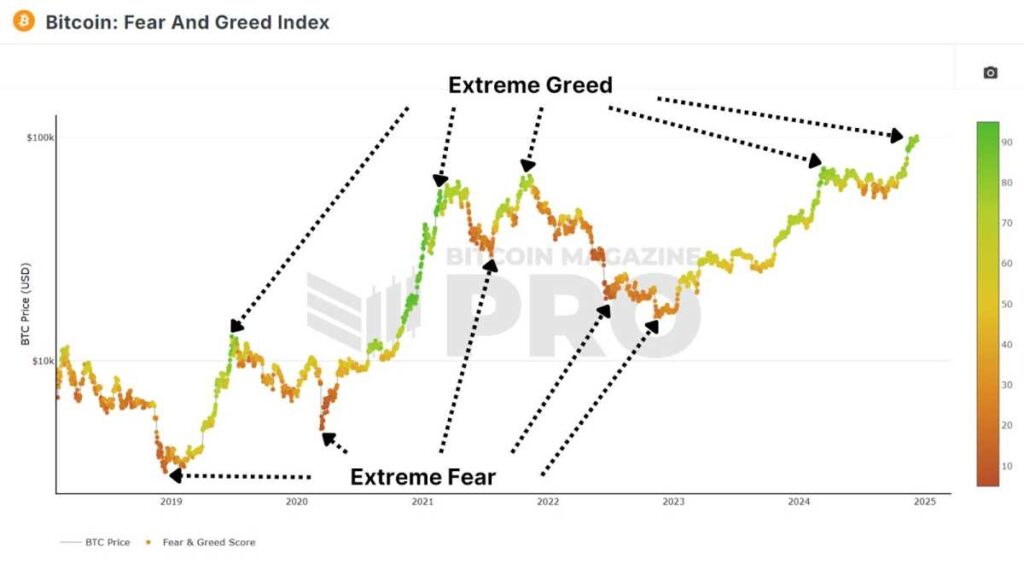

The Bitcoin Fear and Greed Index serves as a valuable sentiment analysis tool that gauges the collective emotions of Bitcoin traders and investors. Ranging from 0 to 100, this index reflects market sentiments from extreme fear to extreme greed. While widely used by analysts, some skeptics question its effectiveness. Let's dive into the data to determine if this tool can indeed enhance your investment decisions.

Understanding Investor Emotion

The Fear and Greed Index amalgamates various metrics to offer a snapshot of market sentiment. These metrics encompass:

Price Volatility: Significant price fluctuations often trigger fear, particularly during market downturns.

Momentum and Volume: Increased buying activity generally indicates a greedy sentiment prevailing in the market.

Social Media Sentiment: Public discussions about Bitcoin on various platforms mirror collective optimism or pessimism.

Bitcoin Dominance: A higher Bitcoin dominance relative to altcoins typically signifies cautious market behavior.

Google Trends: Interest in Bitcoin-related search terms correlates with public sentiment.

By synthesizing this data, the index offers a straightforward visual representation: red zones signify fear (lower values), while green zones indicate greed (higher values).

Figure 1: Bitcoin Fear & Greed Index.

View Live Chart 🔍

One notable observation is that this tool emphasizes how mass psychology often presents opportunities for contrarian actions. In essence, if the majority expresses bearish sentiments, taking a more bullish stance might be advantageous, and vice versa.

Effectiveness of Contrarian Strategy

To assess whether the Fear and Greed Index offers more than just a visually appealing chart, a test was conducted using data dating back to February 2018, the index's inception. The strategy was simple:

Allocate 1% of your capital to Bitcoin when the index reads 20 or below, and sell 1% of your Bitcoin holdings when the index reaches 80 or above. If this basic strategy demonstrated satisfactory performance, then it can be deemed a valuable tool for investors.

Figure 2: Raw API data converted to visualize the index on TradingView.

