Introduction

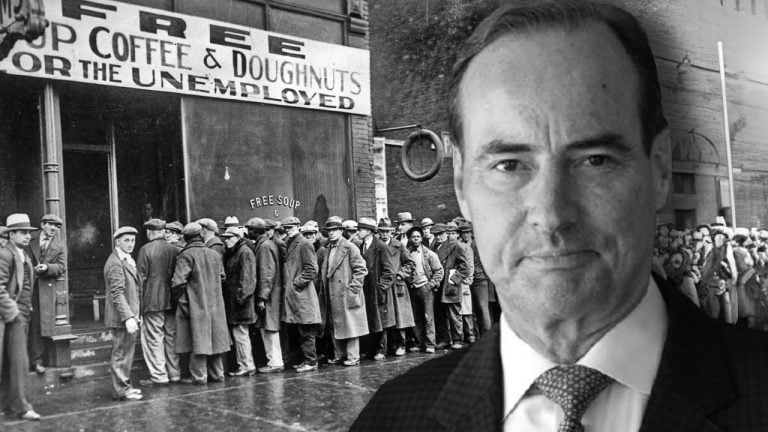

In a recent interview with Fox News, Harry Dent, a well-known economist, issued a dire prediction for the global economy. He anticipates that 2024 will be the year of the most significant financial crash in living memory. Dent's analysis, based on overvalued markets, excessive stimulus spending, and artificial inflation of asset prices, paints a grim picture of the near future. With his reputation for contrarian yet often accurate forecasts, Dent's warnings carry weight in financial circles.

Dent's Analysis of the Current Economic Situation

Dent, known for his unconventional yet insightful market analyses, believes that the current economic situation is entirely artificial. He attributes this artificial inflation to unprecedented levels of money printing and deficit spending, totaling $27 trillion over 15 years. According to Dent, this sets the stage for a dangerous and inevitable downturn.

Economic Landscape of Late 2023

The U.S. economy in late 2023 displays a mix of growth and uncertainty. Looming concerns include potential rises in unemployment rates due to the Federal Reserve's persistent interest rate hikes. This complex economic landscape sets the stage for 2024, with expert forecasts ranging from continued expansion to potential recession.

The "Everything Bubble" Phenomenon

According to Dent, the core of his argument revolves around what he terms the "everything bubble." He believes this phenomenon began in late 2021, after the COVID-19 pandemic. Unlike previous market bubbles that were confined to certain sectors, Dent asserts that this bubble encompasses nearly all asset classes, making its potential burst far more devastating. Real estate and stock markets are prime examples of this overvaluation. Dent warns against complacency, stressing that the impending crash will not be a mere correction, but a catastrophic fall on par with the Great Depression.

Dent's Predictions for the Crash

Dent predicts an 86% crash in the S&P and a 92% crash in the Nasdaq, with even greater losses in the crypto economy. He foresees significant consequences for the wealthy, stating that they will experience a significant loss of accumulated net worth. The average person, on the other hand, may lose their job for up to two years. Dent also suggests that the crash will lead to a subsequent boom period for the millennial generation, lasting until around 2037.

Dent's Criticism of the Recent Market Rally

Challenging the optimistic outlook of many investors and analysts, Dent criticizes the recent market rally, including the record highs of the Dow Jones Industrial Average. He views these developments as temporary and misleading, urging investors to prepare for the impending financial storm.

The Federal Reserve's Efforts and Dent's Predictions

Dent argues that the Federal Reserve's recent hints at ending its campaign against inflation and the possibility of rate cuts will not prevent the looming crisis. He believes that these efforts are too little, too late, and predicts a shift from disinflation to deflation, a scenario not seen since the 1930s.

Potential Economic Slowdown and Long-Term Recovery

Dent raises concerns about a protracted economic slowdown following the burst of the "everything bubble." He suggests that this slowdown could last for 12 to 14 years, exacerbating the wealth gap in America. However, Dent concludes with a somewhat optimistic note for the long term. He predicts a recovery led by the millennial generation, characterized by the middle class regaining ground. This new phase could extend until around 2037, offering hope after a period of intense economic turmoil.

What are your thoughts on Harry Dent's prediction concerning 2024? Feel free to share your opinions in the comments section below.

