Introduction

As the halvening approaches, Bitcoin mining operators are faced with a crucial challenge. The outcome of this battle could make or break their bets made during this Bitcoin epoch. The looming question is not only how to weather this event but where to position themselves strategically. While building and operating an efficient fleet of bitcoin miners is important, the critical success factor lies in managing energy costs. To find the higher ground, miners must perform hash recon and optimize their operations.

The Significance of Energy Cost

For both experienced and inexperienced mining operators, energy cost plays a vital role in profitability. While inexperienced operators may focus solely on increasing hashrate, the energy consumed per hash produced is a crucial long-term factor. Energy cost outweighs other variables such as dollars per terahash, bitcoin price, and network hashrate. Even the legendary Antminer S9, a 7-year-old miner, remains profitable today with cheap enough energy.

Foundational Elements: Mining Revenue and Energy Expenses

The considerations at the heart of miners' operations are mining revenue and energy expenses. These variables are used to determine mining profitability. However, additional operating costs like labor and other associated expenses must also be taken into account. While this formula helps miners keep the lights on, it is important to optimize energy costs to maximize profitability.

Distinguishing Mining Operators by Scale

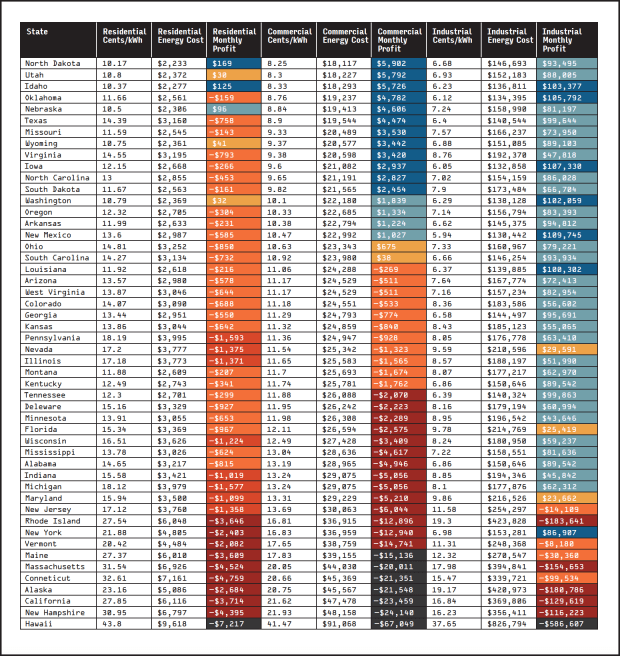

Mining operators can be categorized based on their power usage. In the U.S., the Energy Information Administration (EIA) classifies consumption and power costs into Residential, Commercial, and Industrial customer power rates. The following are the three categories:

Residential: <30 kW

This category includes home miners with 1 to 10 bitcoin mining machines. Residential-scale operators have the highest energy rates within the same state. Additional electrical infrastructure may be required to exceed this power limit.

Commercial: 30 kW-1 MW

Commercial-scale operators encompass small to medium-sized businesses and bitcoin mining operators with 10 to 300 mining machines. While they have better rates than residential customers, they are not large enough to negotiate lower rates with power companies.

Industrial: >1 MW

Industrial-scale operators have more than 300 mining machines and can negotiate energy costs via power purchase agreements. They have the advantage of acquiring energy at the lowest cost within the same state.

The Search for Cost-Efficient Power

Regardless of scale, all mining operators share the need for cost-efficient power. Some miners are limited by geographical constraints, while others explore regions with affordable energy rates through jurisdictional arbitrage. Additionally, miners aim to scale their operations to have a seat at the table where they can negotiate lower rates.

