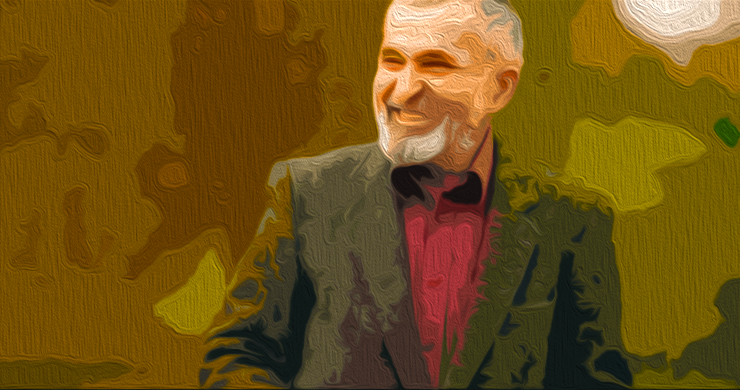

Economist Peter Schiff's Warnings

Renowned economist and gold bug, Peter Schiff, has once again raised concerns about the state of the U.S. economy and the U.S. dollar. In a series of social media posts, Schiff highlighted the imminent arrival of a financial and economic crisis that he believes has been long overdue. While many may claim that the crisis was impossible to foresee, Schiff argues that the signs have been evident for years. He also predicts that the crisis will be more severe and prolonged due to higher inflation rates and an inflationary depression, rather than just stagflation.

The Role of the Federal Reserve and Government

Schiff also commented on the remarks made by Federal Reserve Chair, Jerome Powell, regarding the economy. He argues that the pandemic did not cause inflation, but rather the actions of the Fed and the federal government exacerbated the problem. Massive budget deficits and the printing of a significant amount of money to finance stimulus checks contributed to the worsening inflation situation during the pandemic. Schiff further criticizes Powell's statement that monetary policy decisions are not influenced by fiscal policy, calling it a reckless admission that will define Powell's failed legacy.

The Collapse of Demand for U.S. Dollars

One of Schiff's key concerns is the collapse in demand for U.S. dollars. Historically, the primary use of U.S. dollars has been to purchase Treasuries. However, with the biggest buyers now becoming sellers and the national debt and federal budget deficits skyrocketing, the demand for dollars is expected to plummet. Schiff predicts that once the dollar starts to decline, Treasury yields will rise at a faster rate.

The Impending Bond Market Crash and Financial Crisis

Schiff warns of an impending bond market crash and an unprecedented financial crisis. He believes that bond investors have lost confidence in the Fed's ability to bring inflation back down to the targeted 2%. As a result, 30-year Treasuries are currently yielding 5.1%, which Schiff argues is not high enough to offset the effects of high inflation over three decades. He predicts that bond yields will continue to rise rapidly, with short-term yields moving from 5.5% to 6% and long-term yields moving from 5% to 7%-8%. Given the substantial amount of debt, the U.S. economy cannot sustain a normal yield curve. Schiff suggests that quantitative easing (QE) will likely be implemented in the near future.

Schiff's Outlook on Interest Rates

Schiff anticipates no further interest rate hikes due to the ongoing uncertainties, including the war in the Middle East. In fact, he suggests that the Fed may even need to consider cutting rates. Schiff has repeatedly emphasized the possibility of a "tragic ending" and the collapse of the U.S. dollar. He warns that the day of reckoning is approaching and has been vocal about the potential for a significant bond market crash and an unprecedented financial crisis.

In conclusion, economist Peter Schiff's warnings about the U.S. economy and the U.S. dollar highlight the risks and challenges ahead. While some may dismiss his predictions, Schiff's expertise and track record make his insights worth considering. Only time will tell how accurate his forecasts will prove to be. What are your thoughts on Schiff's warnings? Share your views in the comments section below.

