Over the course of the last two years, the Lightning Network, a distinctive node-based payment protocol engineered to address the scalability issue of Bitcoin, has vastly surpassed all predictions of success, experiencing an extraordinary growth of over 1200%.

The Underlying Concept of the Lightning Network

The Lightning Network, significantly known as a 'layer 2' decentralized network, is built upon the foundation of Bitcoin’s blockchain. It is primarily constructed to resolve the scalability issue prevalent in bitcoin transactions. Bitcoin, with its proof-of-work system, can ensure a trustless and decentralized global currency, validating all operations on the blockchain, one block at a time. However, with Bitcoin's skyrocketing popularity and value, the requirement for verification of transactions has exponentially increased, reaching tens of millions per month. Each of these transactions necessitates computational power for validation.

The Dire Need for the Lightning Network

With the exponential growth of Bitcoin usage and acceptance, the transaction fees required to authenticate these micro-purchases have also magnified, to an extent that the cost of spending the money surpasses the actual expenditure multiple times. This issue was anticipated since the inception of Bitcoin, and consequently, the innovative Lightning Network was brought to life around 2015-2016.

Functionality and Efficiency of the Lightning Network

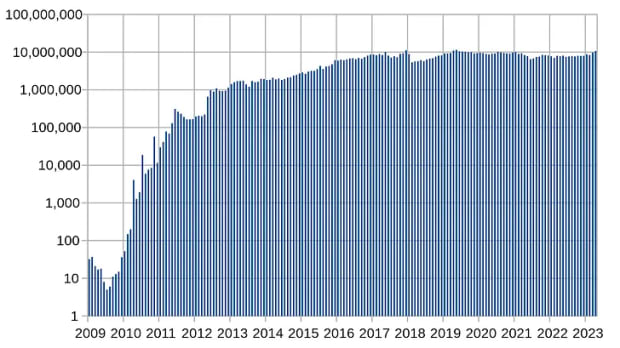

A network of Lightning nodes operating on top of Bitcoin can process a colossal number of microtransactions in a decentralized manner without directly updating the blockchain. These trades are settled collectively in a minimal number of on-chain transactions. The usage is almost instantaneous, and the improvement in efficiency is a game-changer. The Lightning Network has seen an enormous growth in popularity since its public introduction in 2019. This protocol has shown exceptional potential for growth, which was unexpected years after its launch.

Unprecedented Growth of the Lightning Network

Recent data from River, a company specializing in financial services and Bitcoin technology, depict a staggering 1,200% rise in Lightning Network transactions over the last two years. The report published by River on October 12 aimed to dispel misconceptions about the Lightning Network. Despite the data suggesting a plateau in the number of active nodes since mid-2022, the Network’s actual capacity to process bitcoins has consistently been on the rise. The study highlighted the fact that Bitcoin’s highest prices ever occurred in 2021, and yet the Lightning Network has grown exponentially during the same period, indicating that more seasoned users have been instrumental in adopting this protocol.

The Lightning Network: A Multifaceted Platform

In addition to this, the study analyzed the types of transactions taking place on the Lightning Network. A significant portion of these transactions were conducted in unexpected "growth areas", such as tipping on social media, streamers, and the gaming industry. Gaming firm THNDR has begun a limited rollout of its new API, Clinch, which uses the Lightning Network to offer gamers worldwide a unique access to the gambling industry. This could potentially break into a multibillion-dollar industry given the increase in numbers of Lightning users participating in such games in recent years.

New Applications of the Lightning Network

Mid-October 2023 saw the launch of several new applications for the Lightning Network. Bitcoin infrastructure company, Blockstream, announced Greenlight, a solution providing secure self-custody options for Lightning transactions. Blockstream is aiming to attract both private and institutional customers with this "Lightning-as-a-Service" model, offering developers free access to on-demand nodes to develop applications on the protocol.

Conclusion: The Future of the Lightning Network

The growth of the Lightning Network across nearly all metrics is undeniable. Despite a bear market for Bitcoin and a plateau in new Lightning Network nodes, this ground-breaking protocol has flourished immensely. The Lightning Network and its community are advancing rapidly, releasing new applications at a constant rate and fostering an active and dynamic ecosystem of new developers. Bitcoin has earned its reputation and resilience, the ability to recover from market downturns and government crackdowns, through the innovation of its global community. The numbers clearly indicate that this community greatly values the Lightning Network, making it a promising catalyst for future success.

Frequently Asked Questions

Can I buy gold with my self-directed IRA?