War Games: Simulating Mining Profitability

To understand how mining operators would handle different scenarios, let's run the numbers using the following data points:

- BTC price at $30,000

- Network hashrate at 400EH/s

- Bitmain Antminer S19j Pro 100TH/s at 3kW per unit

- Residential scale: 10 Bitcoin Miners

- Commercial scale: 100 Bitcoin Miners

- Industrial scale: 1000 Bitcoin Miners

- Energy rates at 2023 YTD (EIA)

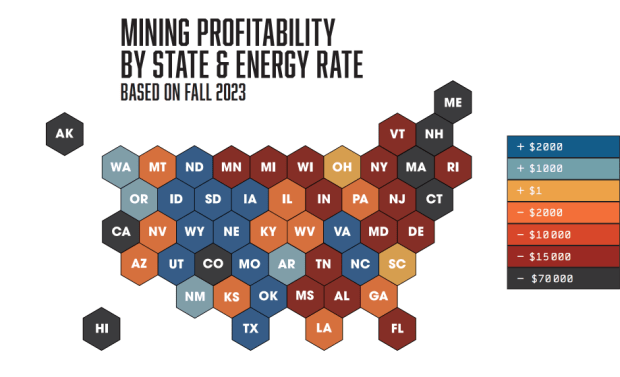

Running the numbers reveals the profitability of mining operations under the outlined scenario. It becomes apparent that mining is unprofitable in most states, especially if a halving is enforced, cutting daily mining revenue in half. However, this simulation does not account for changes in network hashrate and bitcoin price, which can influence profitability.

The Landscape for Different Scales

At the residential scale, profitability appears elusive, and mining operations are likely running at a loss nationwide. While some may continue to mine for KYC-free sats, operating at a deficit may not be justifiable for many operators.

Commercial rates offer a more promising outlook, extending profitability to many more states. However, only a few states provide a profitable environment for small and medium-sized business miners, especially in potentially challenging years like 2024.

At the industrial scale, miners have more influence and earn a seat at the table. With the ability to negotiate energy costs, profitability is possible in 40 states. However, several states still pose challenges for industrial-scale miners.

The Battle for Survival

The battle for mining operators is far from over. Increased competition, the halving, and the ever-unpredictable bitcoin price pose significant challenges. Operators must find efficiencies where possible, with low hardware and energy costs being fundamental to profitability. The geographic location of a mining operation emerges as the most critical success factor. While many regions in the country may not be suitable for mining, opportunities still exist for those willing to explore and perform hash recon. This is where operators earn their stripes and claim the high ground.

Frequently Asked Questions

How much is gold taxed under a Roth IRA

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

But if you put the money into a traditional IRA or 401(k), there's no tax when you withdraw the money. Only earnings from capital gains and dividends are subject to tax. These taxes do not apply to investments that have been held for more than one year.

Each state has its own rules regarding these accounts. For example, in Maryland, you must take withdrawals within 60 days after reaching age 59 1/2 . Massachusetts allows you to delay withdrawals until April 1. New York is open until 70 1/2. To avoid penalty fees, it is important to plan and take distributions in time to pay all your retirement savings.

What are the pros & con's of a golden IRA?

The main advantage of an Individual Retirement Account (IRA) over a regular savings account is that you don't have to pay taxes on any interest earned. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. However, there are also disadvantages to this type of investment.

You may lose all your accumulated savings if you take too much out of your IRA. You may also be prohibited by the IRS from making withdrawals from an IRA after you turn 59 1/2. If you do decide to withdraw funds from your IRA, you'll likely need to pay a penalty fee.

The downside is that managing your IRA requires fees. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management fees ranging from $10 to $50.

If you prefer to keep your money outside a bank, you'll need to purchase insurance. Most insurers require you to own a minimum amount of gold before making a claim. You may be required by some insurers to purchase insurance that covers losses as high as $500,000.

If you decide to open a gold IRA, it is important to know how much you can use. Some providers limit the number of ounces of gold that you can own. Others allow you to pick your weight.

It is also up to you to decide whether you want to purchase physical gold or futures. Physical gold is more costly than gold futures. Futures contracts provide flexibility for purchasing gold. They let you set up a contract that has a specific expiration.

