As we witness the current surge in Bitcoin's price, it's natural to wonder if this cycle truly stands out or if there's more than meets the eye. Is Bitcoin truly shining brighter than Gold and NASDAQ, or are there hidden nuances waiting to be uncovered? Let's explore the numbers, compare various cycles, and dissect Bitcoin's journey not just against the US dollar but also in comparison to assets like Gold and US tech stocks. It's time to unravel the truth behind Bitcoin's performance in this intricate web of financial landscapes.

Diving into Past Bitcoin Price Trends

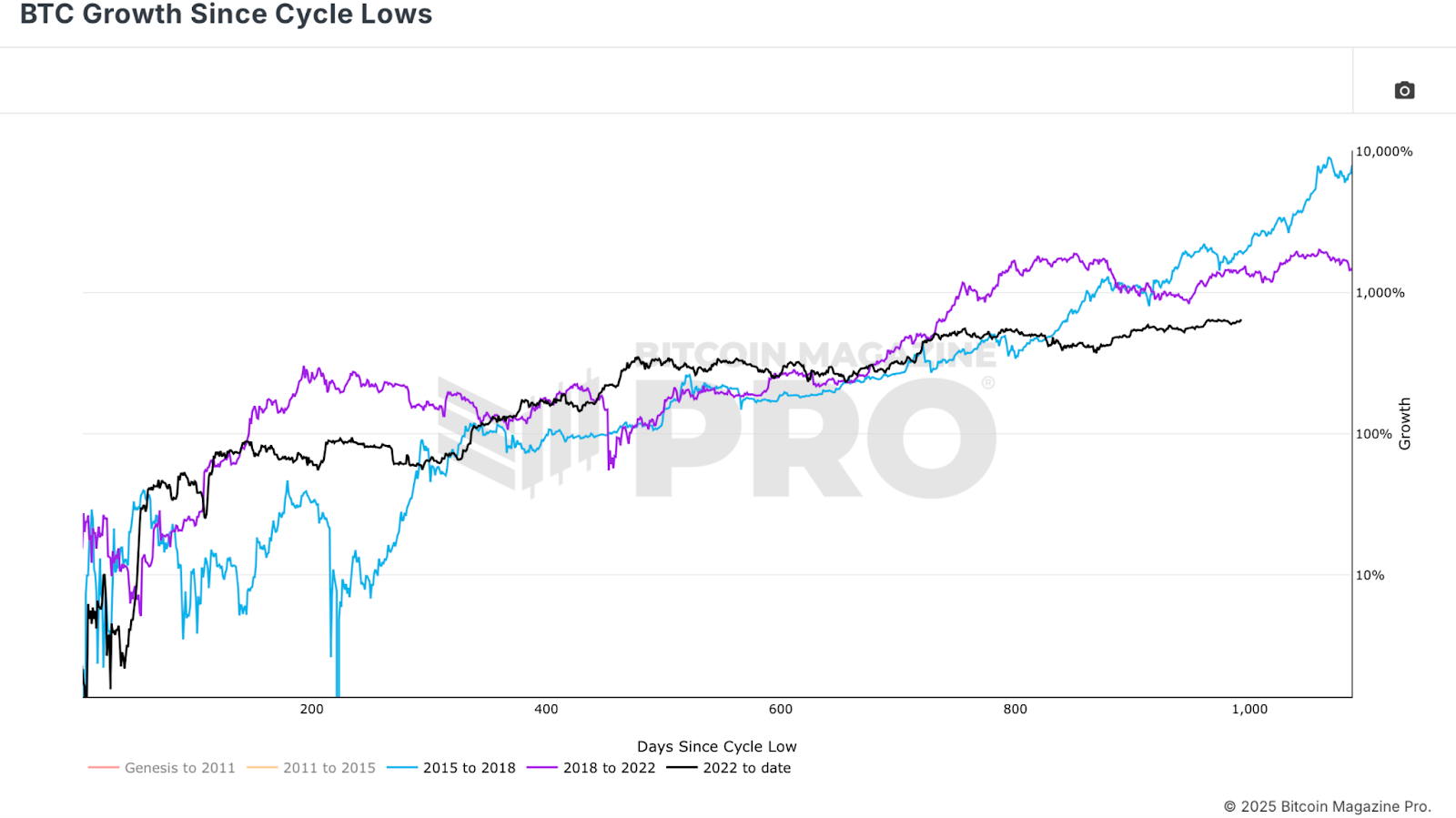

When we delve into the Bitcoin Growth Since Cycle Lows chart, the numbers paint a promising picture. Starting from the lows of the previous bear market, Bitcoin has surged by approximately 634% as of now. These remarkable gains are not merely a result of price spikes but are deeply rooted in strong fundamentals. The influx of institutional investments through ETFs and Bitcoin treasury reserves has been robust, coupled with on-chain data showcasing steadfast commitment from long-term holders. This groundwork typically sets the stage for a robust uptrend phase towards the end of the bullish cycle, reminiscent of past cycles.

Analyzing the Current Bitcoin Price Cycle

Glancing at the USD price chart on TradingView, the ongoing Bitcoin price cycle boasts remarkable stability. With the deepest pullback standing at around 32%, occurring post the $100,000 milestone before retracing to approximately $74,000–$75,000, this cycle's corrections are notably milder compared to historical trends. While reduced volatility might hint at moderated upward potential, it also renders the market less daunting for investors. The price trajectory follows a distinct "step-up" pattern – swift surges succeeded by consolidation phases, then another upswing – persistently driving towards fresh all-time highs. Fundamentally, the market remains robust.

Bitcoin in Comparison to Other Assets

When pitting Bitcoin against relatively stable entities like NASDAQ or other US tech stocks, a contrasting narrative unfolds. Given the speculative nature of US tech stocks akin to Bitcoin, this comparison offers a more direct lens than Bitcoin versus USD. In the current cycle, Bitcoin's progress beyond the previous peak appears modest. Nevertheless, the current trend showcases Bitcoin converting past hurdles into stepping stones, potentially setting the groundwork for sustained growth. Reflecting on the prior double-top cycle, the secondary peak sits significantly lower, hinting that the preceding cycle's peak might have been fueled more by global liquidity expansion and fiat devaluation than by genuine outperformance.

