A Surge in Bitcoin Ownership Among Americans

Unchained, a leading Bitcoin financial services provider, has recently released a new report that highlights a significant increase in bitcoin ownership among Americans. According to the findings, one in four Americans, as well as 55% of surveyed investors aged between 18 and 78 with at least one investment account, now own bitcoin.

Consideration to Increase Bitcoin Holdings

The study, which surveyed 402 US investors, also revealed that 95% of current bitcoin owners are considering increasing their holdings in 2024. Interestingly, almost half of non-bitcoin owners expressed a strong inclination towards purchasing bitcoin within the next year.

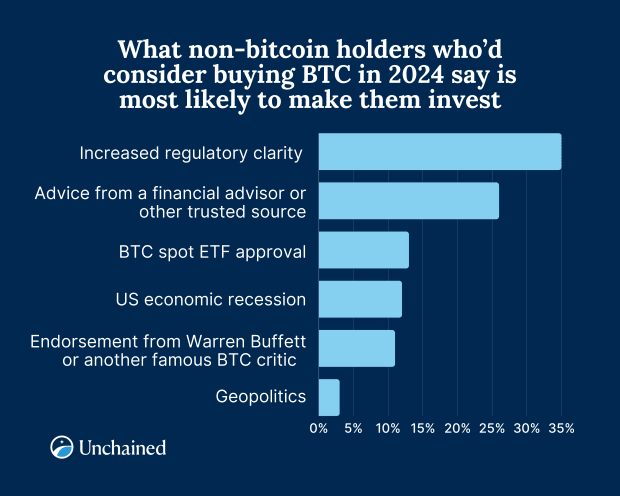

Key Drivers for BTC Purchases in 2024

The potential drivers that are influencing the interest in bitcoin purchases in 2024 include increased regulatory clarity around digital assets. About 42% of current bitcoin owners and 35% of non-owners highlighted this factor. Additionally, the potential approval of a bitcoin spot Exchange-Traded Fund (ETF) by the Securities and Exchange Commission (SEC) and the anticipation of a US economic recession were also identified as influential elements.

Optimistic Outlook for Bitcoin

Despite the decline in BTC's price by over 50% from its peak, 79% of investors believe that bitcoin will surpass its all-time high of $69,000. Furthermore, more than half of the surveyed investors (55%) predict a new all-time high for bitcoin in 2024, with a third of them believing that bitcoin will outperform cash, gold, and the S&P 500.

Rise in Bitcoin Allocation Within Retirement Portfolios

Unchained's survey also indicates a significant rise in bitcoin allocation within retirement portfolios. Nearly half of current bitcoin owners already have BTC in their retirement accounts, and an additional 35% are considering adding it in 2024. Among non-bitcoin owners who are open to investing in the asset, 23% expressed interest in including bitcoin in their retirement accounts.

Unchained's Commitment to Serve Investors

Joe Kelly, co-founder and CEO of Unchained, stated, "At Unchained, we are witnessing an increase in bitcoin newcomers who now recognize the longevity of this asset. As reflected in the survey results and the activities of our clients, US investors are eager to gain or expand their bitcoin exposure, especially through tax-advantaged vehicles like Unchained's bitcoin IRA. As more investors look to open or grow their bitcoin positions, Unchained is dedicated to serving them through collaborative custody, the Unchained IRA, our trading desk, or our inheritance solutions."

Valuable Insights for the US Investor Population

With an estimated 158 million Americans owning investment accounts, Unchained's survey provides valuable insights. The survey represents the US investor population with a 5% margin of error at a 95% confidence level. The survey was conducted digitally from October 26 to 28, 2023, during a period when the price of bitcoin ranged from $33,610 to $34,977. The findings offer a compelling outlook on bitcoin sentiment and expectations for 2024.

Frequently Asked Questions

Can the government take your gold

The government cannot take your gold because you own it. You worked hard to earn it. It belongs exclusively to you. But, this rule is not universal. Your gold could be taken away if your crime was fraud against federal government. You can also lose precious metals if you owe taxes. However, even though your taxes have not been paid, you can still keep your precious metals, even though they are considered the property of United States Government.

What is the best way to hold physical gold?

Not only is gold paper currency, but it's also money. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Today, investors invest in gold as part a diversified portfolio. This is because gold tends do better in financial turmoil.

Many Americans now invest in precious metals. It is possible to make money by investing in gold. However, it doesn't guarantee that you'll make a lot of money.

Gold has historically performed better during financial panics than other assets. Between August 2011 and early 2013 gold prices soared nearly 100 percent, while the S&P 500 plunged 21 percent. During turbulent market conditions gold was one of few assets that outperformed stock prices.

One of the best things about investing in gold is its virtually zero counterparty risk. Your shares will still be yours even if your stock portfolio drops. You can still own your gold even if the company where you invested fails to pay its debt.

Finally, gold is liquid. This means that you can sell gold anytime, regardless of whether or not another buyer is available. It makes sense to buy small quantities of gold, as it is more liquid than other investments. This allows for you to benefit from the short-term fluctuations of the gold market.

How much should precious metals be included in your portfolio?

First, let's define precious metals to answer the question. Precious elements are those elements which have a high price relative to other commodities. This makes them highly valuable for both investment and trading. The most traded precious metal is gold.

