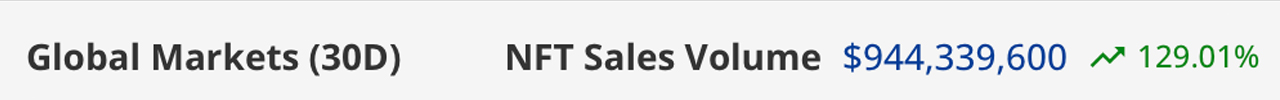

November Sees Significant Surge in NFT Sales

Sales of non-fungible tokens (NFTs) experienced a notable surge in November, with a 129.01% increase in sales volume compared to October. This surge resulted in close to $1 billion in transactions, reaching an exact figure of $944.33 million. This represents a slight increase of just above 129% compared to the $412 million in sales observed in the previous month.

Bitcoin Overtakes Ethereum in NFT Sales

In a significant shift, NFT sales originating from the Bitcoin blockchain surpassed those from Ethereum. BTC-based NFT sales reached $382.88 million in the past 30 days, exceeding Ethereum's sales by $20.32 million. This notable surge in Bitcoin NFT sales represents a significant 1,928.65% increase compared to October's figures. Meanwhile, Ethereum's sales also grew, registering a 57.28% increase over the sales in October.

Other Blockchain Platforms Experience Varied Results

While Bitcoin and Ethereum saw impressive growth in NFT sales, other blockchain platforms had mixed results. Solana's NFT sales experienced a significant boost, soaring by 190.11% to reach $86.99 million. On the other hand, Polygon saw a decrease of 33.90%, tallying $26.78 million in sales, while Mythos experienced a 30.32% drop, recording $25.66 million in sales volume.

Top NFT Collections and Sales Figures

During November, BTC led with the "SATS BRC-20" collection, amassing $93.44 million in sales, a staggering 974% increase from the previous month. The "$RATS BRC-20" collection from Bitcoin secured the second position, garnering $45.58 million in sales, skyrocketing by a massive 4,768,571% compared to the previous month.

Ethereum's Bored Ape Yacht Club (BAYC) ranked third in November with sales of $43.36 million, marking an 88.66% increase. Cryptopunks claimed the fourth spot, achieving $29 million in transactions, a rise of 169.61%. Sales from Mythos' Dmarket reached $25.10 million, showing a 31.36% decrease from October.

Notable NFT Sales Highlights

While Bitcoin led in overall NFT sales, the most expensive NFT sold in November hailed from the Ethereum blockchain. The NFT "Uniswap V3 Positions NFT-V1 #14" was purchased for a substantial $1.66 million. Additionally, a "$BTCS BRC-20" NFT fetched $376K, the "Voting Token Lockup #3" from Arbitrum achieved a sale price of $300K, the "Boogle #057" NFT from Solana was acquired for $126K, and Cardano's "EMURGO x NMKR Cardano Summit" NFT garnered $59K.

The Rise of Bitcoin and the Future of NFT Sales

Bitcoin's surge in NFT sales and its overtaking of Ethereum in terms of sales volume in November indicates a shift in the NFT landscape. As more artists, creators, and collectors explore the potential of NFTs, the market is evolving with the emergence of new blockchain platforms and collections. It will be interesting to see how these trends continue to unfold and shape the future of NFT sales.

What are your thoughts on the record-setting NFT sales in November and Bitcoin's dethroning of Ethereum in terms of sales? Share your opinions in the comments section below.

Frequently Asked Questions

What Should Your IRA Include in Precious Metals?

It's important to understand that precious metals aren't only for wealthy people. They don't require you to be wealthy to invest in them. You can actually make money without spending a lot on gold or silver investments.

You might also be interested in buying physical coins, such bullion rounds or bars. It is possible to also purchase shares in companies that make precious metals. You may also be interested in an IRA transfer program offered by your retirement provider.

You'll still get the benefit of precious metals no matter which country you live in. They are not stocks but offer long-term growth.

And unlike traditional investments, they tend to increase in value over time. If you decide to make a sale of your investment in the future, you will likely realize more profit than with traditional investments.

Who has the gold in a IRA gold?

The IRS considers gold owned by an individual to be “a type of money” and is subject taxation.

This tax-free status is only available to those who have owned at least $10,000 of gold and have kept it for at minimum five years.

Although gold can help to prevent inflation and price volatility, it's not sensible to have it if it's not going to be used.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

To find out what options you have, consult an accountant or financial planner.

What Is a Precious Metal IRA?

An IRA with precious metals allows you to diversify retirement savings into gold and silver, palladium, rhodiums, iridiums, osmium, or other rare metals. These are called “precious” metals because they're very hard to find and very valuable. These metals are great investments and can help protect your financial future from economic instability and inflation.

Bullion is often used to refer to precious metals. Bullion is the physical metal.

Bullion can be purchased via a variety of channels including online sellers, large coin dealers, and grocery stores.

An IRA for precious metals allows you to directly invest in bullion instead of purchasing stock shares. You'll get dividends each year.

Unlike regular IRAs, precious metal IRAs don't require paperwork or annual fees. Instead, you only pay a small percentage on your gains. You can also access your funds whenever it suits you.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

irs.gov

investopedia.com

cftc.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement plans

How To

The growing trend of gold IRAs

As investors look for ways to diversify their portfolios and protect themselves against inflation, the gold IRA trend is on the rise.

Owners can invest in gold bars and bullion with the gold IRA. This IRA can be used to grow your wealth tax-free and is an alternative option to stocks and bonds.

An investor can use a gold IRA to manage their assets and not worry about market volatility. They can use the gold IRA to protect themselves against inflation and other potential problems.

Investors also have the benefit of physical gold, which has unique properties such durability, portability and divisibility.

Additionally, the gold IRA has many benefits. It allows you to quickly transfer your gold ownership to your heirs. The IRS doesn't consider gold a commodity or currency.

This is why the gold IRA has become increasingly popular with investors looking to provide financial security during times of financial uncertainty.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Sales of Non-Fungible Tokens (NFTs) Surge in November, Bitcoin Climbs Past Ethereum

Sourced From: news.bitcoin.com/nft-sales-boom-in-november-bitcoin-dethrones-ethereum-in-market-surge/

Published Date: Sat, 02 Dec 2023 15:00:43 +0000