Are you concerned about the impact of the economy on your retirement savings? The dollar doesn't affect gold's value, so investing in gold can provide a safe haven against economic downturns or stock market volatility. The fact is that gold's price tends to rise when the dollar loses value because investors look to precious metals for protection.

IRA-eligible gold can be invested in a self-directed retirement plan, which will provide you with valuable tax benefits and security. Investors can invest in gold IRAs, which allow them to hold assets other than stocks. The IRS has strict guidelines about the type of gold that you can have within your IRA.

Continue reading to find out more about IRA-eligible Gold and the benefits and details of opening a Self-Directed Gold IRA.

There are many gold products that you can include in your IRA

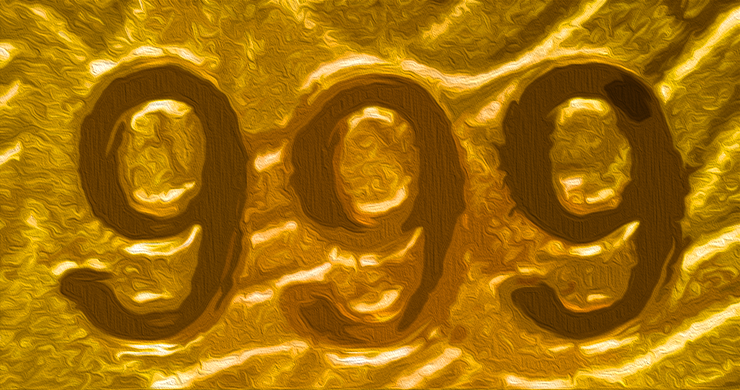

Pre-approved lists of precious metals that are eligible for IRA investment have been prepared by the IRS. Each product must meet certain purity, weight and manufacturing standards. However, some exceptions to the requirements have been approved.

99.5% purity is required for gold bullion coins, bars and rounds. Some coins made of gold are not eligible, even if they meet the purity requirements. Even if the coin is on the approved list, any certified or graded piece of gold coins are not suitable for an IRA.

Gold Coins

These gold coins are IRA-eligible

- American Eagle Gold Coins

- Australian Kangaroo Gold Coins

- Austrian Philharmonic Gold Coins

- Canadian Maple Leaf Gold Coins

- Chinese Gold Panda Coins

- Britannia Gold Coins

- Proof American Eagle Coins

- American Buffalo Bullion Coins

The American Eagle gold coins, which are 91.67% pure, remain a popular option for gold IRAs.

Bars of Gold

These are the gold bars that are eligible for IRA eligibility:

- Credit Suisse Gold Bars

- Johnson Matthey Gold Bar

- Valcambi Gold CombiBar

Many gold bars, and even the gold rounds mentioned above, contain 99.99% pure Gold.

Why are some gold products not eligible for IRAs

To be eligible for an IRA, gold bullion products must comply with specific requirements. There are several conditions that the IRS requires, such as:

- Bars and coins made of gold must contain at least 99.5% pure Gold

- An IRS-approved depository must hold gold in an IRA.

- A custodian must be appointed to store and buy gold for Gold IRAs.

You, the self-directed IRA account holder, can choose the products and depository you want to store your gold in. However, the custodian must purchase the gold and arrange storage. These are the conditions for IRA-eligible coins:

- All proof coins must be protected in mint packaging with a certificate of authenticity.

- Bullion coins should be in uncirculated, brilliant conditions

- All coins, bars and rounds must be from an approved or certified manufacturer or national mint.

- The weight requirements for small bullion bars should be met.

Some coins may not meet the purity requirements but they are still eligible for the IRA. These coins include the UK Sovereign coins and French 20 Franc Gold coins.

Are Certain IRA-eligible gold products more effective?

The spot price of gold is the value of IRA-eligible products. The spot price of gold is the current market value, as determined by the next month's most volume futures contract. The price of gold does not change based on the manufacturer. Therefore, the mint that you buy from will depend on your preferences.