There are many other precious metals, such as silver and platinum. The price for gold is subject to fluctuations, but stays relatively stable in times of economic turmoil. It also remains relatively unaffected by inflation and deflation.

The general trend is for precious metals to increase in price with the overall market. However, they may not always move in synchrony with each other. When the economy is in trouble, for example, gold prices tend to rise while other precious metals fall. This is because investors expect lower rates of interest, which makes bonds less attractive investments.

The opposite effect happens when the economy is strong. Investors are more inclined to invest in safe assets, such as Treasury Bonds, and they will not demand precious metals. These precious metals are rare and become more costly.

Therefore, to maximize profits from investing in precious metals, you must diversify across multiple precious metals. Additionally, since the prices of precious metals tend to rise and fall together, it's best to invest in several different types of precious metals rather than just focusing on one type.

Should You Buy or Sell Gold?

In times past, gold was considered a safe haven for investors in times of economic trouble. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

Experts believe this could change soon. They believe gold prices could increase dramatically if there is another global financial crises.

They also point out that gold is becoming popular because of its perceived value and potential return.

These are some important things to remember if your goal is to invest in gold.

- Consider first whether you will need the money to save for retirement. It is possible to save enough money to retire without investing in gold. Gold does offer an extra layer of protection for those who reach retirement age.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each account offers different levels of security and flexibility.

- Remember that gold is not as safe as a bank account. If you lose your gold coins, you may never recover them.

You should do your research before buying gold. And if you already own gold, ensure you're doing everything possible to protect it.

What are the benefits of having a gold IRA?

It is best to put your retirement money in an Individual Retirement Account (IRA). You can withdraw it at any time, but it is tax-deferred. You are in complete control of how much you take out each fiscal year. There are many types of IRAs. Some are better for those who want to save money for college. Some are better suited for investors who want higher returns. Roth IRAs, for example, allow people to contribute after they turn 59 1/2. They also pay taxes on any earnings when they retire. These earnings don't get taxed if they withdraw funds. This account may be worth considering if you are looking to retire earlier.

Because you can invest money in many asset classes, a gold IRA works similarly to other IRAs. Unlike a regular IRA that requires you to pay taxes on the gains you make while you wait to access them, a gold IRA does not have to do this. This makes gold IRA accounts excellent options for people who prefer to keep their money invested instead of spending it.

Another benefit to owning IRA gold is the ability to withdraw automatically. This eliminates the need to constantly make deposits. Direct debits could be set up to ensure you don't miss a single payment.

Gold is one of today's most safest investments. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even during economic turmoil the gold price tends to remain fairly stable. It is therefore a great choice for protecting your savings against inflation.

Should You Invest Gold in Retirement?

How much money you have saved, and whether or not gold was an option when you first started saving will determine the answer. If you're unsure about which option to choose then consider investing in both.

Gold is a safe investment and can also offer potential returns. Retirement investors will find gold a worthy investment.

Although most investments promise a fixed rate of return, gold is more volatile than others. Because of this, gold's value can fluctuate over time.

This does not mean you shouldn’t invest in gold. It is important to consider the fluctuations when planning your portfolio.

Another benefit of gold is that it's a tangible asset. Gold is more convenient than bonds or stocks because it can be stored easily. It's also portable.

As long as you keep your gold in a secure location, you can always access it. You don't have to pay storage fees for physical gold.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

Additionally, it will be a benefit to have some of your savings invested into something that won't lose value. Gold rises in the face of a falling stock market.

You can also sell gold anytime you like by investing in it. You can also liquidate your gold position at any time you need cash, just like stocks. You don't even have to wait until you retire.

If you do decide to invest in gold, make sure to diversify your holdings. Do not put all your eggs in one basket.

You shouldn't buy too little at once. Start with just a few drops. Add more as you're able.

It's not about getting rich fast. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

Gold may not be the most attractive investment, but it could be a great complement to any retirement strategy.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

finance.yahoo.com

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options Types, Spreads and Example. Risk Metrics

bbb.org

How To

How to Keep Physical Gold in an IRA

The best way to invest in Gold is by purchasing shares of companies that produce it. This method is not without risks. There's no guarantee these companies will survive. Even if the company survives, they still face the risk of losing their investment due to fluctuations in gold's price.

Alternative options include buying physical gold. You will need to either open an online or bank account or simply buy gold from a reliable seller. The advantages of this option include the ease of access (you don't need to deal with stock exchanges) and the ability to make purchases when prices are low. It is also easier to check how much gold you have stored. You'll get a receipt showing exactly what you paid, so you'll know if any taxes were missed. You are also less likely to be robbed than investing in stocks.

There are also some drawbacks. For example, you won't benefit from banks' interest rates or investment funds. Additionally, you won’t be able diversify your holdings. You will remain with the same items you bought. Finally, the taxman might want to know where your gold has been placed!

BullionVault.com has more information about how to buy gold in an IRA.

—————————————————————————————————————————————————————————————-

By: Nik Hoffman

Title: One in Four Americans Own Bitcoin: Unchained Study

Sourced From: bitcoinmagazine.com/markets/one-in-four-americans-own-bitcoin-unchained-study

Published Date: Wed, 29 Nov 2023 20:00:00 GMT