Introduction

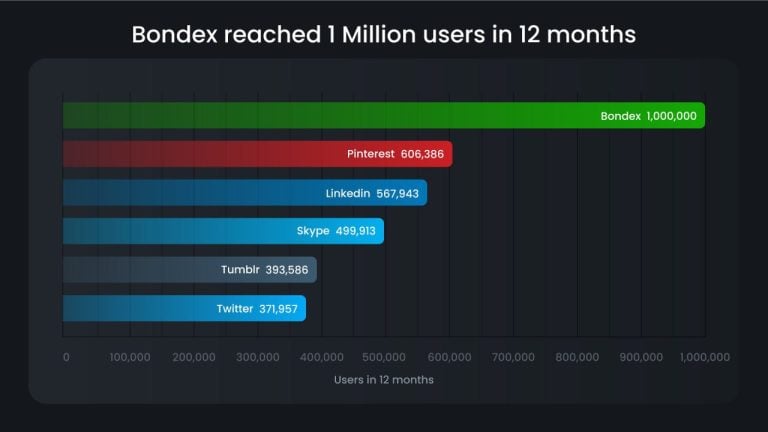

Bondex, a groundbreaking decentralized professional talent network, is proud to announce the launch of its innovative Job Portal, marking a paradigm shift in the recruitment landscape. In collaboration with industry giants such as Coinlist and Chainlink, Bondex aims to become the leading talent platform in Web 3.

Democratizing the Hiring Process

Bondex introduces an innovative referral reward system that democratizes the hiring process. This system creates a symbiotic ecosystem where talent, employers, and recruiters come together for mutual benefit and potential financial gains. It offers users a new means of gaining passive income. The ongoing campaign with Coinlist for the next three months provides users with the potential to boost their airdrop eligibility, giving them the opportunity to receive more financial rewards.

The Bondex Platform

The Bondex platform and app, available on Google Play and the App Store, have garnered over three million downloads, with four million registered users and a thriving monthly active user base of one million. As a gamified decentralized token-based professional talent network, Bondex incentivizes user participation for career advancement, talent referrals, networking, and skill development. The platform shares the resulting economic value with its participants, creating a decentralized professional network where user participation is determined by reputation.

Redefining Recruitment with Bondex's Job Portal

Bondex's Job Portal redefines traditional recruitment through an open referral rewards system. This system provides users with incentives to become recruiters by leveraging their professional networks. Users can profit from hiring companies' bounties by utilizing the combined reach of their networks. This crowdsourced approach guarantees the best possible matches between employers and candidates, setting Bondex apart from outdated Web 2 leaders.

About Bondex

Bondex is a decentralized professional talent network and job portal that empowers users to become recruiters. It connects talent with employers through a unique referral rewards system. With over three million downloads and four million registered users, Bondex disrupts traditional recruitment models and fosters a symbiotic ecosystem for mutual benefit.

Media Inquiries

For media inquiries, please contact:

Dina Mattar, CEO of DVerse

dina@dverse.xyz

Frequently Asked Questions

How much of your portfolio should you hold in precious metals

To answer this question we need to first define precious metals. Precious elements are those elements which have a high price relative to other commodities. This makes them highly valuable for both investment and trading. Today, gold is the most commonly traded precious metal.

However, many other types of precious metals exist, including silver and platinum. While gold's price fluctuates during economic turmoil, it tends to remain relatively stable. It is also not affected by inflation and depression.

As a general rule, the prices for all precious metals tend to increase with the overall market. However, they may not always move in synchrony with each other. If the economy is struggling, the gold price tends to rise, while the prices for other precious metals tends to fall. This is because investors expect lower interest rates, making bonds less attractive investments.

When the economy is healthy, however, the opposite effect occurs. Investors are more inclined to invest in safe assets, such as Treasury Bonds, and they will not demand precious metals. These precious metals are rare and become more costly.

Diversifying across precious metals is a great way to maximize your investment returns. Additionally, since the prices of precious metals tend to rise and fall together, it's best to invest in several different types of precious metals rather than just focusing on one type.

How to open a Precious Metal IRA

First, you must decide if your Individual Retirement Account (IRA) is what you want. Open the account by filling out Form 8606. Next, fill out Form 5204. This will determine the type of IRA that you are eligible for. You must complete this form within 60 days of opening your account. Once you have completed this form, it is possible to begin investing. You can also contribute directly to your paycheck via payroll deduction.

To get a Roth IRA, complete Form 8903. Otherwise, it will be the same process as an ordinary IRA.

To qualify for a precious-metals IRA, you'll need to meet some requirements. The IRS requires that you are at least 18 years old and have earned an income. For any tax year, your earnings must not exceed $110,000 ($220,000 for married filing jointly). Contributions must be made regularly. These rules are applicable whether you contribute through your employer or directly from the paychecks.

You can use a precious-metals IRA to purchase gold, silver and palladium. But, you'll only be able to purchase physical bullion. This means you won’t be able to trade stocks and bonds.

You can also use your precious metals IRA to invest directly in companies that deal in precious metals. This option can be provided by some IRA companies.

There are two major drawbacks to investing via an IRA in precious metals. First, they don't have the same liquidity as stocks or bonds. It is therefore harder to sell them when required. Second, they are not able to generate dividends as stocks and bonds. You'll lose your money over time, rather than making it.

Can I buy gold with my self-directed IRA?

However, gold can only be purchased with your self-directed IRA. To do so, you must first open a brokerage account at TD Ameritrade. You can also transfer funds from an existing retirement fund.

The IRS allows individuals contributing up to $5.500 each ($6,500 if married, filing jointly) into a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contracts can be described as financial instruments that are determined by the gold price. These contracts allow you to speculate on future gold prices without actually owning it. But physical bullion refers to real gold and silver bars you can carry in your hand.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- How do you keep your IRA Gold at Home? It's Not Exactly Legal – WSJ

irs.gov

bbb.org

cftc.gov

How To

Guidelines for Gold Roth IRA

Start saving as soon as possible to save for your retirement. You should start as soon as you are eligible (usually at age 50) and continue saving throughout your career. It is important to invest enough money each and every year to ensure you get adequate growth.

Also, you want to take advantage tax-free options such as a traditional 401k, SEP IRA or SIMPLE IRA. These savings vehicles enable you to make contributions while not paying any taxes on the earnings, until they are withdrawn. These savings vehicles are great for those who don't have access or can't get employer matching funds.

It is important to save consistently over time. You will lose any potential tax advantages if you don't contribute enough.

—————————————————————————————————————————————————————————————-

By: Media

Title: Bondex: Revolutionizing the Recruitment Landscape for User Benefits

Sourced From: news.bitcoin.com/bondex-changing-the-recruitment-landscape-for-users-benefits/

Published Date: Wed, 29 Nov 2023 17:49:44 +0000