Your self-directed IRA can be used to purchase gold, but first you need to open an account with a brokerage firm such as TD Ameritrade. Transfer funds from an existing retirement account are also possible.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals may contribute up to $1,000 ($2,000 if married, filing jointly) directly into a Roth IRA.

You should consider buying physical gold bullion if you decide to invest in it. Futures contracts can be described as financial instruments that are determined by the gold price. These financial instruments allow you to speculate about future prices without actually owning the metal. Physical bullion, however, is real gold and silver bars that you can hold in your hand.

How much of your portfolio should you hold in precious metals

Before we can answer this question, it is important to understand what precious metals actually are. Precious metals refer to elements with a very high value relative other commodities. They are therefore very attractive for investment and trading. Gold is today the most popular precious metal.

There are also many other precious metals such as platinum and silver. While gold's price fluctuates during economic turmoil, it tends to remain relatively stable. It is also unaffected significantly by inflation and Deflation.

The general trend is for precious metals to increase in price with the overall market. However, they may not always move in synchrony with each other. For example, when the economy is doing poorly, the price of gold typically rises while the prices of other precious metals tend to fall. Investors are more likely to expect lower interest rates making bonds less attractive investments.

Contrary to this, when the economy performs well, the opposite happens. Investors favor safe assets like Treasury Bonds, and less precious metals. They become less expensive and have a lower value because they are limited.

Therefore, to maximize profits from investing in precious metals, you must diversify across multiple precious metals. Furthermore, because the price of precious Metals fluctuates, it is best not to focus on just one type of precious Metals.

How much tax is gold subject to in an IRA

The tax on the sale of gold is based on its fair market value when sold. If you buy gold, there are no taxes. It isn't considered income. If you decide to make a sale of it, you'll be entitled to a taxable loss if the value goes up.

Gold can be used as collateral for loans. Lenders seek to get the best return when you borrow against your assets. This often means selling gold. It's not guaranteed that the lender will do it. They may hold on to it. Or, they may decide to resell the item themselves. You lose potential profits in either case.

If you plan on using your gold as collateral, then you shouldn't lend against it. You should leave it alone if you don't intend to lend against it.

Who is the owner of the gold in a gold IRA

The IRS considers any individual who holds gold “a form of income” that is subject to taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

To find out what options you have, consult an accountant or financial planner.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

cftc.gov

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

irs.gov

How To

The best place to buy silver or gold online

You must first understand the workings of gold before you can purchase it. The precious metal gold is similar to platinum. It's very rare, and it is often used as money for its durability and resistance. It's hard to use, so most people prefer buying jewelry made out of it to actual bars of gold.

There are two types of gold coins available today – one type is legal tender, while the other is called bullion. Legal tender coins are designed for circulation in a country. They often have denominations like $1 or $5 or $10.

Bullion coin are not intended for investment. However, their value will increase with inflation.

They cannot be used in currency exchanges. A person can buy 100 grams of gold for $100. Every dollar spent on gold purchases, the buyer receives one gram of gold.

Next, you need to find out where to buy gold. You have a few options to choose from if you are looking to buy gold directly through a dealer. First, you can visit your local coin store. You might also consider going through a reputable online seller like eBay. Finally, you can look into purchasing gold through private sellers online.

Individuals selling gold at wholesale prices and retail prices are known as private sellers. Private sellers typically charge 10% to 15% commission on each transaction. Private sellers will typically get you less than a coin shop, eBay or other online retailers. This option can be a good choice for investing in gold because it allows you to control the price.

Another option for buying gold is to invest in physical gold. Although physical gold is easier to store than paper certificates you will still need to ensure it is safe. You need to make sure that your physical gold is safe by storing it in an impenetrable container like a vault or safety depositbox.

If you are looking to purchase gold on your own, you have two options: a bank or an pawnshop. A bank will be able to provide you with a loan for the amount of money you want to invest in gold. Customers can borrow money from pawnshops to purchase items. Banks tend to charge higher interest rates, while pawnshops are typically lower.

You can also ask for help to purchase gold. Selling gold is easy too. You can contact a company like GoldMoney.com to set up an account and receive payments right away.

—————————————————————————————————————————————————————————————-

By: Landon Manning

Title: Unleashing the Power of the Lightning Network: A Revolutionary Breakthrough in Bitcoin Transactions

Sourced From: bitcoinmagazine.com/markets/lightning-network-sees-record-adoption-amidst-new-applications

Published Date: Thu, 19 Oct 2023 16:30:00 GMT