Decoding Real Purchasing Power

Delving deeper, adjusting the Bitcoin vs. Gold chart for Global M2 money supply expansion reveals a more nuanced reality. Considering the substantial liquidity injections into the global economy lately, Bitcoin's peak in terms of "liquidity-adjusted Gold" remains below the previous high. This sheds light on the absence of fervor in retail circles, as the real purchasing power fails to hit new highs.

In Closing

Thus far, Bitcoin's bullish journey has been remarkable in dollar value, showcasing over 600% upswings from the lows and a relatively stable ascent. However, when juxtaposed with assets like US tech stocks or Gold, especially post liquidity adjustments, the performance appears less striking. Indications suggest that a significant portion of this cycle's rally might be propelled by fiat devaluation rather than sheer superiority. While there's potential for substantial growth ahead, particularly if Bitcoin shatters liquidity-adjusted barriers and aims for loftier peaks, investors should closely monitor these ratio charts. They provide valuable insights into relative performance, offering crucial hints on Bitcoin's future trajectory.

Frequently Asked Questions

Can I buy gold with my self-directed IRA?

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

If you do decide that you want to invest, it is a good idea to buy physical bullion and not in futures. Futures contracts can be described as financial instruments that are determined by the gold price. These financial instruments allow you to speculate about future prices without actually owning the metal. You can only hold physical bullion, which is real silver and gold bars.

Can the government steal your gold?

Your gold is yours, so the government cannot confiscate it. You earned it through hard work. It belongs to your. There may be exceptions to this rule. You could lose your gold if convicted of fraud against a federal government agency. Also, if you owe taxes to the IRS, you can lose your precious metals. However, even if taxes are not paid, gold is still your property.

What proportion of your portfolio should you have in precious metals

First, let's define precious metals to answer the question. Precious elements are those elements which have a high price relative to other commodities. This makes them very valuable in terms of trading and investment. Gold is today the most popular precious metal.

There are however many other types, including silver, and platinum. While gold's price fluctuates during economic turmoil, it tends to remain relatively stable. It is also relatively unaffected both by inflation and deflation.

