Recorded Net Income and Adjusted EBITDA

In the third quarter of 2023, Coinbase, the publicly-traded cryptocurrency exchange, outperformed expectations despite the extended crypto market slump. In their most recent shareholder letter, Coinbase disclosed a net income of $2 million and an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $181 million for the quarter ending on September 30, 2023.

Declining Total Revenue

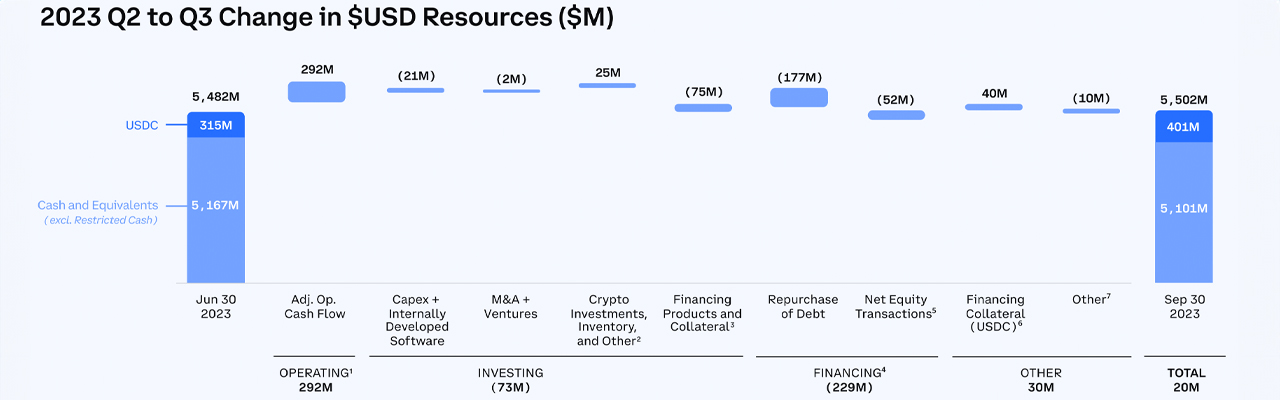

In a shareholder letter published on November 2, 2023, Coinbase reported that its total revenue declined to $674 million from $736 million in the second quarter. The company attributed this decline to lower crypto asset volatility and declining global spot trading volumes. Specifically, transaction revenue, which makes up the majority of the revenue, dropped 12% sequentially to $289 million.

Market Cap and BTC Price Decline

Coinbase stated that the overall crypto market cap declined 9% quarter-on-quarter (Q/Q) to $1.1 trillion when comparing the end of Q3 to the end of Q2. Additionally, the average crypto market cap declined 3% over the same time frame. The price of BTC, which accounts for roughly half of the crypto market cap, declined 12% during this period.

Steady Subscription and Services Revenue

While transaction revenue declined, Coinbase's subscription and services revenue remained relatively steady at $334 million, compared to $335 million in the previous quarter. The stablecoin revenue, driven by higher interest rates, increased by 14% to $172 million. However, blockchain rewards revenue fell by 15% and interest income dropped by 21%. Coinbase also disclosed a 4% sequential decrease in operating expenses, which amounted to $754 million.

Positive Outlook for the Fourth Quarter

Coinbase projected that it generated approximately $105 million in transaction revenue in October for the fourth quarter. The company expects subscription and services revenue to remain relatively flat sequentially. Furthermore, Coinbase anticipates lower expenses due to reduced stock-based compensation. The company's shares have experienced a positive trend, with an increase of over 10% in the past five days and more than 13% in the last month.

Focus on Product Development and International Expansion

Despite the uncertain market conditions, Coinbase emphasized its focus on product development and international expansion. The company also highlighted its progress in bringing regulated crypto derivatives to market in the United States and overseas. Additionally, Coinbase continues to advocate for clear legislation in the United States and is engaged in a court battle with the U.S. Securities and Exchange Commission (SEC), with oral arguments scheduled for January 2024.

