Bitcoin's soaring prices have become the new norm, prompting investors to delve into key on-chain data for insights into the market's health. By analyzing these metrics, traders can anticipate price movements and prepare for market peaks and potential retracements.

Terminal Price

The Terminal Price metric, incorporating Coin Days Destroyed (CDD) and Bitcoin's supply, historically predicts Bitcoin cycle peaks. CDD measures coin transfer velocity based on holding duration and quantity moved.

Bitcoin's Terminal Price has surpassed $185,000, expected to rise towards $200,000 as the cycle progresses. With Bitcoin over $100,000, several months of positive price action are anticipated.

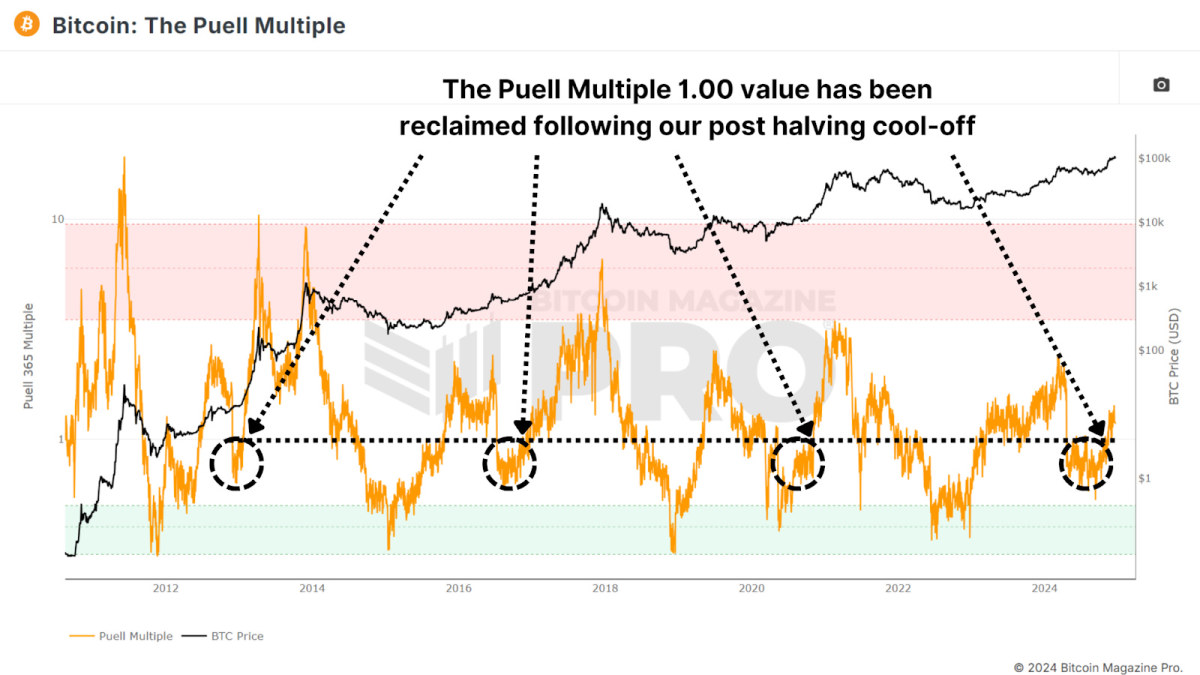

Puell Multiple

The Puell Multiple compares daily miner revenue to the 365-day moving average. Post halving, miners saw revenue drop, leading to consolidation.

The Puell Multiple exceeding 1 indicates profitability for miners, often a sign of the later bull cycle stages. Previous bull runs show similar patterns.

