Radiant Capital Falls Victim to Flash Loan Attack

Radiant Capital, a decentralized finance (defi) platform, confirmed on January 3, 2023, that it has suffered an attack resulting in the loss of approximately $4.5 million worth of digital assets. The attack caused the protocol to accumulate bad debt in the WETH market, accounting for about 1.3% of the total protocol TVL. In response, Radiant Capital is urging the hackers to establish contact with the defi platform before involving law enforcement.

All Markets on Arbitrum Paused

Radiant Capital has also announced that all markets on Arbitrum have been paused following the flash loan attack that occurred on January 2. The attack caused the protocol to accumulate bad debt in the WETH market, resulting in a loss of $4.5 million in digital assets. Peckshield, a blockchain analytics firm, conducted an assessment of the hack and revealed that the attackers exploited a time window when a new market was activated in a lending market. The attack could have been prevented if the new market had been activated with CF 0%.

Meanwhile, the Radiant Decentralized Autonomous Organization (DAO) Council has initiated an investigation into the incident. The defi platform is taking precautionary measures to address the situation and ensure the safety of its users' funds.

Radiant Capital Remains Solvent

Radiant Capital has reassured its users that the protocol is still solvent and has plans to implement a remediation plan to address the bad debt and restore the capital of the protocol. The platform aims to give users full access to their deposits and prevent any unfair penalties for users at risk of liquidation during the pause period.

In an appeal to the attackers, Radiant Capital has urged them to establish contact with the defi platform before involving law enforcement. The platform also hopes to lift the pause on affected users' accounts within the next 24 hours.

What are your thoughts on this incident? Share your opinions in the comments section below.

Frequently Asked Questions

Can I buy or sell gold from my self-directed IRA

Your self-directed IRA can be used to purchase gold, but first you need to open an account with a brokerage firm such as TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals may contribute up to $1,000 ($2,000 if married, filing jointly) directly into a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contracts, which are financial instruments based upon the price of gold, are financial instruments. They allow you to speculate on future prices without owning the metal itself. But physical bullion refers to real gold and silver bars you can carry in your hand.

What tax is gold subject in an IRA

The fair market value of gold sold is the basis for tax. When you purchase gold, you don't have to pay any taxes. It isn't considered income. If you sell it later, you'll have a taxable gain if the price goes up.

Loans can be secured with gold. Lenders seek to get the best return when you borrow against your assets. This often means selling gold. There's no guarantee that the lender will do this. They may hold on to it. They might decide that they want to resell it. Either way, you lose potential profit.

To avoid losing money, only lend against gold if you intend to use it for collateral. It's better to keep it alone.

Are gold investments a good idea for an IRA?

Gold is an excellent investment for any person who wants to save money. It can be used to diversify your portfolio. There is much more to gold than meets your eye.

It's been used as a form of payment throughout history. It is often called “the oldest currency in the world.”

But gold, unlike paper currency, which is created by governments, is mined out from the ground. Because it is rare and difficult to make, it is extremely valuable.

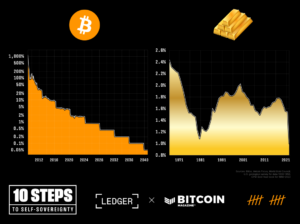

The supply-demand relationship determines the gold price. The strength of the economy means people spend more, and so, there is less demand for gold. The value of gold rises as a consequence.

On the flipside, people may save cash rather than spend it when the economy slows. This results in more gold being produced, which drives down its value.

This is why it makes sense to invest in gold for individuals and companies. You will benefit from economic growth if you invest in gold.

In addition to earning interest on your investments, this will allow you to grow your wealth. In addition, you won’t lose any money if gold falls in value.

Are You Ready to Invest in Gold?

It depends on how much you have saved and if gold was available at the time you started saving. Consider investing in both.

Gold offers potential returns and is therefore a safe investment. This makes it a worthwhile choice for retirees.

Gold is more volatile than most other investments. As a result, its value changes over time.

However, this does not mean that gold should be avoided. It just means that you need to factor in fluctuations to your overall portfolio.

Another advantage to gold is that it can be used as a tangible asset. Gold can be stored more easily than stocks and bonds. It can be easily transported.

You can always access your gold if it is stored in a secure place. Plus, there are no storage fees associated with holding physical gold.

