Billionaire Investor Considers Bitcoin as a Store of Value

Renowned billionaire hedge fund manager, Stanley Druckenmiller, recently expressed his views on bitcoin, stating that although he does not currently own any, he believes he should. Druckenmiller sees bitcoin as a brand and highlights its appeal to young people as a store of value.

Insights from a Fireside Chat

During a fireside chat at the JPMorgan/Robin Hood Investors Conference in New York City on October 24, Druckenmiller engaged in a discussion about bitcoin investing with fellow hedge fund manager, Paul Tudor Jones. Druckenmiller, who is the chairman and CEO of Duquesne Family Office LLC, has a wealth of experience in the investment industry, having previously held a managing director position at Soros Fund Management.

The Age-Old Debate: Gold vs Bitcoin

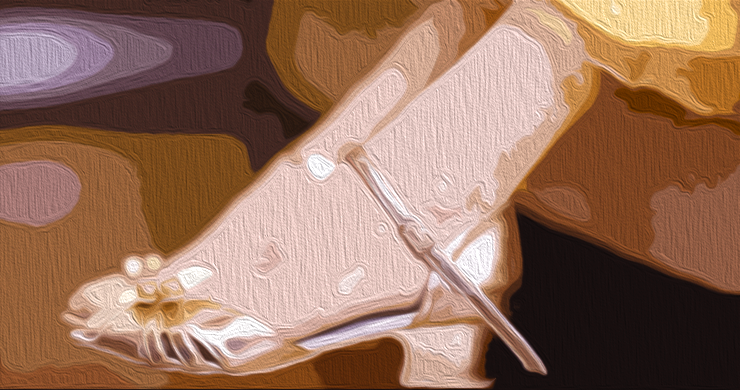

When asked about his thoughts on gold and bitcoin, Druckenmiller, who is 70 years old, revealed that he owns gold. However, he acknowledged the potential of bitcoin and expressed his regret for not currently owning any. Druckenmiller believes that young people view bitcoin as a store of value due to its ease of use compared to gold.

A Brand for the Next Generation

Druckenmiller considers bitcoin to be a brand, similar to gold's status as a 5,000-year-old brand. He recognizes that the younger generation, particularly those on the West Coast, holds significant wealth and sees bitcoin as an attractive investment option. Bitcoin recently celebrated the 15th anniversary of Satoshi Nakamoto's Bitcoin white paper, which further highlights its growing presence and influence.

Druckenmiller's Changing Stance on Bitcoin

Although Druckenmiller currently does not own any bitcoin, he has not always held this position. In November 2020, he stated that he had warmed up to the idea of bitcoin as a store of value. He even expressed a preference for bitcoin over gold in an inflationary bull market, citing its liquidity and potential for higher returns.

However, Druckenmiller eventually exited the cryptocurrency market due to concerns about tightening measures imposed by central banks. Despite this, he believes that cryptocurrency, including bitcoin, could play a significant role in a Renaissance-like era where people lose trust in traditional central banking systems.

Final Thoughts

Stanley Druckenmiller's views on bitcoin provide valuable insights into the evolving investment landscape. As a highly successful hedge fund manager, his opinions carry weight and influence. While he currently does not own bitcoin, he recognizes its appeal to the younger generation and acknowledges its potential as a store of value. Whether or not Druckenmiller will ultimately invest in bitcoin remains to be seen, but his statements shed light on the growing importance of cryptocurrencies in today's financial world.

Frequently Asked Questions

Can I keep physical gold in an IRA?

Gold is money, not just paper currency or coinage. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Today, investors use gold as part of a diversified portfolio because gold tends to do better during financial turmoil.

Many Americans are now more inclined to invest in precious metals like gold and silver than stocks or bonds. Even though owning gold is not a guarantee of making money, there are many reasons why you might want to add gold to your retirement savings portfolio.

Gold has historically performed better during financial panics than other assets. Between August 2011 and early 2013 gold prices soared nearly 100 percent, while the S&P 500 plunged 21 percent. Gold was one of the few assets that performed better than stocks during turbulent market conditions.

Gold is one of the few assets that has virtually no counterparty risks. You still have your shares even if your stock portfolio falls. You can still own your gold even if the company where you invested fails to pay its debt.

Finally, the liquidity that gold provides is unmatched. You can sell your gold at any time without worrying about finding a buyer, which is a major advantage over other investments. You can buy gold in small amounts because it is so liquid. This allows for you to benefit from the short-term fluctuations of the gold market.

Can I own a gold ETF inside a Roth IRA

This option may not be available in a 401(k), but you should look into other options such as an Individual Retirement account (IRA).

A traditional IRA allows contributions from both employee and employer. Another way to invest in publicly traded companies is through an Employee Stock Ownership Plan.

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The money in the ESOP can then be subject to lower tax rates than if the money were in the individual's hands.

A Individual Retirement Annuity is also possible. You can make regular payments to your IRA throughout your life, and you will also receive income when you retire. Contributions to IRAs can be made without tax.

Is gold a good IRA investment?

Anyone who is looking to save money can make gold an excellent investment. It can be used to diversify your portfolio. But gold is not all that it seems.

It has been used throughout history as currency and it is still a very popular method of payment. It's sometimes called “the world's oldest money”.

Gold is not created by governments, but it is extracted from the earth. It's hard to find and very rare, making it extremely valuable.

