The United States federal government has recently increased its Bitcoin holdings by transferring $922 million from wallets linked to Bitfinex hackers in a seizure.

Accumulating Bitcoin through Seizures

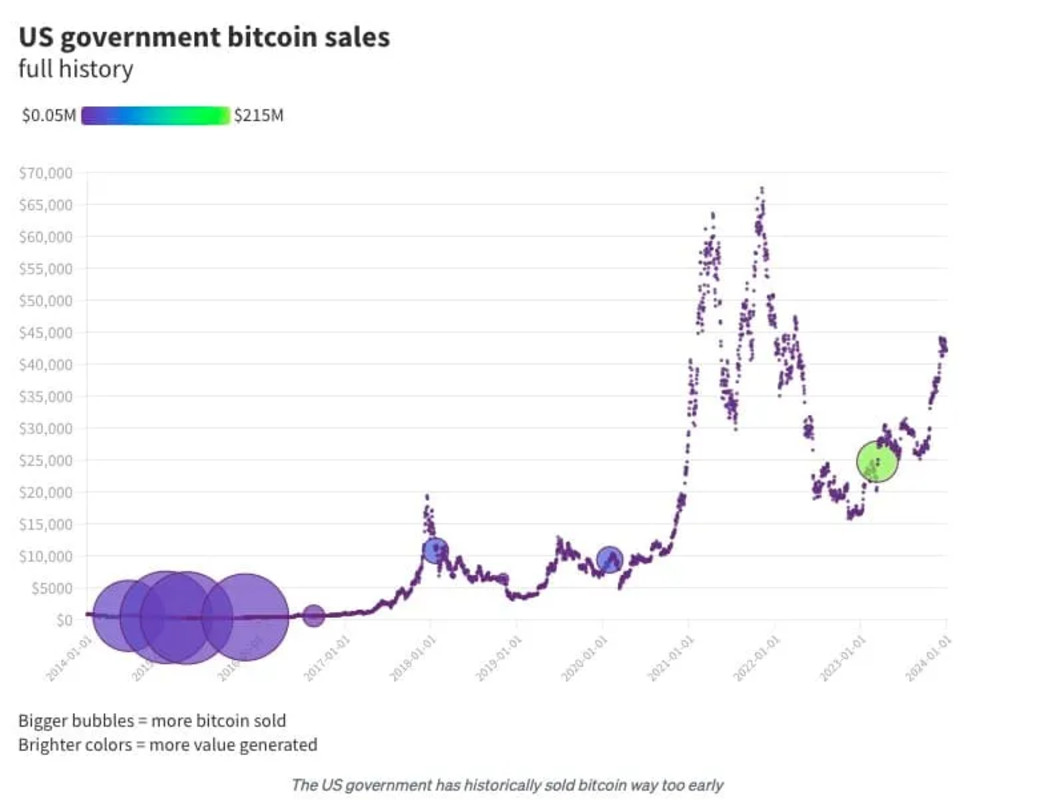

Through a series of seizures and asset forfeitures, the US federal government has amassed a significant amount of Bitcoin, establishing itself as one of the largest holders in the crypto space. In the early days of Bitcoin, the community's crypto-anarchist ethos led to illicit activities, notably the Silk Road. While the era of overtly illegal ventures has passed, the success of these early endeavors resulted in the accumulation of substantial Bitcoin reserves that have since been acquired by the US government.

Seizures from the Silk Road

The Silk Road has been a focal point for multiple seizures by law enforcement, with assets seized not only from the site's coffers but also from hackers who targeted the platform. Despite some Bitcoin being sold through auctions, the government still retains billions in seized assets. Law enforcement agencies seem in no rush to divest themselves of these holdings.

Recent Addition to the Stockpile

On February 29, the US government added over 15,000 bitcoins to its reserve by transferring funds from wallets associated with two Bitfinex hackers. The hackers, Ilya Lichtenstein and Heather "Razzlekhan" Morgan, were involved in a major 2016 hack of Bitfinex, resulting in the theft of nearly 120,000 bitcoins. While Bitfinex remains operational, certain restrictions prevent US citizens and others from accessing the platform.

Government's Bitcoin Reserves

Analysts estimate that the US government holds close to 200,000 bitcoins, valued at around $12.1 billion, making it a significant player in the cryptocurrency market. With approximately 1% of all Bitcoin in circulation, the US government wields substantial influence over the space, alongside major entities like Binance and Satoshi.

Government's Acquisition Strategy

Exiled whistleblower Edward Snowden's comments on governments secretly acquiring Bitcoin resonate amid the global acceptance of the cryptocurrency. While the US government has not publicly purchased Bitcoin, it holds a substantial reserve. Snowden's prediction aligns with the notion that governments could amass Bitcoin reserves discreetly, leveraging plausible deniability.