Frequently Asked Questions

What are the pros and disadvantages of a gold IRA

An Individual Retirement Account is a more beneficial option than regular savings accounts. You don't pay taxes on any interest earned. This makes an IRA great for people who want to save money but don't want to pay tax on the interest they earn. There are some disadvantages to this investment.

You could lose all of your accumulated money if you take out too much from your IRA. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. If you do decide to withdraw funds from your IRA, you'll likely need to pay a penalty fee.

The downside is that managing your IRA requires fees. Many banks charge between 0.5%-2.0% per year. Other providers may charge monthly management fees, ranging between $10 and $50.

If you prefer your money to be kept out of a bank, then you will need insurance. Insurance companies will usually require that you have at least $500,000. Some insurers may require you to have insurance that covers losses up $500,000.

If you choose to go with a gold IRA, you'll need to determine how much gold you want to use. Some providers restrict the amount you can own in gold. Others allow you to pick your weight.

It is also up to you to decide whether you want to purchase physical gold or futures. Physical gold is more expensive than gold futures contracts. Futures contracts offer flexibility for buying gold. Futures contracts allow you to create a contract with a specified expiration date.

You'll also need to decide what kind of insurance coverage you want. The standard policy doesn't include theft protection or loss due to fire, flood, or earthquake. However, it does cover damage caused by natural disasters. You may consider adding additional coverage if you live in an area at high risk.

You should also consider the cost of storage for your gold. Storage costs are not covered by insurance. In addition, most banks charge around $25-$40 per month for safekeeping.

You must first contact a qualified custodian before you open a gold IRA. A custodian maintains track of all your investments and ensures you are in compliance with federal regulations. Custodians cannot sell your assets. Instead, they must maintain them for as long a time as you request.

After you've determined which type of IRA is best for you, fill out the paperwork indicating your goals. You must include information about what investments you would like to make (e.g. stocks, bonds and mutual funds). Your monthly investment goal should be stated.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. The company will review your application and send you a confirmation letter.

You should consult a financial planner before opening a Gold IRA. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can also help reduce your costs by suggesting cheaper options for purchasing insurance.

How much tax is gold subject to in an IRA

The fair market price of gold when it is sold determines the tax due on its sale. You don't pay taxes when you buy gold. It is not considered income. If you sell it after the purchase, you will get a tax-deductible gain if you increase the price.

Loans can be secured with gold. Lenders try to maximize the return on loans that you take against your assets. Selling gold is usually the best option. The lender might not do this. They may hold on to it. Or, they may decide to resell the item themselves. You lose potential profits in either case.

If you plan on using your gold as collateral, then you shouldn't lend against it. You should leave it alone if you don't intend to lend against it.

What are the benefits to having a gold IRA

You can save money on retirement by putting your money into an Individual Retirement Account. You can withdraw it at any time, but it is tax-deferred. You are in complete control of how much you take out each fiscal year. There are many types and types of IRAs. Some are better suited for people who want to save for college expenses. Others are intended for investors seeking higher returns. Roth IRAs are a way for individuals to make contributions after the age of 59 1/2, and then pay taxes on any earnings upon retirement. Once they start withdrawing money, however, the earnings aren’t subject to tax again. This type account may make sense if it is your intention to retire early.

A gold IRA is similar to other IRAs because it allows you to invest money in various asset classes. Unlike a regular IRA where you pay taxes on gains, a gold IRA doesn't require you to worry about taxation while you wait to get them. This makes gold IRA accounts excellent options for people who prefer to keep their money invested instead of spending it.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. This eliminates the need to constantly make deposits. Direct debits could be set up to ensure you don't miss a single payment.

Finally, gold is one the most secure investment options available. Because it isn't tied to any particular country its value tends be steady. Even during economic turmoil, gold prices tend to stay relatively stable. This makes it a great investment option to protect your savings from inflation.

How can I withdraw from a Precious metal IRA?

First, determine if you would like to withdraw money directly from an IRA. Then make sure you have enough cash to cover any fees or penalties that may come with withdrawing funds from your retirement plan.

