Bitcoin's upcoming halving event is set to redefine scarcity in the digital realm, surpassing even the coveted status of gold as a store of value. Let's delve into the intricacies of this monumental shift and what it means for the future of digital assets.

The Bitcoin Halving: A Game-Changer for Scarcity

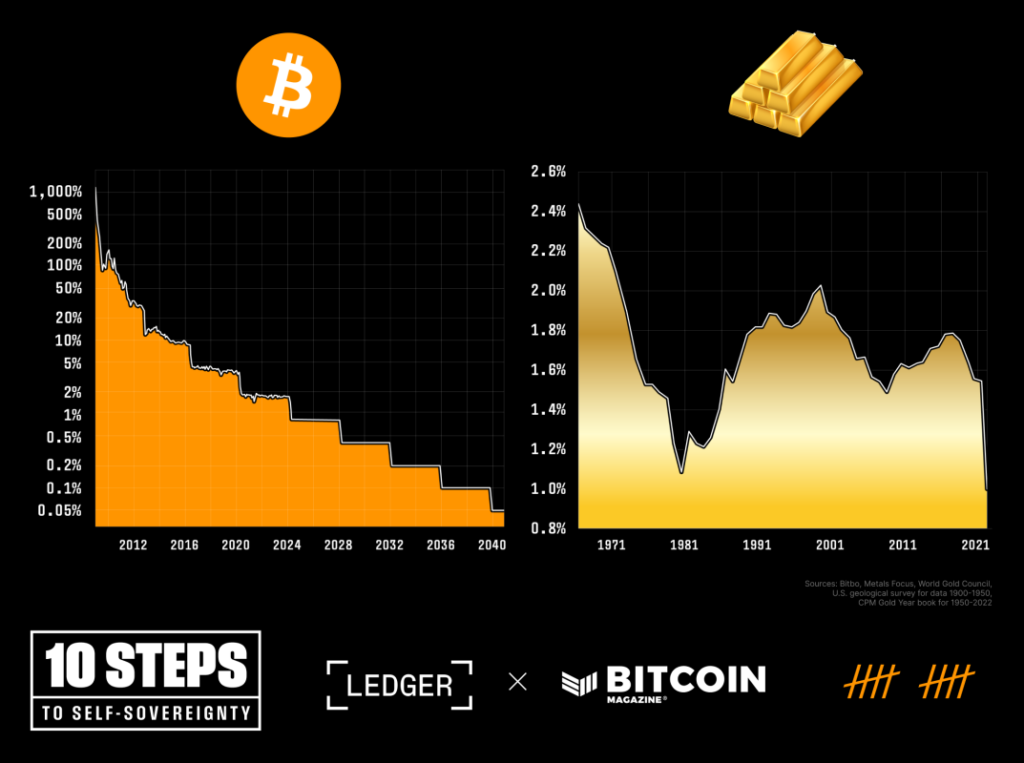

At Bitcoin block height 840,000, the annual inflation rate of Bitcoin will be halved, dropping from 1.7% to 0.85%. This will mark the first time Bitcoin's inflation rate will be lower than that of gold, a traditional symbol of enduring value. In contrast, gold's annual supply is projected to increase by 1-2% annually, influenced by technological advancements and economic factors.

The Evolution of Bitcoin Halving Events

Bitcoin has undergone three halving events in its history:

- November 28, 2012: Block subsidy decreased from 50 BTC to 25 BTC per block.

- July 9, 2016: Second halving reduced block subsidy from 25 BTC to 12.5 BTC per block.

- May 20, 2020: Third halving lowered block subsidy from 12.5 BTC to 6.25 BTC per block.

The upcoming fourth halving, expected on April 20, 2024 EDT, will further decrease the block subsidy to 3.125 BTC per block, solidifying Bitcoin's scarcity. This reduction will bring the total supply closer to the ultimate limit of 21 million bitcoins.

Gold's Timeless Appeal and Limitations

Gold has historically been likened to the price of a fine man's suit over centuries, showcasing its enduring store-of-value function. However, gold's verification process, transportation costs, and storage challenges have posed obstacles to its utility as a medium of exchange. The transition from the gold standard further underscores the limitations of physical gold as a currency.

Bitcoin's Journey to Digital Store of Value

Initially viewed as a speculative asset, Bitcoin has emerged as a reliable store of value due to its digital scarcity and robust monetary properties. With a market cap of $1.4 trillion as of March 13, 2024, Bitcoin has gained widespread acceptance as a digital asset with intrinsic value.

Bitcoin vs. Gold: Monetization in the Digital Era

Bitcoin's unique qualities, including scarcity, durability, and immutability, position it as a digitally perfected form of money. Its decentralized nature and cryptographic security make it an attractive alternative to traditional currencies and precious metals.

Redefining Value in the Digital Landscape

As Bitcoin's scarcity surpasses that of gold post-halving, its role as a store of value is solidified in the digital age. Market participants are increasingly recognizing Bitcoin's resilience to inflation and its potential to preserve wealth over time.

The Future of Digital Assets

With Bitcoin's halving event on the horizon, the spotlight is shifting towards digital scarcity and decentralized monetary systems. While the future of investments remains uncertain, Bitcoin's immutable supply cap and growing adoption signal a transformative shift in the financial landscape.

As gold fades into the background, Bitcoin emerges as the shining star of the digital economy, poised to redefine value and scarcity for generations to come.

