There are several reasons why investing in gold is one of the best investments available.

First off, gold has been used as currency since ancient times. This makes it a safe investment option.

Second, gold is a tangible asset that cannot be easily manipulated. Unlike stocks, bonds, and currencies, gold is a physical commodity that does not fluctuate based on the whims of politicians and central banks.

Third, gold is considered a store of value. If you invest in gold, you are essentially storing wealth for future generations.

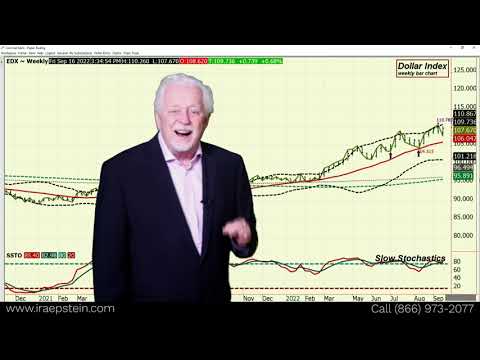

Finally, gold is a hedge against inflation. As the U.S. dollar continues its downward spiral, investors are increasingly turning toward alternative assets such as precious metals.

Inflation erodes purchasing power. For example, if you purchase $10 worth of goods today, you will receive $9 worth of goods tomorrow.

However, if you invested in gold, you would still receive $10 worth of goods tomorrow. Because gold prices tend to rise with inflation, it acts as a safeguard against rising costs.

As the U.S. economy continues to grow, the Federal Reserve may continue to raise interest rates. Higher interest rates mean higher borrowing costs for consumers and businesses.

This means that the value of the U.S. Dollar will decrease over time. As the U. S. Dollar declines in value, the price of commodities such as gold will increase.

Investing in gold is a smart financial decision. If you invest in a gold IRA, you can benefit from these five benefits.

#1. Safe Investment Option

Unlike stocks, bonds, and other types of investments, gold is a safe investment option. Even though gold prices have declined recently, the metal remains relatively stable compared to other assets.

Because gold is a tangible asset, it is protected from fluctuations in the stock market.

#2. Tangible Asset That Cannot Be Easily Manipulated

Like gold, silver is another popular investment option. However, unlike gold, silver tends to fluctuate based on political events.

For instance, if the U.S. Government decided to devalue the U.S. Dollars, the price of silver would skyrocket.

On the other hand, if the U. S. Government decided to print money, the price of silver would drop.

Therefore, it is difficult to predict the direction of silver prices.

With gold, however, the price of gold tends to remain steady regardless of economic conditions.

#3. Store of Value

When you invest in gold, it becomes a store of value. This means that you will receive the same amount of gold in 20 years as you did in 10 years.

If you purchased $100 worth of gold ten years ago, you would receive $100 worth of gold in 20 years.

#4. Hedge Against Rising Costs

As the U. S. dollar continues to decline in value, investors are increasingly turning towards alternative assets such as precious metals.

Although gold prices have fallen lately, the metal remains relatively steady compared to other assets. Therefore, it serves as a hedge against inflation.

#5. Tax Breaks

Because gold is a tax-free investment, you can deduct any losses incurred from your taxes.

Furthermore, if you sell your gold, you can claim capital gains tax on the profits.

These tax breaks allow you to save thousands of dollars each year.

Investing in a gold IRA allows you to enjoy these five benefits.