Global Crypto Regulations

Coinbase noted that 83% of G20 nations have implemented crypto regulations, highlighting the need for clear legislation in the United States. The company sees this as an area where the U.S. is lagging behind and continues to advocate for regulatory clarity.

Share your thoughts and opinions about Coinbase's shareholder letter in the comments section below.

Frequently Asked Questions

What are the benefits of having a gold IRA?

You can save money on retirement by putting your money into an Individual Retirement Account. It's not subject to tax until you withdraw it. You have total control over how much each year you take out. And there are many different types of IRAs. Some are better suited to college savings. Some are for investors who seek higher returns. Roth IRAs are a way for individuals to make contributions after the age of 59 1/2, and then pay taxes on any earnings upon retirement. But once they start withdrawing funds, those earnings aren't taxed again. This account may be worth considering if you are looking to retire earlier.

Because you can invest money in many asset classes, a gold IRA works similarly to other IRAs. Unlike a regular IRA where you pay taxes on gains, a gold IRA doesn't require you to worry about taxation while you wait to get them. People who prefer to save their money and invest it instead of spending it are well-suited for gold IRAs.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. This means that you don't need to worry about making monthly deposits. You could also set up direct debits to never miss a payment.

Finally, gold is one of the safest investment choices available today. Because it's not tied to any particular country, its value tends to remain steady. Even in times of economic turmoil, gold prices tend not to fluctuate. It is therefore a great choice for protecting your savings against inflation.

How do I Withdraw from an IRA with Precious Metals?

First, determine if you would like to withdraw money directly from an IRA. Then make sure you have enough cash to cover any fees or penalties that may come with withdrawing funds from your retirement plan.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. This option is also available if you are willing to pay taxes on the amount you withdraw.

Next, you'll need to figure out how much money you will take out of your IRA. This calculation depends on several factors, including the age when you withdraw the money, how long you've owned the account, and whether you intend to continue contributing to your retirement plan.

Once you have determined the percentage of your total savings that you would like to convert to cash, you can then decide which type of IRA to use. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

Finally, you'll need to open a brokerage account once these calculations are completed. To encourage customers to open accounts, brokers often offer signup bonuses and promotions. To avoid unnecessary fees, however, try opening an account using a debit card rather than a credit card.

When you do finally decide to withdraw from your precious metallic IRA, you will need a safe space where you can safely store your coins. Some storage facilities can accept bullion bar, while others require you buy individual coins. You'll have to weigh the pros of each option before you make a decision.

Bullion bars are easier to store than individual coins. However, each coin will need to be counted individually. However, you can easily track the value of individual coins by storing them in separate containers.

Some people prefer to keep coins safe in a vault. Others prefer to store their coins in a vault. Whatever method you choose to store your bullion, you should ensure it is safe and secure so you can enjoy its many benefits for many years.

What amount should I invest in my Roth IRA?

Roth IRAs allow you to deposit your money tax-free. The account cannot be withdrawn from until you are 59 1/2. If you decide to withdraw some of your contributions, you will need to follow certain rules. First, your principal (the original deposit amount) cannot be touched. This means that no matter how much you contribute, you can never take out more than what was initially contributed to this account. If you decide to withdraw more money than what you contributed initially, you will need to pay taxes.

You cannot withhold your earnings from income taxes. You will pay income taxes when you withdraw your earnings. For example, let's say that you contribute $5,000 to your Roth IRA every year. Let's also assume that you make $10,000 per year from your Roth IRA contributions. This would mean that you would have to pay $3,500 in federal income tax. You would have $6,500 less. The amount you can withdraw is limited to the original contribution.

If you took $4,000 from your earnings, you would still owe taxes for the $1,500 remaining. On top of that, you'd lose half of the earnings you had taken out because they would be taxed again at 50% (half of 40%). Even though you had $7,000 in your Roth IRA account, you only received $4,000.

