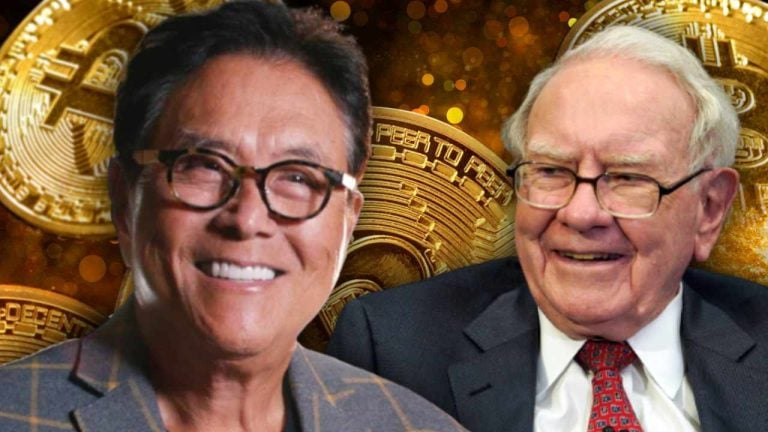

Robert Kiyosaki Differentiates His Investment Strategy From Warren Buffett’s

Robert Kiyosaki, the author of the best-selling book Rich Dad Poor Dad, has revealed his investment strategy, highlighting how it differs from the approach taken by Warren Buffett, the CEO of Berkshire Hathaway. Kiyosaki shared on social media that he is an average investor who focuses on accumulating assets for the long term. He has been accumulating gold, silver, bitcoin, and real estate over the years.

Kiyosaki's investment strategy stands in contrast to Warren Buffett's value investing approach. Buffett believes in investing in businesses with strong economic characteristics and trustworthy management. On the other hand, Kiyosaki recommends investing in gold, silver, and bitcoin, predicting significant price increases for these assets in the future.

Kiyosaki’s Investment Recommendations

Robert Kiyosaki has been advocating for the purchase of gold, silver, and bitcoin for quite some time. He believes that the price of bitcoin will reach $135,000, while gold will surpass $2,100 and continue to rise. Additionally, he predicts that silver will increase from $23 to $68 per ounce.

Kiyosaki has made several accurate predictions in the past regarding the prices of bitcoin, gold, and silver. He previously stated that in the event of a global economic crisis, bitcoin would surge to $1 million, gold would reach $75,000, and silver would climb to $60,000. He also projected that by 2025, the price of bitcoin would reach $500,000, gold would rise to $5,000, and silver would reach $500.

Warren Buffett's Stance on Bitcoin

Unlike Kiyosaki, Warren Buffett is not a supporter of bitcoin. He has referred to the cryptocurrency as "rat poison squared" and has stated that it lacks intrinsic value. Buffett has also expressed his skepticism about bitcoin by stating that he wouldn't pay $25 for all the bitcoin in the world.

Ultimately, the choice between Kiyosaki's investment strategy and Buffett's value investing approach is up to individual investors. It is important to carefully consider the different perspectives and do thorough research before making any investment decisions.

What are your thoughts on Robert Kiyosaki's investment strategy? Do you prefer to follow Warren Buffett's value investing strategy? Share your opinions in the comments section below.

Frequently Asked Questions

Do You Need to Open a Precious Metal IRA

The most important thing you should know before opening an IRA account is that precious metals are not covered by insurance. There are no ways to recover the money you lost in an investment. All your investments can be lost due to theft, fire or flood.

It is best to invest in physical gold coins and silver coins to avoid this type loss. These items can be lost because they have real value and have been around for thousands years. If you were to sell them today, you would likely receive more than what you paid for them when they were first minted.

You should choose a reputable firm that offers competitive rates. It is also a smart idea to use a third-party trustee who will help you have access to your assets at all times.

When you open an account, keep in mind that you won't receive any returns until your retirement. Do not forget about the future!