However, some IRA-eligible coins may have a higher value due to their collectability, but they will still be comparable to the spot gold price. While the return on investment will not be significantly different between specific gold products (bars and coins), it may be easier to liquidate bars than coins.

Do You Need to Only Purchase Gold Products that Are IRA-Eligible?

While you can still invest in precious metals and gold without opening a self directed IRA, the IRA provides valuable tax benefits that will help you retire. A gold IRA can be a great way to save money on retirement, but it may not work for everyone.

Before you start a self-directed gold IRA, consider these things:

- Contribution limits. For individuals under 50, the IRS has a $6,000 annual contribution limit and for those over 50, a $7,000 annual limit. You can still purchase gold outside your IRA.

- Minimum investment. Minimum investment. Some gold IRAs require a minimum deposit of $25,000. This can be difficult to achieve if there isn't an existing balance that you can roll over.

- Fees. Due to the higher fees associated with setting up and maintaining an account, gold IRAs can be more costly than traditional IRAs.

- Early withdrawal penalty. Any withdrawals made before the age of 59 and a 1/2 years will be subject to a 10% tax penalty by IRS.

- Fraud and theft. To protect your gold bullion from theft and fraud, you must have a custodian. Before you trust them with your retirement account, it is important to do research on gold IRA companies as well as custodians.

If you don't plan to invest in retirement, or if you need to withdraw prior to retirement age, a gold IRA may not be right for your needs.

If you're looking for a way of building retirement savings that is less risky and still receive tax benefits from IRS, a gold IRA may be the best option. You will have full control over what gold products you purchase with your account funds. Your savings will also be protected from market crashes or inflation.

You can have physical assets and not risk your retirement with volatile paper investments such as bonds or stocks. A self-directed precious metals IRA lets you manage your precious metals investments. To find out if precious metal investing is right to you, check out our list of top gold IRA companies.

Tips to Buy IRA-Eligible Gold Products

There are many options available for you to start your self-directed gold IRA.

- Transfer funds from another savings account such as a Roth IRA or a traditional IRA.

- Transfer your employer-sponsored savings accounts such as 401(k), 403(b), to another account

- Create a new account

You can use your retirement savings account funds to fund your gold IRA if you have one. You will need to make a minimum deposit of $2,000 if you don't have a retirement savings account that can roll over funds before you can purchase gold for your IRA.

No matter where your funds are coming from, the steps for starting your gold IRA investment journey are the exact same.

- You can open a self-directed IRA

- Fond the account

- Appoint a custodian

- Buy IRA-eligible products of gold

- Keep your gold safe in an IRS-approved bank

You will usually work with a professional bullion broker to buy gold and other precious metals to add to your IRA. Your chosen company will help you to set up your IRA, and appoint a trustee. Many professional gold IRA companies also work with depositories that you can use for your gold.

Is it possible to store IRA Gold products in your home?

Account holders are not allowed to store their gold in their homes or security deposit boxes. The IRS treats gold taken into your possession as distribution. If you are under retirement age, you may lose tax-deferred benefits.

IRS-approved depositories are a good place to store your gold. These depositories offer safe storage for precious metals and gold, and are preferred storage locations by many gold IRA companies.

You don't need to keep your entire gold in an IRA. You can buy approved or unapproved gold from an IRA and keep it at home or in another safe location. While you will lose tax benefits and be at greater risk of theft, you'll still have more control over your investment and storage.

Learn more about Gold IRAs, and Investing Today

We provide resources to help you learn more about IRA-eligible Gold and how to build retirement savings that are safe from economic risk. Our site allows you to compare investment options and gold IRAs. Take our quiz to get started.

—————————————————————————————————————————————————————————————-

By: Learn About Gold

Title: IRA-eligible Gold: What Is It and Why Should You Buy It?

Sourced From: learnaboutgold.com/blog/ira-eligible-gold/?utm_source=rss&utm_medium=rss&utm_campaign=ira-eligible-gold

Published Date: Wed, 17 Aug 2022 17:41:00 +0000