Introduction

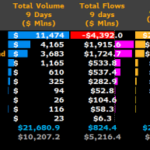

Over the course of six days in the U.S. market, several newly launched spot bitcoin exchange-traded funds (ETFs), including the revamped GBTC, witnessed a staggering trading volume of $16.53 billion. However, GBTC, which dominated this trade volume, experienced a significant decrease in its bitcoin holdings. In just 24 hours, the trust shed over 14,300 bitcoin, reducing its total holdings to 566,973 bitcoin.

$2 Billion in Bitcoin Leaves Grayscale's GBTC Since Jan. 12

GBTC, now recognized as a spot bitcoin ETF, holds a substantial reserve of bitcoin (BTC). Since its transition into a publicly traded ETF, the trust has seen notable outflows. On Thursday, GBTC's holdings decreased by 10,823.86 BTC, and after Friday's trading sessions, the fund saw a further reduction of 14,300.52 BTC. In total, since Jan. 12, 2024, the trust has experienced an outflow of 50,106.59 BTC, valued at slightly above $2 billion.

Possible Reasons for the Sell-Off

There are several factors contributing to the intense selling of GBTC. Firstly, shareholders may have felt constrained when the shares, initially trading at a premium to their net asset value (NAV), suddenly transitioned to a discount. This discount began in February 2021 and persisted until the beginning of this year. Long-term investors may have been waiting for an opportunity to sell once the discount narrowed. Additionally, investors who speculated that the discount would diminish and bought GBTC at a lower price may now be selling their shares for substantial gains.

Another possible reason for the sell-off is that some GBTC investors are exploring alternatives with more competitive management fees, as Grayscale's GBTC has the highest fees in its category. However, Grayscale's bitcoin trust has recorded the highest trading volume out of all nine newly launched ETFs, with $8.97 billion out of the $16.53 billion aggregate. This means that GBTC trades accounted for 54.26% of all the trading activity among spot bitcoin ETFs.

The Emergence of Equilibrium

Prior to the mass approvals on Jan. 11, 2024, the focus was largely on expected inflows into GBTC, with little attention given to potential outflows. However, a modest semblance of equilibrium has now emerged, as IBIT and FBTC collectively hold 53,479 BTC, slightly surpassing the outflows experienced by GBTC since Jan. 12.

Additionally, the cluster of ETFs competing with GBTC, IBIT, and FBTC have also seen growth in their BTC reserves, although not to the same extent. Despite holding significant amounts of bitcoin, these funds, along with the other seven ETFs, remain substantially smaller compared to GBTC's vast reserve of hundreds of thousands of bitcoin.

Conclusion

The massive outflow of bitcoin from Grayscale's GBTC since Jan. 12 raises questions about the motivations behind this sell-off. Factors such as the transition from a premium to a discount, speculation, and the search for lower management fees may have contributed to this trend. However, it is worth noting that GBTC continues to dominate the spot bitcoin ETF market in terms of trading volume. The dynamics among GBTC, IBIT, FBTC, and the other ETFs will continue to shape the landscape of bitcoin investments. Share your thoughts and opinions on this subject in the comments section below.

Frequently Asked Questions

How much gold should your portfolio contain?

The amount of capital required will affect the amount you make. You can start small by investing $5k-10k. As your business grows, you might consider renting out office space or desks. Renting out desks and other equipment is a great way to save money on rent. You only pay one month.

Also, you need to think about the type of business that you are going to run. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. Consider how much you expect to make from each client, if you decide to do this kinda thing.

As freelance work requires you to be paid freelancers, your monthly salary won't be as high as mine. This means that you may only be paid once every six months.

You need to determine what kind or income you want before you decide how much of it you will need.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

Is buying gold a good option for retirement planning?

Buying gold as an investment may not seem very appealing at first glance, but when you consider how much people spend on average on gold per year worldwide, it becomes worth considering.

The most popular form of investing in gold is through physical bullion bars. There are other ways to invest gold. You should research all options thoroughly before making a decision on which option you prefer.

For example, purchasing shares of companies that extract gold or mining equipment might be a better option if you aren't looking for a safe place to store your wealth. If you need cash flow to finance your investment, then gold stocks could be a good option.

ETFs allow you to invest in exchange-traded funds. These funds give you exposure, but not actual gold, by investing in gold-related securities. These ETFs typically include stocks from gold miners, precious metallics refiners, commodity trading companies, and other commodities.

Which precious metal is best to invest in?

The answer to this question depends on how much risk you are willing to take and what type of return you want. Gold is a traditional haven investment. However, it is not always the most profitable. For example, if you need a quick profit, gold may not be for you. If patience and time are your priorities, silver is the best investment.

If you don’t want to be rich fast, gold might be the right choice. Silver may be a better option for investors who want long-term steady returns.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement account

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

cftc.gov

irs.gov

How To

A growing trend: Gold IRAs

Investors are increasingly turning to gold IRAs as a way to diversify and protect their portfolios from inflation.

The gold IRA allows investors to purchase physical gold bars and bullion. It is a tax-free investment that can be used to grow wealth and offers an alternative investment option to those who are concerned about stocks or bonds.

Investors can have confidence in their investments and avoid market volatility with a gold IRA. They can also use the gold IRA as a protection against potential problems like inflation.

Investors also enjoy the benefits of owning physical gold, which includes its unique properties such as durability, portability, and divisibility.

Additionally, the gold IRA has many benefits. It allows you to quickly transfer your gold ownership to your heirs. The IRS doesn't consider gold a commodity or currency.

All this means that the gold IRA is becoming increasingly popular among investors seeking a haven during financial uncertainty.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: The Massive Outflow of Bitcoin from Grayscale's GBTC: What Does it Mean?

Sourced From: news.bitcoin.com/gbtcs-mixed-fortune-54-market-share-in-etf-trade-volume-accompanied-by-2-billion-btc-exodus/

Published Date: Sat, 20 Jan 2024 17:00:22 +0000