Frequently Asked Questions

What are the benefits to having a gold IRA

An Individual Retirement Account (IRA) is the best way to put money towards retirement. It's not subject to tax until you withdraw it. You are in complete control of how much you take out each fiscal year. There are many types available. Some are better suited to college savings. Some are better suited for investors who want higher returns. For example, Roth IRAs allow individuals to contribute after age 59 1/2 and pay taxes on any earnings at retirement. The earnings earned after they withdraw the funds aren't subject to any tax. This type account may make sense if it is your intention to retire early.

Because you can invest money in many asset classes, a gold IRA works similarly to other IRAs. Unlike a regular IRA that requires you to pay taxes on the gains you make while you wait to access them, a gold IRA does not have to do this. People who want to invest their money rather than spend it make gold IRA accounts a great option.

Another benefit of owning gold through an IRA is that you get to enjoy the convenience of automatic withdrawals. It means that you don’t have to remember to make deposits every month. To make sure you don't miss any payments, you can also set up direct deductions.

Finally, gold remains one of the best investment options today. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even during economic turmoil the gold price tends to remain fairly stable. It is therefore a great choice for protecting your savings against inflation.

Can the government steal your gold?

Your gold is yours and the government cannot take it. You earned it through hard work. It belongs exclusively to you. This rule could be broken by exceptions. For example, if you were convicted of a crime involving fraud against the federal government, you can lose your gold. Your precious metals can also be lost if you owe tax to the IRS. However, even though your taxes have not been paid, you can still keep your precious metals, even though they are considered the property of United States Government.

Is gold a good choice for an investment IRA?

Anyone who is looking to save money can make gold an excellent investment. It is also an excellent way to diversify you portfolio. There is much more to gold than meets your eye.

It has been used throughout history as currency and it is still a very popular method of payment. It is sometimes called the “oldest currency in the world”.

But gold, unlike paper currency, which is created by governments, is mined out from the ground. It is very valuable, as it is rare and hard to create.

The supply and demand for gold determine the price of gold. If the economy is strong, people will spend more money which means less people can mine gold. As a result, the value of gold goes up.

The flip side is that people tend to save money when the economy slows. This increases the production of gold, which in turn drives down its value.

This is why it makes sense to invest in gold for individuals and companies. You'll reap the benefits of investing in gold when the economy grows.

Also, your investments will earn you interest which can help increase your wealth. Plus, you won't lose money if the value of gold drops.

Should you Invest In Gold For Retirement?

It depends on how much you have saved and if gold was available at the time you started saving. If you are unsure which option to choose, consider investing in both options.

In addition to being a safe investment, gold also offers potential returns. It is a good choice for retirees.

While most investments offer fixed rates of return, gold tends to fluctuate. Therefore, its value is subject to change over time.

But this doesn't mean you shouldn't invest in gold. This just means you need to account for fluctuations in your overall portfolio.

Another benefit of gold is that it's a tangible asset. Gold is less difficult to store than stocks or bonds. It can also be transported.

You can always access gold as long your place it safe. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

Additionally, it will be a benefit to have some of your savings invested into something that won't lose value. When the stock market drops, gold usually rises instead.

You can also sell gold anytime you like by investing in it. As with stocks, your position can be liquidated whenever you require cash. You don't have to wait for retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all of your eggs in one basket.

Also, don't buy too much at once. Start with just a few drops. Continue adding more as necessary.

Keep in mind that the goal is not to quickly become wealthy. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

How much money should my Roth IRA be funded?

Roth IRAs let you save tax on retirement by allowing you to deposit your own money. These accounts cannot be withdrawn until you turn 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. First, you cannot touch your principal (the original amount deposited). You cannot withdraw more than the original amount you contributed. If you decide to withdraw more money than what you contributed initially, you will need to pay taxes.

You cannot withhold your earnings from income taxes. Also, taxes will be due on any earnings you take. Let's take, for example, $5,000 in annual Roth IRA contributions. Let's further assume you earn $10,000 annually after contributing. You would owe $3,500 in federal income taxes on the earnings. That leaves you with only $6,500 left. This is the maximum amount you can withdraw because you are limited to what you initially contributed.

