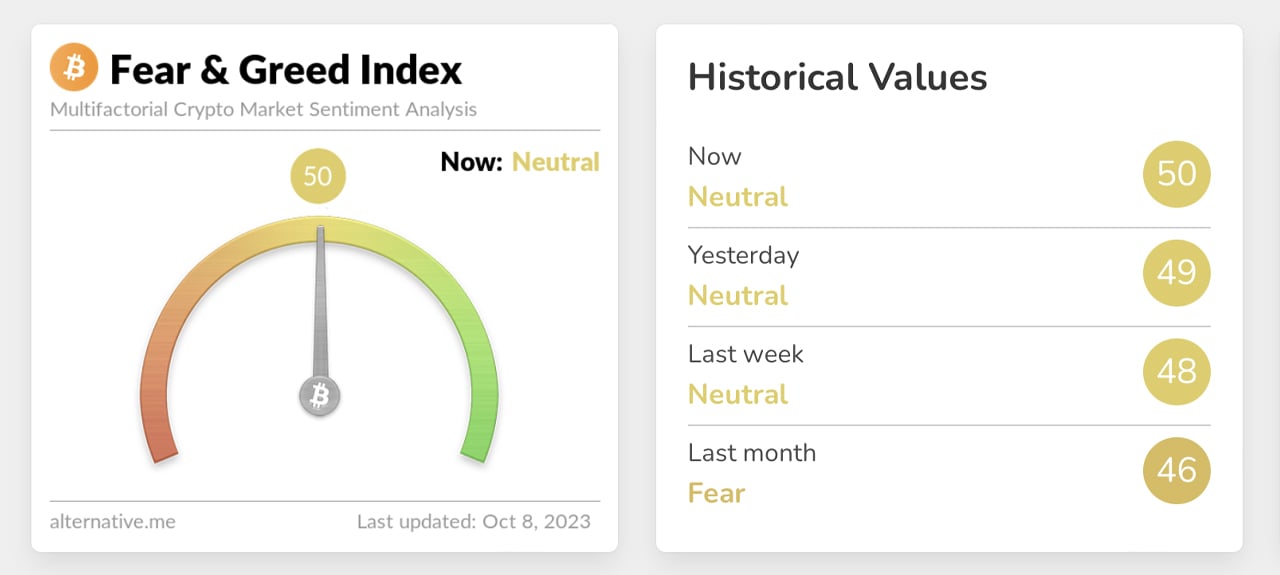

As of October 8, 2023, Bitcoin oscillates just under the mark of $28K, exemplifying a 2.6% upsurge compared to the earlier week. The present fidelity of the Crypto Fear and Greed Index (CFGI) is pinned at an even 50 on a scale of 100, reinforcing the market's stable stance over the preceding week. This equilibrium is further confirmed by relevant technical data, suggesting Bitcoin has entered into a tighter trading range.

Bitcoin's Balancing Act Amid a Market Seemingly in Suspension

The previous week listed Bitcoin (BTC) at a unit price of $27,189. In contrast, the last 24 hours have seen it swinging between $28,103 and $27,770. With a 2.6% rise in Bitcoin's market value within the week, and a 7.9% move upward on a 30-day basis, fluctuations seem to be the name of the game.

As the market rhythm shifts, the Crypto Fear and Greed Index (CFGI) maintains an unwavering neutrality, reflecting not just today’s sentiment but also the dynamics of the entire past week. The CFGI becomes a market pulse detector, identifying the underlying trend from the many market pulsations, offering dealers insights into the collective market psychology.

The CFGI's Role in Navigating Market Sentiment

Market sentiment tends to swing like a pendulum. On one end is the gripping fear that can cause an undue price slump, while on the other, uncontrolled greed that can instigate irrational price inflation. The CFGI monitors these sentiments to help traders identify potential windows to execute their buy or sell strategies. The CFGI interprets emotions, outlining zones of extreme fear, fear, neutrality, greed, and extreme greed.

