Introduction

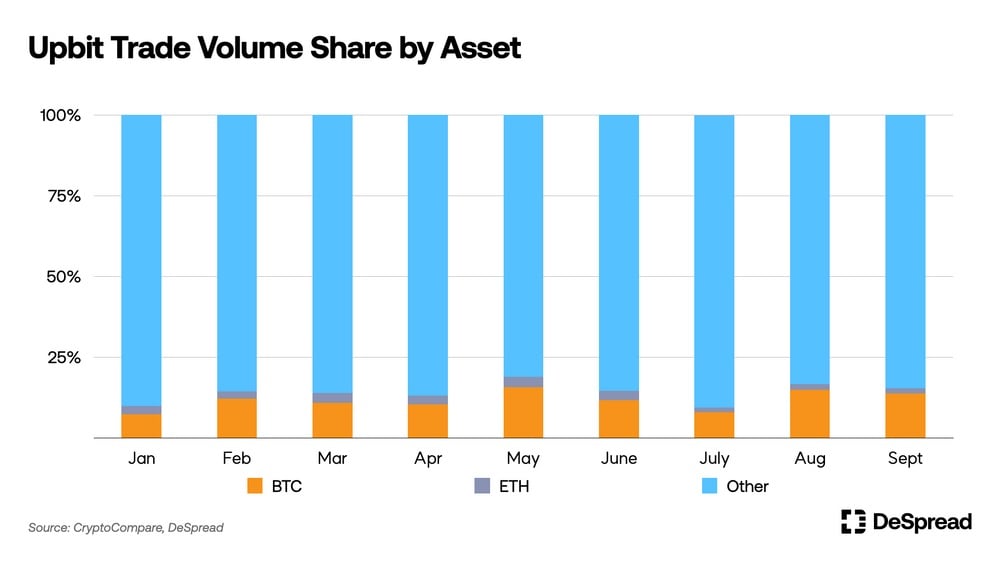

A recent report reveals that South Korean cryptocurrency traders are more attracted to high-risk, high-reward altcoins than their American counterparts. The study indicates that major cryptocurrencies like bitcoin and ethereum have a smaller share in trading volumes on the largest Korean exchange compared to the leading U.S. exchange.

South Korean Investors Favor Altcoins with High Profit Potential

According to a study conducted by the Web3 market strategy consulting firm Despread, many South Koreans prefer a high-risk approach to crypto investments, which offers the potential for significant returns. The report focuses on trading activities on major cryptocurrency exchanges in the country and highlights the strong interest of individual investors on Upbit, South Korea's largest crypto trading platform, in altcoins with high profit potential.

The authors of the report state, "The majority of individual investors on Upbit show strong interest in altcoins with high profit potential and tend to accept the associated high risks. This is considered one of the reasons for the high proportion of altcoin trading in the Korean market."

Upbit currently dominates the domestic exchange market, accounting for 70 to 80% of the market share this year. In February, the platform recorded its highest trading volume of $36 billion. Other significant exchanges in South Korea include Bithumb, Coinone, and Korbit.

Differences in Trading Patterns: South Korea vs. the United States

Trading on America's leading cryptocurrency exchange, Coinbase, differs significantly from Upbit. While Upbit is predominantly driven by individual investors, Coinbase's trading volume is largely influenced by institutional players.

According to Coinbase's Q2 shareholder letter, institutional investors contribute to approximately 85% of the exchange's total trading volume. These investors are more inclined to prioritize portfolio stability, resulting in a larger share of trading in bitcoin (BTC) and ethereum (ETH), the cryptocurrencies with the highest market cap.

Popular Altcoins in South Korea

Among the altcoins that are actively traded in South Korea, the Loom Network (LOOM) claimed the top spot last week, recording the highest trading volume with a ratio of 62%, as revealed by Despread. Following LOOM, ecash (XEC) and flow (FLOW) secured the second and third positions, with trading volumes of 55% and 43% respectively. Stacks (STX) and bitcoin SV (BSV) also garnered attention, with ratios of 37% and 34% respectively.

The report highlights that certain cryptocurrencies, such as Loom Network and Flow, receive temporary attention, while others like Stacks and Ecash consistently attract trading activity on Korean exchanges regardless of global trends. These cases are significant because they demonstrate consistent trading volumes in the Korean market over time.

Conclusion

The research findings suggest that South Korean investors have a greater inclination towards investing in altcoins due to their high-profit potential. The study highlights the strong interest of individual investors in high-risk altcoins on South Korea's largest crypto trading platform, Upbit. In contrast, institutional investors in the United States prioritize portfolio stability, leading to a higher trading volume in established cryptocurrencies like bitcoin and ethereum.

It is important to note that the cryptocurrency market is highly volatile, and investors should conduct thorough research and analysis before making any investment decisions.

What are your thoughts on South Koreans' preference for altcoins? Share your opinions in the comments section below.

Frequently Asked Questions

What is a Precious Metal IRA (IRA)?

A precious metal IRA allows you to diversify your retirement savings into gold, silver, platinum, palladium, rhodium, iridium, osmium, and other rare metals. These are “precious metals” because they are hard to find, and therefore very valuable. They make excellent investments for your money and help you protect your future from inflation and economic instability.

Bullion is often used to refer to precious metals. Bullion refers actually to the metal.

Bullion can be purchased via a variety of channels including online sellers, large coin dealers, and grocery stores.