It is also important to choose the type of insurance coverage that you need. The standard policy does NOT include theft protection and loss due to fire or flood. It does provide coverage for damage from natural disasters, however. If you live in a high-risk area, you may want to add additional coverage.

Additional to your insurance, you will need to consider how much it costs to store your gold. Storage costs are not covered by insurance. Safekeeping costs can be as high as $25-40 per month at most banks.

A qualified custodian is required to help you open a Gold IRA. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians are not allowed to sell your assets. Instead, they must hold them as long as you request.

Once you've chosen the best type of IRA for you, you need to fill in paperwork describing your goals. Information about your investments such as stocks and bonds, mutual fund, or real property should be included in your plan. You should also specify how much you want to invest each month.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. After receiving your application, the company will review it and mail you a confirmation letter.

You should consult a financial planner before opening a Gold IRA. Financial planners are experts in investing and will help you decide which type of IRA works best for your situation. They can help reduce your expenses by helping you find cheaper alternatives to buying insurance.

Can the government steal your gold?

The government cannot take your gold because you own it. It's yours, and you earned it by working hard. It is yours. This rule may not apply to all cases. You can lose your gold if you have been convicted for fraud against the federal governments. Your precious metals can also be lost if you owe tax to the IRS. However, even though your taxes have not been paid, you can still keep your precious metals, even though they are considered the property of United States Government.

Who is the owner of the gold in a gold IRA

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

You must have gold at least $10,000 and it must be stored for at the least five years in order to take advantage of this tax-free status.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

You will need to declare the value of gold if you intend on selling it one day. This could impact how capital gains taxes you owe for cash investments.

It is a good idea to consult an accountant or financial planner to learn more about your options.

Can I keep a Gold ETF in a Roth IRA

Although a 401k plan might not provide this option, you should still consider other options like an Individual Retirement Account (IRA).

A traditional IRA allows contributions from both employee and employer. An Employee Stock Ownership Plan (ESOP) is another way to invest in publicly traded companies.

An ESOP can provide tax advantages, as employees are allowed to share in company stock and the profits generated by the business. The money invested in the ESOP is then taxed at lower rates than if it were held directly in the hands of the employee.

Also available is an Individual Retirement Annuity. An IRA allows for you to make regular income payments during your life. Contributions to IRAs do not have to be taxable

What is the best precious metal to invest in?

This question depends on how risky you are willing to take, and what return you want. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. Gold may not be right for you if you want quick profits. Silver is a better investment if you have patience and the time to do it.

If you're not looking to make quick money, gold is probably your best choice. If you want to invest in long-term, steady returns, silver is a better choice.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement funds

cftc.gov

bbb.org

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

How To

The History of Gold as an Asset

From the very beginning of time, gold was a currency. It was popular because of its purity, divisibility. uniformity. scarcity and beauty. Due to its value, it was also internationally traded. Different weights and measurements existed around the world, however, because there were not international standards to measure gold. One pound sterling, for example, was equivalent in England to 24 carats, and one livre tournois, in France, to 25 carats. A mark, on the other hand, was equivalent in Germany to 28 carats.

In the 1860s the United States began issuing American currency made up 90% copper (10% zinc) and 0.942 gold (0.942 pure). This caused a drop in foreign currency demand which resulted in an increase of their prices. In this period, large amounts of gold coin were minted by the United States, which caused the gold price to drop. Due to the excessive amount of money flowing into the United States, they had to find a way for them to repay some of their debt. They decided to return some of the gold they had left to Europe.

Since most European countries were not confident in the U.S. dollar they began accepting gold as payment. Many European countries started to accept paper money as a substitute for gold after World War I. The value of gold has significantly increased since then. Today, although the price fluctuates, gold remains one of the safest investments you can make.

—————————————————————————————————————————————————————————————-

By: Joe Rodgers

Title: Optimizing Bitcoin Mining Operations: The Importance of Energy Cost

Sourced From: bitcoinmagazine.com/markets/hash-recon-

Published Date: Thu, 21 Dec 2023 21:00:50 GMT