Investing in gold can help protect against inflation. It's a great way to hedge against rising prices, as gold prices tend to increase along with other commodities.

Also, you'll reap the benefits of having some savings invested in something with a stable value. When the stock market drops, gold usually rises instead.

Gold investment has another advantage: You can sell it anytime. As with stocks, your position can be liquidated whenever you require cash. You don't even have to wait until you retire.

If you do decide to invest in gold, make sure to diversify your holdings. Don't place all your eggs in the same basket.

You shouldn't buy too little at once. Begin by buying a few grams. Then add more as needed.

It's not about getting rich fast. Instead, the goal is to accumulate enough wealth that you don't have to rely on Social Security.

While gold may not be the best investment, it can be a great addition to any retirement plan.

What should I pay into my Roth IRA

Roth IRAs allow you to deposit your money tax-free. These accounts are not allowed to be withdrawn before the age of 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. First, your principal (the original deposit amount) cannot be touched. You cannot withdraw more than the original amount you contributed. You must pay taxes on the difference if you want to take out more than what you initially contributed.

The second rule is that your earnings cannot be withheld without income tax. Withdrawing your earnings will result in you paying taxes. Let's take, for example, $5,000 in annual Roth IRA contributions. Let's also assume that you make $10,000 per year from your Roth IRA contributions. On the earnings, you would be responsible for $3,500 federal income taxes. You would have $6,500 less. You can only take out what you originally contributed.

Therefore, even if you take $4,000 out of your earnings you still owe taxes on $1,500. In addition, 50% of your earnings will be subject to tax again (half of 40%). You only got back $4,000. Even though you were able to withdraw $7,000 from your Roth IRA,

There are two types of Roth IRAs: Traditional and Roth. Traditional IRAs allow pre-tax contributions to be deducted from your taxable tax income. You can withdraw your contributions plus interest from your traditional IRA when you retire. You have the option to withdraw any amount from a traditional IRA.

Roth IRAs do not allow you to deduct your contributions. But once you've retired, you can withdraw the entire contribution amount plus any accrued interest. There is no minimum withdrawal required, unlike a traditional IRA. It doesn't matter if you are 70 1/2 or older before you withdraw your contribution.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

irs.gov

finance.yahoo.com

bbb.org

How To

The best way online to buy gold or silver

Understanding how gold works is essential before you buy it. The precious metal gold is similar to platinum. It's rare and often used to make money due its resistance and durability to corrosion. It is difficult to use so people prefer to buy jewelry made from it to gold bars.

Today, there are two types available in gold coins: one is legal tender and the other is bullion. The legal tender coins are issued for circulation in a country. They usually have denominations such as $1, $5, $10, and so on.

Bullion coins should only be used for investment purposes. Inflation can cause their value to increase.

They cannot be used in currency exchanges. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. Each dollar spent by the buyer is worth 1 gram.

Next, you need to find out where to buy gold. There are a few options if you wish to buy gold directly from a dealer. First, you can visit your local coin store. Another option is to go through a reputable site like eBay. You may also be interested in buying gold through private sellers online.

Private sellers are individuals who offer gold for sale, either at wholesale prices or retail prices. When selling gold through private sellers, you pay a commission fee of 10% to 15% per transaction. A private seller will usually return less money than a coin shop and eBay. This option is often a great choice for investing gold as it allows you more control over its price.

Another way to buy gold is by investing in physical gold. Although physical gold is easier to store than paper certificates you will still need to ensure it is safe. Physical gold should be stored in an impenetrable container, such a vault and safety deposit box to ensure its safety.

If you are looking to purchase gold on your own, you have two options: a bank or an pawnshop. A bank will be able to provide you with a loan for the amount of money you want to invest in gold. Customers can borrow money from pawnshops to purchase items. Banks often charge higher interest rates then pawnshops.

Finally, another way to buy gold is to simply ask someone else to do it! Selling gold is simple too. You can contact a company like GoldMoney.com to set up an account and receive payments right away.

—————————————————————————————————————————————————————————————-

By: Terence Zimwara

Title: Defi Platform Radiant Capital Loses $4.5 Million in Digital Assets After Flash Loan Attack

Sourced From: news.bitcoin.com/defi-platform-radiant-capital-loses-digital-assets-worth-4-5-million-after-flash-loan-attack/

Published Date: Thu, 04 Jan 2024 09:30:51 +0000