All precious metals prices tend to rise with the overall market. However, they may not always move in synchrony with each other. If the economy is struggling, the gold price tends to rise, while the prices for other precious metals tends to fall. Investors are more likely to expect lower interest rates making bonds less attractive investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors are more inclined to invest in safe assets, such as Treasury Bonds, and they will not demand precious metals. Because they are rare, they become more pricey and lose value.

Diversifying across precious metals is a great way to maximize your investment returns. Additionally, since the prices of precious metals tend to rise and fall together, it's best to invest in several different types of precious metals rather than just focusing on one type.

What is the cost of gold IRA fees

$6 per month is the Individual Retirement Account Fee (IRA). This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

You may have to pay additional fees if you want to diversify your portfolio. These fees can vary depending on which type of IRA account you choose. Some companies offer free check accounts, but charge monthly fee for IRA accounts.

Many providers also charge annual management fees. These fees range between 0% and 1 percent. The average rate is.25% annually. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

How much should I contribute to my Roth IRA account?

Roth IRAs let you save tax on retirement by allowing you to deposit your own money. These accounts cannot be withdrawn until you turn 59 1/2. If you decide to withdraw some of your contributions, you will need to follow certain rules. First, you cannot touch your principal (the original amount deposited). This means that you can't take out more money than you originally contributed. If you take out more than the initial contribution, you must pay tax.

The second rule says that you cannot withdraw your earnings without paying income tax. Also, taxes will be due on any earnings you take. Let's suppose that you contribute $5,000 annually to your Roth IRA. Let's say you earn $10,000 each year after contributing. On the earnings, you would be responsible for $3,500 federal income taxes. That leaves you with only $6,500 left. Since you're limited to taking out only what you initially contributed, that's all you could take out.

If you took $4,000 from your earnings, you would still owe taxes for the $1,500 remaining. You would also lose half of your earnings because they are subject to another 50% tax (half off 40%). So even though you received $7,000 in Roth IRA contributions, you only received $4,000.

There are two types if Roth IRAs, Roth and Traditional. Traditional IRAs allow pre-tax contributions to be deducted from your taxable tax income. You can withdraw your contributions plus interest from your traditional IRA when you retire. You have the option to withdraw any amount from a traditional IRA.

Roth IRAs don't allow you deduct contributions. But once you've retired, you can withdraw the entire contribution amount plus any accrued interest. There is no minimum withdrawal amount, unlike traditional IRAs. You don’t have to wait for your turn 70 1/2 years before you can withdraw your contributions.

How Much of Your IRA Should Include Precious Metals?

When investing in precious metals, the most important thing to know is that they aren't just for wealthy people. You don’t need to have a lot of money to invest. You can actually make money without spending a lot on gold or silver investments.

You might consider purchasing physical coins, such as bullion bars and rounds. Shares in precious metals-producing companies could be an option. Or, you might want to take advantage of an IRA rollover program offered by your retirement plan provider.

You'll still get the benefit of precious metals no matter which country you live in. Even though they aren't stocks, they still offer the possibility of long-term growth.

And, unlike traditional investments, their prices tend to rise over time. You'll probably make more money if your investment is sold down the line than traditional investments.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement funds

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

finance.yahoo.com

investopedia.com

How To

Tips for Investing In Gold

Investing in Gold has become a very popular investment strategy. There are many benefits to investing in gold. There are many ways you can invest in gold. There are many ways to invest in gold. Some prefer buying physical gold coins while others prefer gold ETFs (Exchange Traded Funds).

Before you purchase any type or gold, here are some things to think about.

- First, find out if your country allows gold ownership. If so, then you can proceed. You can also look at buying gold abroad.

- Secondly, you should know what kind of gold coin you want. You have options: you can choose from yellow gold, white or rose gold.

- Thirdly, it is important to take into account the gold price. Start small and build up. When purchasing gold, diversify your portfolio. Diversify your investments in stocks, bonds or real estate.

- You should also remember that gold prices can change often. Be aware of the current trends.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Is Bitcoin Leading the Pack: A Deep Dive into Performance Against Gold and NASDAQ

Sourced From: bitcoinmagazine.com/markets/bitcoin-price-gold-and-nasdaq

Published Date: Fri, 15 Aug 2025 13:13:53 +0000