If you are willing to pay a penalty for early withdrawal, you should consider opening a taxable brokerage account instead of an IRA. This option will require you to pay taxes on the amount that you withdraw.

Next, determine how much money you plan to withdraw from your IRA. This calculation is dependent on several factors like your age when you take the money out, how long you have had the account, and whether or not your plan to continue contributing.

Once you know what percentage of your total savings you'd like to convert into cash, you'll need to determine which type of IRA you want to use. Traditional IRAs let you withdraw money tax-free after you turn 59 1/2, while Roth IRAs require you to pay income taxes upfront but allow you access the earnings later without paying any additional taxes.

Once these calculations have been completed you will need to open an account with a brokerage. To encourage customers to open accounts, brokers often offer signup bonuses and promotions. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When you finally get around to making withdrawals from your precious metal IRA, you'll need a safe place where you can store your coins. While some storage facilities accept bullion bars and others require that you purchase individual coins, others will allow you to store your coins in their own safe. Before you choose one, weigh the pros and cons.

Bullion bars, for example, require less space as you're not dealing with individual coins. You will need to count each coin individually. However, keeping individual coins in a separate place allows you to easily track their values.

Some prefer to keep their money in a vault. Others prefer to store them in a safe deposit box. You can still enjoy the benefits of bullion for many years, regardless of which method you choose.

Is it a good retirement strategy to buy gold?

Although gold investment may not seem appealing at first glance due to the high average global gold consumption, it's worth considering.

The most popular form of investing in gold is through physical bullion bars. But there are many other options for investing in gold. It is best to research all options and make informed decisions based on your goals.

If you don’t have the funds to invest in safe places, such as a safe deposit box or mining equipment companies, buying shares of these companies might be a better investment. If you need cash flow from an investment, purchasing gold stocks is a good choice.

You can also put your money in exchange traded funds (ETFs). These funds allow you to be exposed to the price and value of gold by holding gold related securities. These ETFs can include stocks of precious metals refiners and gold miners.

How much gold do you need in your portfolio?

The amount of capital required will affect the amount you make. Start small with $5k-10k. Then as you grow, you could move into an office space and rent out desks, etc. So you don't have all the hassle of paying rent. Rent is only paid per month.

It is also important to decide what kind of business you want to run. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. So if you do this kind of thing, you need to consider how much income you expect from each client.

You won't get a monthly paycheck if you work freelance. This is because freelancers are paid. This means that you may only be paid once every six months.

Decide what kind of income do you want before you calculate how much gold is needed.

I recommend starting with $1k to $2k of gold, and then growing from there.

Who holds the gold in a gold IRA?

The IRS considers anyone who owns gold to be “a form money” and therefore subject to taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

If you plan to eventually sell the gold, you'll need a report on its value. This could impact the amount of capital gains taxes your owe if you cash in your investments.

Consult a financial advisor or accountant to determine your options.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

irs.gov

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

cftc.gov

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options Types, Spreads, Example and Risk Metrics

How To

Three Ways to Invest In Gold For Retirement

It's essential to understand how gold fits into your retirement plan. You have many options for investing in gold if there is a 401K account at your workplace. You might also consider investing in gold outside your workplace. For example, if you own an IRA (Individual Retirement Account), you could open a custodial account at a brokerage firm such as Fidelity Investments. If you don't have any precious metals yet, you might want to buy them from a reputable dealer.

These are three simple rules to help you make an investment in gold.

- You can buy gold with your cash – No need to use credit cards or borrow money for investment financing. Instead, put cash into your accounts. This will help to keep your purchasing power high and protect you against inflation.

- Physical Gold Coins You Should Buy – Physical gold coins should be purchased over a paper certificate. The reason is that it's much easier to sell physical gold coins than certificates. Also, there are no storage fees associated with physical gold coins.

- Diversify your Portfolio – Don't put all your eggs in one basket. This is how you spread your wealth. You can invest in different assets. This helps reduce risk and gives you more flexibility during market volatility.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Renowned Economist Harry Dent Predicts Severe Financial Crash in 2024

Sourced From: news.bitcoin.com/economist-harry-dents-grim-prediction-2024-market-crash-to-eclipse-great-depression/

Published Date: Thu, 21 Dec 2023 20:00:10 +0000