What should I pay into my Roth IRA

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. These accounts cannot be withdrawn until you turn 59 1/2. There are some rules that you need to keep in mind if you want to withdraw funds from these accounts before you reach 59 1/2. First, your principal (the deposit amount originally made) is not transferable. You cannot withdraw more than the original amount you contributed. You must pay taxes on the difference if you want to take out more than what you initially contributed.

The second rule is that you cannot withdraw your earnings without paying income taxes. You will pay income taxes when you withdraw your earnings. Let's assume that you contribute $5,000 each year to your Roth IRA. Let's also assume that you make $10,000 per year from your Roth IRA contributions. You would owe $3,500 in federal income taxes on the earnings. The remaining $6,500 is yours. Since you're limited to taking out only what you initially contributed, that's all you could take out.

The $4,000 you take out of your earnings would be subject to taxes. You'd still owe $1,500 in taxes. You would also lose half of your earnings because they are subject to another 50% tax (half off 40%). So even though you received $7,000 in Roth IRA contributions, you only received $4,000.

There are two types if Roth IRAs: Roth and Traditional. A traditional IRA allows for you to deduct pretax contributions of your taxable income. You can withdraw your contributions plus interest from your traditional IRA when you retire. A traditional IRA can be withdrawn up to the maximum amount allowed.

Roth IRAs don't allow you deduct contributions. But once you've retired, you can withdraw the entire contribution amount plus any accrued interest. There is no minimum withdrawal limit, unlike traditional IRAs. It doesn't matter if you are 70 1/2 or older before you withdraw your contribution.

Should you Invest In Gold For Retirement?

How much money you have saved, and whether or not gold was an option when you first started saving will determine the answer. If you are unsure which option to choose, consider investing in both options.

In addition to being a safe investment, gold also offers potential returns. Retirees will find it an attractive investment.

While many investments promise fixed returns, gold is subject to fluctuations. Its value fluctuates over time.

However, it doesn't necessarily mean that you shouldn't invest your money in gold. You should just factor the fluctuations into any overall portfolio.

Another benefit to gold? It's a tangible asset. Unlike stocks and bonds, gold is easier to store. It can also be carried.

Your gold will always be accessible as long you keep it in a safe place. You don't have to pay storage fees for physical gold.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

You'll also benefit from having a portion of your savings invested in something that isn't going down in value. Gold tends to rise when the stock markets fall.

Investing in gold has another advantage: you can sell it anytime you want. You can also liquidate your gold position at any time you need cash, just like stocks. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all your eggs on one basket.

Also, don't buy too much at once. Start with a few ounces. Add more as you're able.

Don't expect to be rich overnight. It's not to get rich quickly, but to accumulate enough wealth to no longer need Social Security benefits.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

irs.gov

bbb.org

cftc.gov

finance.yahoo.com

How To

The History of Gold as an Asset

From the beginning of history, gold was a popular currency. It was popular because of its purity, divisibility. uniformity. scarcity and beauty. Because of its intrinsic value, it was also widely traded. Different weights and measurements existed around the world, however, because there were not international standards to measure gold. One pound sterling, for example, was equivalent in England to 24 carats, and one livre tournois, in France, to 25 carats. A mark, on the other hand, was equivalent in Germany to 28 carats.

In the 1860s, the United States began issuing American coins made up of 90% copper, 10% zinc, and 0.942 fine gold. This led to a decrease of demand for foreign currencies which in turn caused their prices to rise. In this period, large amounts of gold coin were minted by the United States, which caused the gold price to drop. They needed to pay off debt because they had too much money coming into circulation. To do so, they decided to sell some of the excess gold back to Europe.

Most European countries distrusted the U.S. Dollar and began to accept gold as payment. However, after World War I, many European countries stopped taking gold and began using paper money instead. The price of gold has risen significantly since then. Even though the price fluctuates, gold is still one of best investments.

—————————————————————————————————————————————————————————————-

By: Kevin Helms

Title: Robert Kiyosaki Shares His Investment Strategy — Says He’s Not Trying to Be Warren Buffett

Sourced From: news.bitcoin.com/robert-kiyosaki-shares-his-investment-strategy-says-hes-not-trying-to-be-warren-buffett/

Published Date: Wed, 25 Oct 2023 00:30:12 +0000