Frequently Asked Questions

Do You Need to Open a Precious Metal IRA

Before opening an IRA, it is important to understand that precious metals aren't covered by insurance. There are no ways to recover the money you lost in an investment. This includes any loss of investments from theft, fire, flood or other circumstances.

It is best to invest in physical gold coins and silver coins to avoid this type loss. These items have been around thousands of years and are irreplaceable. You would probably get more if you sold them today than you paid when they were first created.

Choose a reputable company with competitive rates and quality products if you are looking to open an IRA. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

If you decide to open an account, remember that you won't see any returns until after you retire. Do not forget about the future!

Who has the gold in a IRA gold?

The IRS considers gold owned by an individual to be “a type of money” and is subject taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

The purchase of gold can protect you from inflation and price volatility. But it's not smart to hold it if your only intention is to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

It is a good idea to consult an accountant or financial planner to learn more about your options.

Can I keep a Gold ETF in a Roth IRA

Although a 401k plan might not provide this option, you should still consider other options like an Individual Retirement Account (IRA).

A traditional IRA allows for contributions from both employer and employee. Another option is to invest in publicly traded corporations with an Employee Stockownership Plan (ESOP).

An ESOP is a tax-saving tool because employees have a share of company stock as well as the profits that the business generates. The money invested in ESOPs is taxed at a lower rate that if it were owned directly by an employee.

You can also get an Individual Retirement Annuity, or IRA. An IRA allows for you to make regular income payments during your life. Contributions to IRAs will not be taxed

What are the pros and cons of a gold IRA?

The main advantage of an Individual Retirement Account (IRA) over a regular savings account is that you don't have to pay taxes on any interest earned. An IRA is a good choice for those who want a way to save some money but don’t want the tax. However, there are also disadvantages to this type of investment.

For example, if you withdraw too much from your IRA once, you could lose all your accumulated funds. You might also not be able to withdraw from your IRA until the IRS deems you to be 59 1/2. You will likely have to pay a penalty fee if you withdraw funds from an IRA.

Another disadvantage is that you must pay fees to manage your IRA. Many banks charge between 0.5% and 2.0% per year. Other providers charge monthly management charges ranging anywhere from $10 to $50.

Insurance will be required if you would like to keep your cash out of banks. In order to make a claim, most insurers will require that you have a minimum amount in gold. It is possible that you will be required to purchase insurance that covers losses of up to $500,000.

If you choose to go with a gold IRA, you'll need to determine how much gold you want to use. Some providers limit the number of ounces of gold that you can own. Some providers allow you to choose your weight.

You'll also need to decide whether to buy physical gold or futures contracts. Gold futures contracts are more expensive than physical gold. Futures contracts provide flexibility for purchasing gold. They let you set up a contract that has a specific expiration.

Also, you will need to decide on the type of insurance coverage you would like. Standard policies don't cover theft protection, loss due to fire, flood or earthquake. It does provide coverage for damage from natural disasters, however. If you live in a high-risk area, you may want to add additional coverage.

In addition to insurance, you'll need to consider the cost of storing your gold. Storage costs are not covered by insurance. In addition, most banks charge around $25-$40 per month for safekeeping.

A qualified custodian is required to help you open a Gold IRA. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians cannot sell your assets. Instead, they must maintain them for as long a time as you request.

Once you've decided which type of IRA best suits your needs, you'll need to fill out paperwork specifying your goals. Information about your investments such as stocks and bonds, mutual fund, or real property should be included in your plan. You should also specify how much you want to invest each month.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. The company will review your application and send you a confirmation letter.

Consider consulting a financial advisor when opening a golden IRA. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can also help you lower your expenses by finding cheaper alternatives to purchasing insurance.

How is gold taxed in Roth IRA?

Investment accounts are subject to tax based only on their current value and not the amount you originally paid. If you invest $1,000 into a mutual fund, stock, or other investment account, then any gains are subjected tax.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

These rules vary from one state to another. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. Massachusetts allows you to wait until April 1. New York has a maximum age limit of 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

investopedia.com

finance.yahoo.com

forbes.com

bbb.org

How To

3 Ways to Invest Gold for Retirement

It's crucial to understand where gold fits in your retirement strategy. There are several options to invest in precious metals if your employer has a 401k. It is also possible to invest in gold from outside of your work environment. A custodial account can be opened by a brokerage firm like Fidelity Investments if you already have an IRA. If you don't have any precious metals yet, you might want to buy them from a reputable dealer.

These are the rules for gold investing:

- Buy Gold With Your Cash – Do not use credit cards to purchase gold. Instead, cash in your accounts. This will help protect you against inflation and keep your purchasing power high.

- Physical Gold Coins: You should own physical gold coins, not just a certificate. Physical gold coins are easier to sell than certificates. Physical gold coins don't require storage fees.

- Diversify your Portfolio – Don't put all your eggs in one basket. Also, diversify your wealth and invest in different assets. This helps to reduce risk and provides more flexibility when markets are volatile.

—————————————————————————————————————————————————————————————-

By: Bitcoin Magazine

Title: Bitcoin Halving: Redefining Scarcity in the Digital Age

Sourced From: bitcoinmagazine.com/sponsored/quality-money-bitcoin-to-become-scarcer-than-gold-post-halving

Published Date: Thu, 11 Apr 2024 15:55:35 GMT