Proposal to Include Bitcoin ETFs in State Retirement Systems

The Arizona State Senate is currently reviewing a proposal that suggests the Arizona State Retirement System (ASRS) and the Public Safety Personnel Retirement System (PSPRS) should investigate the possibility of incorporating Bitcoin ETFs into their investment portfolios.

Recent Progress in the Senate

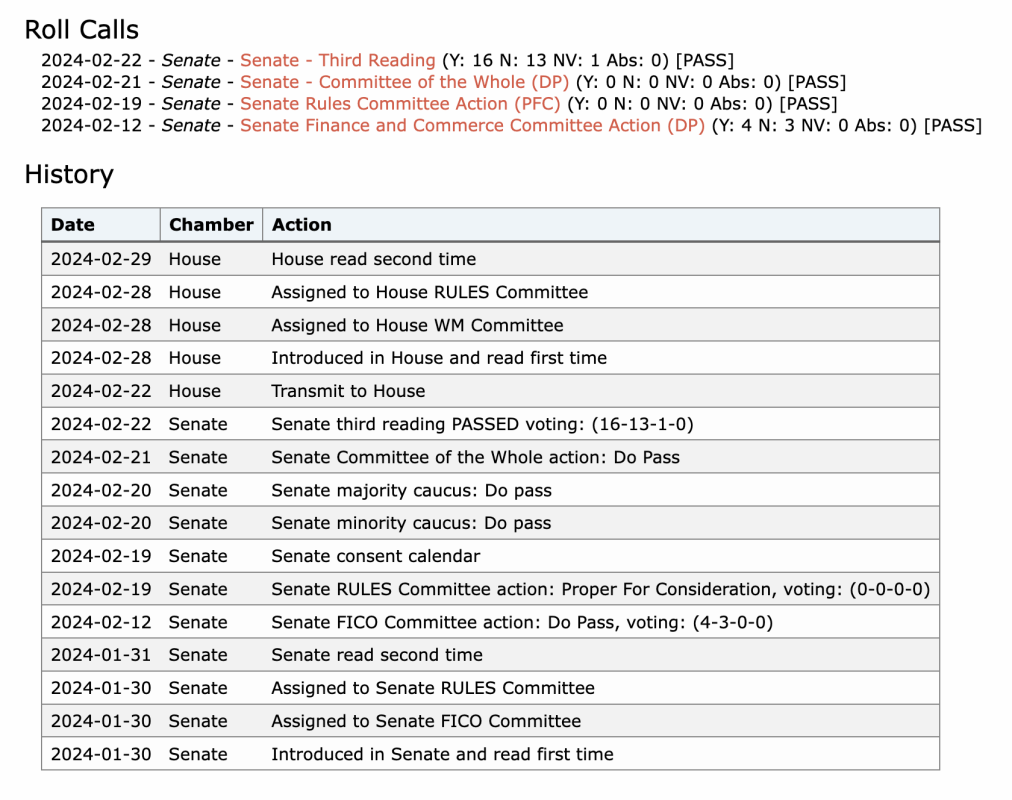

On February 22, the bill successfully passed the Senate's Third Reading with a vote of 16-13. The next step involves the House reviewing the proposal for the second time.

Emphasis on Monitoring and Exploration

The proposal highlights the importance of keeping a close eye on the developments surrounding Bitcoin ETFs. It also encourages ASRS and PSPRS to carefully consider the potential implications of including such assets in their portfolios. This involves seeking guidance from firms that have received approval from the U.S. Securities and Exchange Commission to offer Bitcoin ETFs.

Comprehensive Report Requirement

If the proposal moves forward, ASRS and PSPRS will need to prepare a detailed report assessing the feasibility, risks, and potential benefits of allocating a portion of state retirement funds towards Bitcoin ETFs. This report, which will include various investment options and recommendations for managing the asset class securely, must be submitted to key state officials at least three months before the start of the Fifty-Seventh Legislature, First Regular Session.