Strong Currents of Neutrality Fuelling Speculation of an Impending Shift

The narrative on October 8, 2023, paints a picture of market neutrality. Sources like alternative.me and Coinmarketcap.com verify this with their respective 'Fear and Greed' index scores of 50 and 46. As Bitcoin hones into an increasingly narrow band and the market showcases utter indifference, it becomes apparent that a definitive market trend is yet to form.

Neutrality or ambivalence often denotes the lack of a prevailing sentiment – a market stalemate – where neither bearish nor bullish forces reign supreme. Neutrality, however, is far from stagnancy. Prices might ebb and tide, but the index reflects a checkmate, a balance of bullish and bearish currents.

Technical Indicators Echo the Market Sentiment

Technical indicators, including oscillators, namely the relative strength index (RSI) and the stochastic (14,3,3), also encapsulate the current neutrality. Oscillators like the RSI and stochastic indicate whether an asset is overbought or oversold upon demonstrating neutrality. With an RSI score of about 61 and a stochastic reading close to 75, equilibrium seems to exist between buy and sell forces. The congruence between these oscillators and the CFGI suggests the market is in a consolidation phase, a ticking time bomb awaiting a trigger.

What's your take on the evolving Crypto Fear and Greed indications? Is market consolidation imminent? We encourage you to express your thoughts and views on this subject in the comments section below.

Frequently Asked Questions

What proportion of your portfolio should you have in precious metals

Before we can answer this question, it is important to understand what precious metals actually are. Precious metals refer to elements with a very high value relative other commodities. They are therefore very attractive for investment and trading. The most traded precious metal is gold.

There are also many other precious metals such as platinum and silver. The price for gold is subject to fluctuations, but stays relatively stable in times of economic turmoil. It is also relatively unaffected both by inflation and deflation.

As a general rule, the prices for all precious metals tend to increase with the overall market. That said, they do not always move in lockstep with each other. For instance, gold's price will rise when the economy is weak, while precious metals prices will fall. Investors expect lower interest rate, making bonds less appealing investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors favor safe assets like Treasury Bonds, and less precious metals. These precious metals are rare and become more costly.

Therefore, to maximize profits from investing in precious metals, you must diversify across multiple precious metals. You should also diversify because precious metal prices can fluctuate and it is better to invest in multiple types of precious metals than in one.

Should You Buy Gold?

In times past, gold was considered a safe haven for investors in times of economic trouble. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

Some experts think that this could change in the near future. They say that gold prices could rise dramatically with another global financial crisis.

They also mention that gold is becoming more popular due to its perceived worth and potential return.

Consider these things if you are thinking of investing in gold.

- The first thing to do is assess whether you actually need the money you're putting aside for retirement. You can save for retirement and not invest your savings in gold. However, when you retire at age 65, gold can provide additional protection.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each account offers different levels of security and flexibility.

- Keep in mind that gold may not be as secure as a bank deposit. If you lose your gold coins, you may never recover them.

So, if you're thinking about buying gold, make sure you do your research first. You should also ensure that you do everything you can to protect your gold.

Do you need to open a Precious Metal IRA

It is essential to be aware of the fact that precious metals do not have insurance coverage before opening an IRA. If you lose money in your investment, nothing can be done to recover it. This includes all investments that are lost to theft, fire, flood, or other causes.

You can protect yourself against such losses by purchasing physical gold and silver coins. These items are timeless and have a lifetime value. If you were to sell them today, you would likely receive more than what you paid for them when they were first minted.

Choose a reputable company with competitive rates and quality products if you are looking to open an IRA. You should also consider using a third party custodian to protect your assets and give you access at any time.

Do not open an account unless you're ready to retire. Remember the future.

How much tax is gold subject to in an IRA

The fair market price of gold when it is sold determines the tax due on its sale. Gold is not subject to tax when it's purchased. It isn't considered income. If you sell it later you will have a taxable profit if the price goes down.

Gold can be used as collateral for loans. Lenders seek to get the best return when you borrow against your assets. For gold, this means selling it. The lender might not do this. They might just hold onto it. They might decide to sell it. In either case, you risk losing potential profits.

If you plan on using your gold as collateral, then you shouldn't lend against it. If you don't plan to use it as collateral, it is better to let it be.

