Bitcoin Hits $37K, Ending 18-Month Drought

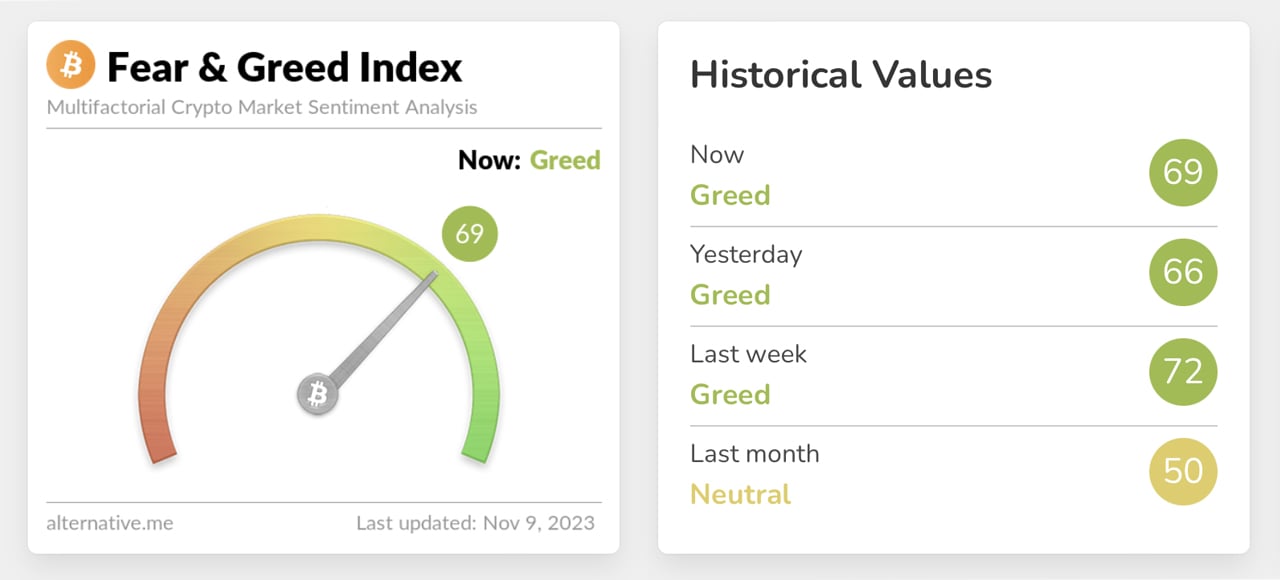

The cryptocurrency market is currently experiencing a mood of "greed" as reflected by the Crypto Fear and Greed Index (CFGI) scoring a 69 out of 100. On November 9, 2023, at 5:20 a.m. Eastern Time, the price of bitcoin reached above $37K, a level not seen since May 2022, marking the end of an 18-month high.

Bitcoin Soars by 4.4% Against the US Dollar

Bitcoin's valuation (BTC) has surged by 4.4% against the US dollar on Thursday, displaying a significant 34% appreciation over the past month. The price of bitcoin is now trading just above the $37K threshold, a level last witnessed on May 6, 2022.

Bitcoin's Prolonged Stay Below $37K

For over a year, bitcoin's price remained below the $37K mark, spanning over 550 days. Additionally, it has been 238 days since bitcoin's value dipped below $25,000 on March 16, 2023, and 299 days since it fell below $20,000 on January 14, 2023.

Bitcoin's Long-Term Price Analysis

Bitcoin has not been priced at $10,000 or lower since July 27, 2020, which adds up to approximately 1,200 days. From 2020 to 2023, bitcoin's price remained below $10,000 for 202 days, below $20,000 for 471 days, and under $25,000 for a total of 637 days.

Positive Signs for Bitcoin's Price Trajectory

This week, bitcoin's price has consistently stayed above $35K, signaling a bullish outlook. Technical indicators such as the 10-day short-term exponential moving average (EMA) and simple moving average (SMA) are displaying bullish signals, indicating a strong price trajectory in recent times.

Greedy Sentiment Persists Despite Positive Indications

Despite the positive signs mentioned above, the Crypto Fear and Greed Index (CFGI) continues to suggest a tilt towards "greed." This sentiment has been consistent over the past week and month, according to alternative.me's reports.

The CFGI serves as a gauge of trader and investor sentiment. Extreme fear may indicate widespread concern and a potential buying opportunity, while extreme greed suggests the possibility of a market correction.

Short Bets Result in Significant Losses

Despite the prevailing greedy sentiment, traders who bet on a crypto downturn through short positions have faced significant losses. In the past day alone, these short bets have resulted in losses amounting to $162 million. Bitcoin's rapid climb to $37K has caused the liquidation of over 59% of these shorts, totaling approximately $96 million.