Two types of Roth IRAs are available: Roth and traditional. Traditional IRAs allow pre-tax contributions to be deducted from your taxable tax income. Your traditional IRA can be used to withdraw your balance and interest when you are retired. You have the option to withdraw any amount from a traditional IRA.

Roth IRAs don't allow you deduct contributions. You can withdraw your entire contribution, plus accrued interests, after you retire. There is no minimum withdrawal requirement, unlike traditional IRAs. You don't need to wait until your 70 1/2 year old age before you can withdraw your contribution.

Is physical gold allowed in an IRA.

Not just paper money or coins, gold is money. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Gold is a part of a diversified portfolio that investors can use to protect their wealth from financial uncertainty.

Many Americans are now more inclined to invest in precious metals like gold and silver than stocks or bonds. It's not guaranteed that you'll make any money investing gold, but there are several reasons it might be worthwhile to add gold to retirement funds.

One reason is that gold historically performs better than other assets during financial panics. The S&P 500 declined 21 percent during the same period. Gold prices increased nearly 100 per cent between August 2011 – early 2013. Gold was one asset that outperformed stocks in turbulent market conditions.

The best thing about gold investing is the fact that there's virtually no counterparty risk. Even if your stock portfolio is down, your shares are still yours. But if you own gold, its value will increase even if the company you invested in defaults on its debt.

Gold provides liquidity. You can sell your gold at any time without worrying about finding a buyer, which is a major advantage over other investments. Because gold is so liquid compared to other investments, buying it in small amounts makes sense. This allows you to profit from short-term fluctuations on the gold market.

How does a gold IRA account work?

The Gold Ira Accounts are tax-free investment options for those who want to make investments in precious metals.

You can purchase physical bullion gold coins at any point in time. To invest in gold, you don't need to wait for retirement.

An IRA allows you to keep your gold forever. When you die, your gold assets won't be subjected to taxes.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

First, an individual retirement account will be set up to allow you to open a golden IRA. After you do this, you will be granted an IRA custodian. This company acts as a middleman between you and the IRS.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reports.

Once your gold IRA is established, you can purchase gold bullion coins. The minimum deposit required for gold bullion coins purchase is $1,000 You'll get a higher rate of interest if you deposit more.

You will pay taxes when you withdraw your gold from your IRA. You will be liable for income taxes and penalties if you take the entire amount.

A small percentage may mean that you don't have to pay taxes. There are exceptions. There are some exceptions. For instance, if you take out 30% or more from your total IRA assets, federal income taxes will apply plus a 20 percent penalty.

You shouldn't take out more then 50% of your total IRA assets annually. Otherwise, you'll face steep financial consequences.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads, Example, and Risk Metrics

finance.yahoo.com

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Lawful – WSJ

irs.gov

How To

The History of Gold as an Asset

From the very beginning of time, gold was a currency. It was accepted worldwide and became popular due to its durability, purity, divisibility, uniformity, scarcity, and beauty. Aside from its inherent value, it could be traded internationally. There were different measures and weights for gold, as there was no standard to measure it. For example in England, a pound sterling equals 24 carats. In France, a livre tournois equals 25. Carats of golden. Germany had one mark which equals 28. Carats.

In the 1860s, the United States began issuing American coins made up of 90% copper, 10% zinc, and 0.942 fine gold. This led to a decline in demand for foreign currencies, which caused their price to increase. The price of gold dropped because the United States began to mint large quantities of gold coins. They needed to pay off debt because they had too much money coming into circulation. To do so, they decided to sell some of the excess gold back to Europe.

Because most European countries did not trust the U.S. dollar, they started accepting gold as payment. Many European countries started to accept paper money as a substitute for gold after World War I. The price of gold rose significantly over the years. Today, although the price fluctuates, gold remains one of the safest investments you can make.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Coinbase Exceeds Expectations with Strong Q3 Performance

Sourced From: news.bitcoin.com/coinbase-turns-the-tide-q3-earnings-show-net-profit-amid-crypto-market-slump/

Published Date: Fri, 03 Nov 2023 15:30:54 +0000