Objective of the Proposal

The primary goal of this proposal is to equip ASRS and PSPRS with essential information to facilitate well-informed decisions regarding the integration of Bitcoin ETFs into their investment strategies. By potentially diversifying their portfolios and exploring new avenues for growth, the state retirement systems aim to enhance their overall investment approach.

Frequently Asked Questions

How much do gold IRA fees cost?

$6 per month is the Individual Retirement Account Fee (IRA). This includes account maintenance and any investment costs.

You may have to pay additional fees if you want to diversify your portfolio. The type of IRA you choose will determine the fees. For example, some companies offer free checking accounts but charge monthly fees for IRA accounts.

Most providers also charge an annual management fee. These fees range between 0% and 1 percent. The average rate per year is.25%. However, these rates are typically waived if you use a broker like TD Ameritrade.

Should You Buy Gold?

In times past, gold was considered a safe haven for investors in times of economic trouble. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

Although gold prices have shown an upward trend in recent years, they are still relatively low when compared to other commodities like oil and silver.

This could be changing, according to some experts. According to them, gold prices could soar if there is another financial crisis.

They also pointed out that gold is gaining popularity due to its perceived value, and potential return.

If you are considering investing in gold, here are some things that you need to keep in mind.

- Consider whether you will actually need the money that you are saving for retirement. It is possible to save enough money to retire without investing in gold. The added protection that gold provides when you retire is a good option.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each offers varying levels of flexibility and security.

- Keep in mind that gold may not be as secure as a bank deposit. If you lose your gold coins, you may never recover them.

If you are thinking of buying gold, do your research. You should also ensure that you do everything you can to protect your gold.

What amount should I invest in my Roth IRA?

Roth IRAs are retirement accounts where you deposit your own money tax-free. These accounts are not allowed to be withdrawn before the age of 59 1/2. You must adhere to certain rules if you are going to withdraw any of your contributions prior. First, you cannot touch your principal (the original amount deposited). No matter how much money you contribute, you cannot take out more than was originally deposited to the account. If you take out more than the initial contribution, you must pay tax.

The second rule states that income taxes must be paid before you can withdraw earnings. Also, taxes will be due on any earnings you take. Consider, for instance, that you contribute $5,000 per year to your Roth IRA. In addition, let's assume you earn $10,000 per year after contributing. On the earnings, you would be responsible for $3,500 federal income taxes. This leaves you with $6,500 remaining. Because you can only withdraw what you have initially contributed, this is all you can take out.

Therefore, even if you take $4,000 out of your earnings you still owe taxes on $1,500. On top of that, you'd lose half of the earnings you had taken out because they would be taxed again at 50% (half of 40%). Even though you had $7,000 in your Roth IRA account, you only received $4,000.

There are two types of Roth IRAs: Traditional and Roth. Traditional IRAs allow pre-tax contributions to be deducted from your taxable tax income. Your traditional IRA allows you to withdraw your entire contribution plus any interest. You have the option to withdraw any amount from a traditional IRA.

Roth IRAs are not allowed to allow you deductions for contributions. But once you've retired, you can withdraw the entire contribution amount plus any accrued interest. Unlike a traditional IRA, there is no minimum withdrawal requirement. You don't have to wait until you turn 70 1/2 years old before withdrawing your contribution.

Can I buy gold using my self-directed IRA

However, gold can only be purchased with your self-directed IRA. To do so, you must first open a brokerage account at TD Ameritrade. Transfer funds from an existing retirement account are also possible.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals are allowed to contribute $1,000 each ($2,000 if married or filing jointly) to a Roth IRA.

You should consider buying physical gold bullion if you decide to invest in it. Futures contracts are financial instruments based on the price of gold. These financial instruments allow you to speculate about future prices without actually owning the metal. You can only hold physical bullion, which is real silver and gold bars.

Is physical gold allowed in an IRA.

Gold is money and not just paper currency. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Investors use gold today as part of their diversified portfolio, because it tends to perform better in times of financial turmoil.

Today, Americans prefer precious metals like silver and gold to stocks and bonds. While owning gold doesn't guarantee you'll make money investing in gold, there are several reasons why it may make sense to consider adding gold to your retirement portfolio.