We would love to hear your thoughts on the Crypto Fear and Greed Index. Share your opinions and insights in the comments section below.

Frequently Asked Questions

How does a gold IRA account work?

The Gold Ira Accounts are tax-free investment options for those who want to make investments in precious metals.

You can purchase gold bullion coins in physical form at any moment. To start investing in gold, it doesn't matter if you are retired.

An IRA allows you to keep your gold forever. Your gold holdings will not be subject to tax when you are gone.

Your heirs inherit your gold without paying capital gains taxes. You don't need to include your gold in your final estate report, as it isn't part of the estate.

You'll first have to set up an individual retirement account (IRA) to open a gold IRA. After you have done this, an IRA custodian will be assigned to you. This company acts as a mediator between you, the IRS.

Your gold IRA custody will take care of the paperwork and send the forms to IRS. This includes filing annual reports.

Once you've set up your gold IRA, it's possible to buy gold bullion. The minimum deposit required to purchase gold bullion coins is $1,000 The minimum deposit is $1,000. However, you will receive a higher percentage of interest if your deposit is greater.

Taxes will be charged on gold you have withdrawn from an IRA. If you're withdrawing the entire balance, you'll owe income taxes plus a 10 percent penalty.

You may not be required to pay taxes if you take out only a small amount. There are exceptions. For example, taking out 30% or more of your total IRA assets, you'll owe federal income taxes plus a 20 percent penalty.

Avoid taking out more that 50% of your total IRA assets each year. You could end up with severe financial consequences.

Can I buy gold using my self-directed IRA

Your self-directed IRA can be used to purchase gold, but first you need to open an account with a brokerage firm such as TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

Individuals can contribute as much as $5,500 per year ($6,500 if married filing jointly) to a traditional IRA. Individuals can contribute up $1,000 per annum ($2,000 if they are married and jointly) directly to a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contracts are financial instruments that are based on gold's price. They allow you to speculate on future prices without owning the metal itself. But physical bullion refers to real gold and silver bars you can carry in your hand.

How much should I contribute to my Roth IRA account?

Roth IRAs are retirement accounts where you deposit your own money tax-free. These accounts cannot be withdrawn until you turn 59 1/2. There are some rules that you need to keep in mind if you want to withdraw funds from these accounts before you reach 59 1/2. First, you cannot touch your principal (the original amount deposited). No matter how much money you contribute, you cannot take out more than was originally deposited to the account. If you wish to withdraw more than you originally contributed, you will have to pay taxes.

The second rule states that income taxes must be paid before you can withdraw earnings. Also, taxes will be due on any earnings you take. Let's assume that you contribute $5,000 each year to your Roth IRA. Let's also say that you earn $10,000 per annum after contributing. On the earnings, you would be responsible for $3,500 federal income taxes. You would have $6,500 less. The amount you can withdraw is limited to the original contribution.

So, if you were to take out $4,000 of your earnings, you'd still owe taxes on the remaining $1,500. In addition, 50% of your earnings will be subject to tax again (half of 40%). Even though you had $7,000 in your Roth IRA account, you only received $4,000.

There are two types of Roth IRAs: Traditional and Roth. A traditional IRA allows you to deduct pre-tax contributions from your taxable income. Your traditional IRA can be used to withdraw your balance and interest when you are retired. You have the option to withdraw any amount from a traditional IRA.

Roth IRAs are not allowed to allow you deductions for contributions. You can withdraw your entire contribution, plus accrued interests, after you retire. There is no minimum withdrawal limit, unlike traditional IRAs. It doesn't matter if you are 70 1/2 or older before you withdraw your contribution.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement account

finance.yahoo.com

cftc.gov

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Guidelines for Gold Roth IRA

Start saving as soon as possible to save for your retirement. As soon as you become eligible, which is usually around age 50, start saving and keep it up throughout your career. It's vital to contribute enough money each year to ensure adequate growth on an ongoing basis.

You may also wish to take advantage of tax-free investments such as a SIMPLE IRA, SEP IRA, and traditional 401(k). These savings vehicles allow you the freedom to contribute without having to pay tax on your earnings until they are withdrawn. This makes them great options for people who don't have access to employer matching funds.

It is important to save consistently over time. If you aren't contributing the maximum amount permitted, you could miss out on tax benefits.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Bitcoin Surges to 18-Month High as Market Sentiment Turns Greedy

Sourced From: news.bitcoin.com/bitcoin-hits-18-month-high-as-market-greed-takes-hold-igniting-short-squeeze-frenzy/

Published Date: Thu, 09 Nov 2023 14:30:33 +0000