The Outcomes

This strategy significantly outperformed a simple buy-and-hold approach. The Fear and Greed Strategy yielded a 1,145% return on investment, surpassing the 1,046% ROI achieved through a Buy & Hold Strategy during the same period. While the difference may not be monumental, it highlights that strategically entering and exiting Bitcoin positions based on market sentiment can lead to superior returns compared to merely holding the asset.

Figure 3: Fear & Greed strategy outperformed Buy & Hold.

The Fear and Greed Index operates on human psychology principles. Markets often exhibit overreactions in both directions. By acting against these extremes, the strategy effectively leverages irrational and emotional market behaviors. Scaling in during fear and scaling out during greed helps mitigate risks and enhance profits, surpassing the performance of one of the world's top-performing assets.

It's crucial to note that successful implementation of this strategy requires proper trade management by gradually scaling in and out over extended periods. Additionally, it does not factor in any associated fees or taxes. Market conditions can sustain irrational fear or greed for prolonged durations, making it unlikely for strategies solely reliant on this metric to succeed in the long run.

Final Thoughts

Despite its simplicity, the Fear and Greed Index has proven its value when utilized thoughtfully. It aligns with the fundamental principle of "buying when others are fearful and selling when others are greedy," a strategy followed by many successful investors.

While the Fear and Greed Index should complement other tools such as on-chain data and macroeconomic indicators for comprehensive analysis, the data unequivocally positions it as a metric worthy of inclusion in your analytical arsenal.

For a comprehensive examination of this subject, watch a recent YouTube video: Does The Bitcoin Fear & Greed Index ACTUALLY Work?

Stay informed on live data, charts, indicators, and profound research to stay ahead of Bitcoin's price movements at Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before making investment decisions.

Frequently Asked Questions

Can I buy gold with my self-directed IRA?

Although you can buy gold using your self-directed IRA account, you will need to open an account at a brokerage like TD Ameritrade. If you have an existing retirement account, you can transfer funds to another one.

The IRS allows individuals contributing up to $5.500 each ($6,500 if married, filing jointly) into a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

If you do decide to invest in gold, you'll want to consider purchasing physical bullion rather than investing in futures contracts. Futures contracts are financial instruments that are based on gold's price. They allow you to speculate on future prices without owning the metal itself. But, physical bullion is real bars of gold or silver that you can hold in one's hand.

Can the government seize your gold?

The government cannot take your gold because you own it. It is yours because you worked hard for it. It belongs to you. This rule could be broken by exceptions. For example, if you were convicted of a crime involving fraud against the federal government, you can lose your gold. You can also lose precious metals if you owe taxes. However, if you do not pay your taxes, you can still keep your gold even though it is considered property of the United States Government.

What is the best precious metal to invest in?

This question is dependent on the amount of risk you are willing and able to accept as well as the type of return you desire. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. You might not want to invest in gold if you're looking for quick returns. If you have time and patience, you should consider investing in silver instead.

If you're not looking to make quick money, gold is probably your best choice. Silver might be a better investment option if steady returns are desired over a long period of time.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

forbes.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

bbb.org

investopedia.com

How To

Tips to Invest in Gold

Investing in Gold is one of the most popular investment strategies worldwide. Because investing in gold has many benefits. There are several ways to invest in gold. Some people choose to purchase gold coins physically, while some prefer to invest with gold ETFs.

Before buying any kind of gold, you need to consider these things.

- First, make sure you check if your country allows you own gold. If your country allows you to own gold, then you are allowed to proceed. You might also consider buying gold in foreign countries.

- The second thing you need to do is decide what type of gold coins you want. You have options: you can choose from yellow gold, white or rose gold.

- You should also consider the price of gold. Start small and build up. Diversifying your portfolio is a key thing to remember when purchasing gold. Diversify your investments in stocks, bonds or real estate.

- Remember that gold prices are subject to change regularly. It is important to stay up-to-date with the latest trends.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: How Using a Bitcoin Sentiment Analysis Tool Can Improve Investment Strategy

Sourced From: bitcoinmagazine.com/markets/how-a-bitcoin-fear-and-greed-index-trading-strategy-beats-buy-and-hold-investing

Published Date: Fri, 13 Dec 2024 14:22:54 GMT