One reason is that gold historically performs better than other assets during financial panics. The S&P 500 declined 21 percent during the same period. Gold prices increased nearly 100 per cent between August 2011 – early 2013. During these turbulent market times, gold was among few assets that outperformed the stocks.

The best thing about gold investing is the fact that there's virtually no counterparty risk. If your stock portfolio goes down, you still own your shares. But if you own gold, its value will increase even if the company you invested in defaults on its debt.

Finally, gold provides liquidity. You can sell your gold at any time without worrying about finding a buyer, which is a major advantage over other investments. Because gold is so liquid compared to other investments, buying it in small amounts makes sense. This allows you to profit from short-term fluctuations on the gold market.

What are the benefits of a Gold IRA?

The best way to save money for retirement is to place it in an Individual Retirement Account. It's tax-deferred until you withdraw it. You are in complete control of how much you take out each fiscal year. There are many types available. Some are more suitable for students who wish to save money for college. Some are better suited for investors who want higher returns. Roth IRAs permit individuals to contribute after the age 59 1/2. Any earnings earned at retirement are subject to tax. Once they start withdrawing money, however, the earnings aren’t subject to tax again. This type account may make sense if it is your intention to retire early.

Because it allows you money to be invested in multiple asset classes, a ‘gold IRA' is similar to any other IRAs. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. This makes gold IRA accounts excellent options for people who prefer to keep their money invested instead of spending it.

Another benefit to owning IRA gold is the ability to withdraw automatically. You won't have the hassle of making deposits each month. You could also set up direct debits to never miss a payment.

Finally, the gold investment is among the most reliable. Because it isn't tied to any particular country its value tends be steady. Even during economic turmoil the gold price tends to remain fairly stable. Gold is a good option for protecting your savings from inflation.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

finance.yahoo.com

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Legal – WSJ

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

irs.gov

How To

The best way to buy gold (or silver) online

First, understand the basics of gold. Gold is a precious metallic similar to Platinum. It's very rare, and it is often used as money for its durability and resistance. It's hard to use, so most people prefer buying jewelry made out of it to actual bars of gold.

Two types of gold coins are available today: the legal tender type and the bullion type. Legal tender coins are those that are intended for circulation in a country. They typically have denominations of $1, $5 or $10.

Bullion coins are minted for investment purposes only, and their values increase over time due to inflation.

They aren't circulated in any currency exchange systems. One example is that if someone buys $100 worth gold, they get 100 grams with a $100 value. Each dollar spent earns the buyer 1 gram gold.

When looking to buy precious metals, the next thing you should be aware of is where it can be purchased. There are many options for buying gold directly from dealers. You can start by visiting your local coin shop. You can also go to a reputable website such as eBay. You might also consider buying gold from an online private seller.

Individuals selling gold at wholesale prices and retail prices are known as private sellers. When selling gold through private sellers, you pay a commission fee of 10% to 15% per transaction. This means that you will get less back from a private seller than if you sell it through a coin shop or on eBay. This option is often a great choice for investing gold as it allows you more control over its price.

The other option is to purchase physical gold. It is easier to store physical gold than paper certificates. But, you still have to take care of it. Physical gold should be stored in an impenetrable container, such a vault and safety deposit box to ensure its safety.

When buying gold on your own, you can visit a bank or a pawnshop. A bank can provide you with a loan to cover the amount you wish to invest in gold. Small establishments that allow customers to borrow money for items they have brought are called pawnshops. Banks usually charge higher interest rates that pawn shops.

Finally, another way to buy gold is to simply ask someone else to do it! Selling gold can be as easy as selling. It is easy to sell gold by contacting a company like GoldMoney.com. You can create a simple account immediately and begin receiving payments.

—————————————————————————————————————————————————————————————-

By: Nik Hoffman

Title: Arizona State Senate Considers Adding Bitcoin ETFs to Retirement Portfolios

Sourced From: bitcoinmagazine.com/business/arizona-state-senate-considering-adding-bitcoin-etfs-to-retirement-portfolios

Published Date: Wed, 06 Mar 2024 15:29:53 GMT