Transparency Challenges

Despite the potential for secretive acquisitions, Bitcoin's transparent blockchain poses challenges to governments aiming to build reserves covertly. Recent acquisitions by an anonymous entity known as "Mr. 100" have sparked speculation that a national government, possibly in Asia or the Middle East, is accumulating significant amounts of Bitcoin.

Global Trends in Bitcoin Reserves

As governments recognize the importance of holding Bitcoin reserves, seizing assets may emerge as a preferred strategy over direct purchases. Countries like the UK have seized substantial amounts of Bitcoin and enacted laws to facilitate asset seizures, signaling a shift towards building significant crypto reserves.

In conclusion, the growing legitimacy of Bitcoin in the eyes of governments worldwide underscores the need for powerful nations to secure their own reserves. While challenges exist in acquiring Bitcoin discreetly, the race to build substantial reserves has begun, with Bitcoin poised to play a central role in the future of global finance.

Frequently Asked Questions

What is the Performance of Gold as an Investment?

The supply and the demand for gold determine how much gold is worth. Interest rates also have an impact on the price of gold.

Due to their limited supply, gold prices fluctuate. There is also a risk in owning gold, as you must store it somewhere.

How is gold taxed by Roth IRA?

An investment account's tax rate is determined based upon its current value, rather than what you originally paid. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

The rules governing these accounts vary by state. For example, in Maryland, you must take withdrawals within 60 days after reaching age 59 1/2 . Massachusetts allows you up to April 1st. New York offers a waiting period of up to 70 1/2 years. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

How is gold taxed in an IRA?

The fair value of gold sold to determines the price at which tax is due. You don't have tax to pay when you buy or sell gold. It isn't considered income. If you sell it later you will have a taxable profit if the price goes down.

Loans can be secured with gold. Lenders will seek the highest return on your assets when you borrow against them. Selling gold is usually the best option. There's no guarantee that the lender will do this. They might keep it. They may decide to resell it. Either way, you lose potential profit.

In order to avoid losing your money, only lend against your precious metal if you plan to use it to secure other collateral. Otherwise, it's better to leave it alone.

How much should precious metals make up your portfolio?

To answer this question we need to first define precious metals. Precious metals refer to elements with a very high value relative other commodities. This makes them extremely valuable for trading and investing. Gold is by far the most common precious metal traded today.

However, many other types of precious metals exist, including silver and platinum. The price of gold fluctuates, but it generally remains stable during times of economic turmoil. It also remains relatively unaffected by inflation and deflation.

In general, prices for precious metals tend increase with the overall marketplace. That said, they do not always move in lockstep with each other. The price of gold tends to rise when the economy is not doing well, but the prices of the other precious metals tends downwards. This is because investors expect lower rates of interest, which makes bonds less attractive investments.

Contrary to this, when the economy performs well, the opposite happens. Investors favor safe assets like Treasury Bonds, and less precious metals. They become less expensive and have a lower value because they are limited.

Therefore, to maximize profits from investing in precious metals, you must diversify across multiple precious metals. It is also a good idea to diversify your investments in precious metals, as prices tend to fluctuate.

Can I own a gold ETF inside a Roth IRA

You may not have this option with a 401(k), however, you might want to consider other options, like an Individual retirement account (IRA).

An IRA traditional allows both employees and employers to contribute. Another way to invest in publicly traded companies is through an Employee Stock Ownership Plan.

An ESOP is a tax-saving tool because employees have a share of company stock as well as the profits that the business generates. The money in the ESOP can then be subject to lower tax rates than if the money were in the individual's hands.

An Individual Retirement Annuity (IRA) is also available. An IRA allows for you to make regular income payments during your life. Contributions to IRAs don't have to be taxable

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

cftc.gov

finance.yahoo.com

irs.gov

How To

Gold IRAs: A Growing Trend

The gold IRA trend is growing as investors seek ways to diversify their portfolios while protecting against inflation and other risks.

Owners can invest in gold bars and bullion with the gold IRA. It can be used for tax-free growth and provides an alternative investment option for those concerned about stocks and bonds.

Investors can manage their assets with a gold IRA without worrying about market volatility. Investors can use the gold IRA for protection against inflation and potential problems.

Investors also get the unique benefits of owning physical Gold, including its durability, portability, flexibility, and divisibility.

A gold IRA provides many additional benefits. One is the ability for heirs to quickly transfer ownership of gold. Another is the fact that gold is not considered a currency or a commodities by the IRS.

Investors who seek financial stability and a safe haven are finding the gold IRA increasingly attractive.

—————————————————————————————————————————————————————————————-

By: Landon Manning

Title: The United States Federal Government Expands its Bitcoin Hoard

Sourced From: bitcoinmagazine.com/markets/us-government-continues-bitcoin-seizures-controls-nearly-1-of-circulating-supply-

Published Date: Mon, 04 Mar 2024 14:15:46 GMT