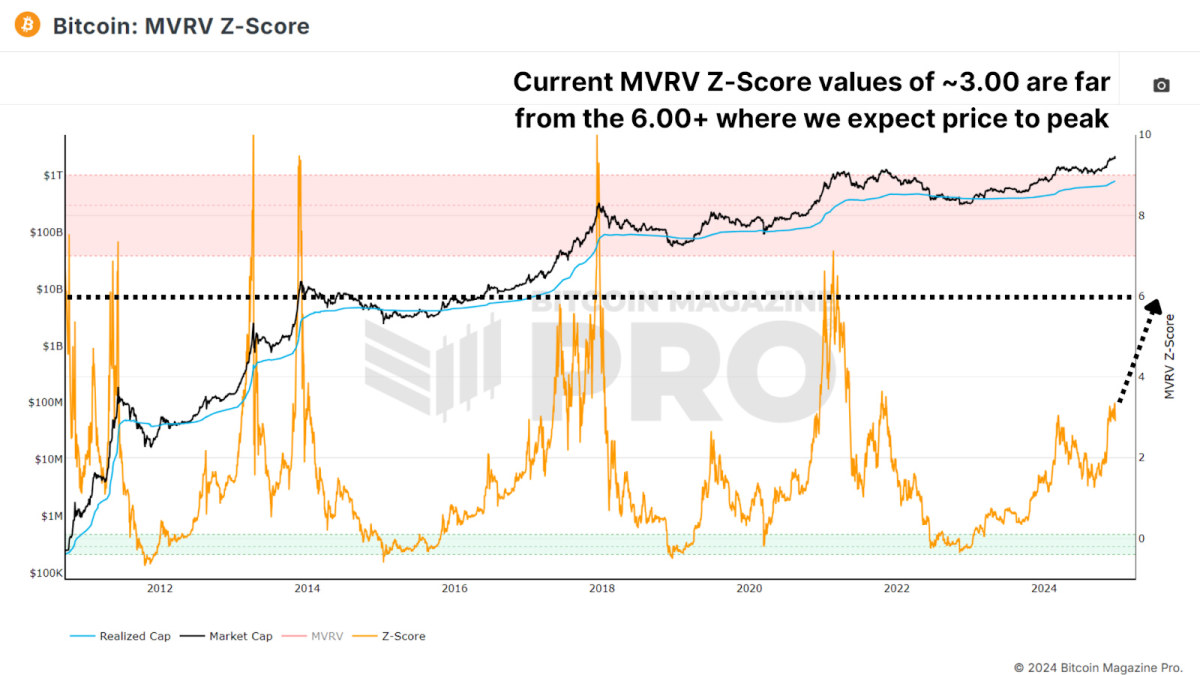

MVRV Z-Score

MVRV Z-Score gauges market value against realized value. Current Z-Score around 3 suggests room for growth, indicating the market is not at a euphoric top.

Active Address Sentiment

This metric tracks the 28-day change in active addresses alongside price change. Overbought conditions may occur if price growth surpasses network activity.

After Bitcoin’s rapid climb, a cooling period indicates healthy consolidation, setting the stage for long-term growth.

Spent Output Profit Ratio

SOPR measures profits from Bitcoin transactions. An increase in profit-taking suggests the cycle's later stages.

Consideration should be given to Bitcoin ETFs and derivatives, influencing SOPR values with the shift from self-custody to ETFs.

Value Days Destroyed

VDD Multiple weighs larger, long-term holders. Overheated levels signal major price peaks as experienced participants start cashing out.

While VDD shows a slightly overheated market, sustaining this range for months before a peak is possible, as seen in past cycles.

Conclusion

Overall, these indicators imply Bitcoin is in the later stages of its bull market. Though some suggest short-term cooling, most predict significant upside in 2025. Resistance levels between $150,000 and $200,000 may emerge, with SOPR and VDD offering clearer signals nearing the peak.

For a detailed analysis, watch this YouTube video: What's Happening On-chain: Bitcoin Update.

Disclaimer: This content serves informational purposes only and not financial advice. Conduct thorough research before making investment decisions.

Frequently Asked Questions

Can I buy gold using my self-directed IRA

While you can purchase gold from your self-directed IRA (or any other brokerage firm), you must first open a brokerage account such as TD Ameritrade. You can also transfer funds from an existing retirement fund.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals are allowed to contribute $1,000 each ($2,000 if married or filing jointly) to a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contracts are financial instruments based on the price of gold. They allow you to speculate on future prices without owning the metal itself. However, physical bullion is real gold or silver bars you can hold in your hands.

What's the advantage of a Gold IRA?

A gold IRA has many benefits. It's an investment vehicle that lets you diversify your portfolio. You control how much money goes into each account and when it's withdrawn.

Another option is to rollover funds from another retirement account into a IRA with gold. This will allow you to transition easily if it is your decision to retire early.

The best part about gold IRAs? You don't have to be an expert. They are readily available at most banks and brokerages. Withdrawals can be made instantly without the need to pay fees or penalties.

There are also drawbacks. Gold is known for being volatile in the past. It is important to understand why you are investing in gold. Are you seeking safety or growth? Do you want to use it as an insurance strategy or for long-term growth? Only by knowing the answer, you will be able to make an informed choice.

If you plan on keeping your gold IRA alive for a while, you may want to consider purchasing more than 1 ounce of pure gold. One ounce won't be enough to meet all your needs. You may need several ounces, depending on what you intend to do with your precious gold.

You don't need to have a lot of gold if you are selling it. You can even get by with less than one ounce. However, you will not be able buy any other items with those funds.

What are the fees for an IRA that holds gold?

Six dollars per month is the fee for an Individual Retirement Account (IRA). This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

If you wish to diversify your portfolio, you may need to pay additional fees. These fees vary depending on what type of IRA you choose. Some companies offer free check accounts, but charge monthly fee for IRA accounts.

Many providers also charge annual management fees. These fees are usually between 0% and 1%. The average rate is.25% annually. However, these rates are typically waived if you use a broker like TD Ameritrade.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement account

finance.yahoo.com

irs.gov

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

The History of Gold as an Asset

From ancient times to the beginning of the 20th century, gold was used as a currency. It was universally accepted and loved for its beauty, durability, purity and divisibility. In addition, because of its value, it was traded internationally. However, since there were no international standards for measuring gold at this point, different weights and measures existed worldwide. One pound sterling in England was equivalent to 24 carats silver, while one livre tournois in France was equal 25 carats. In Germany, one mark was equivalent to 28 carats.

In the 1860s the United States began issuing American currency made up 90% copper (10% zinc) and 0.942 gold (0.942 pure). This led to a decline in demand for foreign currencies, which caused their price to increase. The United States began minting large quantities gold coins at this time, which led to a drop in the price. The U.S. government was unable to pay its debts due to too much money being in circulation. They sold some of their excess gold to Europe to pay off the debt.

Many European countries didn't trust the U.S. dollars and started to accept gold for payment. However, after World War I, many European countries stopped taking gold and began using paper money instead. The value of gold has significantly increased since then. Even though gold's price fluctuates, it is still one of the most secure investments you could make.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Understanding the Bitcoin Market Cycle Through On-Chain Indicators

Sourced From: bitcoinmagazine.com/markets/exploring-five-on-chain-indicators-to-understand-the-bitcoin-market-cycle

Published Date: Fri, 20 Dec 2024 13:54:47 GMT