The supply and demand factors determine how much gold is worth. The strength of the economy means people spend more, and so, there is less demand for gold. The value of gold rises as a consequence.

On the flipside, people may save cash rather than spend it when the economy slows. This means that more gold is produced, which reduces its value.

This is why both individuals as well as businesses can benefit from investing in gold. You'll reap the benefits of investing in gold when the economy grows.

You'll also earn interest on your investments, which helps you grow your wealth. Additionally, you won't lose cash if the gold price falls.

How much gold should you have in your portfolio?

The amount of capital required will affect the amount you make. For a small start, $5k to $10k is a good range. You could then rent out desks and office space as your business grows. Renting out desks and other equipment is a great way to save money on rent. You just pay per month.

Consider what type of business your company will be running. My company is a website creator. We charge our clients about $1000-2000 per monthly depending on what they order. Consider how much you expect to make from each client, if you decide to do this kinda thing.

As freelance work requires you to be paid freelancers, your monthly salary won't be as high as mine. Therefore, you might only get paid one time every six months.

Before you can determine how much gold you'll need, you must decide what type of income you want.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

Should You Buy or Sell Gold?

In the past, gold was considered a haven for investors during economic turmoil. Many people are now turning their backs on traditional investments like stocks and bonds, and instead look to precious metals like Gold.

Gold prices have been on an upward trend over recent years, but they remain relatively low compared to other commodities such as oil and silver.

This could be changing, according to some experts. They say that gold prices could rise dramatically with another global financial crisis.

They also point out that gold is becoming popular because of its perceived value and potential return.

Here are some things to consider if you're considering investing in gold.

- Consider first whether you will need the money to save for retirement. It's possible to save for retirement without putting your savings into gold. Gold does offer an extra layer of protection for those who reach retirement age.

- Second, be sure to understand your obligations before you purchase gold. Each offers varying levels of flexibility and security.

- Remember that gold is not as safe as a bank account. Losing your gold coins could result in you never being able to retrieve them.

So, if you're thinking about buying gold, make sure you do your research first. And if you already own gold, ensure you're doing everything possible to protect it.

Should you Invest In Gold For Retirement?

It depends on how much you have saved and if gold was available at the time you started saving. If you are unsure which option to choose, consider investing in both options.

Not only is it a safe investment but gold can also provide potential returns. It's a great investment for retirees.

Although most investments promise a fixed rate of return, gold is more volatile than others. Therefore, its value is subject to change over time.

However, this does not mean that gold should be avoided. This just means you need to account for fluctuations in your overall portfolio.

Another advantage of gold is its tangible nature. Gold is less difficult to store than stocks or bonds. It can also be transported.

You can always access your gold if it is stored in a secure place. Plus, there are no storage fees associated with holding physical gold.

Investing in gold can help protect against inflation. You can hedge against rising costs by investing in gold, which tends to rise alongside other commodities.

You'll also benefit from having a portion of your savings invested in something that isn't going down in value. Gold tends to rise when the stock markets fall.

Another advantage to investing in gold is the ability to sell it whenever you wish. As with stocks, your position can be liquidated whenever you require cash. You don't even have to wait until you retire.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Also, don't buy too much at once. Start with a few ounces. Then add more as needed.

Don't expect to be rich overnight. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

Although gold might not be the right investment for everyone it could make a great addition in any retirement plan.

Can I purchase gold with my self directed IRA?

While you can purchase gold from your self-directed IRA (or any other brokerage firm), you must first open a brokerage account such as TD Ameritrade. If you have an existing retirement account, you can transfer funds to another one.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals are allowed to contribute $1,000 each ($2,000 if married or filing jointly) to a Roth IRA.

If you do decide that you want to invest, it is a good idea to buy physical bullion and not in futures. Futures contracts, which are financial instruments based upon the price of gold, are financial instruments. They allow you to speculate on future prices without owning the metal itself. However, physical bullion is real gold or silver bars you can hold in your hands.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement plans

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Legal – WSJ

How To

The History of Gold as an Asset

Gold was a currency from ancient times until the early 20th century. It was accepted worldwide and became popular due to its durability, purity, divisibility, uniformity, scarcity, and beauty. It was also traded internationally due to its high value. Because there were no internationally recognized standards for measuring and weighing gold, the different weights of this metal could be used worldwide. One pound sterling in England was equivalent to 24 carats silver, while one livre tournois in France was equal 25 carats. In Germany, one mark was equivalent to 28 carats.

The United States began issuing American coin made up 90% copper, 10% zinc and 0.942 fine-gold in the 1860s. This resulted in a decline of foreign currency demand and an increase in the price. At this point, the United States minted large amounts of gold coins, causing the price of gold to drop. The U.S. government needed to find a solution to their debt because there was too much money in circulation. To do so, they decided to sell some of the excess gold back to Europe.

Since most European countries were not confident in the U.S. dollar they began accepting gold as payment. After World War I, however, many European countries started using paper money to replace gold. Since then, the price of gold has increased significantly. Today, although the price fluctuates, gold remains one of the safest investments you can make.

—————————————————————————————————————————————————————————————-

By: Kevin Helms

Title: Stanley Druckenmiller: Bitcoin is a Brand and I Should Own It

Sourced From: news.bitcoin.com/billionaire-stan-druckenmiller-i-dont-own-bitcoin-but-i-should/

Published Date: Wed, 01 Nov 2023 23:30:46 +0000