

While gold prices have been rising in recent years they are still low relative to other commodities, such as silver and oil.

Experts believe this could change soon. Experts predict that gold prices will rise sharply in the wake of another global financial collapse.

They also noted that gold is growing in popularity because of its perceived value as well as potential return.

These are some things you should consider when considering gold investing.

- Consider whether you will actually need the money that you are saving for retirement. You can save money for retirement even if you don't invest in gold. That said, gold does provide an additional layer of protection when you reach retirement age.

- Second, ensure you fully understand the risks involved in buying gold. Each one offers different levels security and flexibility.

- Finally, remember that gold doesn't offer the same level of safety as a bank account. It is possible to lose your gold coins.

Do your research before you buy gold. If you already have gold, make sure you protect it.

Is gold a good choice for an investment IRA?

Anyone who is looking to save money can make gold an excellent investment. It can be used to diversify your portfolio. But gold has more to it than meets the eyes.

It has been used as a currency throughout history and is still a popular method of payment. It is often called “the most ancient currency in the universe.”

But gold is mined from the earth, unlike paper currencies that governments create. That makes it very valuable because it's rare and hard to create.

The supply and demand for gold determine the price of gold. When the economy is strong, people tend to spend more money, which means fewer people mine gold. The value of gold rises as a consequence.

On the other hand, people will save cash when the economy slows and not spend it. This results in more gold being produced, which drives down its value.

This is why investing in gold makes sense for individuals and businesses. If you invest in gold, you'll benefit whenever the economy grows.

Your investments will also generate interest, which can help you increase your wealth. You won't lose your money if gold prices drop.

Can I have physical gold in my IRA

Gold is money. Not just paper currency. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Investors today use gold to diversify their portfolios because gold is more resilient to financial turmoil.

Many Americans today prefer to invest in precious metals, such as silver and gold, over stocks and bonds. Even though owning gold is not a guarantee of making money, there are many reasons why you might want to add gold to your retirement savings portfolio.

Gold has historically performed better during financial panics than other assets. Between August 2011 and early 2013 gold prices soared nearly 100 percent, while the S&P 500 plunged 21 percent. During those turbulent market conditions, gold was among the few assets that outperformed stocks.

Gold is one of the few assets that has virtually no counterparty risks. Even if your stock portfolio is down, your shares are still yours. If you have gold, it will still be worth your shares even if the company in which you invested defaults on its debt.

Finally, the liquidity that gold provides is unmatched. This means that you can sell gold anytime, regardless of whether or not another buyer is available. You can buy gold in small amounts because it is so liquid. This allows for you to benefit from the short-term fluctuations of the gold market.

What are the advantages of a gold IRA

An Individual Retirement Account (IRA) is the best way to put money towards retirement. It's not subject to tax until you withdraw it. You control how much you take each year. There are many types of IRAs. Some are better suited to college savings. Others are made for investors seeking higher returns. Roth IRAs permit individuals to contribute after the age 59 1/2. Any earnings earned at retirement are subject to tax. However, once they begin withdrawing funds, these earnings are not taxed again. This type account may make sense if it is your intention to retire early.

An IRA with a gold status is like any other IRA because you can put money into different asset classes. Unlike a regular IRA, you don't have to worry about paying taxes on your gains while you wait to access them. This makes gold IRA accounts a great choice for those who want their money to be invested, not spent.

Another benefit of owning gold through an IRA is that you get to enjoy the convenience of automatic withdrawals. This means that you don't need to worry about making monthly deposits. To avoid missing a payment, direct debits can be set up.

Gold is one of today's most safest investments. It is not tied to any country so its value tends stay steady. Even during economic turmoil the gold price tends to remain fairly stable. Therefore, gold is often considered a good investment to protect your savings against inflation.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

cftc.gov

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement plans

bbb.org

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options Types, Spreads. Example. And Risk Metrics

How To

How to hold physical gold in an IRA

The most obvious way to invest in gold is by buying shares from companies producing gold. But, this approach comes with risks. These companies may not survive the next few years. Even if they survive, there's always the risk that they will lose money due fluctuations in gold prices.

You can also buy gold directly. You can either open an account with a bank, online bullion dealer, or buy gold directly from a seller you trust. This option has many advantages, including the ease of access (you don’t have to deal with stock markets) and the ability of making purchases at low prices. It's also easy to see how many gold you have. So you can see exactly what you have paid and if you missed any taxes, you will get a receipt. There's also less chance of theft than investing in stocks.

There are also some drawbacks. Bank interest rates and investment funds won't help you. Also, you won't be able to diversify your holdings – you're stuck with whatever you bought. Finally, the taxman might want to know where your gold has been placed!

Visit BullionVault.com to find out more about gold buying in an IRA.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Paypal and First Digital Stablecoins Dominate in December as Binance USD Heads Toward Extinction

Sourced From: news.bitcoin.com/paypal-and-first-digital-stablecoins-dominate-in-december-as-binance-usd-heads-toward-extinction/

Published Date: Tue, 02 Jan 2024 16:30:40 +0000