With a precious metal IRA, you invest in bullion directly rather than purchasing shares of stock. This will ensure that you receive annual dividends.

Precious metal IRAs do not require paperwork nor annual fees, unlike regular IRAs. Instead, you pay only a small percentage tax on your gains. Plus, you get free access to your funds whenever you want.

What is the best precious metal to invest in?

This question depends on how risky you are willing to take, and what return you want. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. For example, if your goal is to make quick money, gold may not suit you. Silver is a better investment if you have patience and the time to do it.

If you don't care about getting rich quickly, gold is probably the way to go. If you want to invest in long-term, steady returns, silver is a better choice.

Can I own a gold ETF inside a Roth IRA

A 401(k) plan may not offer this option, but you should consider other options, such as an Individual Retirement Account (IRA).

A traditional IRA allows contributions from both employee and employer. Another option is to invest in publicly traded corporations with an Employee Stockownership Plan (ESOP).

An ESOP is a tax-saving tool because employees have a share of company stock as well as the profits that the business generates. The money you invest in the ESOP will be taxed at a lower rate than if it were directly held by the employee.

A Individual Retirement Annuity (IRA), is also available. An IRA allows for you to make regular income payments during your life. Contributions made to IRAs are not taxable.

Should You Buy Gold?

Gold was considered a safety net for investors during times of economic turmoil in the past. Many people today are moving away from stocks and bonds to look at precious metals, such as gold, as a way to diversify their investments.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

Some experts think that this could change in the near future. Experts believe that gold prices could skyrocket in the face of another global financial crisis.

They also point out that gold is becoming popular because of its perceived value and potential return.

Here are some things to consider if you're considering investing in gold.

- Before you start saving money for retirement, think about whether you really need it. It is possible to save enough money to retire without investing in gold. That said, gold does provide an additional layer of protection when you reach retirement age.

- Second, ensure you fully understand the risks involved in buying gold. Each offer varying degrees of security and flexibility.

- Last but not least, gold doesn't provide the same level security as a savings account. Your gold coins may be lost and you might never get them back.

So, if you're thinking about buying gold, make sure you do your research first. You should also ensure that you do everything you can to protect your gold.

What tax is gold subject in an IRA

The fair market value of gold sold is the basis for tax. You don't pay taxes when you buy gold. It's not considered income. If you sell it later, you'll have a taxable gain if the price goes up.

Loans can be secured with gold. Lenders try to maximize the return on loans that you take against your assets. This often means selling gold. This is not always possible. They may hold on to it. They might decide to sell it. Either way, you lose potential profit.

In order to avoid losing your money, only lend against your precious metal if you plan to use it to secure other collateral. If you don't plan to use it as collateral, it is better to let it be.

What are the fees associated with an IRA for gold?

$6 per month is the Individual Retirement Account Fee (IRA). This includes account maintenance and any investment costs.

If you want to diversify, you may be required to pay extra fees. These fees will vary depending upon the type of IRA chosen. For example, some companies offer free checking accounts but charge monthly fees for IRA accounts.

Many providers also charge annual management fees. These fees range from 0% to 1%. The average rate is.25% each year. These rates are often waived if a broker like TD Ameritrade is used.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

finance.yahoo.com

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement funds

bbb.org

cftc.gov

How To

The best place online to buy silver and gold

To buy gold, you must first understand how it works. Gold is a precious metal similar to platinum. It's rare and often used to make money due its resistance and durability to corrosion. It's difficult to use, so most people prefer purchasing jewelry made from it rather than actual bars.

Today, there are two types available in gold coins: one is legal tender and the other is bullion. Legal tender coins can be used for circulation within a country. These coins usually come in denominations such $1, $5 and $10.

Bullion coin are not intended for investment. However, their value will increase with inflation.

They cannot be used in currency exchanges. For example, a person who buys $100 worth or gold gets 100 grams. This gold has a $100 price. Each dollar spent earns the buyer 1 gram gold.

When looking to buy precious metals, the next thing you should be aware of is where it can be purchased. There are many options for buying gold directly from dealers. First off, you can go through your local coin shop. You could also look into eBay or other reputable websites. You can also purchase gold through private online sellers.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. When selling gold through private sellers, you pay a commission fee of 10% to 15% per transaction. You would receive less money from a private buyer than you would from a coin store or eBay. However, this option is often a great choice when investing in gold since it gives you more control over the item's price.

You can also invest in gold physical. You can store physical gold much more easily than you can with paper certificates. However, it still needs to be safe. It is important to keep your physical gold safe in an impenetrable box such as a vault, safety deposit box or other secure container.

To purchase gold by yourself, you can visit a bank and a pawnshop. A bank can provide you with a loan to cover the amount you wish to invest in gold. Pawnshops are small establishments allowing customers to borrow money against items they bring. Banks usually charge higher interest rates that pawn shops.

You can also ask for help to purchase gold. Selling gold is simple too. You can contact a company like GoldMoney.com to set up an account and receive payments right away.

—————————————————————————————————————————————————————————————-

By: Lubomir Tassev

Title: South Koreans Show Greater Interest in Altcoins Compared to Americans, Research Finds

Sourced From: news.bitcoin.com/south-koreans-fascinated-with-altcoins-more-than-americans-research-shows/

Published Date: Sat, 28 Oct 2023 10:30:32 +0000