So, if you were to take out $4,000 of your earnings, you'd still owe taxes on the remaining $1,500. You would also lose half of your earnings because they are subject to another 50% tax (half off 40%). Even though you had $7,000 in your Roth IRA account, you only received $4,000.

There are two types if Roth IRAs: Roth and Traditional. Traditional IRAs allow pre-tax contributions to be deducted from your taxable tax income. Your traditional IRA can be used to withdraw your balance and interest when you are retired. There are no restrictions on the amount you can withdraw from a Traditional IRA.

Roth IRAs do not allow you to deduct your contributions. However, once you retire, you can withdraw your entire contribution plus accrued interest. There is no minimum withdrawal required, unlike a traditional IRA. You don’t have to wait for your turn 70 1/2 years before you can withdraw your contributions.

Who has the gold in a IRA gold?

The IRS considers anyone who owns gold to be “a form money” and therefore subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

You will need to declare the value of gold if you intend on selling it one day. This could impact how capital gains taxes you owe for cash investments.

To find out what options you have, consult an accountant or financial planner.

How much should precious metals make up your portfolio?

To answer this question, we must first understand what precious metals are. Precious metals have elements with an extremely high worth relative to other commodity. This makes them very valuable in terms of trading and investment. Today, gold is the most commonly traded precious metal.

However, many other types of precious metals exist, including silver and platinum. The price of gold tends to fluctuate but generally stays at a reasonably stable level during periods of economic turmoil. It is also not affected by inflation and depression.

In general, all precious metals have a tendency to go up with the market. That said, they do not always move in lockstep with each other. When the economy is in trouble, for example, gold prices tend to rise while other precious metals fall. This is because investors expect lower rates of interest, which makes bonds less attractive investments.

The opposite effect happens when the economy is strong. Investors are more inclined to invest in safe assets, such as Treasury Bonds, and they will not demand precious metals. They are more rare, so they become more expensive and less valuable.

Diversifying across precious metals is a great way to maximize your investment returns. You should also diversify because precious metal prices can fluctuate and it is better to invest in multiple types of precious metals than in one.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

finance.yahoo.com

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- How do you keep your IRA Gold at Home? It's Not Exactly Legal – WSJ

investopedia.com

How To

Investing In Gold vs. Investing In Stocks

This might make it seem very risky to invest gold as an investment tool. This is because many people believe gold is no longer financially profitable. This belief arises because most people believe that the global economy is driving down gold prices. They fear that investing in gold will result in a loss of money. In reality, though, gold investment can offer significant benefits. Below we'll look at some of them.

The oldest form of currency known to mankind is gold. It has been in use for thousands of year. People around the world have used it as a store of value. Even today, countries such as South Africa continue to rely heavily on it as a form of payment for their citizens.

The first point to consider when deciding whether or not you should invest in gold is what price you want to pay per gram. The first thing you should do when considering buying gold bullion is to decide how much you will spend per gram. If you don’t know the current market rate for gold bullion, you can always consult a local jeweler to get their opinion.

It is important to remember that even though gold prices have dropped in recent times, the cost of making gold has risen. So while the price of gold has declined, production costs haven't changed.

It is important to keep in mind the amount you plan to purchase of gold when you're weighing whether or not it is worth your time. For example, if you only intend to purchase enough to cover your wedding rings, it probably makes sense to hold off on buying any gold. It is worth considering if you intend to use it for long-term investment. If you sell your gold for more than you paid, you can make a profit.

We hope this article has given you an improved understanding of gold investment tools. We recommend that you investigate all options before making any major decisions. Only then can you make informed decisions.

—————————————————————————————————————————————————————————————-

By: Kevin Helms

Title: Peter Schiff Warns of Inflationary Depression and Recession

Sourced From: news.bitcoin.com/economist-peter-schiff-warns-of-deep-recession-inflationary-depression-and-collapse-of-us-dollar-demand/

Published Date: Sun, 22 Oct 2023 01:30:05 +0000