How is gold taxed within a Roth IRA

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

These accounts are subject to different rules depending on where you live. Maryland requires that you withdraw funds within 60 business days after reaching the age of 59 1/2. Massachusetts allows you up to April 1st. New York is open until 70 1/2. To avoid penalty fees, it is important to plan and take distributions in time to pay all your retirement savings.

How do I open a Precious Metal IRA

First, you must decide if your Individual Retirement Account (IRA) is what you want. Open the account by filling out Form 8606. You will then need to complete Form 5204 in order to determine which type IRA you are eligible. This form should be completed within 60 days after opening the account. Once this is done, you can start investing. You could also opt to make a contribution directly from your paycheck by using payroll deduction.

For a Roth IRA you will need to complete Form 8903. Otherwise, it will be the same process as an ordinary IRA.

You'll need to meet specific requirements to qualify for a precious metals IRA. The IRS says you must be 18 years old and have earned income. You can't earn more than $110,000 per annum ($220,000 in married filing jointly) for any given tax year. You must also contribute regularly. These rules will apply regardless of whether your contributions are made through an employer or directly out of your paychecks.

You can use a precious-metals IRA to purchase gold, silver and palladium. But, you'll only be able to purchase physical bullion. This means you won't be allowed to trade shares of stock or bonds.

You can also use your precious metallics IRA to invest in companies that deal with precious metals. This option is offered by some IRA providers.

There are two major drawbacks to investing via an IRA in precious metals. They aren't as liquid as bonds or stocks. It's also more difficult to sell them when they are needed. Second, they are not able to generate dividends as stocks and bonds. So, you'll lose money over time rather than gain it.

How does a Gold IRA account work?

The Gold Ira Accounts are tax-free investment options for those who want to make investments in precious metals.

You can buy physical gold bullion coins at any time. To invest in gold, you don't need to wait for retirement.

Owning gold as an IRA has the advantage of allowing you to keep it forever. You won't have to pay taxes on your gold investments when you die.

Your heirs will inherit your gold, and not pay capital gains taxes. Because your gold doesn't belong to the estate, it's not necessary to include it on your final estate plan.

To open a IRA for gold, you must first create an individual retirement plan (IRA). Once you've done that, you'll receive an IRA custody. This company acts as a mediator between you, the IRS.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reports.

After you have created your gold IRA, the only thing you need to do is purchase gold bullion. Minimum deposit required is $1,000 A higher interest rate will be offered if you invest more.

You will pay taxes when you withdraw your gold from your IRA. You will be liable for income taxes and penalties if you take the entire amount.

However, if you only take out a small percentage, you may not have to pay taxes. There are exceptions. You'll owe federal income tax and a 20% penalty if you take out more than 30% of your total IRA assets.

It's best not to take out more 50% of your total IRA investments each year. You'll be facing severe financial consequences if you do.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

cftc.gov

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

finance.yahoo.com

How To

Tips for Investing in Gold

Investing in Gold is one of the most popular investment strategies worldwide. Because investing in gold has many benefits. There are many ways to invest gold. Some people prefer to buy gold coins in physical form, while others prefer to invest in gold ETFs.

Before buying any type gold, it is important to think about these things.

- First, make sure you check if your country allows you own gold. If the answer is yes, you can go ahead. If not, you may want to consider purchasing gold from overseas.

- Second, it is important to know which type of gold coin you are looking for. You can choose between yellow gold and white gold as well as rose gold.

- You should also consider the price of gold. Start small and move up. Diversifying your portfolio is a key thing to remember when purchasing gold. Diversifying your portfolio should be a priority, including stocks, bonds and real estate.

- Remember that gold prices are subject to change regularly. Therefore, you have to be aware of current trends.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Bitcoin Balances on the Edge of Change: Is Market Consolidation on the Horizon?

Sourced From: news.bitcoin.com/bitcoin-lingers-in-a-neutral-phase-as-the-fear-and-greed-index-signals-market-consolidation/

Published Date: Sun, 08 Oct 2023 16:30:46 +0000